I walk into it knowing this money could just disappear. I know that’s probably not the best way to approach it but it works for me. Losses are part of the game. Drawdown too. I just look at my weekly and monthly profit/loss % and use them as my measuring stick. Worrying everyday about losing would paralyze me! Maybe you can shift the goal posts as they say in the US. Take it a step back, still worry, but now its not as often?

Wednesday, March 19 – Day #6

Results: +1.9R (1 winner, 1 loser)

Daily P&L: $99.62

Discipline and Execution

• On my first trade (T9), I was stopped out in just a few seconds. A strong spike in price triggered my entry at the wrong price and almost immediately stopped me out for a smaller loss (-0.4R).

• On my second trade (T10), I resisted the temptation to close my trade too early. I was prepared to let it play out to either my TP or SL. My execution and discipline were perfect on this one.

• A few minutes later, I missed a 4R trade because I decided not to take my B+ setup. The setup was good, but I created stories in my head to convince myself not to take the trade. I hesitated because its location was in the middle of the range, it was against the 30m and 240m trend, I saw liquidity below the morning low and the Globex low, and I convinced myself that price would move sideways like yesterday until FOMC at 2 PM. I ended up making a decision based on what I thought would happen instead of what the chart was telling me.

It’s 1 PM, and FOMC is in less than 60 minutes. No trades for me this afternoon.

Thursday, March 20 – Day #7

Results: +0.2R (1 winner, 2 losers)

Daily P&L: $2.09

Discipline and Execution

• I got stopped out quickly on my first trade (T11). I normally don’t trade setups that form in the middle of a leg down or leg up because they have lower odds—I prefer the extremes. However, when a setup aligns perfectly with the NY prior day close, it often becomes a reversal point. So, I had to take this setup for that reason. My setup could have worked, so it was a good loss!

• My second trade (T12) was also a loss. I didn’t particularly like the structure of my setup on the 2-minute chart or the fact that there was liquidity just above my SL. However, the structure on the 5-minute and 60-minute charts indicated a strong supply area, which is why I decided to take the trade. They ended up grabbing the liquidity before reversing lower. Another loss, but that’s okay!

• On my third trade (T13), once I saw liquidity being taken out, I waited for a new setup to form and jumped into a short for a small profit. I normally don’t take partials, but while I was in the trade, PA wasn’t showing any aggression from sellers. So, I decided to close half of my position at the first opposing draw and let the remainder play out to either my SL or my TP, which was slightly lower at the next draw. This trade gave me 2.2R instead of 3R—had I not taken partials, it would have been a full 3R.

I stayed disciplined during my session and didn’t revenge trade after my second loss. If I weren’t doing this journal experience, I might have been frustrated and taken a revenge trade after my second loss. It’s 1:30 PM as I write this, and there’s nothing high-quality on the chart that makes me want to take another trade today. A breakeven day is better than a losing day, so I’m calling it a day here and will come back tomorrow.

Friday, March 21 – Day #8

Results: -2R (0 winners, 2 losers)

Daily P&L: -$119.45

Discipline and Execution

Today was a frustrating day! I decided to stop trading and walk away after my second loss because I didn’t trust my discipline—or rather, I was afraid I’d do something stupid, like going on tilt.

• It started with my limit sell order at 19,569, which got missed by just one tick. This was a great A+ setup. I don’t chase price, so I waited for another retest, but price reversed aggressively without me and reached 5R, exactly where I would have placed my TP. That was frustrating, but it happens occasionally.

• My first trade of the day (T14) was also very frustrating. I got wicked out by just a few ticks, and then price dropped straight to my TP—without me! As I write this, I’m reviewing whether my SL was placed correctly based on my rules, and yes, it was at the right location. I know these “wick-out” losses happen from time to time. There’s nothing I can do about it; it’s just frustrating when it does.

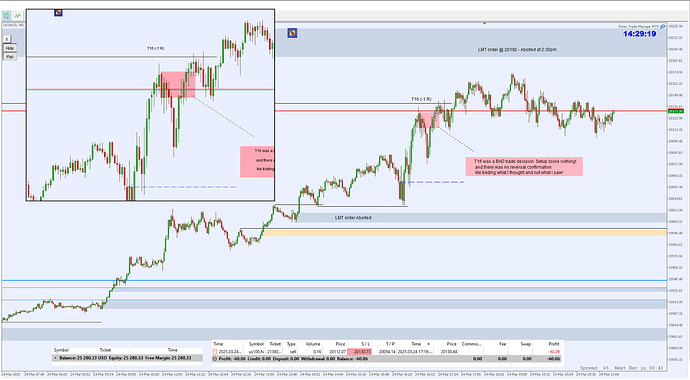

• My second trade (T15) was a bad decision. I had originally marked this area as a B+ setup, but in reality, it was a C setup—there was absolutely no reason for me to take this trade. My decision was impulsive and not well thought out. When I decided to take this long, I was still frustrated from what had happened earlier. I wasn’t in the right state of mind. Since I don’t trade C setups, I shouldn’t have taken this trade.

Despite today’s frustration, I’m happy with my week overall, but I see several areas where I can improve next week. My discipline was good, but I still need to work on my execution. On Monday and Wednesday, I hesitated and didn’t take two quality setups that could have given me 8R total. Next week, I want to take ALL my B+ and A+ setups with no exceptions.

I finished the week at +2.3R with 10 trades. My win rate was only 40%, which is below my setup’s long-term 59% win rate. My biggest win this week was only 2.3R, which is low for my setup. After reviewing my 10 trades, I noticed that my average SL size was 25.9 points, compared to my setup’s long-term average of 15 points. That’s partially why my biggest win was only 2.3R! Nasdaq has been consolidating inside a tight daily range since March 10 with no follow through, which, to me, explains my setup’s poor performance this week. It feels like price is waiting to make its next big decision—either to continue its daily downtrend or start a corrective leg higher. Next week should be interesting, and hopefully, Nasdaq will offer me several quality setups.

Maintaining a Trading journal is a powerful habit and an underrated skill in trading. The fact that you have maintained one is a boss move. Thanks for sharing this with the community on a public forum. Wishing you success and happy trading.

Monday, March 24 – Day #9

Results: -1R (0 winners, 1 loser)

Daily P&L: -$60.06

Discipline and Execution

Today should have been a NO TRADE DAY! Pretty boring price action overall. At 12:30 p.m., I decided to stop actively monitoring price action and do some backtesting until 2:30 p.m. I had a limit sell order at 20,192, which I decided to leave open while backtesting, but it was never tested.

• The trade I took (T16) wasn’t even a valid setup—it was clearly me forcing a trade. I was trading what I thought would happen rather than what the chart was telling me. The reason I took this short was that price had just shown initial selling pressure after testing the QQQ/NQ cash market gap that was still open from March 6th. I honestly can’t explain why I took this trade other than acting on impulse. None of my setup rules were met. This was just poor execution.

Tuesday, March 25 – Day #10

Results: +1.2R (1 winner, 1 loser)

Daily P&L: +$64.28

Discipline and Execution

Today, I almost jumped on a short with a market order—which is against my trade plan because I only place limit orders. I had drawn the setup at 20,270 as a C-setup, and price started to reverse down beautifully. As price moved lower after the retest, I began second-guessing my evaluation of the setup and was extremely tempted to enter with a market order. But I didn’t! I kept telling the little voice in my head, “Don’t chase price, stay disciplined, more opportunities will come.” After about 7–8 minutes, I walked away from my charts. When I returned to my desk, price was attempting to bounce from the prior day’s high, so I reevaluated the setup, and it was still a C-setup. In most circumstances, price action would have sought liquidity just above—so not taking the trade was the right call.

• On my first trade (T17), I got wicked out, and then price moved to 3R before coming back down. I was hoping for a retest before the NY open, but my order was triggered right after 9:30. That’s okay—this setup could have worked!

• On my 2nd trade (T18), since I was trading against the bullish momentum of the pre-market open, I decided to close half of my position at the retest of the 9:30 NY open price and left the remaining position open to hit my TP at the opposing liquidity (draw) 20,179, which was hit fairly quickly. The execution on this trade was good.

Even though I’ve stayed disciplined since starting this journal experiment, I find that NASDAQ hasn’t offered many quality setups. Price has remained within its daily range for 9 days. So far this week, no real pullback has been offered during the NY session to participate in the rally. Yesterday and today, none of the LONG setups I had drawn were tested. When buyers are in control, LONG setups are usually tested and hold firm for the next leg higher. However, for the past two days, most of the heavy lifting has happened during the London session, with consolidation during the NY session. It almost feels like the banks aren’t participating in this rally, which suggests we’re in a daily pullback of the bigger down trend. Further downside is likely expected by the end of the week or early next week, which should offer me better-quality setups to trade. Trading NASDAQ these days is really a game of patience.

Tuesday, March 26 – Day #11

Results: +1.2R (1 winner, 1 loser)

Daily P&L: +$74.10

Discipline and Execution

My discipline today = rubbish

My execution today = rubbish

This was going to happen at some point, and today was the day! I got frustrated due to my hesitations, lack of patience, and the poor quality price action. I couldn’t control myself, I got impulsive—I revenge traded. I got very lucky because I could have lost the account today.

Here’s what happened: I was going to take a short at my B+ quality setup at 20,270, but I hesitated and chose not to. I created stories in my head to avoid taking the setup, convincing myself that there was liquidity above my SL and that the 20,307 setup was more likely to get tested. That trade would have been the NY session high of the day! Not taking it left me frustrated. Then, I took a loss (T19) at my A+ quality setup, which should have been fine. However, I got extremely frustrated and immediately revenge traded.

To make things even worse, after taking a 20-minute break, I spotted a B+ quality setup forming at 20,112. I placed my limit short order in the system, and for about 12–15 minutes, price was consolidating just below my short entry without triggering my order. Once again, I created stories in my head, convincing myself that price was consolidating for a move higher. I canceled my limit order—and, of course, price immediately reversed downward, hitting what would have been my take profit.

I started this journal experiment to fix my hesitations, which too often lead to not following my trade plan—whether that means revenge trading or, even worse, going on tilt. Today is a perfect example of something I’ve experienced countless times. Luckily, I ended the day in the green, but not in the way I want to.

After the frustrating day I just had, it’s a good time to review my first batch of 20 trades.

Number of trading days: 11

Winners: 9 trades

Losers: 11 trades

Win/Loss ratio: 45%

Total cumulative “R”: 9.0R

Profits: $425

What if I had ZERO hesitation during these 11 trading days?

Or, put another way—what was the cost of my hesitations?

Trades I closed too early or before hitting my TP: 1 trade

Trades I didn’t take but should have: 8 trades

Total “R” missed by skipping quality setups: ~30R

Comments:

This doesn’t surprise me, and that’s exactly why I’m doing this journal experiment. My biggest issue is hesitation. It’s simple—I need to eliminate hesitation and take all quality setups like a robot.

Had I taken all the quality setups I hesitated on, my win rate would have been 60%, which aligns with my setup’s long-term W/L ratio of 59%. My cumulative “R” would have been ~39R, and my profit would be over $2,000 instead of just $425.

Goal for the next batch of 20 trades:

Take all quality setups. Easier said than done, but this is where I need to focus most of my effort.

Thursday, March 27 – Day #12

Results: +.2.3R (2 winners, 1 loser, 1 BE)

Daily P&L: +$135.42

Discipline and Execution

After reviewing my first batch of 20 trades last night, I decided to make a small change to my risk management. I will no longer use dynamic risk management but instead a fixed risk of $60 per trade, which is about 0.25%. With my current account balance just above $25,400, this gives me a buffer of 40 trades before reaching the maximum account loss of 8%. Even if I were to lose all my next 40 trades, I would still have 2 more batches of 20 to analyze. Moving forward with this journal experiment, my goal is to take all A+ and B+ setups with no exceptions.

• T21 (+2.3R): The setup was good enough to take the short, but I didn’t expect it to push price to low of day. That’s why I placed my TP at the 9:30 NY open price for a small 2.3R trade. It’s always easier to judge after the fact, but maybe I was too conservative with my take profit on this one.

• T22 (BE): When my SL almost gets touched, price often ends up violating the setup. That’s why I decided to manually close the trade at BE. At that moment, I wanted to let the price reverse and take the newly formed setup, which I did at 19,828—but price missed my limit order by a few ticks. Was getting out at BE on T22 a good decision? YES, because I avoided a loss as price would have wicked my SL before reversing. But NO, because sometimes price doesn’t go for my SL and moves in favor of my trade.

• T23 (-1R) and T24 (+1R): This time, I was wicked out on T23. I took the next trade, T24, with the intent of getting out at 1R because it was a C setup. Closing half at 1R and leaving the remaining position open for a bigger target would have been the better execution – again always easier to judge after the fact!

I should have caught both the low and high of the morning session, but I didn’t because both of my setups were wicked out. Reviewing where my SL was located on both setups, I see no errors—they were properly placed. I’m not ready to give my trades more breathing room yet, but it’s definitely something I need to keep an eye on if it keeps happening too often.

Just coming back to my computer after lunch to close my stuff because I can’t trade this afternoon—I have an appointment in 30 minutes… and I see this!!! Grrrrrr!

Friday, March 28 – Day #13

Results: +1.7R (1 winner, 3 losers)

Daily P&L: +$109.90

Discipline and Execution

Last night, I was thinking about the setup I missed while I was at lunch (see my previous post). I didn’t take it because I wasn’t in front of the computer, but I should have placed a limit sell order and monitored it from my phone. Since the start of this journal experiment, this was the 9th setup I didn’t take due to hesitation or what ever reasons. So this morning, I had one goal and one goal only—take all the setups I see, no matter what. Well, I guess that made me jump the gun too easily!

T25 (-1R): The setup was valid, and it could have worked. It kinda worked, but I was wicked out once again! After hitting my SL, the price dropped to what would have been my TP at the opposing pivot low (~19665).

T26 (-1R): Clearly not reading price action correctly, I identified what was a C setup as a B+ setup (~19723) and took a long trade. Funny enough, this setup was between my T25 entry and its TP, so of course, it wasn’t going to work. That was a bad execution.

Then my limit order at 19652 didn’t get triggered. I saw the price touch my entry twice, but it didn’t trigger my order. That was frustrating! For a second, I thought about entering with a market order, but price reversed so fast that I didn’t have time to react.

T27 (-1R): At this point, I clearly wasn’t in the right mindset to read price action correctly—I was forcing trades. Just like T26, I misidentified a C setup as a B+ setup. I was expecting a retest of the NY open price and then a reversal to new low of day. That’s kind of what happened, but the price reversed at the prior day’s low instead. That was a poor trade decision.

T28 (+5R): This one happened so fast, and I’m lucky it worked because it could have been a -2R trade! At that point, I think I just wanted to take a trade without properly vetting the setup. In fact, T28 wasn’t even my CCCEM setup—it was just an old wick-to-wick supply zone trick I used to trade in the past. I saw the price reverse at the prior day’s low with a strong rejection and thought it was ready to retest the morning’s low. Looking at my M1 chart, I spotted the wick-to-wick setup. It happened so fast that I didn’t had time to use my position size tool. As price retested the M1 wick-to-wick area, I clicked market order without adjusting my lot size. Then, within seconds, I realized—oh s***, that’s a full lot, and I have no SL! I quickly set a TP at ~$300 (which would be a 5R for a normal position size) while the price was trying to reject the wick-to-wick area, showing about a ~$100 drawdown. Then the price dropped to my TP before I even had time to place an SL. I was very lucky on this one.

That was 3 bad trade executions in a row. Enough for me to call it a day and take the weekend to reflect on all of this.

Monday, March 31 – Day #14

Results: 0.0R (0 winner, 0 losers)

Daily P&L: $0.00

Discipline and Execution

Pretty boring morning—no trades for me today.

I was looking for a retest of the Globex high at the NY open for a short or a retest of the Sunday open gap, but instead, we got a drop right at the 9:30 open with no quality setups being tested or created. It’s almost 1 PM as I write this, and I’ve seen enough for today. I’ll be back tomorrow.

Tuesday, April 1 – Day #15

Results: -3.0R (0 winner, 3 losers)

Daily P&L: -$174.78

Discipline and Execution

Red day today!

T29 (-1R): I wanted this setup to be tested during the first 30 minutes of the NY session. Once price took out the Globex low liquidity, I initially canceled my limit order because I thought price would likely grab the liquidity just above my SL. But that little voice in my head said, “What if the setup works and I no longer have my limit order in the system? I’ll regret it!” So, I put my limit sell order back—and got stopped out. That’s okay!

T30 (-1R): This setup was good enough to take, but the problem was that the H4 key level was just above my SL. I took it anyway because I wanted to stick to my plan and take all quality setups no matter what. But honestly, I wasn’t very confident in the trade. That was a bad trade decision. Another small loss. Price ended up reversing in the middle of nowhere, about 70 points above the H4 key level.

T31 (-1R): Not much to say about this one, other than the fact that I was trading against the morning bullish move. But I’ve seen countless similar situations where price reversed downward for a 3R or 4R move before heading back up. Strange how the long-term win/loss ratio of my setup is around 59%, yet over the past few weeks, it’s been closer to 40%.

Looking at the M30 over the past few weeks, Nasdaq price action since March 10th has been crap! Price either grinds higher, grinds lower, or just moves sideways—aka consolidating. The quality supply and demand areas from higher timeframes aren’t being retested, and on the lower timeframes, there are almost no quality retests either. Price has been reversing in the middle of nowhere far too often, well before reaching supply or demand. It’s as if price discovery is nonexistent.

These conditions are frustrating and difficult for me to trade. I need a break and retest to execute trades, but Nasdaq hasn’t been giving me much quality lately. You can really see the difference when comparing the 30-minute charts from February to the last 10 days!