Hey there,

Been on this forum for almost one year and this is my first post. I’ve found this baby and started to trade it since 6/11. Made some nice pips, and lost a considerable amount out of my greed. This rising channel has 2 resistances in the middle. The one on the bottom is the strong and important one and the one close to the top side is the weak one. I value it only as resistance and not support since the price doesn’t pay any attention to it when it’s going down. Not only the price respects the channel lines but also the RSI and Stochastic does too in their own trend lines. At 12:00 I shorted and placed a TP 1,31485 and a SL 1,32049. What I’m looking for here is your future projection. Cuz these channels… You know… always break at one point or another. Any ideas when and which direction it would be.

GBP/USD is moving within a consolidation area with upper band the 1.3320 resistance level and lower band the 1.3040 support level. More upside movement is expected until 1.3615 or a rebound on the upper boundary could slip the price towards 1.3040.

Gbpusd on H1 we can seen already figure out bullish candle, two candle confirmed on uptrend, possible target is on 1.3505 which this area will become strong resistance, if reading news today there are several news high impact for usd, fomc press conference and also unemlpoyment change will giving high impact usually

I thought it was Donald Trumps meeting slagging of other countries again.

I think gbp/usd will go short to 1.37383. And then it will go long to 1.39711.

Morgan Stanley’s currency strategists do not have warm feelings for the dollar, but the British pound likes them even less — the Bank forecasts its decline to 1.32 by the end of the second quarter, while adhering to the forecast for the third and fourth quarters at 1.38.

However, Morgan Stanley do not advise to rush with selling of the British pound right now. The Bank draws attention to the fact that Telegraph, citing sources close to the negotiations, reports that British negotiators are close to agree with representatives of the EU about transition period, while they surprised the latter with their desire to essentially prolong the membership of the UK in the single market and the customs union for another two years starting in March 29, 2019.

“When GBPUSD gets closer to 1.44/1.45, we once again can be sellers of the pound,” noted strategists of Morgan Stanley.

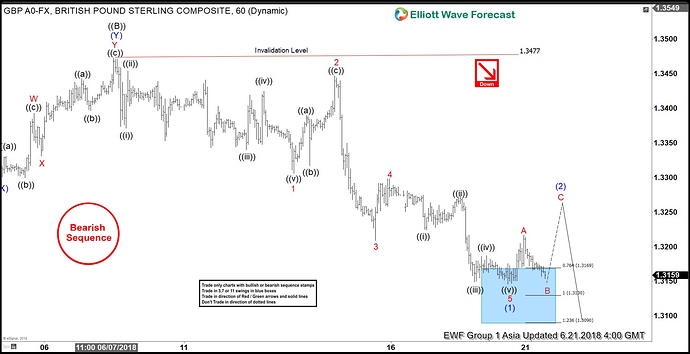

Elliott Wave Analysis: GBPUSD Showing Incomplete Sequence

GBPUSD short-term Elliott Wave view suggests that the recovery to 1.3473 on 6/07/2018 peak ended primary wave ((B)) bounce as double three structure. Below from there, the pair has managed to break below the previous low on 5/29 (1.3203) to confirm the next extension lower in primary wave (©) has started. With this break lower, the sequence from 4/17/2018 peak has become incomplete to the downside.

Down from 1.3473 high, intermediate wave (1) unfolded as an impulse structure with lesser degree sub-division showing 5 waves structure in Minor wave 1, 3 & 5. The internals of Minor wave 1 ended in 5 waves at 1.3306. The Minor wave 2 bounce ended at 1.3447. Then Minor wave 3 ended in another 5 waves at 1.3209. Minor wave 4 ended at 1.3298 & Minor wave 5 of (1) is proposed complete in 5 waves at 1.3146 low.

Above from there, pair could have started intermediate wave (2) recovery in 3, 7 or 11 swings. However, pair needs to make further separation from the lows to validate this view. If pair breaks below 1.3146 low instead, then it is still in the process of ending Minor wave 5 lower. Near-term, while pullbacks stay above from 1.3146 low, the pair is expected to do a bounce higher in intermediate wave (2). The it should find sellers in 3, 7 or 11 swings for further downside extension in the pair. We don’t like buying the pair in the proposed bounce. And expect sellers to appear in any rally in 3, 7, 11 swing for extension lower in the pair.

GBPUSD 1 Hour Elliott Wave Chart

Hi guys! I would like to share with you my chart and trading plan for next week and beyond (GBP/USD), here is the link: Is Pound Exiting EU Too?

GBPUSD my view

A trader should see the political stability of that country before investing in that currency. With the unstable gold prices, it is highly uncertain for the traders to believe in the market. Trade wars in the world will make more instabilities in the coming time. Hope that the world will be out of crisis soon.

Different charts can be drawn and explained by the different members of this community. This will be a great help for the community members in order to know the market more clearly. Beneficial posts should be pinned by the comminity staff in order to help all the mebers.

Different experiences sharing regarding the investment in a currency should be appreciated. The useful posts should be pinned at the top in order to help the new users to learn more about the trading world. There should be a separate section about the productive posts. This will surely be a positive change in helping.

Lots of big moves it appears in the chart today. Is this something you guys traded or stayed away since it was Brexit and news… and who knows what was going to be said?

Hi! Have a look at my latest chart/article: GBPUSD December Outlook

A lot of volatility on the GBP/USD, the pair bounces to the upside, from the 1.2500 zone and reaches the 1.2660 level, which is acting as resistance. Below the 1.2600 level, its next support is the 1.2500 level, and above the 1.2660 level, its next resistance could be the 1.2800 level.

GBP was very popular during previous weeks. The most interesting developments were happening around Brexit negotiations and later voting. This evening is going to be extremely interesting because of the Confidence Vote in the UK. Sit and watch your charts during that time

Short term Elliott Wave view in GBPUSD shows that rally to 1.2816 ended Intermediate wave (4). Internal of that rally unfolded as a triple three Elliott Wave structure. Minor wave W ended at 1…2687, Minor wave X ended at 1.2528, Minor wave Y ended at 1.2739, second Minor wave X ended at 1.2614, and Minor wave Z ended a 1.2816. Decline from there ended at 1.2437 in Minute wave ((a)) as a 5 waves impulsive Elliott Wave structure.

Down from 1.2816, Minutte wave (i) ended at 1.2717, Minutte wave (ii) ended at 1.2773, Minutte wave (iii) ended at 1.258, Minutte wave (iv) ended at 1.2616, and Minutte wave (v) ended at 1.2437. Near term, expect pair to correct decline from 12/31 high (1.2816) within Minute wave ((b)) in 3, 7, or 11 swing before the decline resumes. We don’t like buying the pair with the right side tag showing lower and expect sellers to appear and pair to extend lower as far as pivot at 1.2816 stays intact.

GBPUSD 1 Hour Asia Elliott Wave Chart

The GBPUSD rallies above the 1.2600 level, but it may find some resistance at the 1.2700 zone. To the downside, the 1.2500 zone may act as support.

Experienced traders should do the posts in order to explain the Pros and Cons of different pairings. Their views about the market will be a milestone for the beginners who can’t find a clear path of travel. Hoping to see the more help from the community senior traders.

Hello! I think the pair is on an uptrend, here is my chart: GBPUSD January Outlook