Trading remained subdued in the forex markets today, with most major pairs consolidating within Friday’s ranges. Dollar has given back some of last week’s gains, though selling momentum remains modest and order flows are light. Market conviction on the Fed outlook remains steady. Futures price a 92% probability of a rate cut at the October meeting, with slightly less than 80% odds of another cut in December. These expectations continue to anchor positioning even as the Dollar cools.

Attention today will turn to remarks from a slate of Fed officials, most notably New York Fed President John Williams. While Williams’ comments often carry weight given his central role, markets doubt any of the speakers will meaningfully alter expectations for two more cuts this year. Instead, traders are looking further ahead to next week’s U.S. non-farm payrolls as the data event that could shift sentiment.

Before that, September PMI releases from Australia, the Eurozone, the UK, and the U.S. will arrive tomorrow. With tariff tensions largely settled, the improving trend in business activity is expected to continue, leaving only major surprises capable of stirring the FX market.

ECB survey finds tariff concerns alter consumption, push up inflation expectations

An ECB Economic Bulletin article revealed that Eurozone consumers are already adjusting their spending patterns in anticipation of US tariffs. The survey showed that 26% of respondents have shifted away from American products, while 16% reported reducing overall spending.

The ECB noted differences across income groups: high-income households were more likely to substitute away from U.S. goods, while lower-income households leaned toward cutting total spending. Most of these reductions have been concentrated in discretionary purchases, with necessities largely shielded.

Beyond current spending patterns, the ECB warned that households are also revising their inflation expectations higher, including longer-term views. That suggests consumers see tariff-related price pressures as more than transitory.

RBA’s Bullock: Economy may prove weaker or stronger than forecasts

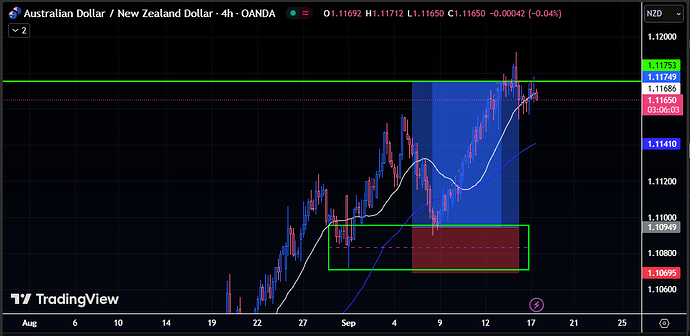

RBA Governor Michele Bullock told a parliamentary committee today that the central bank expects underlying inflation to moderate toward the midpoint of its 2–3% target range, with forecasts conditioned on the market’s assumption of modest further easing. Recent rate cuts are seen supporting household and business spending, while real income growth should help sustain consumption in the year ahead.

She noted that domestic data since the August meeting have been “broadly in line with expectations, or slightly stronger,” giving the Board some confidence heading into next week’s policy meeting. But Bullock stressed that forecasts remain only estimates, and the outlook is highly uncertain, particularly given the unpredictable global environment.

She highlighted risks on both sides: growth momentum may fade, or it could prove “materially stronger” than anticipated. Bullock warned that “excess demand” in the economy and labour market could persist, particularly that “productivity growth has not picked up and growth in unit labour costs remains high”.

PBoC holds fire, China stays patient on stimulus as economy shows strain

The People’s Bank of China left its one-year loan prime rate at 3.0% and the five-year at 3.5% today, extending a steady policy stance for the fourth month running. The unchanged setting came in line with forecasts and follows the central bank’s last 10bps trim in May, part of earlier efforts to shore up growth.

Policymakers opted for patience as the recent strong rally in domestic equities reduced pressure for immediate support, even as official data continue to point to uneven demand and fading momentum in industry and property.

Still, most expect modest easing steps before year-end as Beijing works to lock in its 5% growth target, also as policy focus shifted from deflation management to reflation.