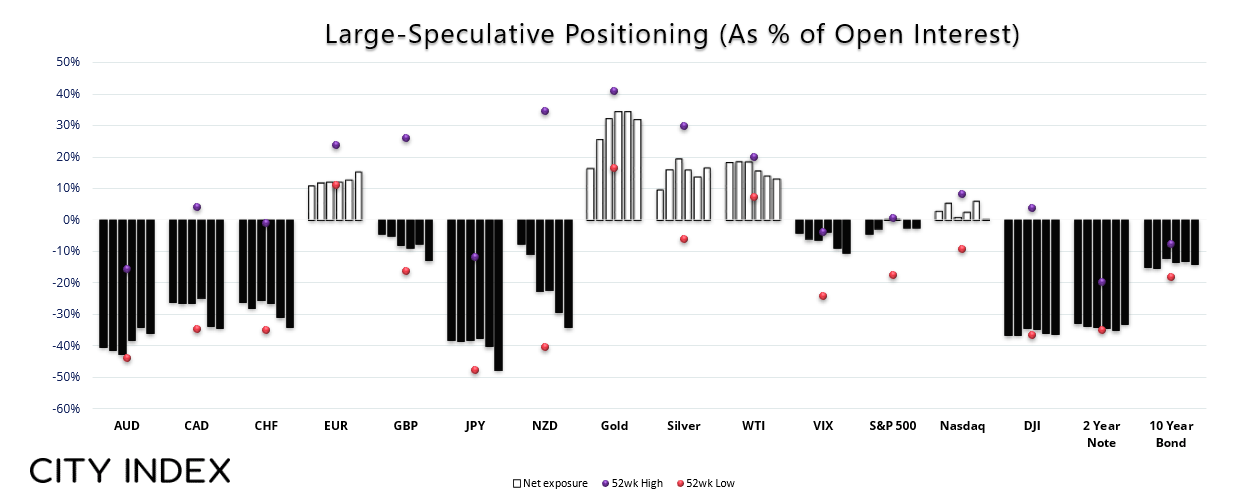

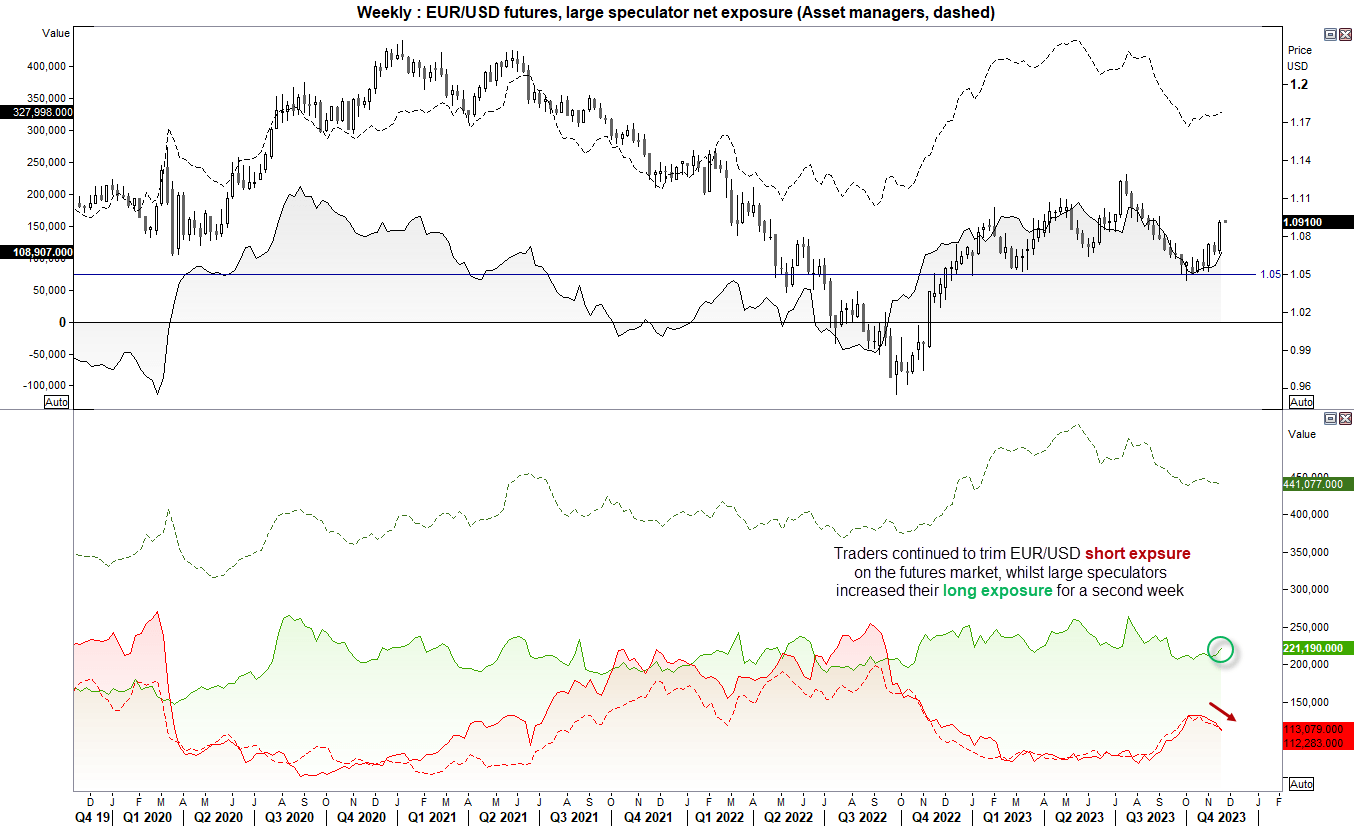

EUR/USD bears continued to trim shorts while large speculators added to longs. Whilst this might not be a bullish bet on the strength of Europe, it may well be a bet against the US dollar. And with the 2-year note holding above key support and shorts being trimmed, it hints at lower yields and a weaker US dollar.

View the latest commitment of traders reports

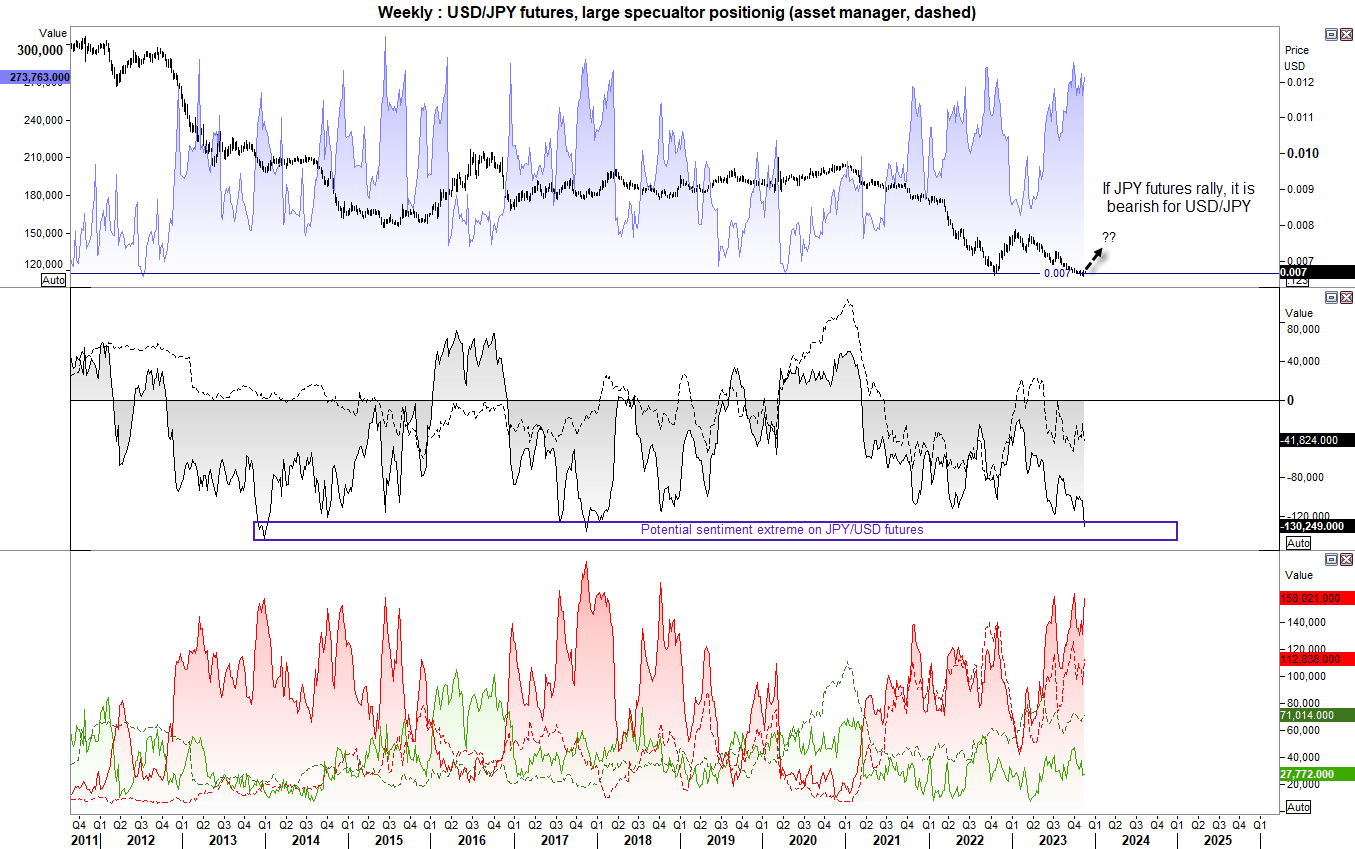

- Asset manager and large speculators increased gross-short exposure to JPY futures by around 20%, sending net-short exposure to a 6-year high (and a potential sentiment extreme)

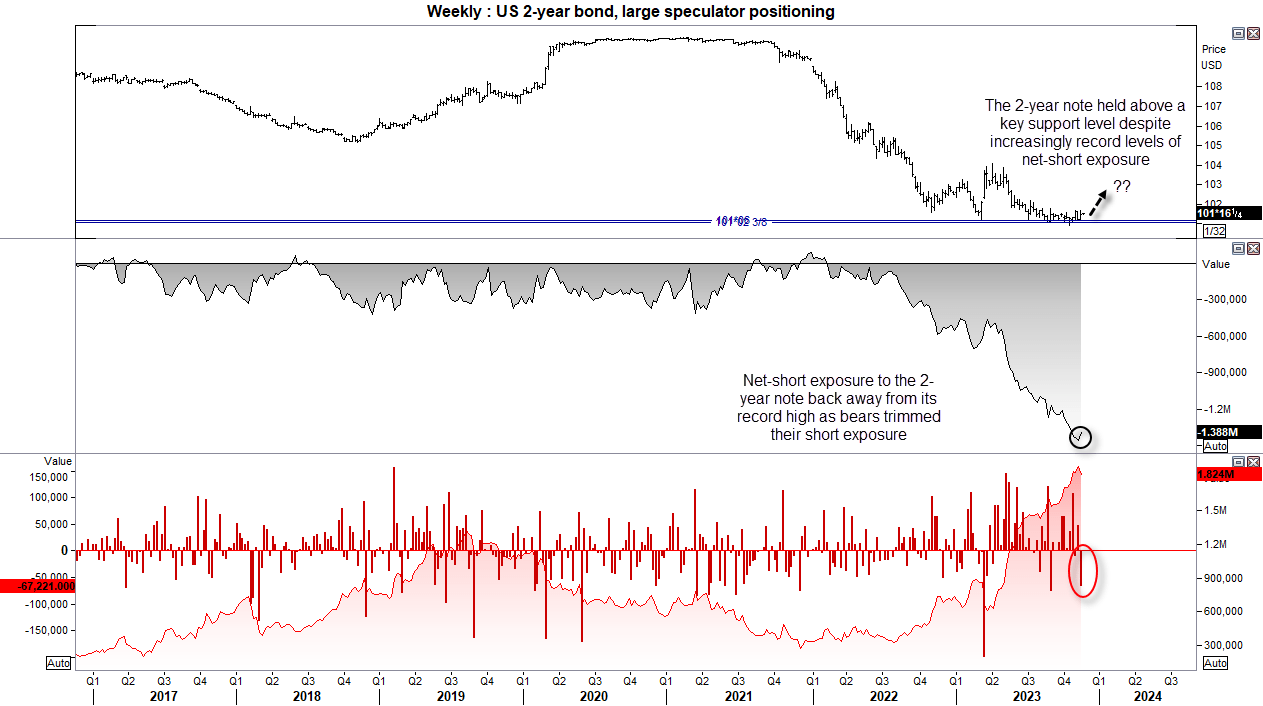

- Bond bears trimmed short exposure to the 2-year note at the fastest pace in 11 weeks (and 2nd fastest in 35 weeks)

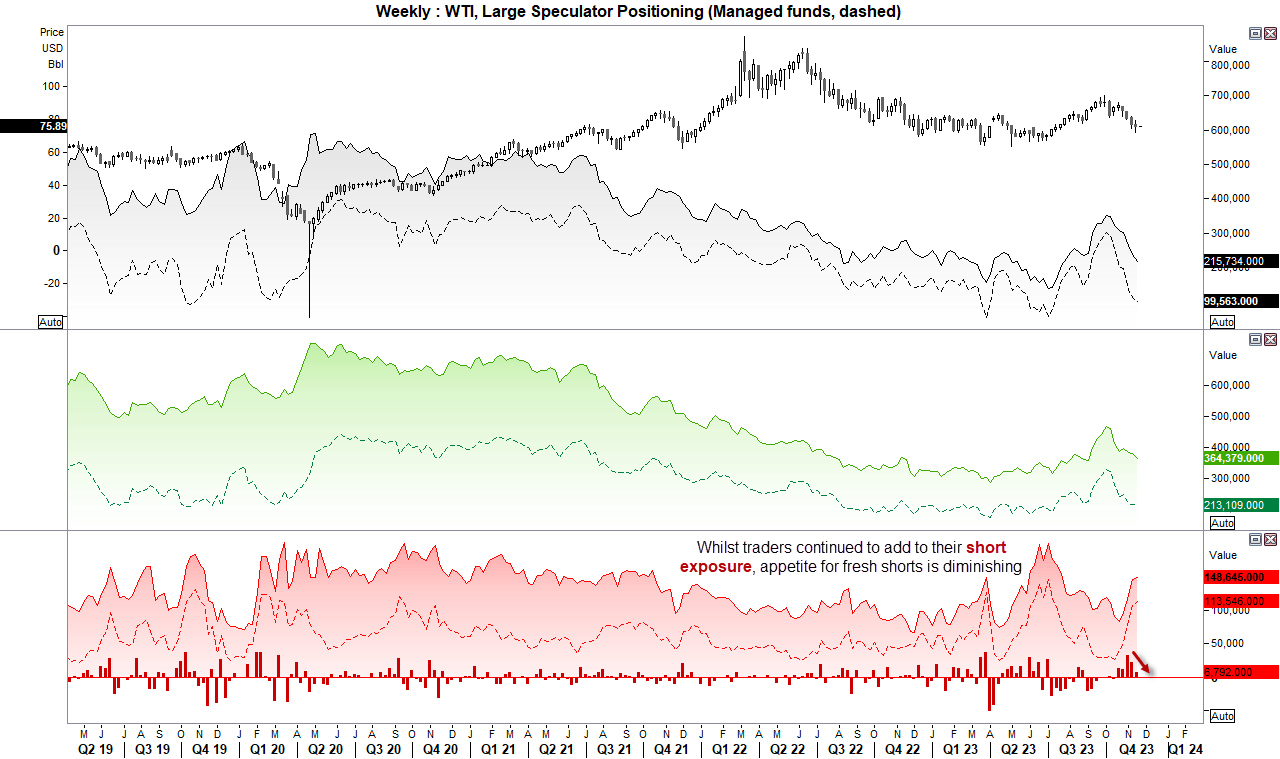

- Whilst bears continued to add to short exposure to crude oil, their appetite for shorts appears to be waning

- Net-long exposure to EUR/USD futures rose by 19.8k contracts to a 10-week high

- Gross-long exposure to CAD futures increased by 19%

- Net-short exposure to GBP futures rose to a 10-month high among large speculators

- Asset managers doubled their gross-long exposure to CHF futures

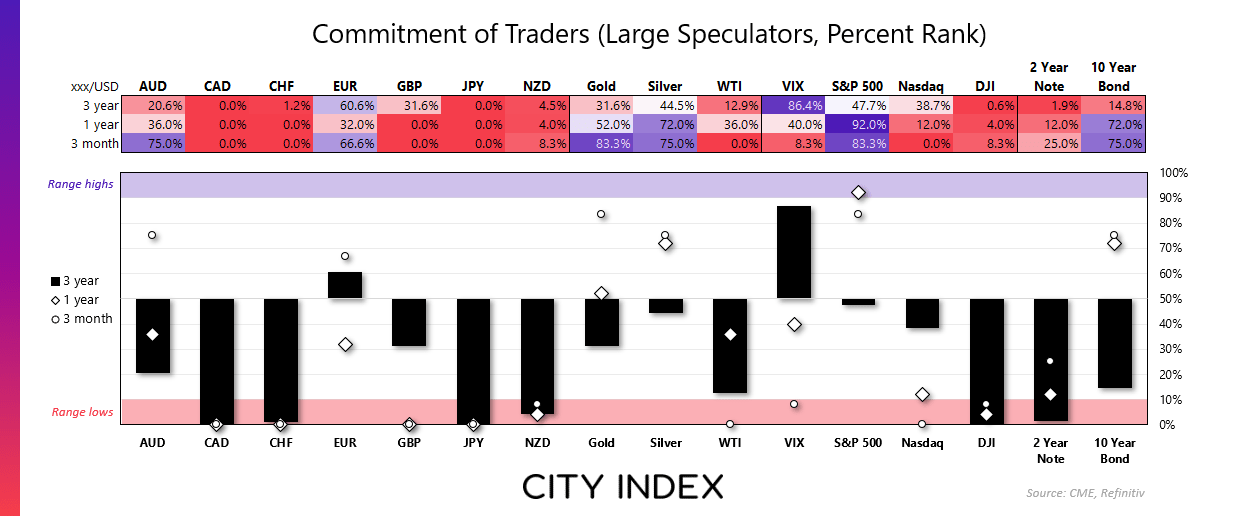

Commitment of traders – as of Tuesday 14th November 2023:

US 2-year bond note futures – Commitment of traders (COT):

I noted a couple of months ago that the 2-year bond note had fallen to a key level of support, yet large speculators continued to pile into shorts and push net-short exposure to a record high. SO the fact that the 2-year note has remained above support should come as a concern to bears, especially since US inflation was much softer than expected and market pricing has all but assured a peak Fed rate and brought forward the potential for a first cut. Last week, large speculators reduced their gross shot exposure at the fastest weekly pace in 11 and second weakest in 35. It may not seem like much, but a closure of shorts around support levels could be the beginning of a move higher, which could also point to lower yields and a weaker US dollar (and positive for risk).

EUR/USD (Euro dollar futures) – Commitment of traders (COT):

Bears continued to trim their exposure to EUR/USD futures for a second week, allowing EUR/USD to continue higher above 1.09 in line with my near-term bullish bias. And as we now see large speculators are adding to their long exposure, a move to 1.10 and 1.11 is within reach. To go long on EUR/USD now is not a bet on the strength of the European economy, but a short bet against the US dollar after its extended run in response to a hawkish Fed. But if bond yields move lower (particularly at the short-end) then it is supportive of risk and most (if not all) major currencies should stand to benefit from the weaker USD.

USD/JPY (Japanese yen futures) – Commitment of traders (COT):

Yen futures have mostly continued to hold above 0.0066 in recent months, which is the equivalent to 150 on USD/JPY. Regardless, traders have continued to pile into yen shorts. As of last week, net-short exposure among large speculators rose to a 6-year high and second highest level in 10 years. Open interest is also near cycle highs which have historically been associated with inflection points. And with JPY futures holding above support, I cannot help but wonder if USD/JPY is at or very near a sentiment extreme. And as USD/JPY produced a 2-bar reversal week (dark cloud over) with two shooting stars 2-3 weeks ago, I suspect USD/JY could be headed for a pullback over the coming weeks (especially if price action on USD/CNY is anything to go by).

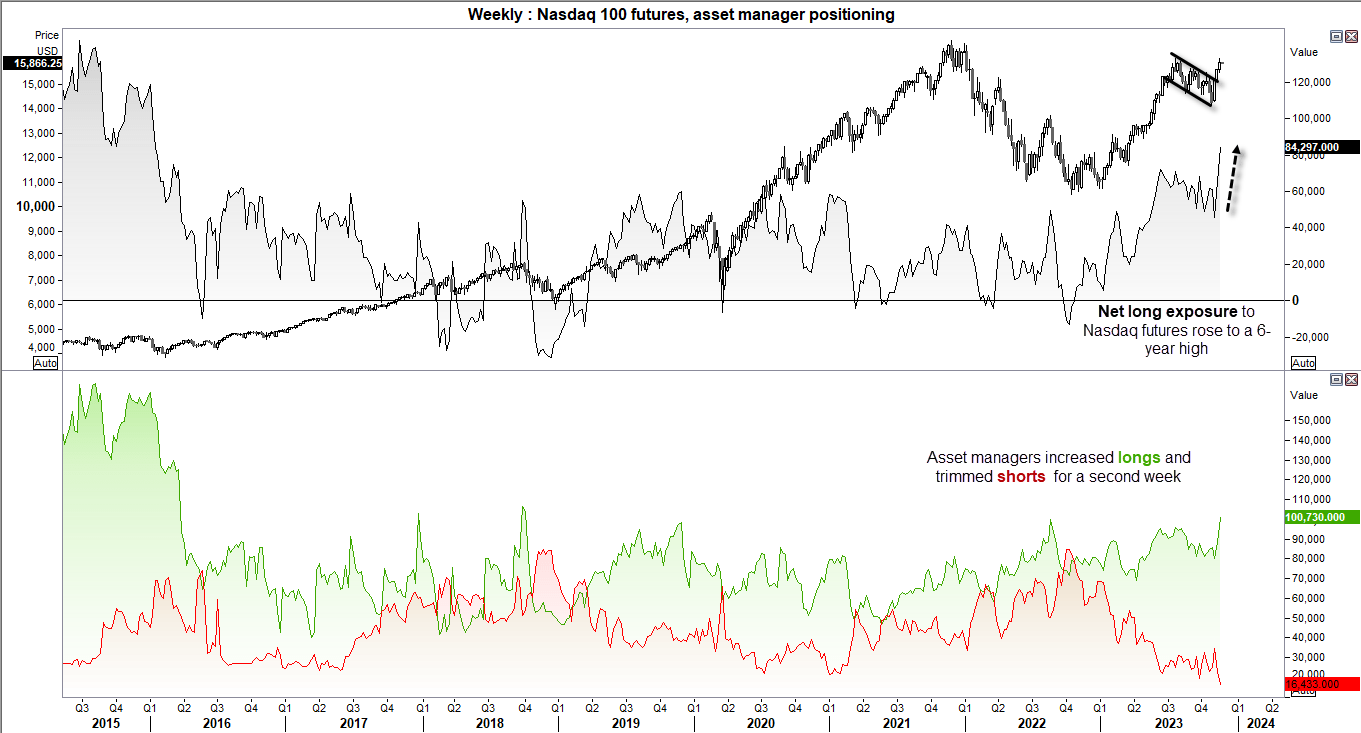

Nasdaq 100 futures (NQ) - Commitment of traders (COT):

Asset managers (real money accounts) continued to crucify Nasdaq bears by pushing net-long exposure to a 6-year high. Longs were increased and shorts were trimmed for a second week, whilst prices continued to rise out of the textbook bull flag pattern on the weekly chart.

Whilst net-long exposure could be seen at a sentiment extreme in recent history, it was around twice as high around 2013-2015. SO from that perspective, perhaps there is some further upside potential for the Nasdaq, although it needs to break convincingly above 16,000 before we can be confident its trend could resume.

Crude oil (CL) – Commitment of traders (COT):

Whilst large speculators and managed funds continued to add to their short exposure, their appetite for shorts is dwindling. The lower panel shows that large speculators increased short exposure for a fifth week, yet at their slowest pace in six. And as WTI formed a Doji on the weekly chart, I am beginning to feel a near-term inflection point (helped by the Bloomberg headline of WTI reaching a technical bear market). Sure, crude oil may still fall to $70, but I suspect it could have a bit more support around these levels and make a head for $80.

– Written by Matt Simpson

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.