GBP/USD consolidates ahead of BoE Bailey’s speech. DAX steadies after last week’s gains, PPI cools.

By : Fiona Cincotta, Senior Market Analyst

GBP/USD consolidates ahead of BoE Bailey’s speech

- BoE & Fed rate cuts are in focus

- BoE Governor Bailey to speak

- GBP/USD consolidates below 1.25

GBP/USD is consolidating below 1.25, after rising to a 2-month high in the previous week amid USD weakness and ahead of a speech by Bank of England governor Andrew Bailey.

The USD is trading out at a 2 1/2 month low after last week’s softer-than-expected US data which fuelled expectations that the Federal Reserve has done hiking interest rates.

Inflation cooled by more than expected, jobless claims showed a weakening labour market, and retail sales fell for the first time in seven months, making the market believe that the next move by the Federal Reserve will be a rate cut, which is expected around June.

Meanwhile, the Bank of England is also expected to start cutting rates in Q2 next year after inflation also cooled by more than expected, and retail sales unexpectedly fell on Friday. The market is pricing in a rate cut by the BoE, potentially as soon as May next year.

BoE governor Andrew Bailey is due to speak today and could shed more light on the future path for UK interest rates. Any dovish comments could pull the pound lower, although Bailey may tread carefully, not wanting to undo the hard work done by the BoE so far.

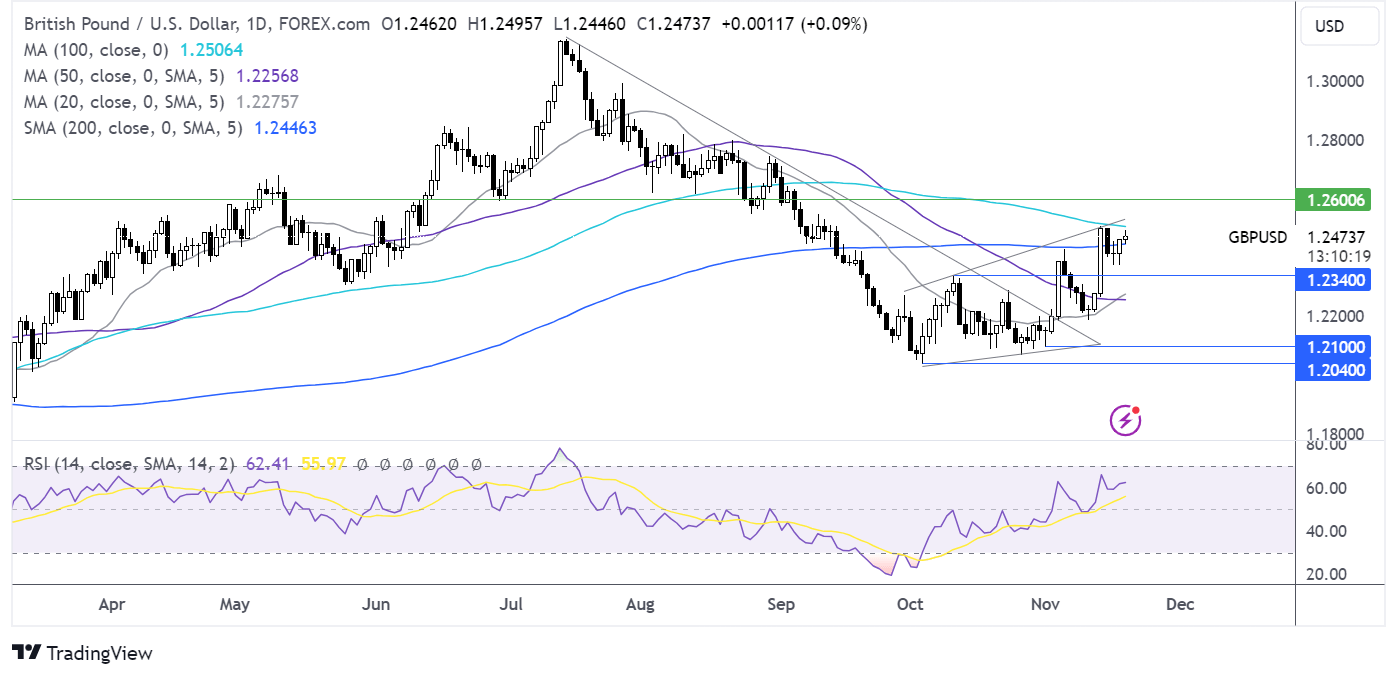

GBP/USD forecast – technical analysis

GBP/USD has risen above the 200 SMA, which, combined with the RSI above 50 keeps buyers optimistic for further upside.

Buyers will look to rise above 1.25, the psychological level and November high. A rise above here brings 1.26, the June low into focus.

On the flip side, if GBP/USD fails to hold above the 200 DMA, sellers could look to test 1.2340 the October high.

DAX steadies after last week’s gains, PPI cools

PPI fell 11% YoY in October after falling -14.7% in September

Optimism that central banks will have ended rate hikes boosts equity demand

DAX consolidates below 16000

The DAX is set for a quiet start after strong gains last week. The price is consolidating near Friday’s highs, following a rally fueled by bets that global central banks could start cutting interest rates next year as inflation shows signs of cooling.

On the data front, Grman PPI cooled by 11% YoY in October after falling 14.7% in September, indicating a low-demand environment.

The data comes after eurozone inflation cooled by to 2.9% annually in October, its lowest level in two years, down from 4.3% in September.

The data is adding to expectations that the ECB won’t hike interest rates further and could start to cut interest rates in Q2 next year.

Meanwhile, the PBoC kept its loan prime rate near a record low, as expected, and injected 80 billion of yuan of liquidity into the market, which has helped the market mood. News that Chinese regulators have pledged further policy support to the real estate sector is also helping the broader market mood.

Looking ahead, ECB chief economist Philip Lane is due to speak. Any discussion regarding possible rate cuts could fuel demand for DAX stocks. However, should Philip Lane caution against the market getting carried away by dovish pivot bets, stocks could fall.

Later in the day, Fed speakers will be in focus, and any support for a dovish pivot could lift riskier assets. The FOMC minutes are due out on Tuesday.

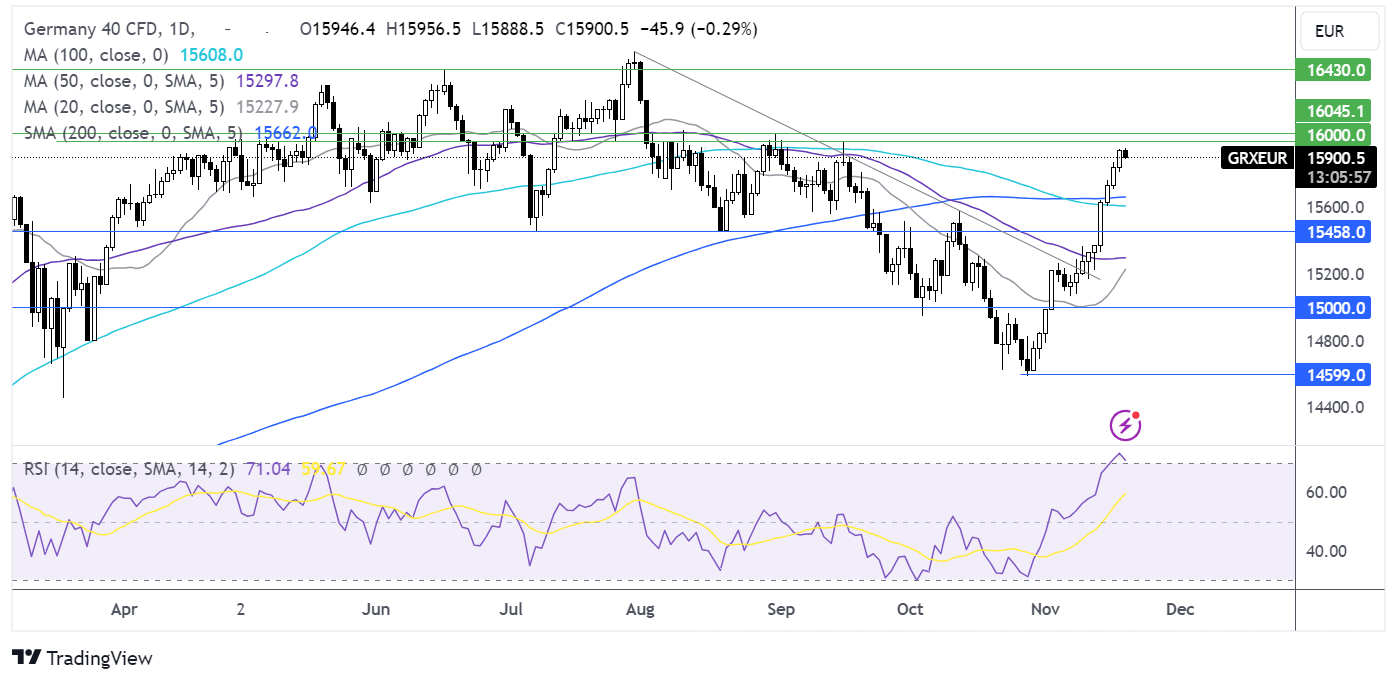

DAX forecast – technical analysis

DAX is consolidating just below 16000 after a strong run up from 14600, the October low. The RSI is in overbought territory.

Buyers could look for a rise above 16000, the August high, to extend gains to 16430, the June high.

Support can be seen at 15665, the 200 SMA, and 15450 the July and August low. A break below here negates the uptrend.

StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information purposes only and it does not take into account your personal circumstances or objectives. This material has been prepared using the thoughts and opinions of the author and these may change. However, City Index does not plan to provide further updates to any material once published and it is not under any obligation to keep this material up to date. This material is short term in nature and may only relate to facts and circumstances existing at a specific time or day. Nothing in this material is (or should be considered to be) financial, investment, legal, tax or other advice and no reliance should be placed on it.

No opinion given in this material constitutes a recommendation by City Index or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although City Index is not specifically prevented from dealing before providing this material, City Index does not seek to take advantage of the material prior to its dissemination. This material is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For further details see our full non-independent research disclaimer and quarterly summary.