Trade War Battle Lines

Changes in global politics indicate that the friendship between the EU and the US is slowly turning into a marriage of convenience. What’s particularly surprising his how over the past few days China’s announcements were focused on resolving trade issues while European leaders escalated tensions by making statements opposing Trump. Considering the upcoming US elections, this can clearly be interpreted as a political move on their behalf. Yesterday an EU official proclaimed that the European Union is opposed to war in all its forms as well as opposed to countries who would themselves initiate such measures. While this declaration appears to be in defiance of Trump’s perceived hostility, coming from Brussels bureaucrats it seems wholly insincere and was likely made with the sole purpose of expressing support for the President’s opposition.

Final Countdown

It’s the last trading day before the US November midterm elections. As there are no notable macroeconomic figures being released today, the entire market can devote its full attention to the internal power struggle of the world’s top economy. Lacking any definitive news, the Asian trading session closed slightly in the positive, led by Nikkei. This approximately 0.6-1% increase was less than typical, since over the past month market participants were used to twice as much volatility. The Shanghai Composite was the only major Asian index that closed the day in the negative with a loss of 6 points or 0.23%. The latest forecasts project Democrats taking the House while Republicans retain control of the Senate. Analysts suggest that this kind distribution of power typically results in the markets strengthening.

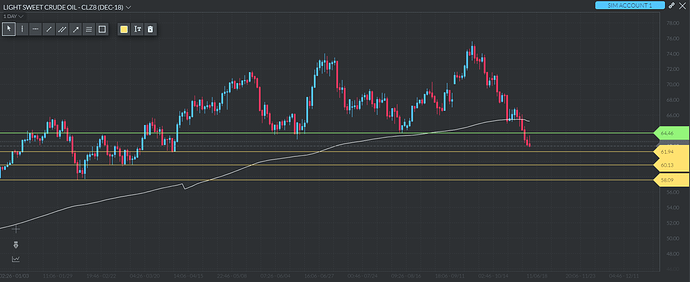

WTI

Oil prices don’t seem to indicate the loss of Iranian oil exports having any kind of major effect on global supply. The exemptions, the delays and the fallout from the Saudi assassination crisis all show that it’s not easy to exclude any one country from the global economy. It’s imperative that counties that often employ these economic sanctions recognize this fact, since the tight interlocking of economic and political relations tends to lead to a sort of domino effect that sweeps from country to country until going full circle to affect the country initially imposing the sanctions itself and thus making them difficult to enforce. The tools previously available to isolated economies have become unfeasible in this current climate of global politics and trade.

Oil has gone through a notable price correction over the past few weeks. Those previously expecting price to rise above 100 dollars were rendered silent by seeing how effortlessly price breached a series of support lines all previously through to be quite powerful. The most notable among them was the 64.50 line, which not only failed to stop the decline, but couldn’t even slow it down. Last week, price not only subdued it’s support lines, but also broke through it’s 200-Day moving average, making it clear that the fundamental price trend of oil no longer points upwards. On the daily charts we can see three additional lines that each have the the potential to halt the declined, these are the lines at 61.94, 60.13 and 58.09. There are still a number of unsolved problems surrounding oil producing countries, so it’s still entirely possible to see news of supply difficulties in the future.

AUDUSD

The Reserve Bank of Australia (RBA) held it’s November interest rate meeting today, where they held the 1.5% base interest rate as per market expectations. According to Australia’s central bank their inflation is low by global standards and the the country’s economic outlook remains positive. The RBA expects a 3.4% GDP growth as well as the continued decline of unemployment. The current 5% unemployment is close to the lowest unemployment rate of the past six years, which the RBA considers a sign of a tight labor market and a factor that will accelerate wage growth. Considering the inflation rate, they expect the rise of product prices to realistically stay under 2% this year and only predict an increase of 2.25% in 2019. These conditions make it difficult to imagine that Australia would raise its base interest rates in the future.

The AUD reacted to this news positively and strengthened against the USD and it still has much more room to grow, since it has been on a continuous downwards trend against the US dollar for most of early 2018. For a fleeting moment in late October it seemed as if the 0.7049 support line would break, however, price reversed after a brief stint below it. The rebound was so successful that the pair entered November above 0.72. As the RBA’s actions came with no surprises, the role of affecting price falls to the news & events on the USD side of the pair. Some analysts have come out suggesting that the potential diffusion of power between Democrats and Republicans could result in a more consolidated economic policy for the US. Possibility even the slowing of the interest rate increased and the weakening of the USD. If the market decides to price in this scenario, the AUDUSD pair could very well aim for the 0.7450 price level.

Sincerely,

Laszlo | Market Analyst

Disclaimer:

Leveraged trading is high risk and may not be suitable for everyone as your losses may exceed your investment. We advise you to consider whether trading is appropriate for you in light of your experience, objectives, financial resources, risk tolerance and other relevant circumstances. Ensure you fully understand all of the risks involved and seek independent advice if necessary. Please refer to our full disclaimer for more details. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.