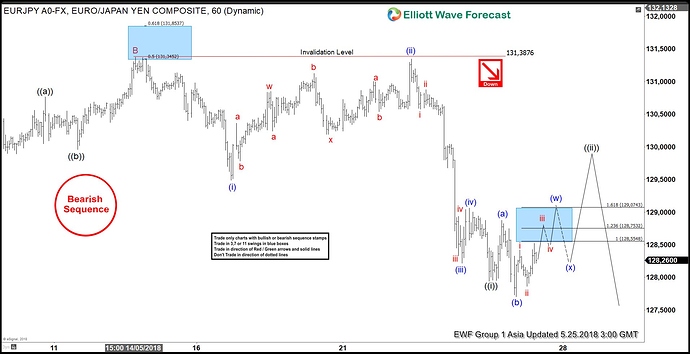

Elliott Wave Analysis: EURJPY Has a Bearish Sequence

EURJPY short-term Elliott Wave view suggests that the bounce to 5/14 high at 131.38 ended Minor wave B. Down from there, the decline is unfolding as Elliott wave impulsive structure in Minor wave C lower. The internal sub-division of each leg lower is showing 5 waves structure in lesser degree cycles, which is characteristic of an an impulse. Also, it’s important to note here that the below chart is showing a bearish sequence tag, which refers to the incomplete downward structure in the pair.

Below from 131.38 high the lesser degree Minutte wave (i) of ((i)) ended in 5 waves structure at 129.49. Above from there, the bounce to 131.35 high ended Minutte wave (ii) of ((i)) as a double three structure. Then the decline to 128.22 low ended in Minutte wave (iii) of ((i)) with another 5 waves structure. Up from there, the lesser degree Minutte wave (iv) of ((i)) ended at 129.06 high. Down from there, Minutte wave (v) of ((i)) ended at 127.94 low in another 5 waves. Above from there, the pair is correcting the short-term cycle from 131.38 high within Minute wave ((ii)) bounce which is epxected to fail in 3, 7 or 11 swings for further downside extension. We don’t like buying it into a proposed bounce.

EURJPY Elliott Wave 1 Hour Chart

1 Like

EURJPY Elliott Wave Analysis: Pullback can Provide Buying Opportunity

EURJPY short-term Elliott wave analysis suggests that the decline to $126.63 on 6/19 low ended intermediate wave (2) pullback. Up from there, intermediate wave (3) remains in progress as Elliott wave impulse. The internals of Minor wave 1 is unfolding as a leading diagonal with sub-division of 5-3-5-3-5. Up from $126.63 low, Minute wave ((i)) ended in 5 waves at $128.84. Minute wave ((ii)) pullback ended in 3 swings as a double three Elliott Wave structure at $127.12 low. Then rally from there ended Minute wave ((iii)) in another 5 waves at $129.5 high. Down from there, the pullback to $128.44 low ended Minute wave ((iv)) pullback as a Running Flat. Above from there, Minute wave ((v)) of 1 remains in progress in another 5 waves structure. The cycle looks mature but pair can extend higher 1 more time before it completes Minor wave 1. Afterwards, the pair is expected to do a pullback in Minor wave 2 in 3, 7 or 11 swings to correct cycle from $126.63 low before further upside towards $132.30-$133.63 area is seen. We don’t like selling the proposed pullback.

EURJPY 1 Hour Elliott Wave Chart

1 Like

EURJPY Elliott Wave View: Ended 5 Waves Advance

EURJPY short-term Elliott wave view suggests that the decline to 124.87 low ended intermediate wave (2) pullback of a leading diagonal structure from 5/29/2018 cycle. Above from there, the rally higher is taking place as Elliott wave zigzag structure within intermediate wave (3) of a diagonal. In a zigzag ABC structure, lesser degree cycles should show sub-division of 5-3-5 structure i.e Minor wave A unfolds in 5 waves either impulse or a leading diagonal, Minor wave B unfolds in 3 swings corrective structure. Whereas Minor wave C unfolds in another 5 waves structure either impulse or Ending diagonal structure.

In EURJPY’s case, the rally higher from 124.87 low unfolded as 5 waves impulse structure in Minor wave A. Up from 124.87 the rally higher to 126.49 high ended Minute wave ((i)) in 5 waves structure. Down from there the pullback to 125.55 low ended Minute wave ((ii)) pullback. A rally higher from there to 130.275 high ended Minute wave ((iii)) with another lesser degree 5 waves structure. Below from there, a pullback to 129.55 low ended Minute wave ((iv)). Finally, a rally to 130.86 high ended Minute wave ((v)) & also completed Minor wave A. Currently Minor wave B pullback remains in progress in 3, 7 or 11 swings to correct the cycle from 124.87 low before the rally resumes, provided the pivot at 124.87 low stays intact. We don’t like selling it.

EURJPY 1 Hour Elliott Wave Chart

1 Like

Good stuff! Can you do one for BTCUSD as well? I’d like to see how this will fare with Bitcoin trading. Thanks in advance!