It did go up but wasn’t off my my swing low position so didn’t take it. Still would have worked out but was a little bit of a gamble

True, I still prefer only short positions on euro pairs so I didnt take it as well

Anyone jump on the aus/nzd pin bar at 1.03680. Daily time frame. I’ll ride this for sbout a year cause it’s pretty much the lowest that pair has ever been. I know its not pure price action but dam should be a good investment lol.

Hello Scotty and all,

AUD/NZD has a D1 PB and a W1 PB both closed bullish around a long time price low. Given the pin bar is a reversal signal and that’s what we trade here, it looks like a good probability to head north. I’m in. Good luck!

I’m waiting for the second touch at resistance before going long.

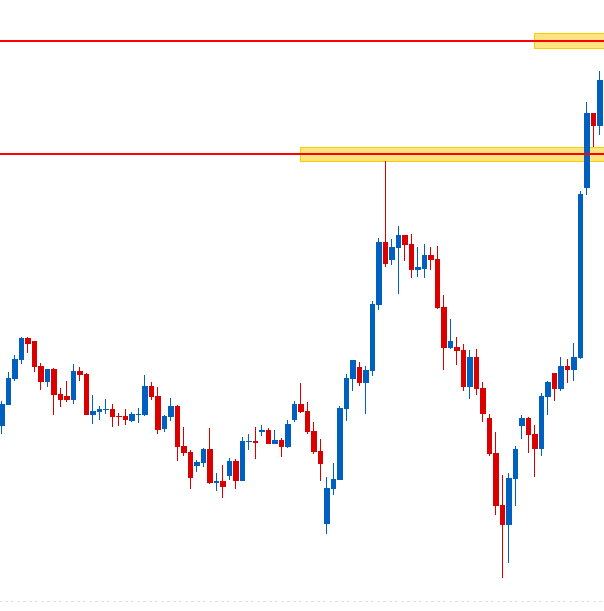

Watching this on NZD/CAD:

We saw a nice bearish pin bar reversal in May last year and a number of other bounces from that level. Hopefully we see something similar this time.

Nikz,

if you enter a trade at the level you have marked will you be trading with or against the trend?

Pip dream,

If you spotted this setup on GBP/JPY’s daily chart last year in September, would you have sat on your hands?

It would be preferable for price to break higher & re-test, but if a pin-bar as shown above forms I’ll be more of a bear than a bull.

Nikz

Hey, just my very noobish opinion here but I would carefully watch that area of old support (maybe new resistance) overhead between .7490 and .7510. Seems to me that the top wick of that bullish engulfing bar may be telling us that price is already rejecting this area. Either way, good luck! Opinions and criticism welcome on my comments; this is how we all learn!

Hey KeptQuiet,

I like how it is making a false break of the high of the recent boxing area and has closed below the killzone level. The bearish price movement that created the signal was very fast and powerful, all happening within 15 minutes. The 4HR chart also shows a BEEB which is engulfing the previous 13 bars and the 15 minute chart has just printed a massive pin bar rejecting the key intraday level. I will not be taking this due to already being in the weekly pin par, but I think there is super high probability with this one.

Daily

4HR

15MIN

One thing I will say though is I suggest you change brokers and get cleaner NY close charts. I can see that you have weekend candles on your chart which can often be confusing in give incorrect information. I personally use FX Choice because I am in the U.S., but other great brokers for outside the U.S. would be Pepperstone or IC Markets.

Best,

Joey

Hey Joey. Thanks for your insight and your recommendations regarding charting software. I actually started demoing a while back with FXCM’s Marketscope, however I decided to go live with Oanda (based on the ability to enter very specific trade size for position sizing reasons). I have circled what I get on the weekends in black…is this what you say will be misleading going forward? The first candle each week after the two that are flat (weekends) opens on sunday nights at 1700. If so, I may end up using one of your recommended brokers for charting and still place the actual trades with Oanda. Thanks again!

Hi Keptquiet you might want to try FXPRO. They are the only broker I know who offers [B]unlimited demo time[/B] and also happens to be [B]NY close.[/B] They also seem reputable and sturdy, as they weren’t affected by the Swiss Shocker.

Hey KeptQuiet,

Yes, those nothing candles are what I am referring to. It is a great idea to use a NY close broker demo account for charting and using your preferred broker to place your live trades.

Joey

Nzd/usd take profit hit at 0.75550 still looks to have more in it too. Oh well I usually have two trades on and take profit first spot than move second to break even but I only put one position on that one silly me. Hope others got some profit off that one. My aud/nzd is still climbing nicely too.

Short on gold run baby run.

Nice job man! Congrats on some pips there. I suppose I stand corrected; no issues with that overhead resistance on NZD/USD 4H.

It may have worked out this time, but taking engulfing bars with strong rejection wicks like that is very very risky, especially when they are rejecting a recent flip level. As Johnathan once said:

“We cannot get sucked in to feeling good when a trade wins knowing that it was a trade we should not be in.”

Safe Trading,

Joey

A candle like this at a high is a sign of weakness.