The US Dollar (USD) slid down against the Canadian Dollar (CAD) on Friday, for the third consecutive day, decreasing the price of USDCAD pair to less than 1.2800, ahead of the release of the US ISM Manufacturing PMI news. The technical bias remains bearish as the pair printed a lower high in the recent upside move.

Technical Analysis

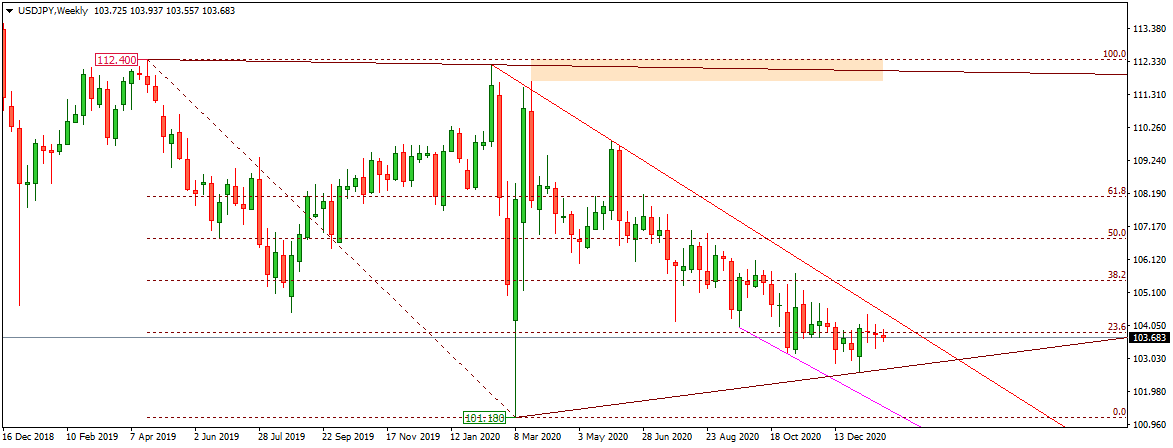

As of this writing, the USDCAD pair hovers around 1.2733, with a few major support levels seen nearby. The price is likely to find some support near the given below levels:

Short-Term Support Levels

1.2686, a major horizontal support

1.2522, the lower trendline arm

1.2432, the low of October 08, 2017

On the upside, the pair might face some resistance near the levels as mentioned below;

Short-Term Resistance Levels

1.2860, a key resistance level

1.2967, the 38.2% Fib level resistance

1.3050, the high of November 10, 2020

The technical bias should remain bearish unless 1.2860, a major horizontal resistance level, is broken.

US ISM Manufacturing PMI news

The Institute for Supply Management (ISM) is scheduled to release stats for the US ISM Manufacturing PMI on Tuesday (January 05, 2021). According to the consensus of economists, the ISM Manufacturing PMI registered a reading of 56.5 points in December, as compared to a reading of 57.5 points in the month before.

The US Manufacturing PMI reflects the overall business conditions in the manufacturing sector. Being an important economic indicator, it also provides insights into the current financial health of the country. Generally speaking, a reading above 50 signals a bullish market trend for the USDCAD and vice versa.

Conclusion

Considering the overall technical outlook, selling the USDCAD pair around current levels might be a good move in short to medium term. Here is a trading plan for next week:

Sell Limit : 1.2769

Stop Loss: 1.2805

Take Profit: 1.2690