What I don’t understand about 2BR is the 2 bars must close near the sessions highs/lows. In this example the first bar has a wick. How small should that wick be for the 2BR to be valid?

Howdy Merchant

There are a few factors that make me skip this trade.

- Very strong uptrend

- Price closed above VBRN 1.3000 so no rejection of it.

- Trade is entered into round number that It did not reject.

- My FTA would be 1.2960 and stop is 1.3080, no real value IMO

Like usual, just my 2 cents worth.

Cheers

There is some discretion involved on this. For certain aspects of price action trading one cannot avoid having to subjectively decide what exactly is ‘close’ or ‘near’.

Fox has written a good article on how he chooses 2B Reversals here.

AUD/CHF daily pin bar, if it hold for tonight as pin, may go long? Other opinions? Yes its not with trend but the pin is very obviously for this moment.

Take a look at the bar right before that pin. I would suggest trading against such a strong candle. If you look back a page or two you’ll see dudest post where he touches on this

Correction: I WOULDN’T suggest trading against such a strong candle.

Sorry

May work but the odds not in my favor. The size of that pin is rapidly turning into an indecision bar so far and compared to the bearish bars this is a midget.

Hi) A very solid and valid looking bearish pin bar is forming on an important resistance area.However the candle is not closed yet.The VBRN of 0.8400 is also present .

Hi everyone) I am just curious to know about the PA of stocks,commodites,futures etc.So far i have read many charts and seen forex currency pairs trending beautifully and giving PA signals quite often.But on the other side when i read charts of stocks listed on NYSE(new york stock exchange) most of them were so choppy and there were so many big gaps in the prices.There was no relevent S&R levels like we see on currency pairs.Indexes were also same like stocks.Some futures and commodities had some similarities like forex pairs.Other than currency pairs i only find silver and gold good for PA trading i guess because gold and silver are pegged with USD.Anyone here so far has any success with stocks,futures and commodities etc using this PA system?

Thanks

Tahir.

I would prefer to see a bigger swing up to test the tops of the resistance and i think that your line should be up higher.

I only trade forex so cant comment on the others, but I now that currencies are well known for their volatility, liquidity and trends

Hallo Tahir,

Many of us also trade PA on the major indices where, (as Paddy put it), the necessary volatility & liquidity are available

On my AxiTrader, that works out to: WTI (oil), France 40, UK 100, DAX 30, Dow Jones 30, SP500, Ausi 200

And of course Gold and Silver

==

The indices have also been up-trending of late, hitting new yearly highs.

I’m waiting for pullbacks on most of them in order to re-enter the up-trend

Cheers!

Hi Johnathon, I’m impatient to submit to your course. Now I haven’t financial opportunities,but when I have itI will do it 100%.I saw alot of courses and I can’t believe that your is so cheap.

I read first 350 pages and i’ve just wondering - Must we confirm PinBar after its open?

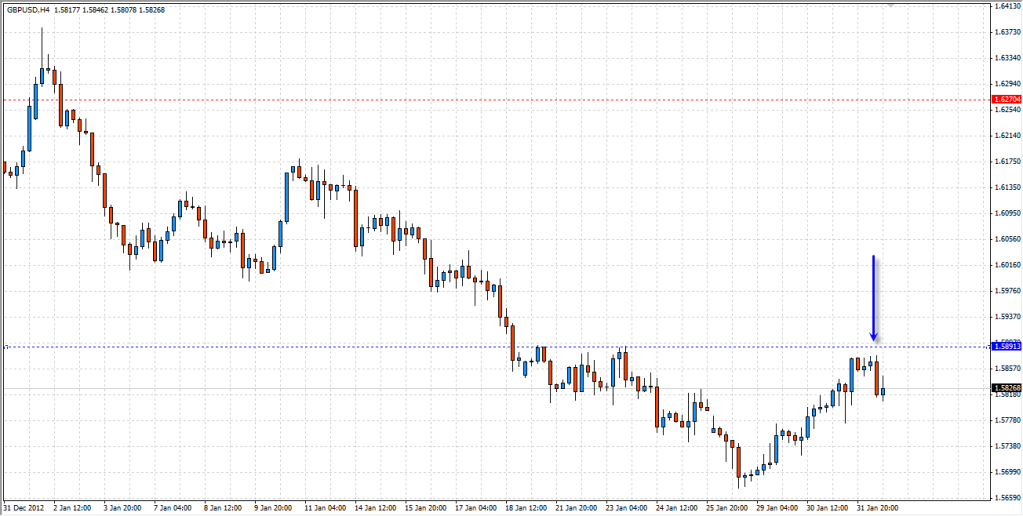

Forbiden, are you asking if we have to wait for the pin bar to completely formed, ie opening of the next candle? Yes because the PB may not end this way. I was looking at realtime GBPUSD yesterday and a nice looking 4H reversal bearish PB became a bullish PB at the close of that candle.

I have been to quite a few courses and my rule now is that the more expensive the course is, the less contents and skill you will get out of it. The more it is advertised in the media the more of that 95% traders camp you will end up belonging. Welcome to the FSO way of trading and hope you will be successful

Awesome! I got interested in Forex 5 months ago, and after mucking around with EAs and moving average crossovers and whatnot I finally arrived at an approach almost similar to this two months ago. I was afraid I was oversimplifying stuff and that my approach looked obvious only in hindsight. And today I found this thread!

Much love to all of ya.

I mean when PB is closed do I must wait to close next candle above/below from PB?

No, just wait the PB to close. Nothing more

In this line of thought what do you think about this trade? My opinion is that:

My worries is that the trend is up on middle bias…

GbpAud 4H

GbpAud Daily

Forbiden, very similar lines to yours. On the 4h I am a bit worried on the higher high troughs and the RR is just not there but that Pin Bar is fakeout a lot of longs. Pass for me. Others may want to have a crack but I am just being fussy.