EURUSD

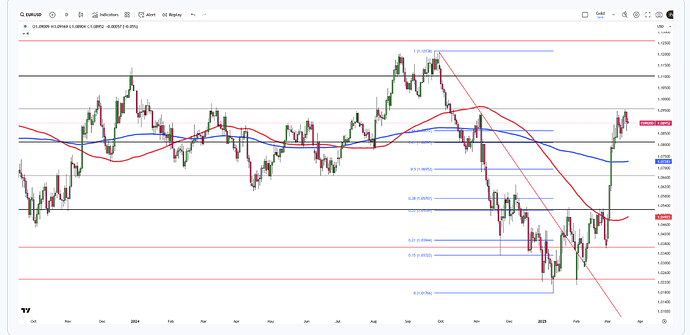

The US Dollar Index faced pressure as some Federal Reserve policymakers called for a pause in tightening policies. This was highlighted by Philadelphia Federal Reserve Bank President Patrick Harker, who reiterated the need to exercise prudence and hit the pause button on policy tightening. In the United States, economic indicators presented a mixed picture, with a contraction in domestic factory activities but a significant increase in jobs. The US ISM agency reported a decline in the Manufacturing Purchasing Managers’ Index (PMI), indicating reduced factory activities. However, the US Automatic Data Processing (ADP) agency reported a robust increase in jobs. In the Eurozone, inflationary pressures softened, leading investors to expect a potential pause in actions by the European Central Bank. However, the ECB President is expected to raise interest rates due to persistent core inflation.

The EUR/USD pair experienced a shift in direction influenced by changing fundamental readings, particularly due to a speech by Lagarde and FED members’ comments. The pair underwent a correction, surpassing the 1.0750 level and approaching the 100MA on the 4-hour chart, located around the 1.0780 level. The upcoming Non-Farm Payrolls (NFP) report is expected to have a significant impact on the EUR/USD pair, as any deviations from the forecasted numbers could alter market expectations for the next Federal Reserve (FED) meeting.

The euro pair is influenced by the market’s inclination towards a more hawkish stance from the Federal Reserve (Fed), particularly following the robust US Nonfarm Payrolls (NFP) report on Friday. Over the weekend, Kristalina Georgieva, the Managing Director of the International Monetary Fund (IMF), suggested that the Fed should take further measures to control inflation. The strong NFP figures, which reached a four-month high, have strengthened expectations of a more hawkish Fed, leading to a recent rise in the US Dollar Index (DXY).

The DXY has also gained strength due to the resolution of the debt-ceiling issue, as US policymakers extended the limit until 2024. On the other hand, the economic growth and inflation indicators in the Eurozone have been discouraging, which favors the Fed’s hawkish stance and puts downward pressure on the EUR/USD price.

The EUR/USD pair continued its downward movement following Friday’s NFP report, reaffirming the prevailing bearish sentiment for the pair. On the other hand, the DXY (US Dollar Index) continued its upward trajectory, confirming a bullish trend on the daily chart and indicating a potential move towards the significant target level of 105.50. In contrast, the next major target for EUR/USD is the historical area around 1.0550.

EURUSD

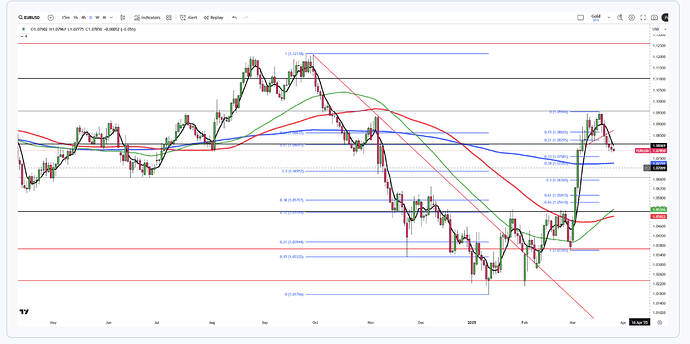

The upcoming meeting of the European Central Bank (ECB) is anticipated to include a rate hike, as reflected in market expectations. ECB’s Schnabel mentioned that the decision on further rate increases will depend on data, while ECB’s Knot expressed skepticism about the adequacy of the current level of tightening. This meeting, which also involves the release of new forecasts, holds significant importance for shaping expectations leading up to July.

In terms of economic data, Germany reported a 0.3% month-on-month increase in industrial production for April on Wednesday, which fell below the anticipated 0.6% growth. On Thursday, a fresh estimate of the Euro area’s GDP for the first quarter will be published, along with employment change data.

Following the Bank of Canada’s rate hike, the US dollar gained momentum on Wednesday, supported by a surge in US bond yields. The 10-year yield climbed by 3.50% to reach 3.79%, marking the highest level since May 29, while the 2-year yield rose to 4.60%. The consensus for the upcoming week still suggests that the Federal Reserve will maintain the Fed Fund rate within the range of 5.00% to 5.25%.

From a technical standpoint, the EUR/USD has formed a symmetrical triangle pattern, suggesting a potential continuation of the downward trend. An important resistance level to watch for is approximately 1.0750, where the 100-day moving average and the downward parallel of the bearish channel intersect. On the other hand, there are support levels around 1.0640, followed by 1.0600.

The upcoming release of US consumer inflation figures on Tuesday, followed by the highly anticipated FOMC monetary policy decision on Wednesday, will provide important insights into the Federal Reserve’s short-term policy outlook. These events will play a crucial role in determining the future direction of the US Dollar (USD) and offer significant momentum to the EUR/USD pair.

Meanwhile, a slight increase in US Treasury bond yields is helping the USD recover from its recent lows since May 24. However, the uncertainty surrounding the Fed’s rate-hike trajectory is limiting further appreciation of the USD. Additionally, the growing expectations of additional rate hikes by the European Central Bank (ECB) are supporting the EUR/USD pair.

From a technical standpoint, the EUR/USD has formed a double bottom at the 1.0700 support level, indicating more uncertainty rather than a clear signal of a potential reversal. It is important to monitor the resistance area around 1.0750/1.0760. Conversely, there are support levels present near 1.0700.

Upside CPI surprise can trigger sharp repricing of Fed rate hike expectations, future price in just 30% change, still lots of change can happen in a very short time span, I would rather avoid buying Euro before CPI

EURUSD

Softer US consumer inflation figures reaffirm market expectations of a pause in the Federal Reserve’s tightening cycle. The headline CPI rose modestly in May, with the annual rate slowing to its lowest level since March 2021. However, the year-on-year inflation rate of 4.0% remains twice the Fed’s target, leaving the possibility open for a 25 basis points increase at the July FOMC meeting.These factors support elevated US Treasury bond yields and lend some strength to the US dollar. On the other hand, influential European Central Bank (ECB) officials’ recent hawkish comments suggest that the Eurozone still has a way to go before raising borrowing costs, despite a decline in the headline Eurozone CPI to 6.1% in May.

ECB President Christine Lagarde indicated the likelihood of additional interest rate hikes due to the absence of clear evidence that underlying inflation has peaked. This could provide support for the euro and the EUR/USD pair. Traders are cautious and await the outcomes of the upcoming FOMC decision and ECB meeting.

Looking at the technical aspect, the EUR/USD pair did not behave as expected following the release of the CPI data, and there was low volatility in the market due to the focus shifting towards the upcoming Fed meeting. It is important to highlight that the next significant resistance level can be found around the 200-day Moving Average (MA) on the 4-hour chart, aligning with the upper Parallel of the descending long-term bearish trend. Additionally, the DXY (US Dollar Index) reached its 200MA and its lower parallel.

EURUSD

The EUR/USD continued its upward trajectory, achieving its highest daily close in a month above 1.0800, despite the US Dollar’s rebound following the hawkish stance of the Federal Open Market Committee (FOMC). Market attention now shifts towards the upcoming European Central Bank (ECB) meeting and forthcoming US data, which have gained significance in light of Fed Chair Powell’s statement that the July meeting will be a ‘live’ one.

On Thursday, the ECB’s Governing Council will convene, with expectations of a 25 basis points interest rate hike. The crucial factors for the Euro’s performance will be the language used in the statement and the comments made by ECB President Lagarde during the subsequent press conference. It is likely that President Lagarde will reiterate their intention to continue raising rates. However, if the meeting adopts a ‘dovish’ tone, hinting at a potential pause in rate hikes, the Euro may face downward pressure.

After the Fed meeting, the US dollar staged a recovery as the central bank chose to keep interest rates unchanged but signaled a willingness to pursue further rate hikes. The hawkish stance had an impact on Treasury bonds, leading to their decline, and bolstered the strength of the greenback. Fed Chair Jerome Powell’s remark that the July meeting would be a “live meeting” indicated that additional rate hikes remained a possibility. According to the projections released by the FOMC, a majority of its members foresee a total tightening of 50 basis points by the end of the year.

EURUSD

On Thursday, the EUR/USD experienced a significant surge, reaching its highest level in a month at 1.0952. The pair is maintaining its gains, indicating that the rally may not be over yet. This strong performance can be attributed to the European Central Bank’s (ECB) hawkish stance and the overall weakness of the US Dollar.As anticipated, the ECB raised its interest rates by 25 basis points while keeping the forward guidance unchanged. ECB President Lagarde emphasized that there is still work to be done and expressed that another rate hike in July is the most likely scenario. Inflation forecasts were revised upwards, and the market has already priced in a 25 basis point increase at the next meeting.The rise in German bond yields coupled with a decline in Treasury yields has contributed to the strengthening of the EUR/USD. Despite Federal Reserve Chair Powell’s hawkish tone on Wednesday, it did not have a lasting impact on the US Dollar. While inflation data from the Eurozone is scheduled for release on Friday, it is not expected to have a significant impact as these figures are final estimates. On the other hand, market participants will be focusing on the University of Michigan Consumer Sentiment Index from the US. The recent central bank meetings will continue to be analyzed and digested by market participants.In terms of technical analysis, the EUR/USD pair made a bullish movement we didn’t saw from more than 4 Months and found resistance at 1.0960 level. A possible correction can happen and the level to watch is 1.0912 but the CPI data today may surprise. In case of a breakout to the upper side the 1.1000 is a good level to watch followed by the 1.1050.

XAUUSD

Concerns over China’s economic slowdown are gaining traction as the People’s Bank of China (PBoC) reduces its benchmark Loan Prime Rates (LPRs) by 10 basis points, in line with market expectations. This move follows recent downward revisions in China’s growth forecasts by prominent banks like Goldman Sachs and JP Morgan, fueling apprehensions about weakened energy demand given China’s significant role as a major consumer of gold.

In contrast, officials from the European Central Bank (ECB) and the Federal Reserve (Fed) have maintained a more hawkish stance, raising concerns about a global economic slowdown, thereby exerting downward pressure on the price of gold.

Looking ahead, significant attention will be directed towards Fed Chair Jerome Powell’s testimony and the preliminary readings of June’s Purchasing Managers’ Index (PMI) for a clearer short-term outlook.

Gold’s upward momentum faced formidable resistance from a bearish descending triangle pattern, resulting in a decline in price until it found support at 1947. This support coincided with a decrease in the DXY (U.S. Dollar Index) and a decline in the yields of U.S. 2/10-year bonds. In relation to support levels, the initial one to consider is at 1945, followed by a significant support level at 1933. A breach below this level might indicate a substantial sell-off in the price of Gold.

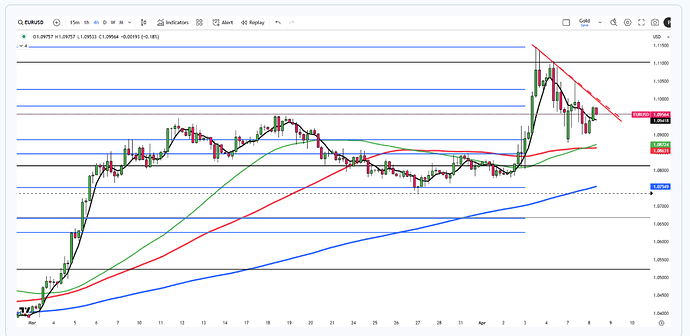

EUR/USD Analysis - 17.03.2025

EUR/USD Dips Amid U.S.-EU Trade Tensions

EUR/USD is slightly down, hovering near 1.0915 in early Asian trading. The Euro faces pressure from rising U.S.-EU trade tensions after Trump announced new tariffs on European goods. Washington imposed duties on steel and aluminum, prompting Brussels to prepare countermeasures, while Trump threatened a 200% tariff on European wine and spirits, adding downside risks for the Euro.

However, losses may be limited by Germany’s fiscal policy shifts. The Green Party supports debt restructuring, and incoming Chancellor Friedrich Merz proposed a €500 billion infrastructure fund with borrowing rule adjustments. The measures expected to be passed this week could support the Euro.

Weak U.S. Retail Sales data also weigh on the Dollar. February sales rose just 0.2% vs. the expected 0.7%, while January’s figures were revised lower to -1.2%. Annual sales growth slowed to 3.1% from 3.9%, fueling concerns about consumer spending and offering near-term support for EUR/USD.

Key resistance is at 1.0950, followed by 1.1000 and 1.1050. Support stands at 1.0880, with further levels at 1.0800 and 1.0730.

EUR/USD Analysis - 19.03.2025

EUR/USD Slips as Dollar Gains Ahead of Fed Decision

EUR/USD slipped to 1.0935 in the Asian session as the dollar rebounded ahead of the Fed’s rate decision. The Greenback gained support after stronger US data, with industrial production rising 0.7% in February, beating the 0.2% forecast.

The Fed is expected to hold rates steady, with focus on Powell’s press conference and the dot plot for policy signals. In Europe, Germany’s parliament approved a major spending plan, unlocking billions for investment to revive its struggling economy.

Key resistance is at 1.0950, followed by 1.1000 and 1.1050. Support stands at 1.0880, with further levels at 1.0800 and 1.0730.

EUR/USD Analysis - 20.03.2025

ECB Rate Cut Hopes Fade, EUR/USD Nears 1.0900

EUR/USD fell for a second day, nearing 1.0900 in the Asian session. The pair found support as the dollar weakened on falling Treasury yields after the Fed reaffirmed plans for two rate cuts. However, uncertainty over Trump’s tariff policies kept sentiment cautious.

In Europe, German lawmakers approved a debt plan by likely Chancellor Friedrich Merz to increase growth and defense spending. A shift from Germany’s conservative fiscal stance could drive inflation and influence ECB policy.

Investors await ECB President Lagarde’s speech on economic and monetary affairs in Brussels on Thursday.

Key resistance is at 1.0950, followed by 1.1000 and 1.1050. Support stands at 1.0880, with further levels at 1.0800 and 1.0730.

EUR/USD Analysis - 21.03.2025

Lagarde Flags Slower Growth from U.S. Tariffs

The euro fell below $1.085, retreating from its March 18 high of $1.0954, after ECB President Christine Lagarde warned of slower growth risks. Speaking to European lawmakers, she said a proposed 25% U.S. tariff on EU goods could cut eurozone growth by 0.3 percentage points in the first year, or 0.5 points if the EU retaliates. Lagarde added that the main impact would be front-loaded, with limited inflation pressures, suggesting the ECB is unlikely to raise rates in response.

Key resistance is at 1.0860, followed by 1.0950 and 1.1000. Support stands at 1.0800, with further levels at 1.0730 and 1.0670.

EUR/USD Analysis - 24.03.2025

Yields Weigh on EUR/USD: Euro at 1.0820

EUR/USD is trading around 1.0820 on Monday, rebounding slightly from last week’s low of 1.0795. The euro has pulled back from its recent high of 1.0955 with uncertainty over Germany’s fiscal policy and rising global trade tensions.

Caution persists before the April 2 announcement of new U.S. tariffs, which could weigh on the eurozone. Despite the modest recovery, the euro remains under pressure from stronger U.S. Treasury yields and demand for the dollar.

Key resistance is at 1.0860, followed by 1.0950 and 1.1000. Support stands at 1.0800, with further levels at 1.0730 and 1.0670.

EUR/USD Analysis - 25.03.2025

US PMI Strength Drives Dollar Higher

EUR/USD is trading at $1.08 as the U.S. dollar strengthens on solid U.S. services PMI data, which signaled economic resilience and pushed yields higher. Confidence in the dollar was further enabled by Trump’s remarks suggesting not all April 2 tariffs will be implemented, with possible exemptions for some countries. Meanwhile, the euro is under pressure as its recent rally fades and Eurozone economic signals weaken, keeping EUR/USD on a downward path driven by dollar strength.

Key resistance is at 1.0860, followed by 1.0950 and 1.1000. Support stands at 1.0730, with further levels at 1.0660 and 1.0600.

EUR/USD Analysis - 26.03.2025

Eurozone Growth Slows, ECB Leans Dovish

The euro hovered near $1.08, its weakest since March 6, as investors digested PMI data and ECB comments. Eurozone private sector activity grew at its fastest pace since August but missed expectations, with manufacturing rebounding and services slowing.

ECB’s Cipollone and Stournaras signaled growing support for a rate cut, possibly in April, citing faster disinflation. Lagarde warned of weaker growth but downplayed inflation risks from EU-U.S. trade tensions, suggesting no rate hikes. De Galhau also noted room for further easing.

Key resistance is at 1.0860, followed by 1.0950 and 1.1000. Support stands at 1.0730, with further levels at 1.0660 and 1.0600.

Are these based on fib retracements or pivots points? TY!

What do you think about price looking to fill the gap down to 1.0532? Or at least down to 1.0650?

EUR/USD Analysis - 07.04.2025

EUR/USD Edges Higher Amid Fed Cut Bets

The EUR/USD rose 0.03% to $1.0967 in Asian trade, supported by expectations of Fed rate cuts amid U.S.-China trade tensions. However, gains were limited by concerns over European growth and global trade disruptions. Without signs of market stability, the pair may stay range-bound under risk aversion pressure.

Key resistance is at 1.1100, followed by 1.1150 and 1.1215. Support lies at 1.1000, then 1.0850 and 1.0730.

EUR/USD Analysis - 08.04.2025

Euro Firms as U.S.-China-EU Trade Rift Widens

The euro hovered near $1.10, its highest since October 2024, as the dollar weakened and trade tensions escalated. China plans to impose 34% tariffs on all U.S. goods from April 10, following Trump’s 10% tariff on all imports, including 20% on EU and 34% on Chinese goods. France urged firms to halt U.S. investments, and the EU is preparing countermeasures. Markets now price in a 90% chance of an ECB rate cut in April, with the deposit rate seen falling to 1.65% by December from 2.5%.

Key resistance is at 1.1100, followed by 1.1150 and 1.1215. Support lies at 1.0900, then 1.0850 and 1.0730.