Freeport-McMoRan Inc., (FCX) engages in the mining of minerals in North America, South America & Indonesia. It primarily explores for Copper, Gold, Molybdenum, Silver & other metals, as well as Oil & gas. It is based in Phoenix, Arizona, US, comes under Basic Materials sector & trades as “FCX” ticker at NYSE.

FCX shown impulse sequence higher since January-2016 low, which ended at $51.99 high. Below there, it corrected in zigzag correction, which ended at $24.80 low between equal leg area before turning higher. It favors short term upside & confirms the new sequence higher above $51.99 high.

FCX - Elliott Wave Latest Weekly View:

It placed $3.52 low as (II) on 1/20/2016. Above there, it placed ((1)) at $17.06 high & ((2)) at $4.82 low as an expanded flat correction. Later, it started third wave extended sequence, which ended as ((3)) at $46.10 high. It favored ended ((4)) at $30.02 low as 0.382 Fibonacci retracement. Finally, it ended ((5)) at $51.99 high on 3/25/2022. Below there, it ended II at $24.80 low as II in zigzag sequence between extreme areas before turning higher. It placed ((A)) at $33.43 low, ((B)) at $43.62 high & ((C)) at $24.80 low.

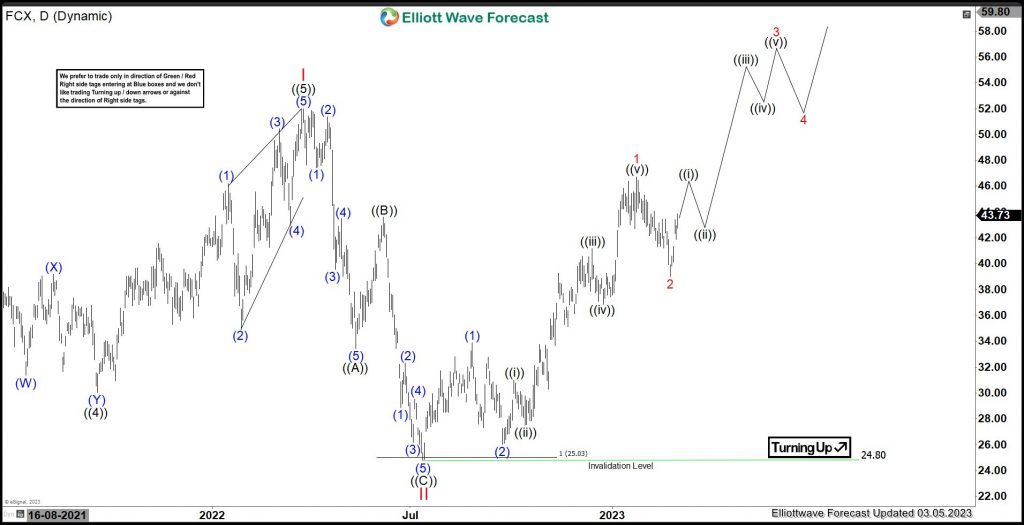

FCX - Elliott wave Latest Daily View:

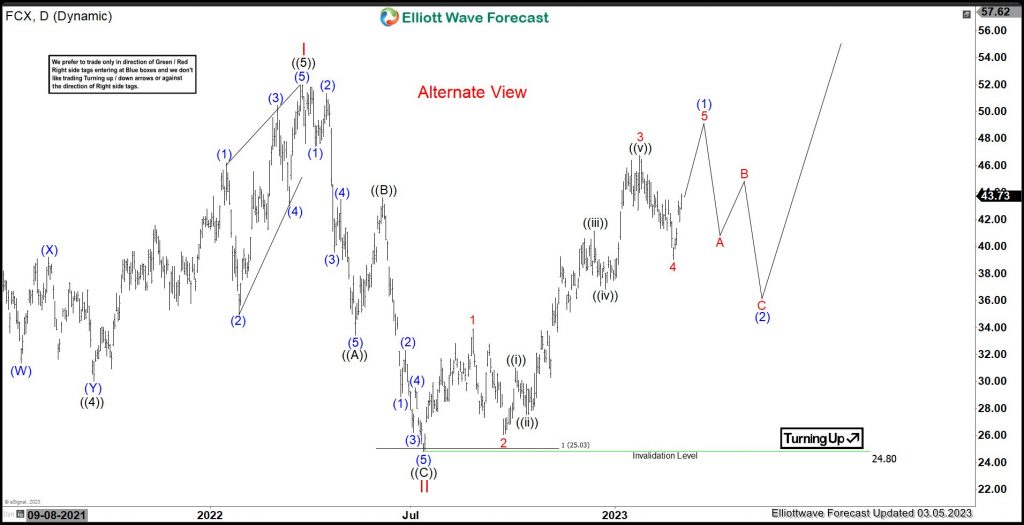

Above II low, it favors higher in III, which will confirm above $51.99 high. It placed (1) of ((1)) at $33.89 high & (2) at $26.03 low. It confirms higher high above (1), calling for upside in (3). It placed 1 of (3) at $46.73 high & proposed ended 2 at $39.01 low. Above there, it favors higher in 3 of (3), which confirms above 1 high as aggressive view. Alternatively, it may ended 4 of (1) of ((1)) at $39.01 low & favors higher in 5 of (1), which confirms above 3 high of $46.73. In either the case, it favors short term upside to continue. It should be remains supported in 3, 7 or 11 swings sequence at extreme areas, while dips remain above II low.

FCX - Alternate Elliott Wave Daily View:

Source: https://elliottwave-forecast.com/stock-market/fcx-favors-upside-remain-supported/