Here I will share my ideas on the forex market. My approach is based on fundamental analysis as the basis for trading ideas and technical analysis for their execution.

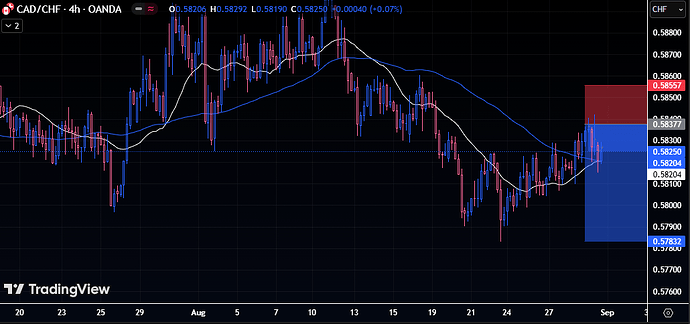

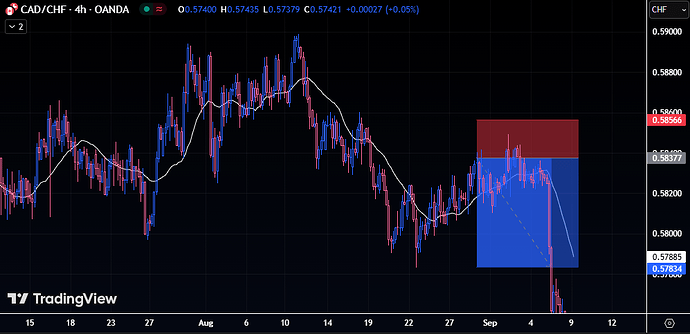

Overall we are neutral now, no much divergence between currencies. I have some Trade Ideas. As we have stagflation fears in US we have XAG and XAU going higher. So these are the best assets to trade now… But also we have weaker EUR ( but i dont know if that weakness will continue ) Next week we have NFP and PMI data around most of currencies but most important will be NFP. Im personally thinking that CAD should be weaker then it is…

(post deleted by author)

Markets adopted a cautious tone again today, as attention swung back to U.S. economic data. Today’s ADP private payrolls and ISM services figures are seen as key precursors to tomorrow’s highly anticipated nonfarm payrolls. The numbers are expected to sharpen the Fed’s rate-cut calculus, with traders reluctant to take large positions before the release.

Fed officials have broadly indicated openness to a rate cut this month, reinforcing expectations of a 25-basis-point move. Fed fund futures now price the odds of such a cut above 97%, reflecting the market’s conviction that easing is imminent.

The debate, however, is less about September and more about what comes afterward. Even Fed Governor Christopher Waller, a known dove, refrained from endorsing consecutive cuts. While he expects multiple moves over the next three to six months, he stressed that there is no fixed schedule, leaving policymakers room to adapt to incoming data.

On the other end of the spectrum, Atlanta Fed President Raphael Bostic reiterated his preference for a single cut this year, arguing that inflation risks remain the dominant concern. The divide highlights how much weight upcoming data, including Friday’s NFP, will carry in shaping expectations for the policy path into year-end.

Trade risks are also back in focus. US President Donald Trump asked the Supreme Court to fast-track his appeal against lower court rulings that deemed most of his global tariffs illegal. The appeals court ruled last week that Trump overstepped his authority when imposing sweeping levies on nearly all U.S. trading partners.

Trump is pushing for arguments to be heard in November with a decision soon after, warning that a delay until June 2026 could see as much as USD 750 billion to USD 1 trillion in tariffs collected and then potentially unwound—an outcome he says would cause major disruption. Normally, the Supreme Court would not deliver a decision until next summer.

Separately, Japan’s top trade negotiator Ryosei Akazawa departed for Washington for ministerial-level talks, signaling progress in implementing the bilateral trade deal reached in July. “Both Japan and the U.S. have agreed to implement the agreement faithfully and swiftly,” Akazawa said before leaving Tokyo.

The foreign exchange market remains largely range-bound as traders await today’s U.S. non-farm payrolls report. Recent labor indicators, including ISM employment components, point to downside risk for NFP. Both manufacturing and services sub-indexes remain in contractionary territory, while ADP payrolls growth slowed sharply in August. This suggests a soft report is more likely than not.

Besides, the implications for Dollar are asymmetric. A weak payrolls print—particularly a sizeable miss—could spark a sustained wave of Dollar selling as traders price in more aggressive Fed action, including the possibility of back-to-back cuts. By contrast, a stronger report may only limit the pace of easing rather than shift the direction, implying any lift for the dollar would be temporary.

Canada’s employment report is also in focus, with markets watching closely to see if the data justify expectations that BoC could resume rate cuts this month.

On trade, US President Donald Trump signed an executive order Thursday to finalize the July agreement with Japan, imposing a 15% baseline tariff on most Japanese imports, including autos. The confirmation removes a significant uncertainty for the BoJ, which can now reassess the scope for further rate hikes later this year.

Trump also signaled fresh pressure on the tech sector, warning that “fairly substantial” tariffs are coming on semiconductor imports from firms that refuse to relocate production to the U.S. Companies with domestic expansion plans, such as Apple, would be spared.

For the week so far, Dollar remains the best performer. Aussie and Euro follow, while Yen lags as the weakest major. Kiwi and Swiss Franc also underperform, while Sterling and Loonie sit mid-table.

Dollar tumbled sharply in early New York trading Friday after much weaker-than-expected non-farm payrolls report. 10-year Treasury yield plunging through the 4.1% level while Gold also surged to fresh record high.

Traders moved swiftly to reprice Fed expectations, with a 25bps cut this month fully baked in and fresh speculation that policymakers may opt for a larger 50bps move. Looking ahead, odds of another 25bps cut in October spiked above 75%, underscoring market conviction that the central bank will need to move aggressively to shield the labor market.

That places next week’s CPI report in sharp focus. Should inflation show further signs of easing, it would open the door for the Fed to accelerate its easing cycle.

In weekly performance terms, Canadian Dollar is faring worst after its own dismal jobs data, while Yen remains under pressure but may recover some ground. Dollar is sliding toward the bottom of the performance table, likely to surpass Yen before the week closes. Euro leads gains, followed by the Aussie and Sterling, with Swiss Franc and Kiwi holding mid-pack.

CLEAR USD AND CAD WEAKNESS SO EVERYONE KNOW WHAT WE SHOULD DO

BANK REPORTS

Crédit Agricole warns that the 8 September French confidence vote is a pivotal event for the euro, with high odds of scenarios that could amplify political and fiscal uncertainty. Their analysis suggests EUR/USD risks are tilted lower, and markets may not be pricing in the full extent of potential volatility.

BofA sees the USD still modestly overvalued, but the drivers of further weakness are shifting away from valuation and more toward structural issues—stagflationary risks, Fed policy easing, and institutional credibility. The medium-term picture still points to gradual USD depreciation across G10.

Market Recap

- U.S. Dollar plunged after a much weaker-than-expected non-farm payrolls report (22k vs. 78k expected), with the unemployment rate rising to 4.3%, a near 4-year high.

- 10-year Treasury yield fell below 4.1%, reflecting aggressive repricing of Fed policy expectations.

- Gold surged to record highs on safe-haven demand and collapsing real yields.

Fed Expectations

- September FOMC: 25bps cut is fully priced, with speculation of a possible 50bps cut if CPI next week is soft.

- October FOMC: Odds of another 25bps cut jumped above 75%, signaling belief that the Fed needs to act aggressively.

- Markets expect accelerated easing cycle, shifting narrative from “soft landing” to “insurance required.”

Currency Performance

- Dollar sliding toward the bottom of the weekly performance table; likely to end the week among the weakest.

- Canadian Dollar underperforms most after disappointing domestic jobs data.

- Euro leads gains, followed by Aussie and Sterling; Swiss Franc and Kiwi mid-pack.

- Yen remains weak but may recover slightly on risk sentiment.

Other Key Points

- Gold thrives, supported by falling yields and USD weakness, and is approaching the $4,000 psychological mark.

- Global equities mixed: Initial optimism from easing hopes faded as growth concerns dominated.

- French political risk (Sept 8 confidence vote) flagged by Crédit Agricole as a potential EUR volatility driver.

- BofA notes USD is still modestly overvalued, but the weakness is now driven by structural concerns and policy shifts.

Im looking for AUD / GBP / EUR longs and USD / CAD shorts next week

I think America is losing it on its immigration policy.

Yeah, most likely. But for us… ahah we dont care too much… We have our bias, employment forced rate cuts not good for USD and correlated CAD. Lets see US CPI this week, i dont think strong CPI will change USD downside… it only can add stagflation fears.

The big market mover from the weekend was the resignation of Japanese Prime Minister Ishiba, who stepped down under heavy pressure from his party after a historic election defeat. Ishiba, who came to power in October 2024, saw his coalition lose its majorities in both the lower and upper houses of parliament.

On the data front, revised GDP showed the economy expanding at a stronger-than-expected 2.2% annualised pace in Q2 (0.5% q/q), up from the 1.0% preliminary estimate. The upgrade reflected firmer private consumption and marked a fifth consecutive quarter of growth.

From China, August trade data revealed exports rising but missing expectations, with year-on-year growth the slowest since February. Shipments to the U.S. plunged 33% y/y, underscoring the drag from tariffs.

Dollar weakened broadly overnight and selling pressure persisted in Asia on Tuesday, with the greenback on the verge of breaking recent lows against Euro, Swiss Franc, and Aussie. The decline comes amid falling U.S. Treasury yields and growing conviction that the Fed will move toward faster easing.

With no major U.S. releases scheduled today and the Fed in blackout mode ahead of next week’s FOMC, traders are still appearing impatient. Thursday’s CPI looms large, but speculative selling has already picked up, raising the risk that Dollar’s decline becomes self-reinforcing if technical levels give way.

Whether the move extends into a broader selloff remains a key focus. A break of recent lows in multiple pairs could invite further technical selling, especially if Thursday’s CPI shows softening price momentum. While a 50bps Fed cut next week is still unlikely, markets are increasingly pricing a dovish dot plot and statement.

At the same time, Euro is struggling under its own weight. France’s Prime Minister François Bayrou lost a confidence vote on Monday, ending a turbulent nine months in office. His departure makes him the fourth prime minister to collapse under President Emmanuel Macron’s second term, highlighting the persistent instability in French politics.

France now faces yet another stretch of political drift and uncertainty. Macron must quickly find a candidate palatable enough to avoid being brought down immediately, but precedent suggests the process could drag on. This instability has weighed on Euro, particularly against the Swiss franc, with investors turning defensive.

For the week so far, Dollar sits at the bottom of performance table, followed by Loonie and Yen. Yen, however, is rebounding as Nikkei retreats from record high and falling U.S. yields offer support. At the other end, Kiwi leads, followed by Aussie and Swiss franc, with Sterling and Euro mixed in the middle.

BANK REPORTS

Credit Agricole sees upside risks to gold beyond their current forecasts. With Fed cuts, EM central bank buying, and de-dollarisation themes at play, XAU remains well supported in the months ahead.

Goldman Sachs argues the USD is in the midst of a structural repricing: weaker U.S. exceptionalism, a slowing labor market, and Fed cuts point to sustained Dollar weakness. Shifting hedging flows and CNY stability add to the case for underperformance, particularly against European and Asian currencies.

Morgan Stanley’s call is clear: the USD bear market has more room to run. Lower real yields, slowing US growth, and policy divergence with Europe and the UK all reinforce dollar downside risks. They highlight that investors underestimating these structural drivers may miss a significant phase of USD weakness.

The yen made a strong comeback today, topping the currency charts as traders jumped on rumors that the Bank of Japan might hike rates as early as October. A Bloomberg piece, citing unnamed sources, hinted that some officials want to move sooner, especially since concerns about economic growth have eased after the U.S.–Japan trade deal. The big question for policymakers is whether U.S. tariffs hit Japan’s economy harder than expected. If the impact stays manageable, the BoJ could argue it’s time to start normalizing rates again—even with the political drama in Tokyo.

That said, the story was based on anonymous sources and came with some mixed headlines. A lot of analysts think the recent resignation of Prime Minister Shigeru Ishiba and the upcoming LDP leadership race mean the BoJ will play it safe. They’re unlikely to tighten policy in the middle of such political uncertainty. Plus, the bank isn’t in a rush—they can easily wait until early next year for the next hike, keeping things steady and avoiding any sense of panic. For markets, this means rate expectations will probably keep swinging around as headlines change.

Over in Europe, the euro slipped across the board, with investors still reacting to the ousting of French Prime Minister François Bayrou on Monday. The government shake-up has added to concerns about political instability in France, though by itself it probably won’t push the euro much lower unless things spiral further. Still, the fact that France has gone through four prime ministers in two years is denting confidence. With President Emmanuel Macron now scrambling to find someone who can actually hold power in parliament, the euro is staying on the defensive.

BANK REPORTS

Despite the frustration of limited traction in recent months, GS argues that the macro backdrop—Fed easing, weaker US growth, and reduced hedging costs—supports further downside in USD/JPY. The trade remains one of their preferred ways to express USD weakness into year-end.

BofA frames this ECB meeting as a relatively muted FX event. A dovish press conference may weigh modestly on the Euro, but no major policy shifts are expected. The bank keeps its medium-term stance cautious on EUR crosses, particularly vs GBP, AUD, and Scandies, while acknowledging that market pricing still looks too hawkish relative to underlying risks.

Godfatherism in Europe?! Sort of explained why French colonies underperformed and still doing.

Dollar sellers hit pause, with the greenback holding just above recent lows as traders locked in profits before two big U.S. inflation reports. Momentum cooled off while markets waited for fresh drivers — PPI today and CPI on Thursday. If price growth runs hotter than expected, fears of stagflation could flare up again, making the Fed’s job trickier as it considers rate cuts to support the softening labor market. On the flip side, if tariffs don’t turn out to be as inflationary as people feared, bets on faster rate cuts would likely pick up quickly.

Another storyline hanging over markets is Fed independence. A federal judge just blocked President Trump’s attempt to remove Fed Governor Lisa Cook. The ruling said the law’s “for cause” clause can’t be used to fire a governor over alleged actions before they took office. The case is expected to head to the Supreme Court and could set a big precedent for presidential power.

Cook, for her part, has denied any wrongdoing tied to Trump’s mortgage fraud claims. Judge Jia Cobb emphasized that protecting the Fed’s independence is in the public’s best interest — something investors see as key for keeping inflation policy credible.

On trade, Trump called on the EU to slap tariffs of up to 100% on China and India over their Russian oil buys — saying the U.S. would match those moves. Washington has already hiked tariffs on Indian imports to as high as 50%, sparking protests from New Delhi. China, the top buyer of Russian oil, has been spared so far thanks to a tariff truce with the U.S.

Over in Europe, French President Emmanuel Macron named Sebastien Lecornu, a close ally, as Prime Minister. The 39-year-old will lead another minority government, expected to push ahead with Macron’s pro-business reforms while navigating political gridlock and debt worries.

Bank insights:

- Morgan Stanley’s CPI preview suggests inflation risks are still tilted to the upside, especially from goods and tariffs. Services might give some temporary relief, but core goods inflation remains sticky, so the Fed will likely stay cautious and avoid rushing cuts in September.

- Credit Agricole thinks commodity currencies are undervalued against the dollar, with room to rebound as global equities and rates evolve. They see NZD as the standout near term, thanks to oil dynamics and equity ties, while AUD and CAD may need stronger commodity momentum to fully catch up.

Opposition groups in France are officially calling for the impeachment of President Emmanuel Macron. This comes after his prime minister was removed from office following a vote of no confidence.

This is another BLS scandal, and Trump was absolutely right to fire the BLS commissioner?![]()

What this means:

1). There was virtually no job creation in the last year of the Biden admin.

2). The Fed should have started cutting in February.

- 2 million jobs from the last 3 years of the Biden admin have now been revised away. This despite the biggest debt issuance spree on record.

I believe the Fed would cut rate by 25bp coming next week.

I think same, we most likely will be data dependant… maybe back to back cuts 0.25bps

The dollar slipped a bit earlier in the U.S. session while futures bounced back after producer price data showed inflation pressures cooling slightly. That gave traders more confidence the Fed might keep cutting rates. Odds of a 50bps cut next week ticked up to 10%, and chances of back-to-back cuts through October are back near 80%.

Still, no one’s going all-in ahead of Thursday’s CPI report. That number will be key for the Fed’s September decision and the bigger policy path. For now, markets are leaning dovish but staying cautious.

Looking at today’s moves, the dollar looks shaky. If CPI comes in softer than expected, selling could pick up fast and push the greenback lower across major currencies. In other words, Thursday’s inflation print could be the turning point.

In FX, the Aussie led the pack, helped by hopes that Fed easing could give China’s central bank more room to cut rates and support its sluggish economy. The Kiwi wasn’t far behind, and Sterling also firmed as risk sentiment improved.

On the commodities side, gold is still shining as a go-to hedge in a world of easy money, geopolitics, and heavy fiscal spending.

ANZ now sees gold hitting $3,800/oz by year-end and peaking near $4,000/oz by mid-2026, making dips look like buying chances. Silver, though choppier, is also expected to climb and add diversification upside.

Meanwhile, Goldman Sachs thinks August CPI will come in a bit hotter than forecasts, mainly due to tariffs. They still see long-term disinflation at play, but near-term inflation may stay sticky before easing again.