GBP/USD looks to BoE Governor Andrew Bailey’s appearance. USD/JPY rises ahead of tomorrow’s US CPI data.

By :Fiona Cincotta, Senior Market Analyst

GBP/USD falls ahead of BoE Bailey’s appearance

- BoE rate cut bets pushed back

- BoE Bailey to appear before the Treasury Select Committee

- GBP/USD tests 1.27 support

GBP/USD has held relatively well against U.S. dollar strength at the start of the year as investors pushed back on BoE rate cut expectations.

The market is pricing in the first rate cut by the Bank of England in Q2, most likely in May, and is expecting 116 basis points worth of rate cuts this year. That’s down considerably from the five lots of 25 basis points cuts that the market was pricing in towards the end of last year.

Attention will now turn to BoE governor Andrew Bailey, who will appear before the Treasury Select Committee. Any comment surrounding the outlook for inflation or interest rates could drive sterling.

Bailey’s appearance comes ahead of GDP data on Friday, which is expected to show that the UK economy contracted 0.1% in November after falling 0.1% in the third quarter, pointing to a potential mild recession in Q4.

On the other hand, the US dollar has been supported at the start of the year as investors reign in Federal Reserve rate-cut bets amid a resilient jobs market and hawkish Fed comments.

The US economic calendar is light today, with attention squarely focused on tomorrow’s inflation report.

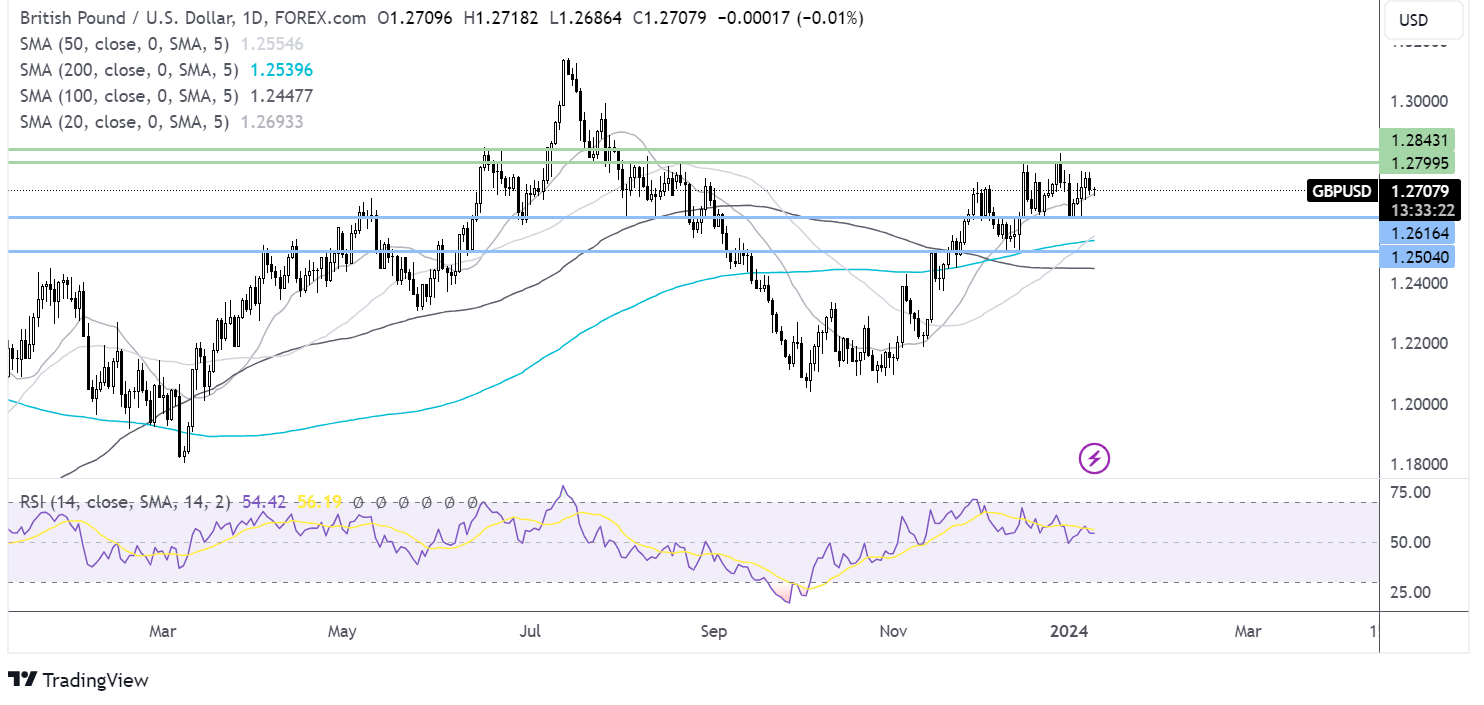

GBP/USD forecast – technical analysis

GBP/USD is being supported by near-term support of the 20 SMA at 1.27. A break below here brings 1.2615 the January and late December low into play. Should sellers break down this level, they expose the 200 SMA at 1.2540.

Should the 20 SMA hold, buyers could look for a rise above 1.28 round number to test the December high of 1.2865.

USD/JPY rises with Thursday’s inflation data in focus

- BoJ hawkish pivot bets are dialed back

- US CPI data is due tomorrow

- USD/JPY tests 145.00 resistance

USD JPY is heading higher for a second straight session and is rising for the sixth time in seven sessions.

The yen has been one of the weakest major just so far in 2024 as has investors become increasingly convinced that the BoJ may delay a move away from negative interest rates.

Following the rebuilding and stimulus measures after the New Year’s Day earthquake, combined with weak wage growth and spending, the BoJ has more headroom to keep its ultra-accommodative monetary policy stance in place for longer.

Meanwhile, the US dollar has been supported by the market reining in Federal Reserve rate cut expectations amid resilience in the US labour market and following hawkish comments from Fed speakers.

Today’s economic calendar is light. Attention is on tomorrow’s inflation data, which is expected to show that inflation ticked higher in December. Sticky inflation could support the view that the Fed won’t start cutting rates until later in the year.

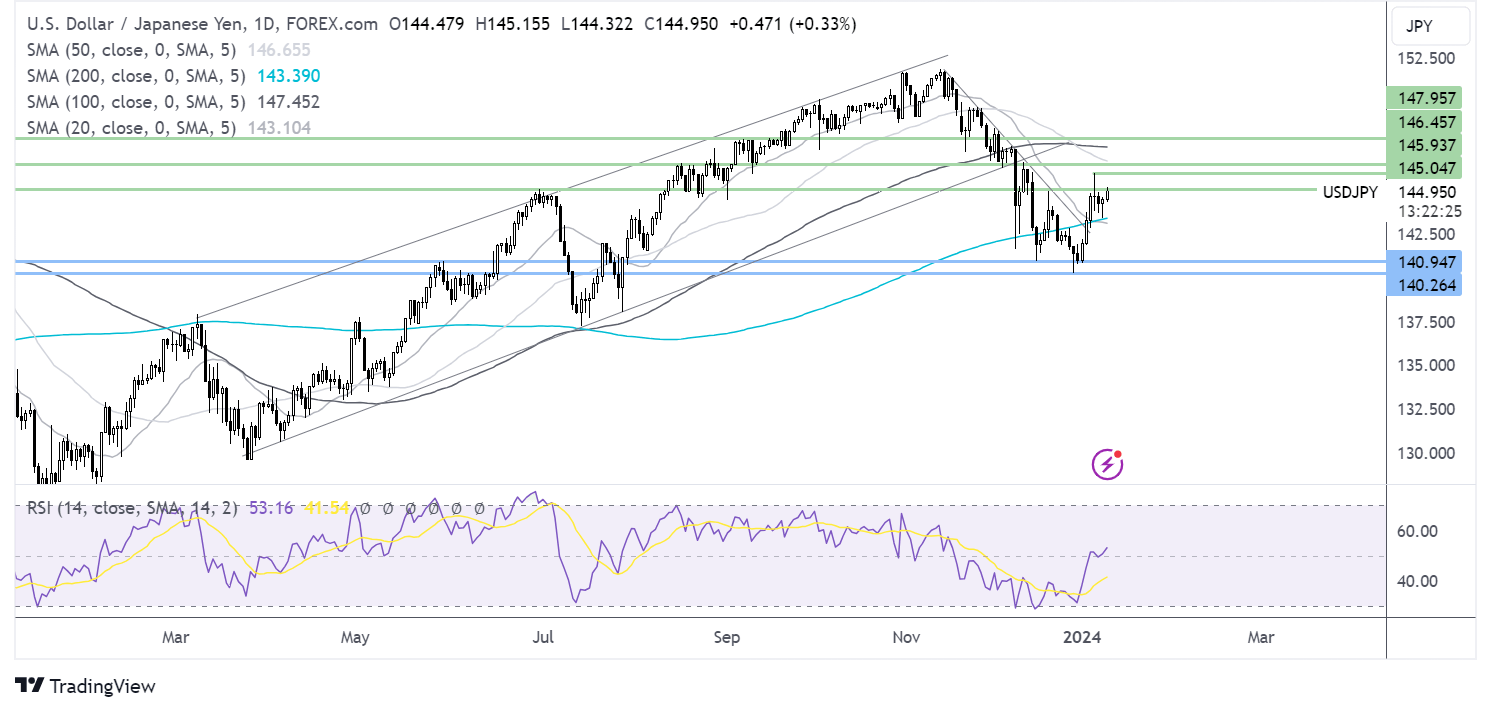

USD/JPY forecast – technical analysis

USD/JPY has extended its rebound from 140.25, rising above the 200 SMA ad tests resistance at 145.00. The RSI is above 50, keeping buyers hopeful of further gains.

A rise above 145.00 opens the door to 146.00, the January high and 146.40.

On the downside, failure to rise above 145.00 could see sellers retest the 200 SMA at 143.30.

StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information purposes only and it does not take into account your personal circumstances or objectives. This material has been prepared using the thoughts and opinions of the author and these may change. However, City Index does not plan to provide further updates to any material once published and it is not under any obligation to keep this material up to date. This material is short term in nature and may only relate to facts and circumstances existing at a specific time or day. Nothing in this material is (or should be considered to be) financial, investment, legal, tax or other advice and no reliance should be placed on it.

No opinion given in this material constitutes a recommendation by City Index or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although City Index is not specifically prevented from dealing before providing this material, City Index does not seek to take advantage of the material prior to its dissemination. This material is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For further details see our full non-independent research disclaimer and quarterly summary.