GBP/USD holds steady after a mixed jobs report & ahead of US CPI. USD/JPY falls with US CPI in focus.

By :Fiona Cincotta, Senior Market Analyst

GBP/USD is holding steady after a mixed jobs report & ahead of US CPI

- Unemployment held steady at 4.2%

- Wage growth cooled by more than expected

- GBP/USD holds steady above 200 SMA

The UK jobs data painted a mixed picture. As expected, unemployment held steady at 4.2%, but wage data missed forecasts. Meanwhile, the claimant count was slightly higher than expected at 16,000, but employment change was also robust at 50,000.

Average earnings, excluding bonuses, rose 7.3% in the three months; however, they were down from 7.8% and missing forecasts of 7.4%. Meanwhile, average earnings excluding bonuses moved further from the record 8% at 7.2%. The BoE will closely monitor wage growth as it continues its fight against inflation.

Rate cut expectations for the BoE in 2024 didn’t change following the release of the data, and the market is pricing in around 75 basis points of cuts by the end of December 2025.

The data comes ahead of the BoE rate decision on Thursday, where the central bank is expected to keep interest rates on hold and could push back on rate cut expectations.

Looking ahead, US CPI data will now be in focus, and hotter-than-expected US inflation could see the pair fall lower.

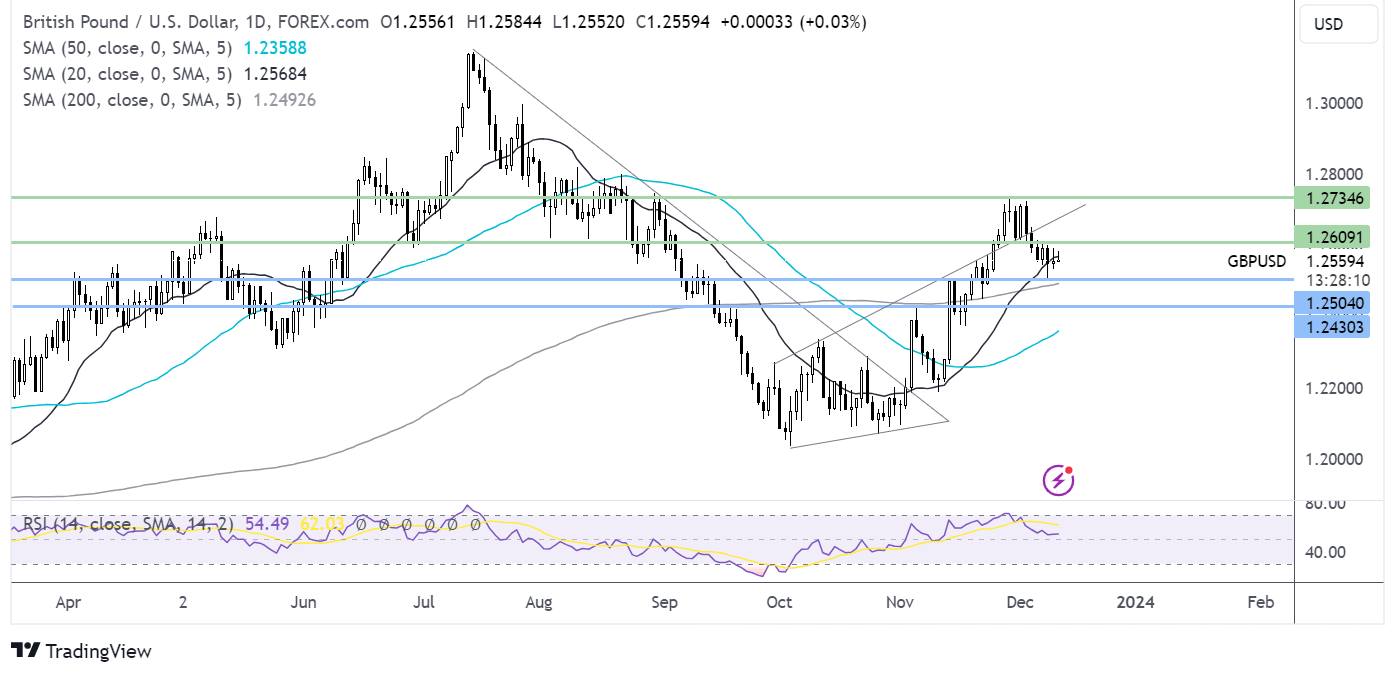

GBP/USD forecast – technical analysis

After finding support at 1.25 last week, GBP/USD has risen and is testing resistance at 20 SMA at 1.2570. Bulls will need to clear this level to test the 1.26 round number.

A move above here brings the rising trendline at 1.2690 into focus ahead of the November high of 1.2730.

Failure to rise above the 20 SMA could see a retest of support at 1.25 and the 200 SMA at 1.2480. A fall below here could see sellers gain momentum and target 1.2730

USD/JPY looks to US inflation data

- Japan PPI 0.3% YoY vs 0.1% expected

- US CPI is forecast to fall to 3.1% YoY in November

- USD/JPY fails at trendline resistance

USD/JPY is falling after two straight days of gains after stronger-than-expected Japan PPI data and amid weaker U.S. dollar ahead of US inflation figures.

US CPI is expected to cool to 3.1% YoY, down from 3.2% in October; however, core CPI is expected to remain on hold at 4%. However, traders will be wary that inflation could be hotter than expected, given Friday’s stronger-than-forecast non-farm payroll report.

Today’s CPI will set the scene for Wednesday’s Federal Reserve interest rate decision, where the market is fully pricing in that the Fed will leave interest rates unchanged; however, the focus will be on guidance for 2024 and the timing of the first rate cut.

The market’s pricing in a 48% chance of a rate cut in March; this is down from 57% a week earlier following the NFP report.

However, it’s worth noting that financial conditions have loosened since the previous Fed meeting, and policymakers will be conscious that the fight against inflation hasn’t yet been won. The Fed will be cautious, not wanting to loosen financial conditions further.

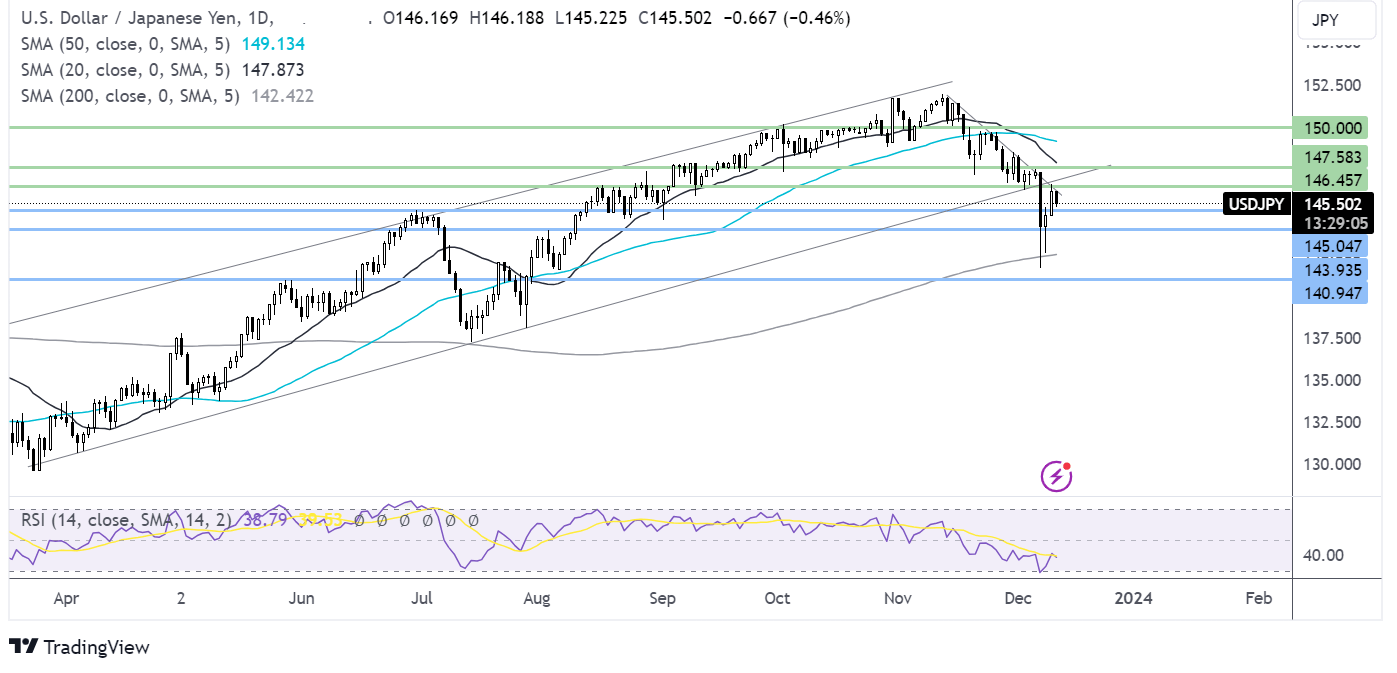

USD/JPY forecast – technical analysis

USD/JPY failed to rise above the multi-week falling trendline and rebounded lower, combined with the RSI below 50, keeping sellers optimistic of further downside.

Sellers will look to take out support at 145.00, the June high ahead of 143.90, the early August high, before exposing the 200 SMA at 142.42.

Buyers need to rise above the falling trendline resistance at 146.5 and yesterday’s high to test 147.50, last week’s high, before bringing 150.00 back into the target.

StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information purposes only and it does not take into account your personal circumstances or objectives. This material has been prepared using the thoughts and opinions of the author and these may change. However, City Index does not plan to provide further updates to any material once published and it is not under any obligation to keep this material up to date. This material is short term in nature and may only relate to facts and circumstances existing at a specific time or day. Nothing in this material is (or should be considered to be) financial, investment, legal, tax or other advice and no reliance should be placed on it.

No opinion given in this material constitutes a recommendation by City Index or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although City Index is not specifically prevented from dealing before providing this material, City Index does not seek to take advantage of the material prior to its dissemination. This material is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For further details see our full non-independent research disclaimer and quarterly summary.