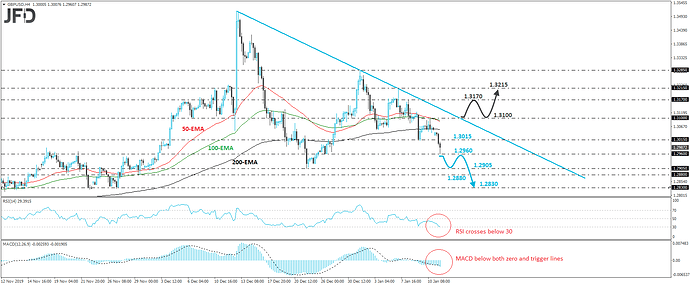

GBP/USD traded lower today, breaking below the 1.3015 support zone, marked by Thursday’s low. The pair has been printing lower highs and lower lows since December 31st, while also trading below the downside resistance line drawn from the high of December 12th. Having all this in mind, as well as that the dip below 1.3015 has confirmed a forthcoming lower low, we would consider the short-term outlook to be negative for now.

After breaking below 1.3015, the rate hit support at 1.2960, and then, it rebounded somewhat. If the bears are strong enough to recharge again soon and push the battle below 1.2960, we could then see them aiming for the 1.2905 barrier, marked by the low of December 23rd. That said, in order to get confident on more bearish extensions, we would like to see a dip below 1.2880, a support defined by the low of November 29th. This could allow declines towards the 1.2830 zone, which provided decent support between November 22nd and 27th.

Taking a look at our short-term oscillators, we see that the RSI just touched its toe below 30, while the MACD lies below both its zero and trigger lines, pointing down as well. Both indicators detect strong downside speed and support the notion for Cable to continue drifting south for a while more.

On the upside, we would like to see a clear recovery back above 1.3100 before we start examining whether the bulls have gained the upper hand. This may also drive the rate above the downside line drawn from the peak of December 12th, and may set the stage for the high of January 8th, at around 1.3170. Another break, above 1.3170, could extend the advances towards the peak of the day before, at around 1.3215.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.