Daily FX Analysis – GBP/USD drops, EUR/USD navigates, NZD/USD strengthens, USD/CHF soars.

Introduction

GBP/USD faces pressure, dropping towards 1.2650 after disappointing UK Retail Sales data. The pair grapples with a resurgent US Dollar and cautious market sentiment, awaiting crucial US data and Federal Reserve speeches. Meanwhile, EUR/USD remains stable below 1.0900, monitoring ECB President Lagarde’s speech. NZD/USD gains strength above 0.6100, while USD/CHF rises to nearly 0.8680 on SNB Chairman’s concerns about the appreciating Swiss Franc. Market dynamics continue to evolve as traders brace for upcoming economic indicators and central bank communications.

Markets In Focus Today – GBP/USD

GBP/USD Drops Toward 1.2650 After UK Retail Sales Data.

GBP/USD is dropping toward 1.2650, under intense selling pressure after the UK Retail Sales dropped more than expected in December. The pair is also feeling the heat from a pause in the US Dollar decline, as sentiment remains tepid ahead of top-tier US data, Fedspeak. GBP/USD reversed its direction after dipping below 1.2700 and closed in positive territory above 1.2750 on Thursday. The positive shift seen in risk mood supports the pair on Friday as markets await Producer Price Index (PPI) data from the US. Inflation figures provided a boost to the US Dollar (USD) with the initial reaction but they seemingly failed to persuade markets that the Federal Reserve (Fed) could refrain from lowering the policy rate in March.

Technical Overview With Chart :

Moving Averages :

Exponential :

- MA 10 : 1.27 | Negative Crossover | Bearish

- MA 20 : 1.27 | Negative Crossover | Bearish

- MA 50 : 1.26 | Positive Crossover | Bullish

Simple :

- MA 10 : 1.27 | Negative Crossover | Bearish

- MA 20 : 1.27 | Negative Crossover | Bearish

- MA 50 : 1.26 | Positive Crossover | Bullish

RSI (Relative Strength Index) : 49.84 | Neutral Zone | Neutral

Stochastic Oscillator : 47.09 | Neutral Zone | Neutral

Resistance And Support Levels :

- R1 : 1.28 R2 : 1.29

- S1 : 1.26 S2 : 1.25

Overall Sentiment : Neutral Market Direction : Buy

Trade Suggestion : Limit Buy : 1.2655 | Take Profit : 1.2754 | Stop Loss : 1.2595

EUR/USD

READ THE FULL REPORT - CAPITAL STREET FX

Daily FX Analysis – Red Sea, Stable EUR, AUD Retreats, USD/JPY Eyes BoJ.

Introduction

The GBP/USD consolidates above 1.2700 amid modest USD weakness, driven by a positive risk-on environment. Despite a rebound in the pair, rising tensions in the Red Sea pose potential challenges. Meanwhile, EUR/USD stabilizes near 1.0900, influenced by an improving risk mood. The Australian Dollar retraces gains as the market awaits potential policy rate reduction by the Australian Central Bank. Japanese Yen struggles against the USD, with investors anticipating dovish actions from the Bank of Japan amid geopolitical risks and China’s economic concerns.

Markets In Focus Today – GBP/USD

GBP/USD Consolidates Above 1.2700 On Modest USD Weakness.

GBP/USD kicks off the new week on a positive note, trading above 1.2700 early Monday. The rebound of the major pair is bolstered by the risk-on environment. However, the rising tension in the Red Sea might boost safe-haven asset demand and cap the upside of the pair. GBP/USD staged a rebound in the second half of the previous week and erased a large portion of its weekly losses. The pair’s near-term technical outlook is yet to point to a build-up of bullish momentum as it holds steady at around 1.2700 in the European morning on Monday. Nevertheless, investors remain indecisive about the timing of the Federal Reserve (Fed) policy pivot ahead of this week’s key growth and inflation data from the US.

Technical Overview With Chart :

Moving Averages :

Exponential :

-

MA 10 : 1.27 | Negative Crossover | Bearish

-

MA 20 : 1.27 | Positive Crossover | Bullish

-

MA 50 : 1.26 | Positive Crossover | Bullish

Simple :

-

MA 10 : 1.27 | Negative Crossover | Bearish

-

MA 20 : 1.27 | Negative Crossover | Bearish

-

MA 50 : 1.26 | Positive Crossover | Bullish

RSI (Relative Strength Index) : 51.69 | Buy Zone | Bullish

Stochastic Oscillator : 55.73 | Buy Zone | Positive

Resistance And Support Levels :

-

R1 : 1.28 R2 : 1.29

-

S1 : 1.26 S2 : 1.25

Overall Sentiment : Bullish Market Direction : Buy

Trade Suggestion : Limit Buy : 1.2685 | Take Profit : 1.2792 | Stop Loss : 1.2619

EUR/USD

READ THE FULL REPORT - CAPITAL STREET FX

Daily FX Analysis – EUR/USD Struggles, GBP/USD Rebounds, USD/CHF Falters, NZD/USD Surges.

Introduction

EUR/USD hovers below 1.0900 following Germany’s PMI data revealing continued economic contraction, hindering Euro’s recovery. Meanwhile, GBP/USD sees improvement near 1.2700 after a sharp Tuesday reversal. USD/CHF, ending its winning streak, trades below 0.8700 amid subdued US Dollar and Fed rate cut speculations. NZD/USD extends gains to 0.6110, benefiting from a weaker USD and in anticipation of US PMI data, following New Zealand’s CPI release. Investors await the ECB’s monetary policy and US GDP data before making significant moves.

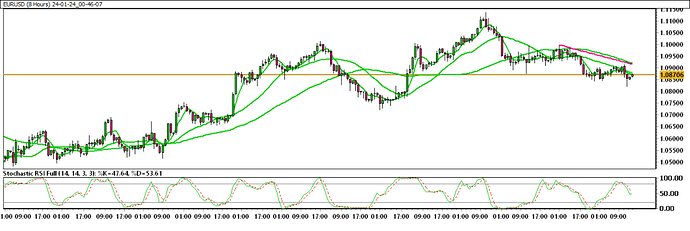

Markets In Focus Today – EUR/USD

EUR/USD Stays Below 1.0900 After The German PMI Data.

EUR/USD continues fluctuating in a narrow channel below 1.0900 on Wednesday. The data from Germany showed that the private sector’s economic activity continued to contract in early January, not allowing the Euro to gather recovery momentum. EUR/USD turned south and touched its lowest level since mid-December at 1.0820 during the American trading hours on Tuesday. Although the pair managed to recover above 1.0850 early Wednesday, the technical outlook is yet to point to a build-up of bullish momentum. Nevertheless, investors are likely to refrain from taking large positions ahead of the European Central Bank’s (ECB) monetary policy announcements on Thursday.

Technical Overview With Chart :

Moving Averages :

Exponential :

-

MA 10 : 1.09 | Negative Crossover | Bearish

-

MA 20 : 1.09 | Negative Crossover | Bearish

-

MA 50 : 1.09 | Negative Crossover | Bearish

Simple :

-

MA 10 : 1.09 | Negative Crossover | Bearish

-

MA 20 : 1.09 | Negative Crossover | Bearish

-

MA 50 : 1.09 | Negative Crossover | Bearish

RSI (Relative Strength Index): 43.09 | Neutral Zone | Neutral

Stochastic Oscillator : 22.06 | Sell Zone | Negative

Resistance And Support Levels :

-

R1 : 1.11 R2 : 1.12

-

S1 : 1.08 S2 : 1.07

Overall Sentiment: Bearish Market Direction: Sell

Trade Suggestion: Stop Sell: 1.0851 | Take Profit: 1.0749 | Stop Loss: 1.0918

GBP/USD

READ THE FULL REPORT - CAPITAL STREET FX

Daily FX Analysis – EUR/USD, GBP/USD, AUD/USD, USD/JPY Dynamics.

Introduction

EUR/USD hovers near 1.0880, tracing the 38.2% Fibonacci level in the early European session, driven by a US Dollar retracement. Wednesday’s bullish momentum to 1.0930 retreated later as the USD rebounded. Investors await the ECB’s policy announcements. GBP/USD experiences a downturn after reaching a two-week high, currently trading around 1.2710. AUD/USD faces a second day of losses at 0.6570 amid an enhanced US Dollar, reacting to positive S&P PMI data. USD/JPY retreats from a one-week peak following the Bank of Japan’s hawkish stance.

Markets In Focus Today – EUR/USD

EUR/USD Moves Lower To Near 1.0880 Followed By The 38.2% Fibonacci Level.

EUR/USD traded lower near 1.0880 during the early European session on Thursday as the US Dollar makes efforts to retrace its recent losses. The 14-day Relative Strength Index (RSI) for the pair is positioned below the 50 mark, indicating a bearish momentum in the market. EUR/USD gathered bullish momentum and advanced to the 1.0930 area on Wednesday. With the US Dollar (USD) staging a rebound later in the day, the pair erased a large portion of its daily gains and returned below 1.0900. Investors await the European Central Bank’s (ECB) policy announcements and high-tier data releases from the US.

Technical Overview With Chart :

Moving Averages :

Exponential :

-

MA 10 : 1.09 | Negative Crossover | Bearish

-

MA 20 : 1.09 | Negative Crossover | Bearish

-

MA 50 : 1.09 | Negative Crossover | Bearish

Simple :

-

MA 10 : 1.09 | Negative Crossover | Bearish

-

MA 20 : 1.09 | Negative Crossover | Bearish

-

MA 50 : 1.09 | Negative Crossover | Bearish

RSI (Relative Strength Index): 46.69 | Buy Zone | Bullish

Stochastic Oscillator : 30.64 | Sell Zone | Neutral

Resistance And Support Levels :

-

R1 : 1.11 R2 : 1.12

-

S1 : 1.08 S2 : 1.07

Overall Sentiment: Bearish Market Direction: Sell

Trade Suggestion: Limit Sell: 1.0913 | Take Profit: 1.0816 | Stop Loss: 1.0978

GBP/USD

READ THE FULL REPORT - CAPITAL STREET FX

Weekly FX Analysis – GBP/USD Swings, EUR/USD Challenges, AUD/USD Rebounds, USD/JPY Gains.

Introduction

GBP/USD retreated below 1.2750, reversing gains after soft US December core PCE inflation data. Despite the setback, the pair eyes marginal weekly gains. Meanwhile, EUR/USD stabilized near 1.0850 post-US inflation data, maintaining positive territory. AUD/USD recovered to 0.6600 on improved market sentiment ahead of US core PCE data, while USD/JPY aimed for the psychological resistance at 148.00, supported by Tokyo CPI slowing below the BoJ’s 2.0% target.

Markets In Focus Today – GBP/USD

GBP/USD Retreats Below 1.2750, And Looks To Post Small Weekly Gains.

GBP/USD lost its traction and retreated below 1.2730 after rising above 1.2750 on soft US December core PCE inflation data in the early American session on Friday. Every week, GBP/USD remains on track to post marginal gains. GBP/USD lost its traction and dropped below 1.2700 in the early trading hours of the European session on Friday. Although the near-term technical outlook is yet to highlight a build-up of bearish momentum, buyers could remain discouraged unless the pair manages to reclaim 1.2700. Upbeat macroeconomic data releases from the US provided a boost to the US Dollar (USD) during the American session on Thursday.

Technical Overview With Chart :

Moving Averages :

Exponential :

-

MA 10 : 1.27 | Negative Crossover | Bearish

-

MA 20 : 1.27 | Negative Crossover | Bearish

-

MA 50 : 1.26 | Positive Crossover | Bullish

Simple :

-

MA 10 : 1.27 | Positive Crossover | Bullish

-

MA 20 : 1.27 | Negative Crossover | Bearish

-

MA 50 : 1.27 | Positive Crossover | Bullish

RSI (Relative Strength Index): 51.13 | Buy Zone | Bullish

Stochastic Oscillator : 59.44 | Buy Zone | Neutral

Resistance And Support Levels :

-

R1 : 1.28 R2 : 1.29

-

S1 : 1.26 S2 : 1.25

Overall Sentiment: Bullish Market Direction**: Buy**

Trade Suggestion: Limit Buy: 1.2622 | Take Profit : 1.2799 | Stop Loss : 1.2524

EUR/USD

READ THE FULL REPORT - CAPITAL STREET FX

Daily FX Analysis – GBP falls, AUD holds, JPY rises, USD/CHF adjusts.

Introduction

“The GBP/USD faces a decline below 1.2600 following soft UK inflation data, amplifying the pressure on Pound Sterling. Meanwhile, robust US economic indicators suggest a prolonged period of higher interest rates, driving the pair to 1.2598. The Australian Dollar also grapples with US Dollar strength amid positive CPI numbers, while the Japanese Yen gains support from a shift in global risk sentiment and verbal intervention. USD/CHF, having reached an 11-week high, corrects slightly as investors anticipate continued US Dollar strength amid inflation concerns.”

Markets In Focus Today – GBP/USD

GBP/USD Slumps Below 1.2600 After Soft UK Inflation Data.

GBP/USD lost its traction and declined below 1.2600 in the European session on Wednesday. The data from the UK showed that the Consumer Price Index (CPI) declined by 0.6% every month in January and weighed heavily on Pound Sterling. The GBP/USD plunges below 1.2600 as strong economic data from the United States (US) suggests the Federal Reserve (Fed) would keep interest rates higher for longer. At the time of writing, the pair trades at 1.2598 after hitting a daily high of 1.2683. GBP/USD slid on hot US CPI data, traders await UK inflation figures.

Technical Overview With Chart :

Moving Averages :

Exponential :

-

MA 10 : 1.2618 | Negative Crossover | Bearish

-

MA 20 : 1.2643 | Negative Crossover | Bearish

-

MA 50 : 1.2634 | Negative Crossover | Bearish

Simple :

-

MA 10 : 1.2616 | Negative Crossover | Bearish

-

MA 20 : 1.2659 | Negative Crossover | Bearish

-

MA 50 : 1.2673 | Negative Crossover | Bearish

RSI (Relative Strength Index): 41.0237 | Neutral Zone | Neutral

Stochastic Oscillator : 30.7950 | Sell Zone | Negative

Resistance And Support Levels :

-

R1 : 1.2763 R2 : 1.2807

-

S1 : 1.2618 S2 : 1.2574

Overall Sentiment: Bearish Market Direction: Sell

Trade Suggestion: Stop Sell: 1.2571 | Take Profit: 1.2494 | Stop Loss: 1.2629

AUD/USD

READ THE FULL REPORT - CAPITAL STREET FX

Daily FX Analysis – Euro, Kiwi up, Pound down, Loonie recovers.

Introduction

EUR/USD remains near 1.0725, closely watching ECB President Lagarde’s speech in the wake of mixed Fedspeak and the upcoming US Retail Sales report. The pair shows signs of balance recovery after a modest US dollar retracement led to gains. In other markets, NZD/USD sees slight gains, while GBP/USD faces pressure following UK GDP data. USD/CAD attempts to rebound, influenced by a subdued US dollar and the potential impact of declining WTI prices. The broader focus includes key economic indicators like the Philly Fed Manufacturing Index and weekly Initial Jobless Claims.

Markets In Focus Today – EUR/USD

EUR/USD Sticks To Lows Near 1.0725, Lagarde Eyed.

EUR/USD is holding lower ground while eyeing the 1.0700 mark in European trading on Thursday. The US Dollar struggles amid mixed Fedspeak, as traders await the US Retail Sales report for fresh policy hints. Ahead of that, ECB Lagarde’s speech is eagerly awaited. The modest retracement in the US dollar (USD) triggered a decent bounce in risk-oriented assets on Wednesday, encouraging EUR/USD to regain some balance and leave the area of yearly lows in the sub-1.0700 zone. On the ECB’s side, Vice President L. de Guindos remarked that although progress is being made, caution is warranted to avoid premature conclusions.

Technical Overview With Chart :

Moving Averages :

Exponential :

-

MA 10 : 1.0762 | Negative Crossover | Bearish

-

MA 20 : 1.0799 | Negative Crossover | Bearish

-

MA 50 : 1.0839 | Negative Crossover | Bearish

Simple :

-

MA 10 : 1.0755 | Negative Crossover | Bearish

-

MA 20 : 1.0806 | Negative Crossover | Bearish

-

MA 50 : 1.0889 | Negative Crossover | Bearish

RSI (Relative Strength Index): 37.4419 | Sell Zone | Bearish

Stochastic Oscillator : 12.4185 | Sell Zone | Positive

Resistance And Support Levels :

-

R1 : 1.0982 R2 : 1.1041

-

S1 : 1.0790 S2 : 1.0731

Overall Sentiment: Bearish Market Direction: Sell

Trade Suggestion: Limit Sell: 1.0750 | Take Profit: 1.0667 | Stop Loss: 1.0804

NZD/USD

READ THE FULL REPORT - CAPITAL STREET FX

Weekly FX Analysis – Stay updated on Forex amid economic uncertainty.

Introduction

GBP/USD rebounded from session lows, hovering below 1.2600 after a dip to 1.2550 post-stronger-than-expected US producer inflation data. The pair faced resistance amid cautious market sentiment. Meanwhile, EUR/USD held above 1.0750 following US data, signaling consolidation. AUD/USD aimed for positive territory, buoyed by Wall Street’s surge, while USD/JPY consolidated below 150.50, influenced by firmer USD and BoJ Ueda’s speech impact. Japanese Yen strength persisted amid doubts about BoJ’s early policy shift due to the unexpected Q4 GDP contraction.

Markets In Focus Today – GBP/USD

GBP/USD Rebounds From Session Lows, And Trades Below 1.2600.

GBP/USD erased much of its daily losses after dropping to 1.2550 following the stronger-than-forecast US producer inflation data. However, with markets turning cautious in the American session, the pair struggles to reclaim 1.2600. GBP/USD benefited from the renewed US Dollar (USD) weakness and snapped a three-day losing streak on Thursday. The pair, however, lost its recovery momentum after testing 1.2600 and edged lower in the early European session on Friday. The 10-year US Treasury bond yield continued to correct lower following the disappointing Retail Sales data from the US on Thursday and weighed on the USD. Meanwhile, Bank of England’s Monetary Policy Committee (MPC) member Megan Greene reiterated on Thursday that the monetary policy will need to remain restrictive for some time, further supporting GBP/USD.

Technical Overview With Chart :

Moving Averages :

Exponential :

-

MA 10 : 1.2611 | Negative Crossover | Bearish

-

MA 20 : 1.2634 | Negative Crossover | Bearish

-

MA 50 : 1.2631 | Negative Crossover | Bearish

Simple :

-

MA 10 : 1.2598 | Positive Crossover | Bullish

-

MA 20 : 1.2648 | Negative Crossover | Bearish

-

MA 50 : 1.2675 | Negative Crossover | Bearish

RSI (Relative Strength Index): 44.8213 | Neutral Zone | Neutral

Stochastic Oscillator : 27.2727 | Sell Zone | Positive

Resistance And Support Levels :

-

R1 : 1.2763 R2 : 1.2807

-

S1 : 1.2618 S2 : 1.2574

Overall Sentiment: Neutral Market Direction: Buy

Trade Suggestion: Stop Buy: 1.2620 | Take Profit: 1.2574 | Stop Loss: 1.2531

EUR/USD

READ THE FULL REPORT - CAPITAL STREET FX

EUR/USD Climbs and GBP/USD Stabilizes Amid Key Data Releases.

KEY HIGHLIGHTS

- EUR/USD Climbs as Markets Await Eurozone, US PMI.

- GBP/USD Stabilizes Amid Upcoming Fed, BoE Decisions…

- Japanese Yen Rebounds Before Crucial Central Bank Events.

- Australian Dollar Holds Steady Ahead of Fed Meeting.

INTRODUCTION

As major central bank decisions approach, the forex market exhibits cautious movements. The EUR/USD pair edges higher ahead of Eurozone and US PMI data, while GBP/USD stabilizes amid expectations for Federal Reserve (Fed) and Bank of England (BoE) rate announcements. Additionally, the Japanese Yen (JPY) and Australian Dollar (AUD) face mixed market pressures as traders assess upcoming monetary policy decisions.

EUR/USD Advances Ahead of Eurozone and US PMI Data

The EUR/USD pair climbs to around 1.0515 during Monday’s European session, with markets awaiting the release of flash PMI data for December. These reports are expected to highlight contrasting economic conditions between the Eurozone and the US. Analysts predict a faster contraction in Eurozone business activity, fueled by declines in both manufacturing and services, while the US economy continues to expand.

The anticipated divergence in economic performance reinforces expectations of further European Central Bank (ECB) interest rate cuts. Following last week’s 25-basis-point reduction in the Deposit Facility Rate to 3%, markets are pricing in an additional 100 basis points of rate cuts by mid-2025. ECB President Christine Lagarde’s upcoming keynote speech at the Bank of Lithuania event will be closely watched for insights into future monetary policy.

Technical Analysis

READ THE FULL REPORT AT - CAPITAL STREET FX

EUR/USD Maintains Gains and GBP/USD Stabilizes Ahead of Fed Decision.

KEY HIGHLIGHTS

- EUR/USD maintains gains above 1.0500 ahead of Fed decision.

- GBP/USD stabilizes near 1.2700 as markets eye UK CPI and Fed.

- USD/CHF retreats below 0.8950 after six-month highs.

- AUD/USD remains under pressure amid risk aversion and Fed anticipation.

INTRODUCTION

Global currency markets are on edge as traders brace for the Federal Reserve’s highly anticipated interest rate decision, widely expected to feature a 25 basis point cut. Key currency pairs, including EUR/USD and GBP/USD, display cautious movements amidst central bank policy shifts and evolving economic outlooks.

EUR/USD Maintains Gains Above 1.0500

The EUR/USD pair continues to hold steady, trading near 1.0505 during early European trading hours on Wednesday. However, market sentiment remains cautious ahead of the Federal Reserve’s interest rate announcement. The central bank is expected to cut rates by 25 basis points, lowering the overnight range to 4.25% – 4.50%. This decision, along with updated economic forecasts and the Fed’s dot plot, will provide critical insights into rate expectations for 2025 and 2026.

A less dovish tone from the Fed may bolster the US Dollar, potentially capping gains for the Euro. Meanwhile, the European Central Bank (ECB) has signaled its intent for further rate reductions. ECB President Christine Lagarde and other key officials have reiterated their commitment to guiding inflation toward the 2% target, signaling a dovish path ahead.

Technical Overview:

- Moving Averages (Exponential):

- MA 10: 1.0511 (Bearish)

- MA 20: 1.0538 (Bearish)

- MA 50: 1.0653 (Bearish)

- Relative Strength Index (RSI): 43.74 (Neutral)

- Stochastic Oscillator: 28.66 (Neutral)

- Support and Resistance Levels:

- R1: 1.0846, R2: 1.0988

- S1: 1.0384, S2: 1.0242

Trade Suggestion:

- Limit Sell: 1.0531

- Take Profit: 1.0461

- Stop Loss: 1.0576

GBP/USD Stabilizes Near 1.2700

The GBP/USD pair remains confined to a narrow range around the 1.2700 level as traders await the UK CPI release and the Federal Reserve’s policy announcement. The Fed’s expected 25 basis point rate cut and its updated dot plot will be closely scrutinized for clues on future rate-cut trajectories.

The US Dollar continues to find support from elevated Treasury yields and ongoing geopolitical tensions. Simultaneously, diminished expectations for a Bank of England (BoE) rate cut lend stability to the British Pound, though upside potential remains limited amid broader market caution.

Technical Overview:

READ THE FULL REPORT AT - CAPITAL STREET FX

Fed’s Hawkish Stance and AUD/USD Slips.

KEY HIGHLIGHTS

- Fed’s Hawkish Stance Sinks EUR/USD Below 1.0400.

- GBP/USD Nears 1.2600 Amid BoE Rate Decision Buzz.

- AUD/USD Slips as US Dollar Gains Strength.

- USD/CAD Retreats After Hitting Two-Year High.

INTRODUCTION

Major currency pairs remain under pressure as the US Dollar strengthens following the Federal Reserve’s hawkish rate cut. Traders now await key economic data, including US GDP and inflation figures, alongside central bank decisions in the UK, Eurozone, and Australia, which continue to shape market sentiment. This article delves into the market movements of EUR/USD, GBP/USD, AUD/USD, and USD/CAD, providing a detailed technical overview and trade suggestions to help investors navigate the evolving forex landscape.

EUR/USD Analysis

Market Overview

The EUR/USD pair remains under pressure, trading below the 1.0400 level, weighed down by the Federal Reserve’s hawkish stance on rate cuts. During Thursday’s Asian session, the pair dipped to around 1.0370 as the US Dollar strengthened.

Key Drivers

- The Federal Reserve implemented a 25 basis point rate cut during its December meeting, reducing the benchmark lending rate to 4.25%-4.50%, the lowest in two years.

- Fed Chair Jerome Powell signaled a cautious approach to further rate reductions due to persistent inflation above the 2% target.

- In the Eurozone, expectations of aggressive ECB rate cuts through June 2025 continue to weigh on the Euro.

Technical Overview

- Moving Averages: Negative crossovers for MA 10, MA 20, and MA 50 indicate a bearish trend.

- Indicators: RSI at 36.45 (sell zone); Stochastic Oscillator at 13.81 (neutral).

- Resistance Levels: R1: 1.0846, R2: 1.0988.

- Support Levels: S1: 1.0384, S2: 1.0242.

Trade Suggestion

Limit Sell: 1.0440

Take Profit: 1.0332

Stop Loss: 1.0516

GBP/USD Analysis

Market Overview

The GBP/USD pair rebounds near 1.2590 during Thursday’s Asian session, recovering from a 1% decline following the Federal Reserve’s hawkish rate cut. Anticipation of the Bank of England’s steady interest rate decision further influences market sentiment.

Key Drivers

- UK CPI rose by 2.6% YoY in November, while Core CPI increased to 3.5%.

- The Bank of England is expected to maintain its current interest rates, focusing on curbing high domestic inflation.

- The pair remains under pressure as traders await critical US economic data, including GDP figures and jobless claims.

Technical Overview

READ THE FULL REPORT B AT - CAPITAL STREET FX

Australian Dollar Falls and Japanese Yen Recovers.

KEY HIGHLIGHTS

- GBP/USD Hits Eight-Month Low After BoE Decision.

- Australian Dollar Falls To Two-Year Low Amid Concerns.

- Japanese Yen Recovers Slightly From Five-Month Low.

- EUR/USD Struggles Near Two-Year Low Before PCE Data.

INTRODUCTION

Asian currencies exhibited a mixed performance on Friday, with the Japanese yen recovering marginally from a five-month low while the Australian dollar tumbled to a two-year low. The dollar index remained strong, driven by a hawkish Federal Reserve stance and growing concerns over a potential U.S. government shutdown. Regional markets faced pressure as risk sentiment weakened, with inflation and central bank decisions taking center stage.

Australian Dollar Falls to Over 2-Year Low

The Australian dollar declined sharply, nearing $0.62—its lowest level since October 2022. Weak economic data and a dovish outlook for the Reserve Bank of Australia (RBA) prompted a sell-off. Markets are increasingly betting that the RBA might begin cutting its 4.35% cash rate as early as February, a shift that underscores slowing economic momentum.

Adding to the pressure, recent data revealed that private sector credit in Australia grew by just 0.5% month-on-month in November, marking the slowest pace in four months. Investors are now focused on upcoming RBA meeting minutes, which are expected to provide further insights into the central bank’s stance.

Technical Overview:

- Exponential Moving Averages:

- MA 10: 0.6316 | Negative Crossover | Bearish

- MA 20: 0.6378 | Negative Crossover | Bearish

- MA 50: 0.6488 | Negative Crossover | Bearish

- Simple Moving Averages:

- MA 10: 0.6329 | Negative Crossover | Bearish

- MA 20: 0.6399 | Negative Crossover | Bearish

- MA 50: 0.6512 | Negative Crossover | Bearish

- Indicators:

- RSI: 27.4454 | Neutral Zone | Neutral

- Stochastic Oscillator: 7.7033 | Buy Zone | Bullish

- Key Levels:

- Resistance: R1: 0.6641 | R2: 0.6701

- Support: S1: 0.6447 | S2: 0.6387

Trade Suggestion:

Limit Buy: 0.6232 | Take Profit: 0.6387 | Stop Loss: 0.6789

Japanese Yen Recovers Marginally

The Japanese yen rebounded slightly on Friday after hitting a five-month low. Stronger-than-expected inflation data helped bolster the currency, with consumer price index (CPI) inflation for November showing resilience. However, sentiment remains cautious as the Bank of Japan (BOJ) maintains a dovish stance, signaling no immediate plans for rate hikes.

On Thursday, the yen weakened sharply, with the USD/JPY pair climbing to 157.93, its highest level since late July. While inflation data has provided temporary relief, BOJ Governor Kazuo Ueda’s remarks suggest that any policy tightening may be deferred until later in 2025.

Technical Overview:

READ THE FULL REPORT B AT - CAPITAL STREET FX

EUR/USD Consolidates and GBP/USD Subdued.

KEY HIGHLIGHTS

- EUR/USD Consolidates Amid Light Volumes, Focus on Fed.

- GBP/USD Subdued as Market Awaits Key Economic Data.

- USD/JPY Bullish Tone Supported by Fed’s Hawkish Stance.

- AUD/USD Declines, Focus Shifts to RBA Minutes.

INTRODUCTION

Currency markets kicked off the week cautiously, with major pairs such as EUR/USD, GBP/USD, USD/JPY, and AUD/USD consolidating amid subdued trading volumes. Investors are focusing on central bank policies, economic data, and geopolitical developments to shape near-term price movements.

EUR/USD: Consolidation Amid a Holiday-Shortened Week

The EUR/USD pair remains steady, trading near 1.0440 during Monday’s European session. This consolidation comes as markets prepare for a holiday-shortened week, with Christmas Eve and Boxing Day affecting trading schedules on Wednesday and Thursday.

Key Factors Influencing EUR/USD

- US Dollar Stabilization: After a steep decline on Friday due to weaker-than-expected US Personal Consumption Expenditure (PCE) Price Index data, the US Dollar (USD) has stabilized. Core PCE inflation, the Federal Reserve’s preferred metric, rose by 2.8% year-over-year, slightly below the 2.9% forecast. This has raised uncertainties about the Fed’s potential rate-cut cycle in 2025.

- Economic Calendar: Monday’s schedule is light, with investors turning their attention to Tuesday’s release of US Durable Goods Orders for November, expected to show a 0.4% decline after a 0.3% rise in October.

Technical Overview

READ THE FULL REPORT B AT - CAPITAL STREET FX