United States of America

The US currency is weakening against the euro and the yen today, but is strengthening against the pound.

The comments of US Treasury Secretary Janet Yellen, made the day before, remain in the focus of the market’s attention. She noted the significant strengthening of the national labor market over the past twelve months, during which more than 6.4M new jobs were created, and the unemployment rate fell below 4.0%. The official also said that, in case of victory over the pandemic, inflation in the USA will begin to decline and by the end of the year will approach the target level of 2.0%, in addition, Janet Yellen supported the course of the US Fed to tighten monetary policy. As for the situation caused by the spread of the Omicron virus, positive changes are also observed here. In a number of American states, the incidence is beginning to decline, but the number of hospitalizations still remains at consistently high levels, which does not yet give grounds to talk about a complete reversal of the trend.

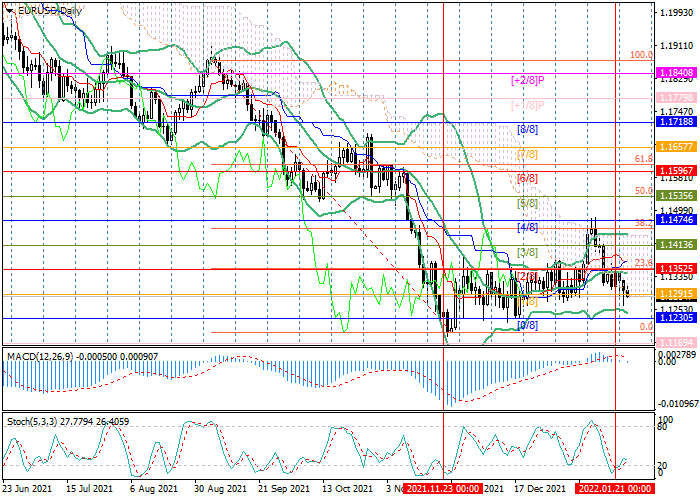

Eurozone

The European currency is strengthening against its main competitors – the yen, the pound and the USD.

Investors are focused on the comments of the head of the European Central Bank (ECB) Christine Lagarde, made during today’s videoconference held by the World Economic Forum in Davos. In particular, she stressed that inflation in the eurozone will not reach the same high rates as in the USA, and economic conditions in the two countries are too different, so the European regulator will not follow the US Fed in tightening monetary policy. Christine Lagarde also confirmed that, according to European officials, energy prices will stabilize in 2022, and supply disruptions will weaken, which will lead to a serious slowdown in inflation.

United Kingdom

The British currency is weakening today against its main competitors – the euro, the yen and the USD.

The pound came under pressure against the background of the publication of December retail sales data in the United Kingdom: on a monthly basis, their volume decreased by 3.7%, and on an annual basis – by 0.9%. Experts believe that residents of the country carried out most of their Christmas purchases back in November, reducing activity in the last month of the year, which naturally led to a decrease in sales. The unfavorable epidemiological situation caused by the spread of the COVID-19 Omicron strain also contributed to the negative dynamics. It is noted that the least often residents of the UK bought clothes, household goods and fuel. The weak statistics on the GfK consumer confidence index shoul also be noted: in January, the value decreased from -15 to -19 points, and this is the weakest indicator since February last year. Consumers fear the deterioration of their economic situation due to a serious increase in inflation.

Japan

The Japanese currency is weakening against the euro, but is strengthening against the USD and the pound.

The December inflation data published today in Japan turned out to be mixed: the nationwide consumer price index rose from 0.6% to 0.8%, while the base value of the indicator remained at the same level of 0.5%, yielding 0.6% predicted by analysts. It should also be noted that today Prime Minister Fumio Kishida called on the Bank of Japan to develop a strategy for the country’s withdrawal from a large-scale economic stimulus program due to a serious increase in the cost of living of the population. At the same time, the official expressed hope that the agency will continue to make efforts to bring inflation to the target level of 2.0% as soon as possible, however, he stressed that the Bank of Japan will continue its current monetary policy in the near future and will not follow the example of other developed countries that are starting to tighten it.

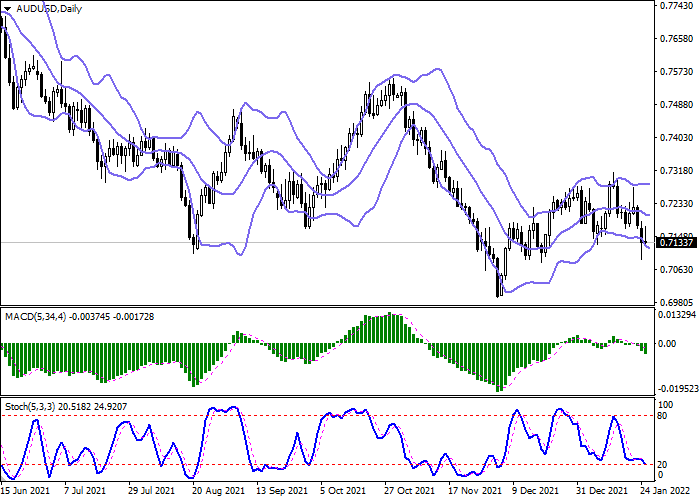

Australia

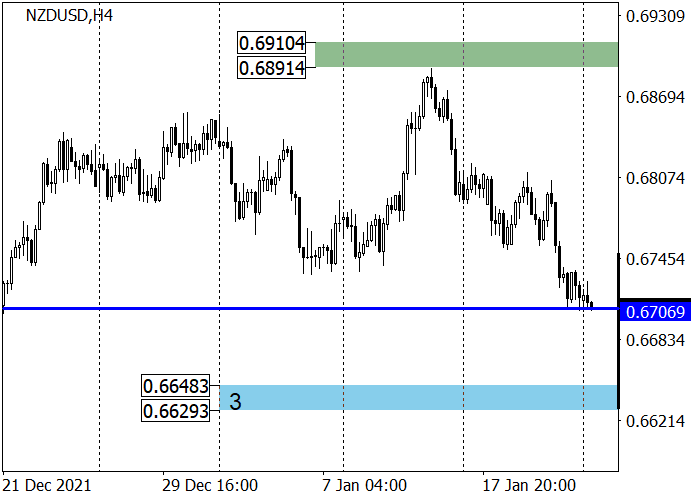

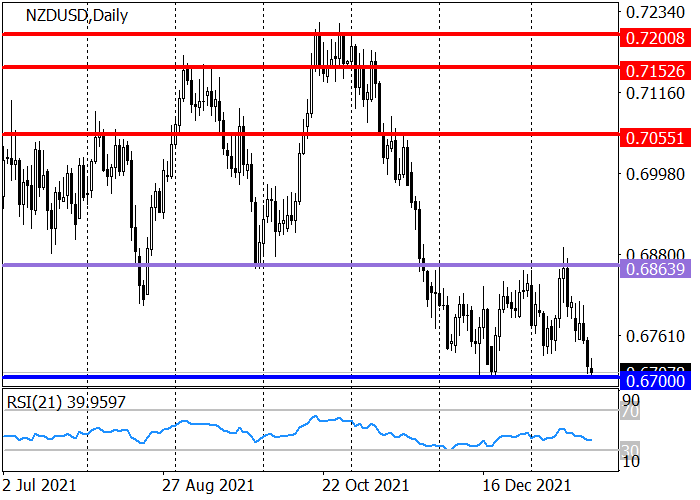

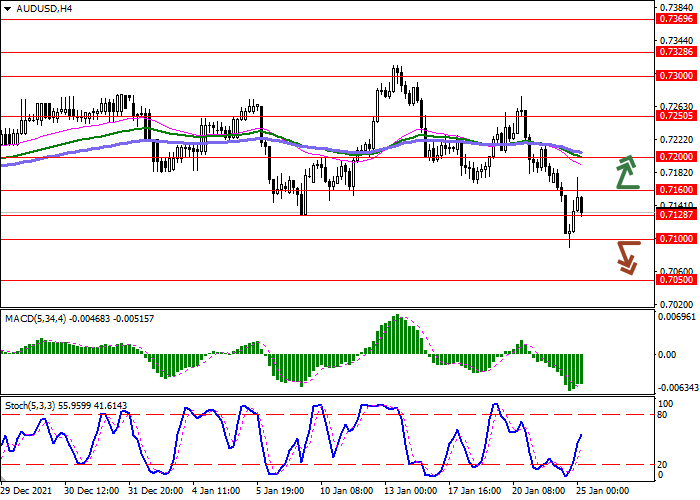

The Australian currency is weakening against the USD, euro and yen today, but has ambiguous dynamics paired with the pound.

In the absence of significant economic releases, the Australian dollar is trading under the influence of external factors. Investors continue to monitor the development of the pandemic, the situation with which in Australia remains difficult. Today it became known that the authorities of the state of Western Australia canceled plans to open the borders of the region, which was scheduled for February 5. The reason for the decision is the risks to the health of citizens due to the surge in morbidity in neighboring states. Experts have already said that the delay in opening borders in Western Australia could worsen the shortage of labor in the mining industry located here. Thus, the pandemic continues to put pressure on the Australian economy.

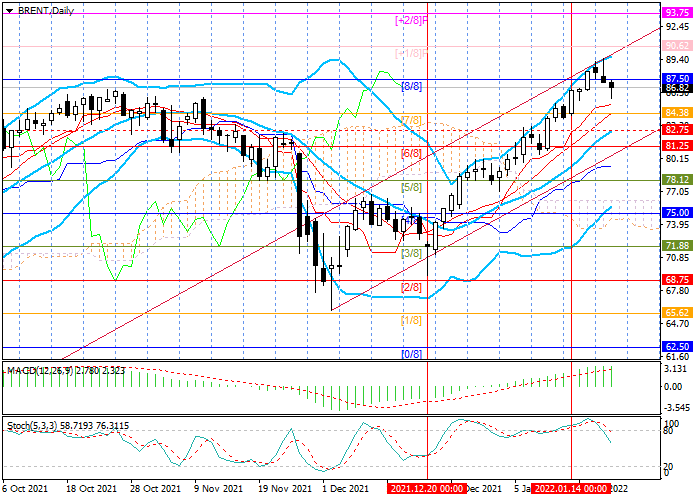

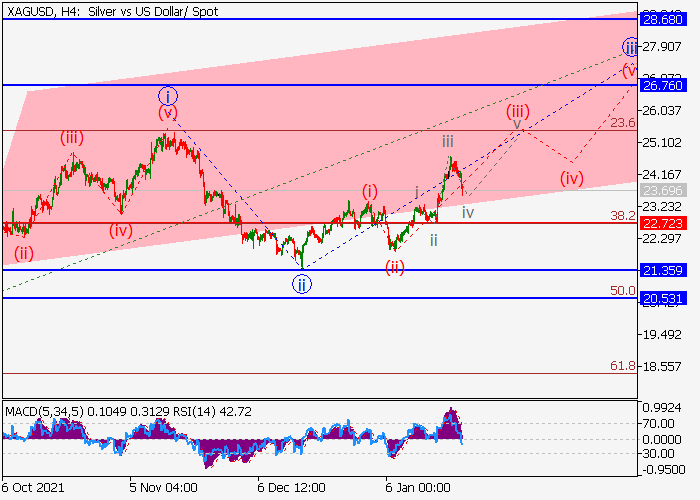

Oil

Oil quotes are making attempts to grow today after a decline earlier.

The report published by the US Energy Information Administration (EIA) recorded an increase in reserves of “black gold” by 0.515M barrels instead of the expected decrease by 0.938M barrels, while gasoline reserves increased immediately by 5.873M barrels and only the distillate index decreased by 1.431M barrels. Nevertheless, the current correction is seen as temporary, since the general fundamental factors remain favorable for the oil market. Investors hope that the demand for “black gold” will continue to increase against the background of the refusal of the world’s leading consumers to introduce serious quarantine measures in connection with the development of the coronavirus pandemic caused by the Omicron strain. Moreover, in a number of regions, for example, in the UK, there are already signs of a decrease in the incidence rate. Also, the growth of tension in the Middle East contributes to the strengthening of energy quotes, primarily due to the ongoing conflict in Yemen. Earlier, Yemeni Houthi rebels had already attacked infrastructure facilities in Saudi Arabia, but this week they launched a missile attack on the airport and industrial facilities of the capital of the United Arab Emirates (UAE), Abu Dhabi. As a result, oil terminals were damaged and several people were killed. The Houthi leaders said that attacks on the infrastructure of Saudi Arabia and the UAE would continue, which could lead to disruptions in the supply of oil to the market of the two leading OPEC producers.