Asian Indices:

- Australia’s ASX 200 index rose by 4.5 points (0.06%) and currently trades at 7,196.80

- Japan’s Nikkei 225 index has risen by 197.95 points (0.61%) and currently trades at 32,665.71

- Hong Kong’s Hang Seng index has fallen by -6.48 points (-0.04%) and currently trades at 18,089.97

- China’s A50 Index has fallen by -19.63 points (-0.16%) and currently trades at 12,631.63

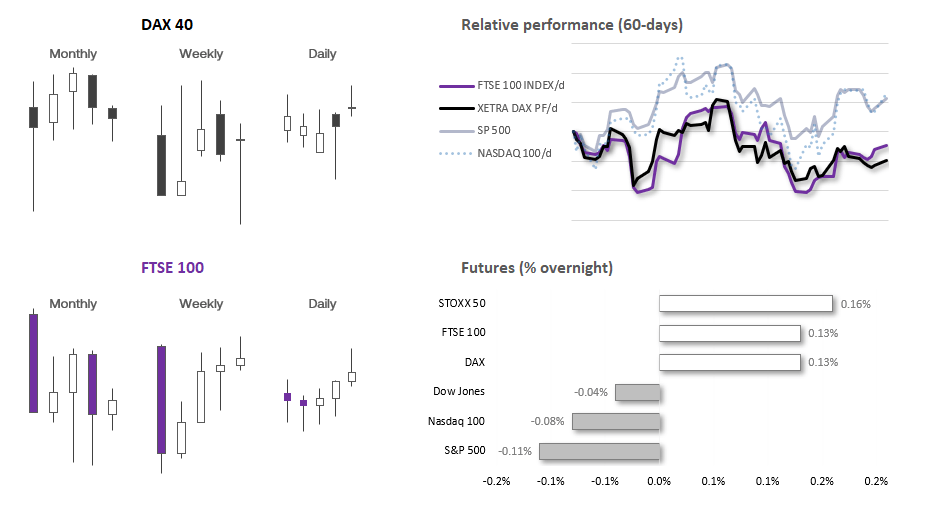

UK and Europe:

- UK’s FTSE 100 futures are currently up 9.5 points (0.13%), the cash market is currently estimated to open at 7,506.37

- Euro STOXX 50 futures are currently up 7 points (0.16%), the cash market is currently estimated to open at 4,261.33

- Germany’s DAX futures are currently up 20 points (0.13%), the cash market is currently estimated to open at 15,820.99

US Futures:

- DJI futures are currently down -15 points (-0.04%)

- S&P 500 futures are currently down -5.5 points (-0.12%)

- Nasdaq 100 futures are currently down -14.5 points (-0.09%)

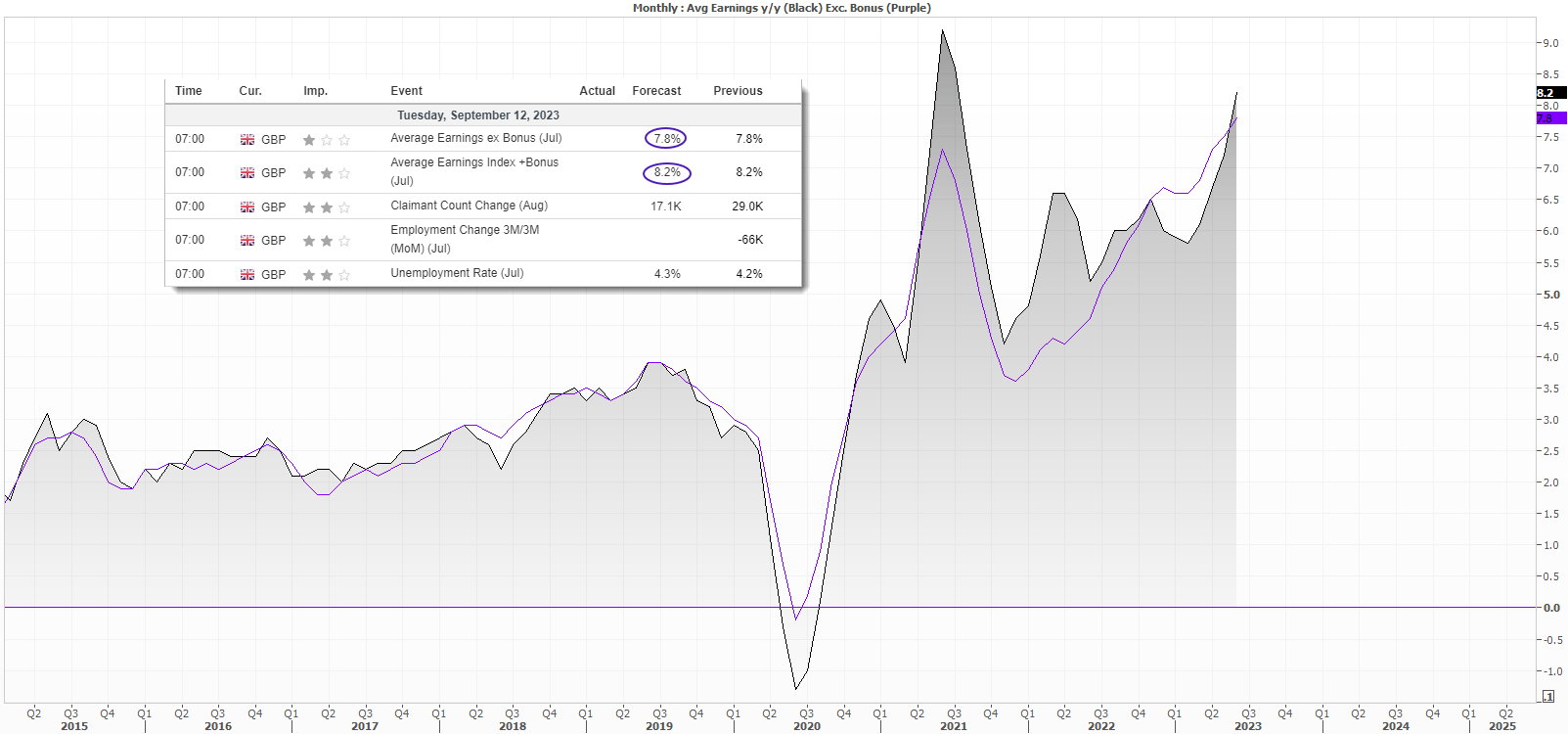

UK wages and ZEW economic sentiment in focus

UK wages data at 07:00 could be seen as a proxy for next week’s CPI data. They’re expected to remain ‘steady’ at the eye-watering level of 7.8% y/y (or 8.2% including bonus). 1-month OIS suggests ~76% chance of a hike this month and ~66% one more hike in 12 months.

Softer wages could diminish those odds and shape expectations for next week’s inflation report. But to be sure the BOE are near their terminal rate, we really need to see wages soften and core CPI behave and get back into its box (currently at 6.9% y/y)

The ZEW economic survey is released at 10:00 BST. It is debatable as to whether it can really move the needle for the ECB’s interest rate decision on Wednesday, but if we’re to see them roll over it should further excite euro bears who are positioned for the ECB to hold rates. And if the German IFO business sentiment survey is anything to go by, perhaps the ZEW sentiment and expectations may point lower today. But in the context of weak growth data and higher-than-liked inflation, perhaps the bigger surprise to move markets were if the ZEW reads declined at a softer rate, and that could help EUR/UD recover further from its lows. Part of the reason the expectations index rose unexpectedly in August was that the majority of respondents do not expect any further hikes from the ECB or Fed.

Events in focus (GMT+1):

- 07:00 – UK employment and wages

- 08:00 – Spanish CPI

- 10:00 – ZEW economic sentiment

- 12:00 – UK GDP estimate

- 12:00 – OPEC monthly report

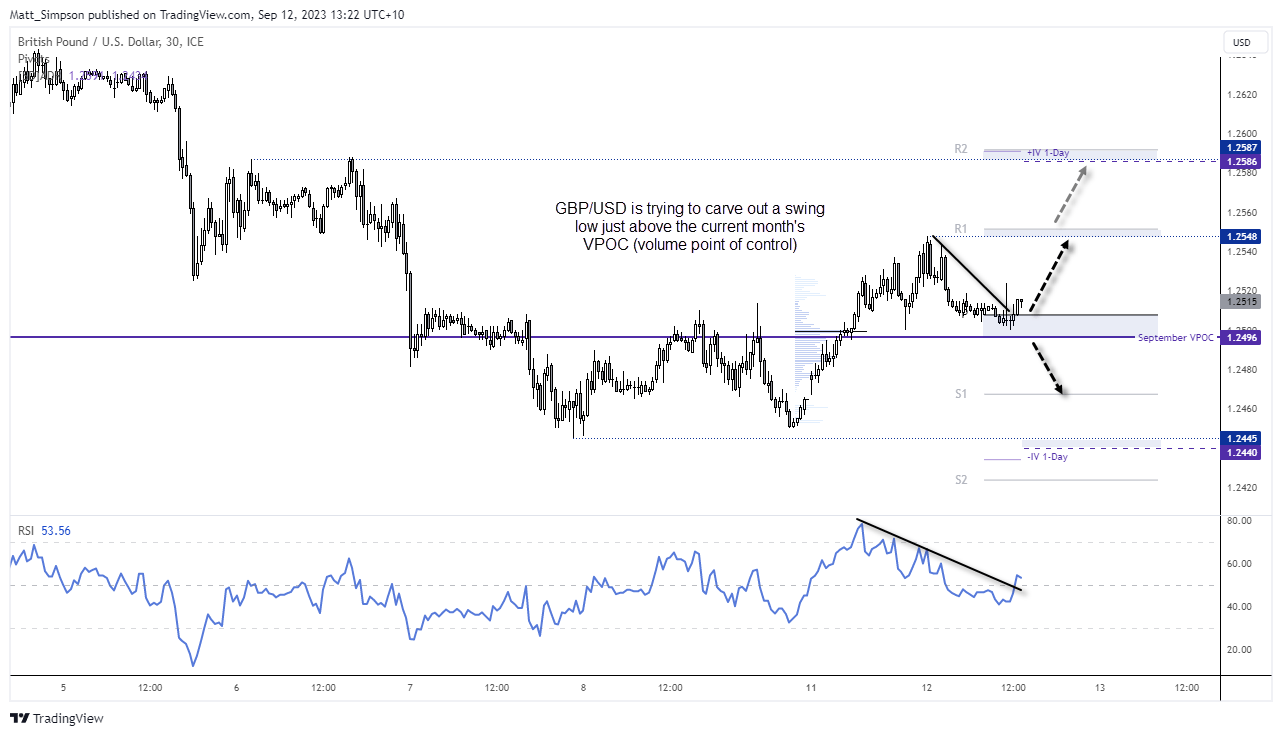

GBP/USD technical analysis (30-minute chart):

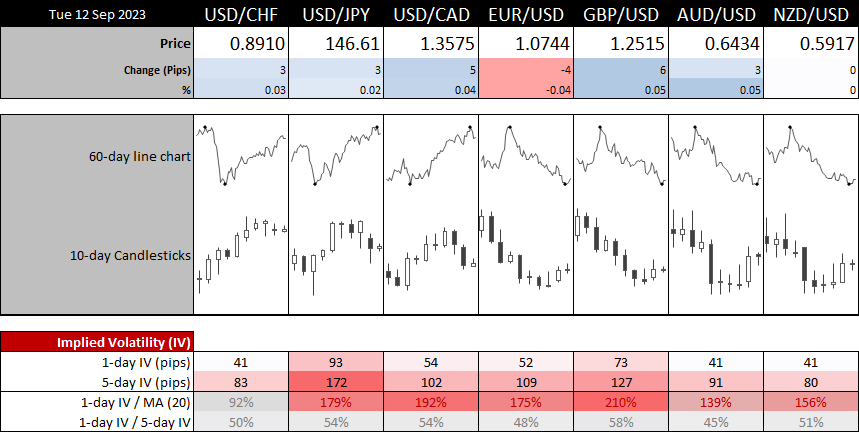

The weaker US dollar on Monday helped GBP/USD rise from its cycle lows and snap a 4-day losing streak. And whilst the trend remains bearish on the daily chart, that is not to see it cannot perform a deeper countertrend move before losses resume. With that said, today’s wage data released shorty is likely to be a key driver for the currency pair in today’s session.

With that said, GBP/USD is trying to form a base above 1.25, which itself is just above the current month’s VPOC (volume point of control). RSI (14) is also above 50and prices are back above the daily pivot point. From a purely technical perspective, it appears the market wants to retest last week’s high around the daily R1 pivot point. But take note that the upper 1-day implied volatility level is near the 6 September double top and daily R2 pivot point, which likely requires a strong employment wages report and a softer US dollar. A break below 1.2490 invalidates the near-term bullish bias.