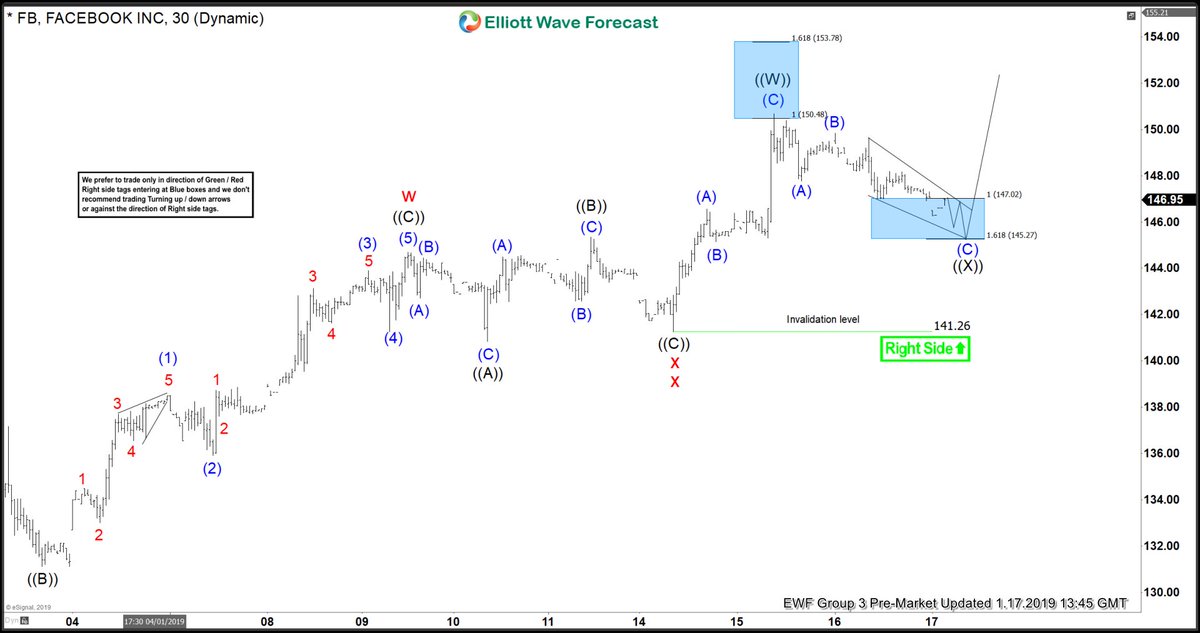

Hello fellow traders. Today, I want to share some Elliott Wave charts of the Facebook stock which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 01/17/19. showing that FB has a 1H right side tag against 141.26 low.

From 01/14/19 low (141.31) Facebook ended that short-term cycle at 01/15/19 peak (150.74) in black wave ((W)). Below from there, we advised members that it should see the equal legs from 01/15/19 peak towards the areas of the 100 - 1.618 Fibonacci extension of blue wave (A)-(B) which came around 147.00-145.27 and unfolded as an Elliott Wave Flat structure. Therefore, we expected buyers to appear in the sequences of 3, 7 or 11 swings. And that was the first area for buyers to appear to take prices to new high above 01/15/19 (150.74) peak. Or a larger 3 waves reaction at least.

FB 01.17.2019 1 Hour Chart Elliott Wave Analysis

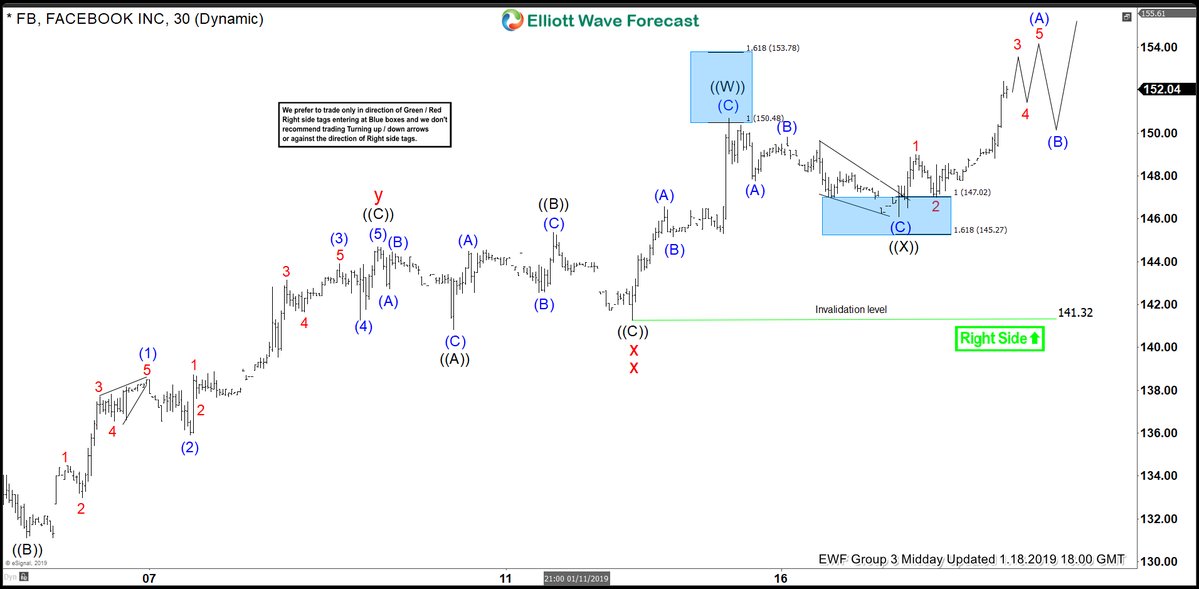

In the last Elliott Wave chart, you can see that FB reached the blue box area and extend a bit lower like forecasted. Then it showed a nice impulsive reaction higher. Due to the right side tag. We advised members to buy the blue box. And if traded our blue box. Any trades from that area have been risk-free, which means the stop-loss was moved to breakeven, targeting higher levels. Do please keep in mind that the 1-hour chart which I presented have changed already. The blue boxes you see in our charts are our so-called High-Frequency boxes. Where the market ideally shows us a reaction either lower or higher.

Facebook 01.18.2018 1 Hour Chart Elliott Wave Analysis

I hope you enjoyed this blog.