Hi Jason

when I see headlines like this I know the top must be getting near. Good stuff your posting, keep it up

Hi Jason

when I see headlines like this I know the top must be getting near. Good stuff your posting, keep it up

Jason always have great information on his blog and i thank him for it.

Thanks guys! :57:

Credit goes to our analysts over at DailyFX.com

Today Michael Boutros shared the key price levels on EUR/USD he’s watching heading into tomorrow’s Nonfarm Payroll employment number.

Retail trader data warns the US Dollar could fall to further lows versus the Euro and the Japanese Yen.

Weekly Summary of Forex Trader Sentiment and Changes in Positioning

But quantitative strategist David Rodriguez discusses key warning signs which are difficult to ignore in his Weekly Speculative Sentiment Index (SSI) report on DailyFX.com

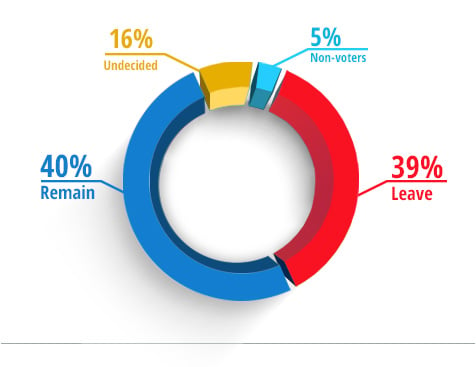

The Brexit referendum is the outcome of a policy initiative by the British Government to give citizens the chance to vote on whether Britain should remain a part of the European Union or whether the country should leave.

The referendum date has been set for 23rd June 2016 and following the European Union Referendum Act 2015 will put the following question to the electorate via a ballot:

Should the United Kingdom remain a member of the European Union or leave the European Union?

The lead up to this vote is likely to cause volatility in the markets which could provide opportunities to traders as both outcomes will cause a certain amount of immediate uncertainty.

If Britain decides to leave the EU, there will likely need to be a period of 2 years to be able to give notice along with a trade deal renegotiation and if Britain stays, there remains the question of the negotiated settlement and whether this could be overruled.

The DailyFX research team can help you to navigate the ongoing Brexit volatility in a unique series of webinars ending with a rally in the final week.

What would a Brexit mean for the UK economy, assessing both the short and long term impacts? How will the decision affect traders across multiple markets? How will the Pound react? To hear their insights and analyses on the impact of this vote, you can sign up for the free webinar series.

The DailyFX research team can help you to navigate the ongoing Brexit volatility in a unique series of webinars ending with a rally in the final week.

What would a Brexit mean for the UK economy, assessing both the short and long term impacts? How will the decision affect traders across multiple markets? How will the Pound react? To hear their insights and analyses on the impact of this vote, you can sign up for the free webinar series.

Markets are now pricing in September as the most likely period for the first rate hike, with the odds of a hike having jumped to 62%. For market participants to fully price in a Fed hike in June, we’d want to see the June implied probability jump above 60% itself.

Correlation is not causation, but the Fed has not raised rates unless market participants have priced in at least a 60% chance in the front month of them doing so. Accordingly, if US data continues to edge up, then June expectations should rise, and keep the US Dollar insulated further.

For more details, see Christopher Vecchio’s article on DailyFX.com

The DailyFX research team can help you to navigate the ongoing Brexit volatility in a unique series of webinars ending with a rally in the final week.

What would a Brexit mean for the UK economy, assessing both the short and long term impacts? How will the decision affect traders across multiple markets? How will the Pound react? To hear their insights and analyses on the impact of this vote, you can sign up for the free webinar series.

The month of May is quickly closing, which means we are wrapping up another $10,000 trading challenge. Our top five competitors this month have had phenomenal success so far, with V.S. from Glendale, California leading the field with an 810% gain!

[I]Past performance is not necessarily indicative of future results. The leaderboard shows the top 10 contestants out of thousands and does not represent a typical contestant’s return. Positive returns are not guaranteed. All contestants have the potential to experience losses in excess of deposited funds.[/I]

Remember though this month’s challenge hasn’t concluded yet—over a week of trading still remains. To get a better idea of what is going on in the market, and what your competitors might be trading, see Walker England’s review of the major market themes occurring during the month of May.

According to Bloomberg, "The pound dropped after a new poll showed a jump in support for the campaign to take Britain out of the European Union, spooking some investors who had thought that the result was a foregone conclusion.

“Sterling fell against all of its 16 major peers as ICM opinion polls released Tuesday by the Guardian showed a lead for the ‘Leave’ camp.”

The latest DailyFX research shows the ratio of long to short positions in the GBP/USD stands at 1.20 as 54% of traders are long. Yesterday the ratio was -1.03; 49% of open positions were long.

We use our Speculative Sentiment Index (SSI) as a contrarian indicator to price action, and the fact that the majority of traders are long gives signal that the GBPUSD may continue lower.

The trading crowd has flipped from net-short to net-long from yesterday and last week. The combination of current sentiment and recent changes gives a further bearish trading bias.

The DailyFX research team can help you to navigate the ongoing Brexit volatility in a unique series of webinars ending with a rally in the final week.

What would a Brexit mean for the UK economy, assessing both the short and long term impacts? How will the decision affect traders across multiple markets? How will the Pound react? To hear their insights and analyses on the impact of this vote, you can sign up for the free webinar series.

Quantitative strategist David Rodriguez had the following to say about the British Pound in his Weekly Speculative Sentiment Index (SSI) report on DailyFX.com:

"Retail FX traders have bought aggressively into the British Pound’s recent slide versus the US Dollar, and a contrarian view of ‘crowd’ positioning acts as signal the GBP/USD may continue lower. Our data shows traders remained net-long GBP/USD as it fell from $1.53 to lows near $1.38, but more recently we have seen periods in which traders turned net-short.

“If we nonetheless see a continued shift towards buying—much as we have this week—our sentiment indicator will keep us firmly in favor of selling the GBP/USD. It will be critical to watch Sterling price action headed into the highly-anticipated UK ‘Brexit’ vote, and we expect the GBP may remain volatile in the weeks ahead.”

The DailyFX research team can help you to navigate the ongoing Brexit volatility in a unique series of webinars ending with a rally in the final week.

What would a Brexit mean for the UK economy, assessing both the short and long term impacts? How will the decision affect traders across multiple markets? How will the Pound react? To hear their insights and analyses on the impact of this vote, you can sign up for the free webinar series.

The past week has brought an out-sized reversal in the US dollar with traders facing the reality that markets will likely have to wait a bit longer to get another rate hike out of the Fed.

But the question remains: Is this a lasting move in the Greenback?

As in, the Fed surely doesn’t want to hike in the face of declining data when numerous questions already exist to the strength of the American economic recovery; but there’s a reason that they’ve been driving for higher rates for over a year now while there are some very big global macro questions.

Currency analyst James Stanley discusses these questions in his article on DailyFX.com

This week brings a flurry of inflection points for markets: Tonight is the expected MSCI decision for Chinese A-shares to be included in equity benchmarks, Wednesday brings FOMC with the Bank of Japan following later that night. In the week after, we have the Brexit referendum.

Currency analyst James Stanley covers these topics today in his article on DailyFX.com

Earlier today, the Bank of England held its main interest rate unchanged at 0.50% as expected. The main point of focus, however, was regarding uncertainities surrounding the referendum vote that will take place next Thursday, June 23.

This was has had the effect of leading to “delays to major economic decision,” according to BOE Governor Mark Carney. Currency strategist Christopher Vecchio discusses the implications for traders in his article on DailyFX.com

The Speculative Sentiment Index (SSI) is a contrarian indicator to price action, and the fact that the majority of traders are short gives signal that the GBP/USD may continue higher. The ratio of long to short positions in GBP/USD stands at -1.05 as 49% of traders are long.

The trading crowd has flipped from net-long to net-short from Friday and last week. On Friday, the ratio was 1.45; 59% of open positions were long.

Long positions are 25.6% lower than on Friday and 33.0% below levels seen last week. Short positions are 13.0% higher than on Friday and 18.9% above levels seen last week. The combination of current sentiment and recent changes gives a further bullish trading bias.

The United Kingdom’s EU Referendum vote (known as the ‘Brexit’) is scheduled to begin early morning London time Thursday June the 23rd and run through the 10 PM. The subsequent tally can keep the market on edge waiting for a clear outcome well into Friday trade.

Why is this event so important? How far does its influence reach? What should you do in the face of this risk? Our research team has organized their analysis and background on the impending Brexit into a [single page on DailyFX.com

This aggregate page](http://bit.ly/28MUxWf) acts as a directory to find the DailyFX analysts’ broad coverage of this extremely important event for the entire financial system.

There is one massive problem with exposure around Brexit: Unquantifiable risk.

The expectation is for extremely low liquidity as banks tighten up their risk, and this means that traders face even greater chances of gap risk against their positions. Traders looking to risk one-to-two percent could end up losing more if liquidity doesn’t exist to execute the stop at the desired rate.

Global markets were shocked by the UK’s vote to leave the EU in yesterday’s referendum. The British pound (GBP) dropped from a session high of 1.50197 to a session low of 1.32263, and is currently trading around 1.38 at the time of this post versus the US dollar (USD).

However, the latest readings from our Historical SSI indicator* show retail traders are back to buying the pound with more than half of retail positions (68.74%) long GBP/USD. That’s close to the pre-Brexit high of 70.87% long positions.

* The Historical SSI indicator charts readings from our Speculative Sentiment Index in real time. SSI is a contrarian indicator to price action, and the fact that the majority of traders are long gives signal that GBP/USD may continue lower.

Friday was an historic day in the markets as the outcome of Thursday’s vote confirmed the United Kingdom voted to leave the European Union. Tyler Yell discusses the ripple effects to watch for in the Euro, the US dollar, stocks and oil in his article on DailyFX.com:

Much of today’s USD/JPY advance has been predicated on international markets rebounding from last weeks “Brexit” vote.

USD/JPY Daily Chart

Trading instructor Walker England discusses this today in his article on DailyFX.com