free signal USD/CHF

Enjoy our tips~

Technical Analysis of USD/CHF Dates 2014.12.12

USD/CHF during the recent weeks was in a strong and consistent uptrend that buyers were successful in achieving the highest price of 0.98187.Right now price in long time frames such as monthly and weekly is above 5-day moving average and warns about price increase in long period of time.Price has been stopped from more ascend by reaching to the specified resistance levels in the chart below and with exit of some buyers from their trades at the end of 8th day.

As it is obvious in the picture below, price during the descending has touched the Up Trendline (made of 2 bottom prices) has created the Spinning top candlestick patterns which shows indecision marker for ascending or descending .Please note that there is a Wolfe wave Pattern which its 5 point is complete and goes toward the goal.Until when the red tape is in the USD/CHF chart, we have the hope of the reform of the previous trend although, it may be a fragile and weak reform.

USD/CHF Chart dated 2014.12.12

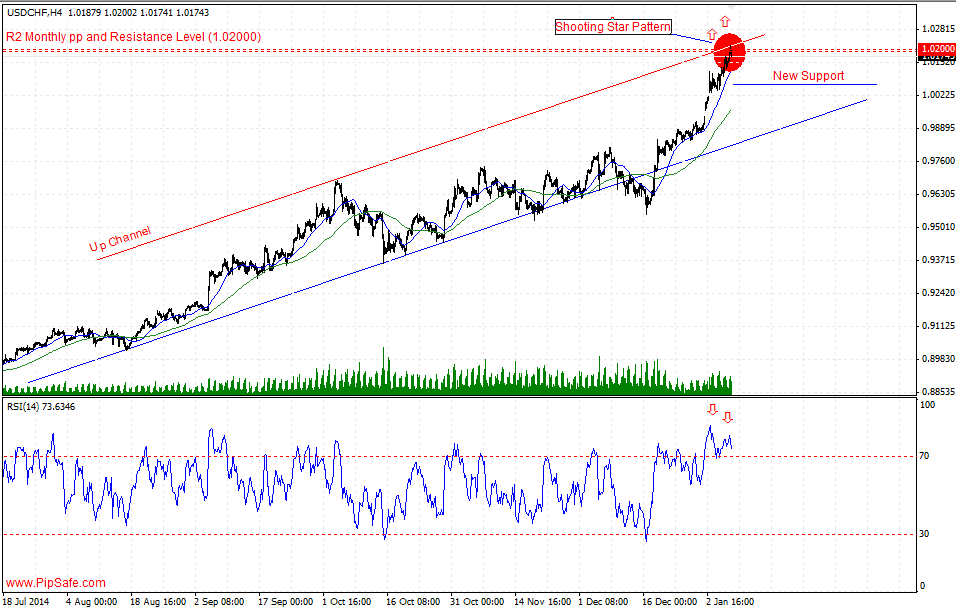

Technical analysis of USD/CHF dated 2014.01.08

USD/CHF chart has experienced a strong ascending trend during the recent days that could record the top price of 1.02117.One of the buyers’ targets was the round level of 1.02000 that they were successful in reaching to it and the price was not able to ascend more by reaching to this level.Right now the price has reached to the resistance level of Monthly Pivot 2 and with forming Shooting Star candlestick pattern warns about formation of a top price (need to be confirmed by a bearish candle).

According to the recent strong ascending, price is in saturation buy area and there is the potential for descending and price reformation.RSI indicator is in saturation buy area and in divergence mode with the price chart in h4 time frame that confirms the current top price and warns changing price direction during the next candles.The first warning in this currency pair for ascending of price (in the same direction of long term time frames) is breaking of the resistance level of 1.02117.

I am looking to go short on the USDCHF during today’s session. I have been bearish on this currency pair since we reached parity, but did not get a clear sell signal yet.

I did go short prior to the NFP (posted about it when I did it). My SL was hit today and I closed the trade today for 60 pips in profits. I’ll give it another short above 1.0215.

So how did this fare in the recent drop on usdchf?