very rarely you hear about ALL the aspects of money management in one post

they are in no particular order…

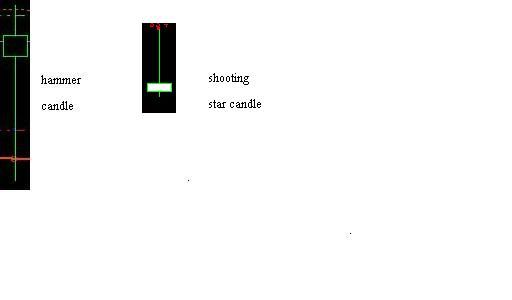

Risk to reward (how much you give vs. how much you take)

win percentage rate (how many times you win out of 100 times at bat)

lot size (how much money you trade per pip)

leverage (how much money you have available vs. how much the broker allows you to borrow to trade )

type of account --nano, micro, mini or standard (each account type has minimum lot requirements)

spreads and commissions (money paid to the broker or bank for their service of “borrowing” their money to trade)

Now things can get even more complicated if you have multiple trades on the board

But for now we will keep it simple and stick to one trade.

An average method or system has a win rate of 70% Thats 70 wins out of 100 tries

If we set up our risk to reward ratio a standard would be 1:2 or

we risk 50 pips to gain 100.

Now we look at our account size to determine our lots and leverage

suppose we have $1000 to trade. The broker allows us to trade $100 dollars for every $1 we have in our account. Therefore we can trade in theory trade $1000X 100=$100,000. The brokers allows us to “borrow” $100 FOR EVERY $1 WE PUT DOWN. When we open the trade we are placing 100X the money we have. When we CLOSE the trade we give the “borrowed” money we used back to the broker. Then depending on whether the trade was profitable or not we either get back the PROFIT made on the trade or we pay back the LOSS incurred on the trade.

Now brokers and banks charge a SPREAD and possibly a commission to use their money to trade. The spread is a difference between the price you buy THE TRADE at called the ASking price and the price the bank gives you called the Bid or offer price.

Example: the price the bank feed shows the euro/usd is 1.4000. When you place a trade you get the ASK price. If the bank has a two pip spread you would obtaIN THE TRADE AT 1.3998. (on a long or buy trade) THERE FORE YOU HAVE TO MAKE UP 2 PIPS JUST TO BREAK EVEN WHEN YOU TRADE IT BACK. THEN THEY MAY CHARGE A COMMISSION ON TOP OF THAT. You want to find brokers with the best spreads and commissions.

So now that we have our win rate, our risk to reward, and our leverage, we can calculate our lot size.

The standard Risk to put on the table is 2% This means if we keep our amount at 2% of our starting equity we could lose 50 times in a row before we would totally be wiped out. (2% X 50=100%)

A highly Improbable scenario considering our win rate is 70%

so 2% of $1000 is 20 bucks

In our example our System or method risks 50 pips to gain 100 making our risk to reward ratio 1:2 so if we can risk $20 we could profit $40. and if we are trying for 100 pips we could lose 50 pips so $20/50pips= 40 cents a pip.

The Pip value for this trade 40 cents.

if we were only going for 20 pips and risking 10 pips (still 1:2 Risk to reward) then

$20/10=$2 pip

But I digress…

Back to our example:If we can trade 40 cents per pip then the TYPE of account comes into play. There are four types nano, micro, mini, and standard,

The smallest amount you can trade on a nano is a penny a pip. Your lots are worth $100 so at 4 cents a pip you would trade 40 lots. This can get confusing because a broker may give you a cents account instaed of a dolar account.

The smallest amount you can trade on a micro is ten cents a pip. your lots are worth $1000 so at 40 cents per pip you would trade 4 lots

A mini account trades in $10,000 lots $1 per pip so you would trade 4/10ths of a lot

And a standard account trades in $100,000 lots $10 per pip so you would trade 4/100ths of a lot.

Are you beginning to see why Money management is so important?

Oh I forgot to mention the difference between a four digit broker and a five digit broker or using a different currency to calcualte all this instead of the USD.

This is just for ONE TRADE! Compound that with multiple trades at various stages of profit and loss and taking on more risk and look at how complicated it gets.

IT IS MORE IMPORTANT TO FIGURE OUT HOW MUCH YOU COULD LOSE THAN HOW MUCH YOU ARE GOING TO WIN. TRADERS CALCULATE A TRADE BY HOW MUCH THEY COULD LOSE. GAMBLERS CALCULATE A TRADE BY HOW MUCH THEY CAN WIN.

And that is what separates the 70% losers from the 30% winners.