Did anyone take this trade ? I am currently in with a small profit. I did take a retrace entry though.

GBP/USD H1. price has broken and closed through weekly support zone. Looks like plenty of room to fall if it wants to. Looking for a pullback up to this resistance zone or BO to sell with this strong trend. Sometimes price only gives a small pullback opportunity to get in during a strong trend. P.A. will lead the way.

I got in this trade too, but using the daily pin bar as entry.

I only get a RR of about 0.6, which in hindsight, may be a bit low for my risk appetite. Could probably consider opening 2 positions and let the other run with SL at break even.

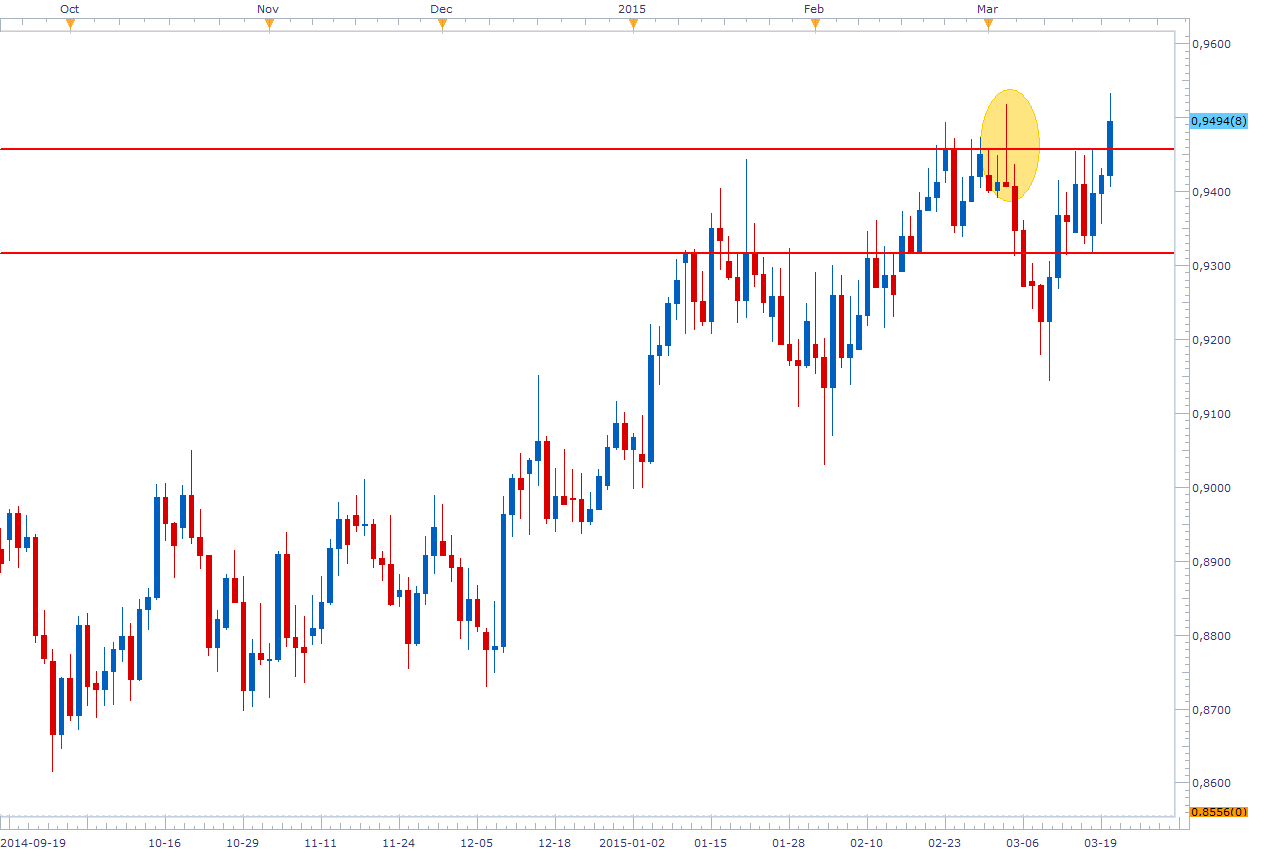

AUD/USD H1. I hope a few folks caught this reversal signal. With trend rejecting key level. When i saw that PB i jumped in without hesitation. :13:

Welcome Shunfeng.

If you are talking about the 2nd last bar on the chart, it looks a bit small to trade to me. Better if it stands out and away from the surrounding bars. It may well go up, but it is a small signal and also you will be trading into a bit of resistance/traffic. Low probability trade for me.

All the best. G

Thanks for your reply, Gforce1!

Agreed that it is small and the trading zone would be in the traffic.

Safe trading,

Shunfeng

Someone told me I shouldn’t go short even if I saw a massive pin-bar like this form on NZDCAD, because it’d be “a counter-trend trade”.

Here’s what happened,

What’s the lesson we can learn from this, kids?

Think for yourself!

Someone told me a massive pin-bar on NZDCAD wouldn’t be a good setup because it’d be a counter-trend trade.

This is how wrong they were,

While that PB may have been a CT trade, it would’ve worked out great. And that’s because the pin-bar was great - commanding and perfect.

What’s the lesson we can learn from this, boys and girls?

Think for yourself!

Actually the trend has not fully reversed yet. At this point is just a retracement and and attempt to form a double top, but it will take another day to confirm it. Have a look at the same NZDCAD 3 months ago, in January:

It looked like a good set-up (including and attempted double top and second pin bar) untill ended up being just the opposite.

This pinbar reversal will be confirmed if price closes under 0.94 on a 4hr chart.

Is it always worth the risk to go against the grain on that size spread?

Isn’t that 15 months ago?

You’re right, was 2014. I was looking back trying to find the same set-up type, a pinbar against the trend, completed later with the rest of the trap, i.e. the double top formation.

NZDCHF has a pb on the daily… I know it’s countertrend… but would it be worth considerating taking this?

It’s been going up quite steeply and for quite a while.

What are your thoughts? =)

Thanks.

If the price gets under 0.7350 would be the first signal to short (below the pinbar bottom). But a much stronger signal would be if price gets underneath 0.7310 (below the bottom of candle before the pinbar).

A target in this case would be around 0.7250, a second 0.7200.

From my experience is better to wait for the stronger signal.

I don’t think anyone said you can’t make a countertrend trade, only that it is less likely to work. Trading with the trend tends to have a higher success rate. Whenever I take a CT trade I try to move to Break even sooner than trading with the trend because they seem to turn against you faster.

I see a nice BUEB with the trend right on your chart that would have been a pretty good play.

AUD/USD Daily, PB with the trend.

But of course we have to wait untill it gets under 0.7830 to take the short.

I don’t think that qualifies as a pin bar because price doesn’t close in the lower third of the candle. It definitely doesn’t close overwhelmingly strong and looks more like an indecision bar to me.

I actually took a short trade off the 4 hour chart on AUD/USD. I saw a 2bar reversal(sorry no chart). I do have the same S/R marked as you do here though.

Erm… is this a worthy PB to trade? Seems more like an indecision candle to me.