FTSE was correcting the cycle from the 6530.6 low,when the pull back was unfolding as Elliott Wave FLAT pattern. We expected FTSE to trade higher due to 5 waves rally in the cycle from the December 27th 2018 low. In addition, we have incomplete bullish sequences in European indices like DAX and IBEX, suggesting that FTSE will be supported as well. In the following article, we’re going to explain the Elliott wave structure and Forecast.

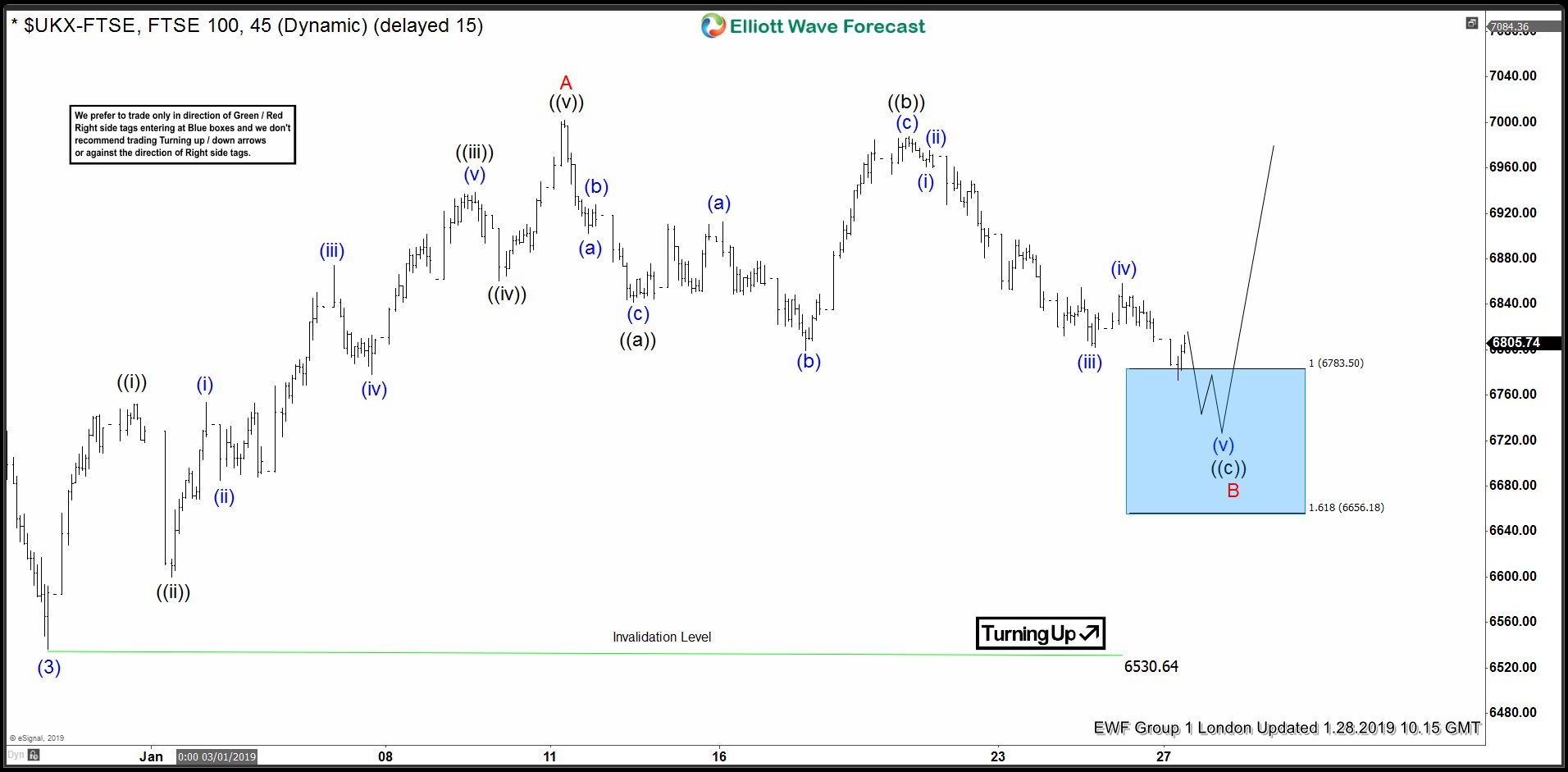

FTSE 1 Hour Elliott Wave Analysis 1.28.2019

As we can see on the chart below , the Index made 5 waves structure in the rally from the 6530.64 low. So we believe that can be only the first leg of the ABC Zig Zag recovery. Pull back against the 6530.64 low is unfolding as Elliott Wave Flat, when we can now be in the last leg wave (v) of (©) of B red Flat. FTSE should ideally find buyers at 6783.5-6656.18 before giving us another leg higher ideally to allow DAX and IBEX to reach their extremes in the cycles from the 12/27 2018 lows. Price has reached the blue box, but there is no sign yet that the pull back is done. FTSE still can extend lower in short term within blue box as shown on the chart. We don’t recommend selling the index at this stage and expect buyers to appear any moment.

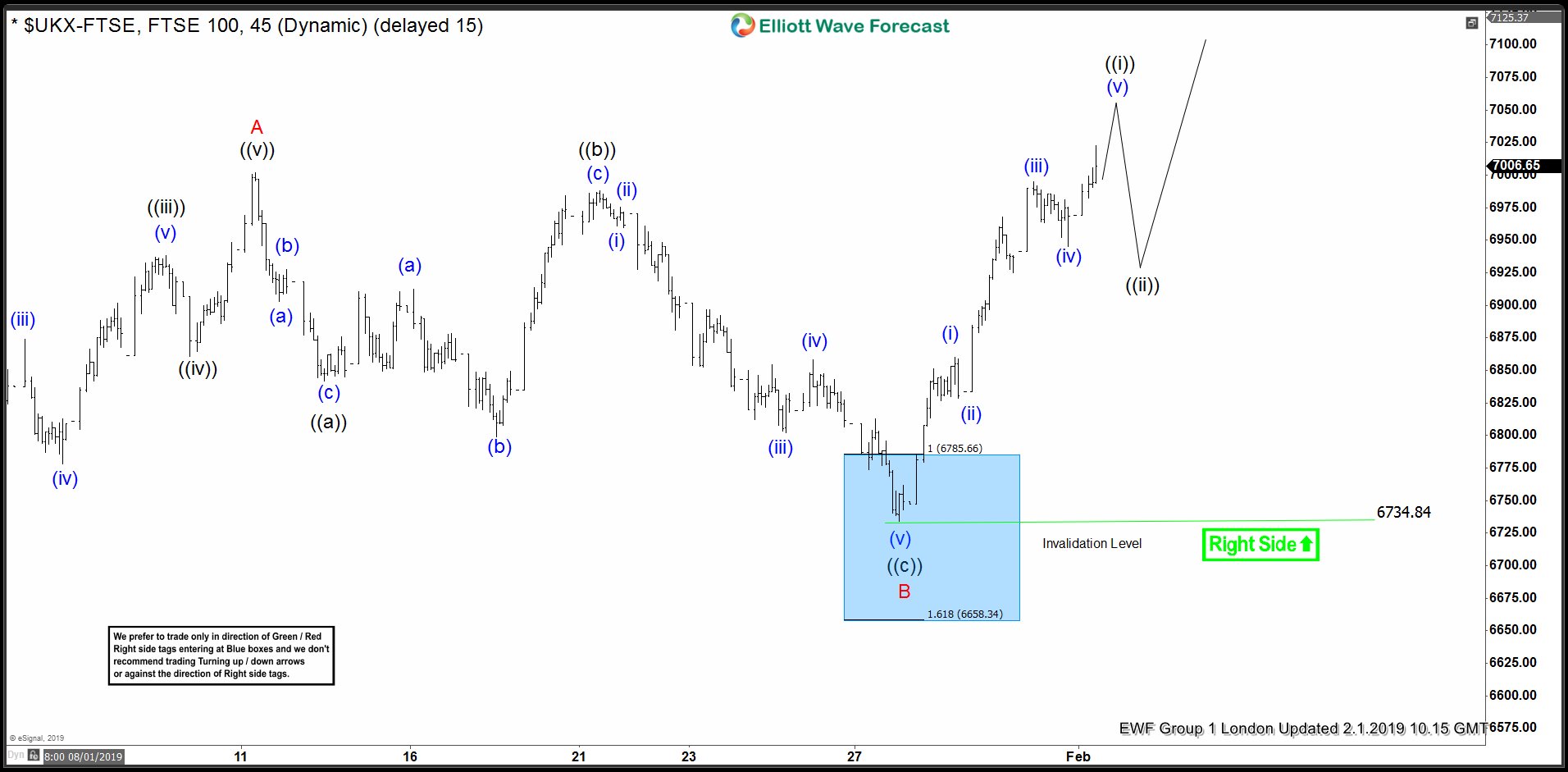

FTSE 1 Hour Elliott Wave Analysis 1.28.2019

Buyers appeared right at the blue box when Elliott Wave Flat completed at 6734.84 low. Recently we got a new short term high with a break above 01/11 low, confirming next leg up C red is in progress. At this stage FTSE is bullish against the 6734.84 pivot, suggesting more upside toward 7197 area. Now as far as 6734.84 pivot holds, intraday pull backs should ideally find buyers in 3,7,11 swings for proposed rally or 3 wave bounce at least.

Keep in mind that market is dynamic and presented view could have changed in the mean time. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.