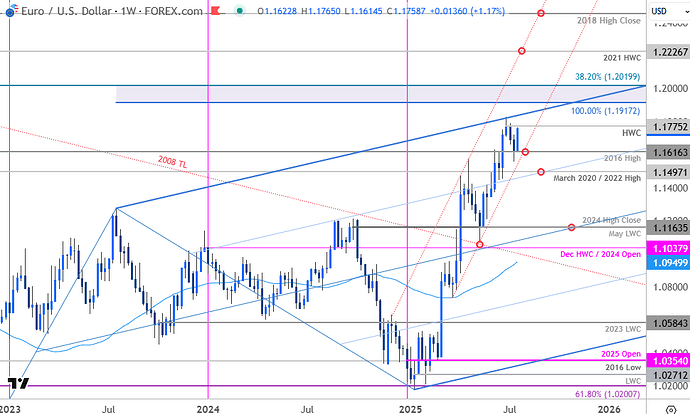

Euro surged nearly 1.9% off the monthly low with the bulls now testing the yearly high-close ahead of the ECB. Battle lines drawn on the EUR/USD weekly technical chart.

By :Michael Boutros, Sr. Technical Strategist

Euro Technical Forecast: EUR/USD Weekly Trade Levels

- Euro bulls stage four-day rally ahead of ECB interest rate decision

- EUR/USD testing resistance at 2025 high-close, remains constructive above weekly low

- Resistance 1.1775, ~1.1840s, 1.1917-1.2020- Support 1.1616 (key), 1.1497, 1.1163

Euro is poised to snap a two-week losing streak with EUR/USD up more than 1.2% since the Sunday open. The advance takes price back into weekly resistance ahead of tomorrow’s European Central Bank rate decision and the focus now shifts to the weekly close for guidance. Battle lines drawn on the Euro weekly technical chart heading into the close of the month.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this EUR/USD technical setup and more. Join live on Monday’s at 8:30am EST.

Euro Price Chart – EUR/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Technical Outlook: In my last Euro Technical Forecast we noted that, EUR/USD had extended into uptrend resistance and that, “From a trading standpoint, pullbacks would need to be limited to 1.1497 IF price is heading higher on this stretch with a close above the upper parallel needed to fuel the next leg of the advance…” Euro plunged more than 2.3% off those highs with price briefly registering an intraweek low at 1.1557 before rebounding. The rally takes EUR/USD into resistance at the objective high-week close (HWC) / high-close at 1.1775- looking for a reaction off this mark with a weekly close above needed to keep the immediate advance viable into the close of the month.

Initial weekly support remains with the 2016 swing high at 1.1616 with the medium-term outlook still constructive while above the March trendline (red). Ultimately, a break below the 2020 / 2022 highs at 1.1497 would be needed to suggest a more significant high is in place / a larger correction is underway with subsequent support seen at the 2024 high close / May low-week close (LWC) at 1.1164.

A breach / close above this pivot zone exposes the upper parallel (blue), currently near 1.1840s, with the next major technical consideration eyed at 1.1917-1.2020- a region defined by the 100% extension of the 2022 advance and the 38.2% retracement of the 2008 decline (area of interest for possible top-side exhaustion / price inflection IF reached). Subsequent resistance objectives eyed at the 2021 HWC at 1.2227 and the 2018 high-close at 1.2456.

Click the website link below to read our exclusive Guide to EUR/USD trading in Q2 2025

https://www.forex.com/en-us/market-outlooks-2025/q2-eur-usd-outlook/

Bottom line: Euro rebounded just ahead of the March uptrend with the rally now testing the yearly high-close ahead of the ECB- watch the Friday close with respect to 1.1775. From a trading standpoint, a good zone to reduce portions of long-exposure / raise protective stops- losses would need to be limited to this week’s low IF price is heading higher on this stretch with a close above the upper parallel still needed to fuel the next major leg of the advance.

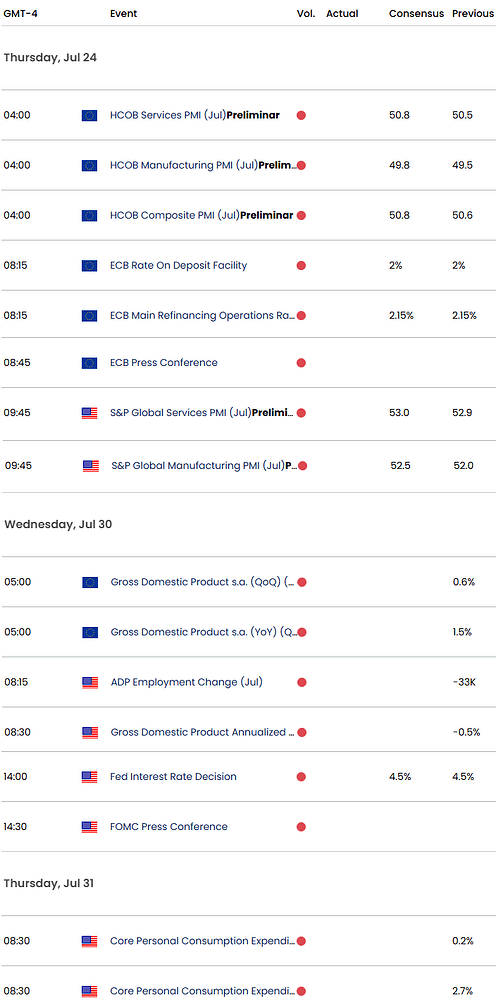

The ECB is widely expected to leave rates unchanged tomorrow with the FOMC rate decision, Core Personal Consumption Expenditures, and Non-Farm Payrolls on tap next week. Stay nimble into the monthly cross and watch the weekly closes here for guidance. Review my latest Euro Short-term Outlook for a closer look at the near-term EUR/USD technical trade levels.

Key Euro / US Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- US Dollar Index (DXY)

- British Pound (GBP/USD)

- S&P 500, Nasdaq, Dow

- Crude Oil (WTI)

- Japanese Yen (USD/JPY)

- Gold (XAU/USD)

- Australian Dollar (AUD/USD)

- Canadian Dollar (USD/CAD)

- Swiss Franc (USD/CHF)

— Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.