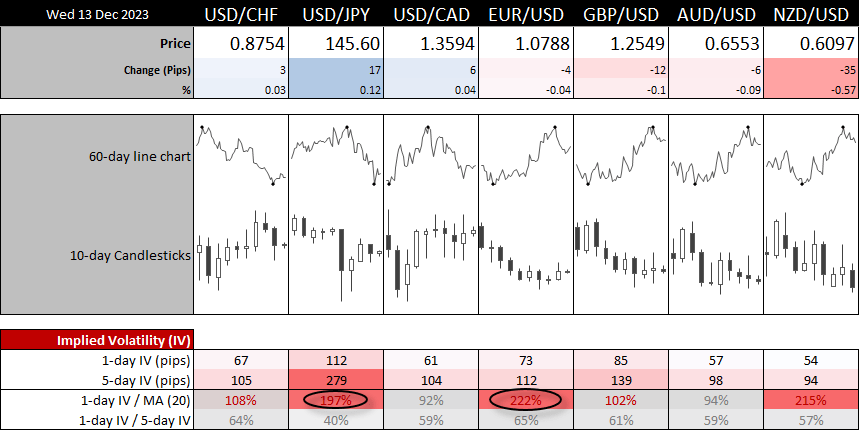

The Fed meet for their final meeting of the year, where they’ll also release their quarterly forecasts and dot plot aside the usual statement and press conference. And the anticipation of a market reaction has seen the implied volatility levels for EUR/USD and USD/JPY rise.

By :Matt Simpson, Market Analyst

Asian Indices:

- Australia’s ASX 200 index rose by 23.8 points (0.33%) and currently trades at 7,259.10

- Japan’s Nikkei 225 index has risen by 61.63 points (0.19%) and currently trades at 32,907.08

- Hong Kong’s Hang Seng index has fallen by -121.83 points (-0.74%) and currently trades at 16,252.67

- China’s A50 Index has fallen by -155.2 points (-1.36%) and currently trades at 11,274.43

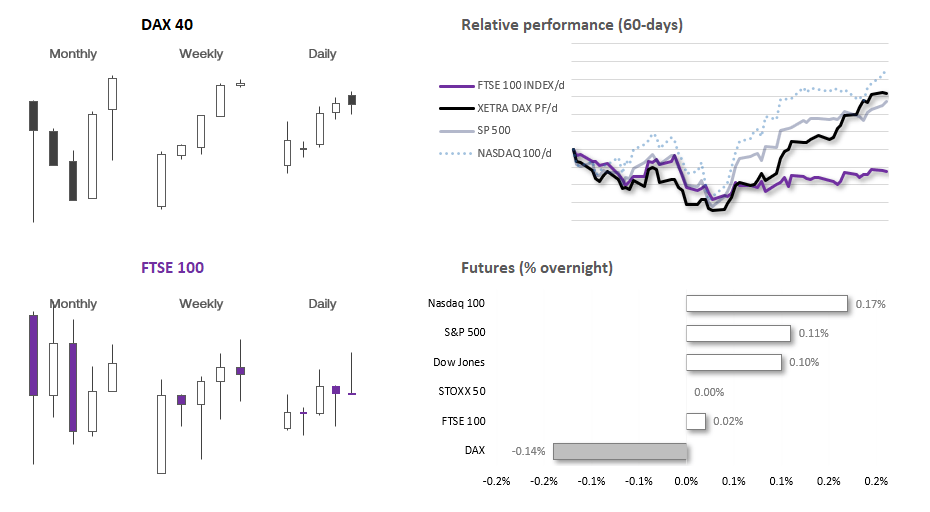

UK and European indices:

- UK’s FTSE 100 futures are currently up 2 points (0.03%), the cash market is currently estimated to open at 7,544.77

- Euro STOXX 50 futures are currently down 0 points (0%), the cash market is currently estimated to open at 4,536.61

- Germany’s DAX futures are currently down -24 points (-0.14%), the cash market is currently estimated to open at 16,767.74

US index futures:

- DJI futures are currently up 41 points (0.11%)

- S&P 500 futures are currently up 5.75 points (0.12%)

- Nasdaq 100 futures are currently up 30.5 points (0.19%)

With the Fed fund futures implying a 98.2% chance that the Fed will hold their interest rate today, a hold is likely a done deal. There was some excitement for a dovish pivot following weaker employment data, but odds for the Fed’s first cut to arrive in March have fallen to 42.3%, down from 54% just one week ago. Inflation data may have come roughly in line with expectations, but it is a choppier descent that we’d all like to see – and that saw some pre-emptive bets of Fed cuts to trimmed. In fact, markets are no longer pricing in a cut with a 50% or higher probability at all next year.

As it is the last FOMC meeting of the year, it includes the staff projections with the famous dot plot, alongside the usual statement and press conference. A big question for today is if the median fed funds projection for 2024 has been lowered enough to justify cuts markets were so desperately trying to price in. My guess is that they won’t, and that could see risk wobble and support the US dollar.

Their Q3 projections estimated a Fed fund to fall to 5.1% in 2024, which would require two 25bp cuts next year. With some banks calling for 200bp worth of cuts and markets responding accordingly, I suspect there may be some disappointment if the Fed stick to their 2024 projection of 5.1%.

Events in focus (GMT):

- 07:00 – UK GDP (m/m, y/y), construction output, manufacturing production, trade balance

- 10:00 – Euro industrial production

- 12:00 – OPEC monthly report

- 13:30 – US PPI

- 15:30 – crude oil inventories

- 19:00 – Fed interest rate decision, FOMC economic projections, dot plot, FOMC statement

- 19:30 – FOMC press conference

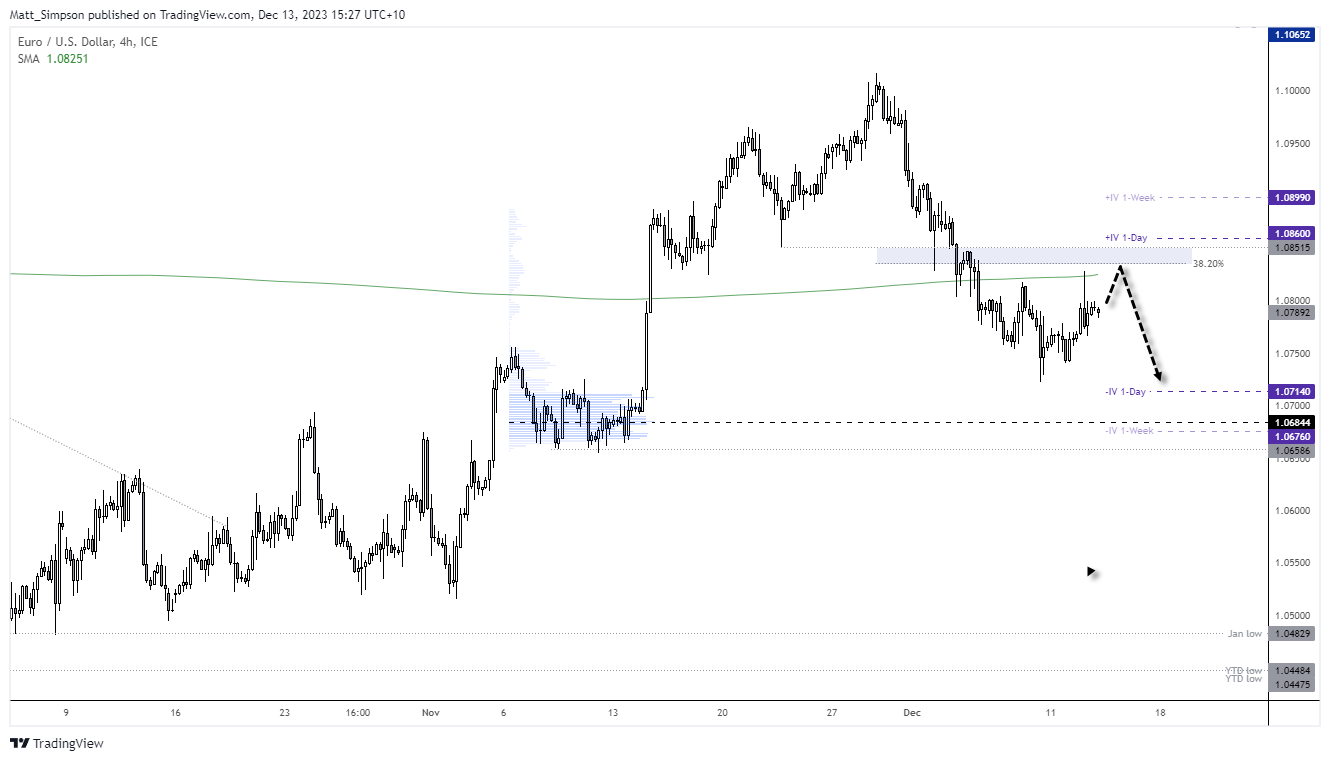

EUR/USD technical analysis (4-hour chart)

We might find that EUR/USD strengthens heading into the FOMC decision on pre-emptive bets that the Fed will provide a dovish meeting. But they Fed actually need to deliver a dovish meeting to hold on to those gains. And given EUR/USD has already been foiled by the 200-day average, any such pre-emptive rally towards it may prompt bears to load up around it in anticipation for a move back towards 1.070.

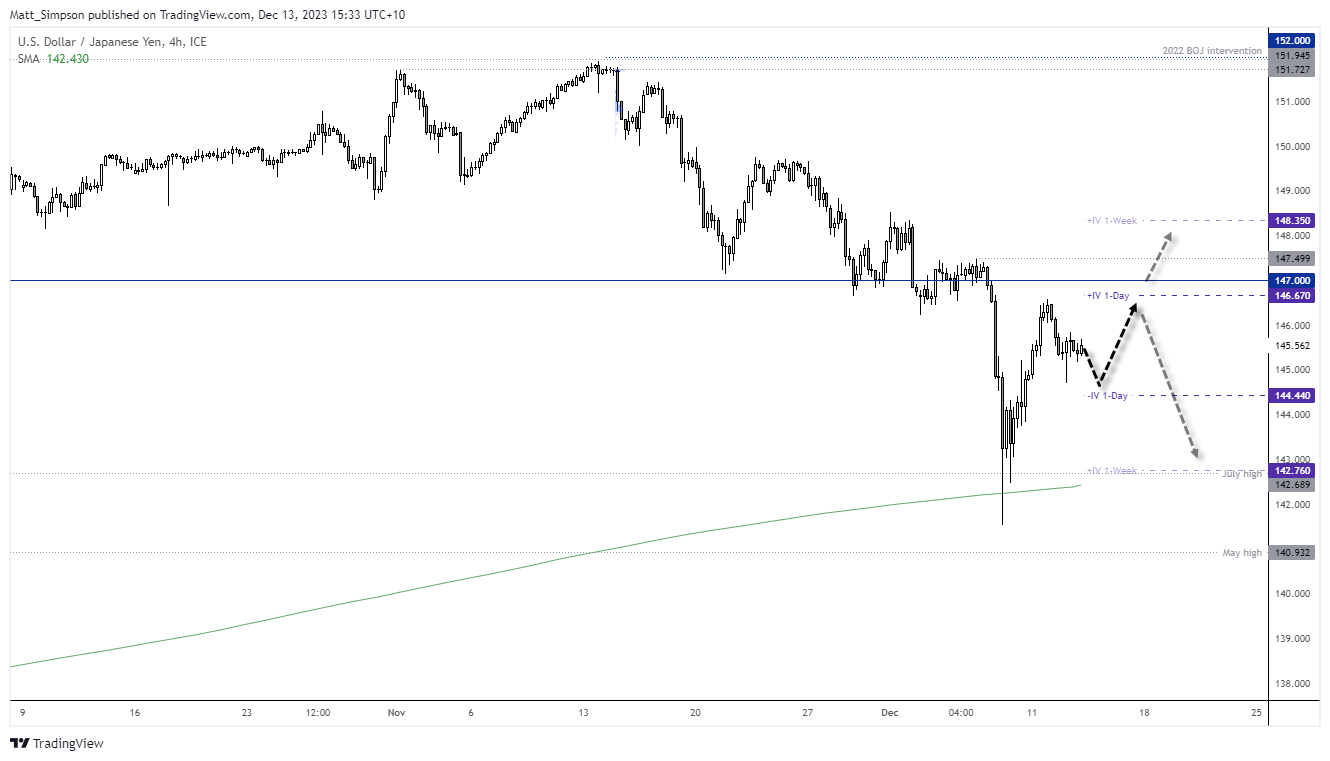

USD/JPY technical analysis (4-hour chart)

Like the euro, I suspect we may see a move ahead of today’s FOMC meeting to the detriment of dollar strength. And that could see USD/JPY retrace towards 145 before its next leg higher unfolds. Of the Fed deliver a hawkish meeting then a break above 147 could be on the cards, given USD/JPY had already fallen for four weeks by Friday’s close and its retracement rebounded from the 200-day average.

If the Fed are to surprise with a dovish meeting, a break below 144 seems probable. And if headlines continue to drip feed clues of a hawkish BOJ, it could be trading below 140 this side of Christmas.

View the full economic calendar

– Written by Matt Simpson

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.