GBP/USD rises ahead of tomorrow’s Autumn budget. USD/JPY falls ahead of FOMC minutes.

By : Fiona Cincotta, Senior Market Analyst

GBP/USD rises ahead of tomorrow’s budget

- UK borrowing not as high as feared

- UK Autumn Statement is tomorrow

- GBP/USD rises above 200 sma

GBP/USD is trading at a two-month high on USD weakness, and attention is turning to tomorrow’s budget. UK government borrowing is running 15% below forecasts, paving the way for Chancellor Jeremy Hunt to potentially announce potential giveaways in his autumn statement.

The budget deficit in the first seven months of the current fiscal year was £98.3 billion, £21.9 billion above the same period last year but £16.9 billion less than the OBR forecast in March. The shortfall in October was £14.9 billion.

The Treasury is enjoying a boom in tax receipts thanks to high inflation boosting wages, company profits, and VAT.

The Autumn Statement

Attention will now move to tomorrow’s autumn budget. The Chancellor should be investing as a way to boost the economy without immediate inflationary impact, yet Jeremy Hunt is under pressure to cut taxes in order to give the Conservatives a lift ahead of the election next year.

His problem is that inflation is still double the Bank of England’s target, and meaningful tax cuts would add inflationary pressure to the UK economy.

The temptation is clear as the conservative party will look to try to regain its reputation as the low-tax party, as UK tax revenues as a percentage of national income have risen to the highest level in almost seven decades at a time when voters are struggling with the cost of living crisis. As a result, households are likely to support a party that gives them the most money in their pockets.

However, tax cuts come with plenty of risks, as we saw when Liz Truss’ mini budget just over a year ago. Inflationary moves, when the economy is stagnant and inflation high, could harm both the economy and the markets.

There are suggestions that Hunt could cut inheritance tax and extend the full expensing scheme, allowing businesses to claim back 25p for every £1 of investment. Hunt is also reportedly weighing up income tax and national insurance cuts for lower and middle earners.

The pound is also finding support from comments from Bank of England governor Andrew Bailey, who pushed back on market views that rates will be cut early next year and said that interest rates might need to rise again should food and energy costs remain an upside risk. He added that central bank policymakers are watching for signs of persistent inflation. His comments come after inflation cooled to 4.6% in October.

Looking ahead, the FOMC minutes could influence the pair.

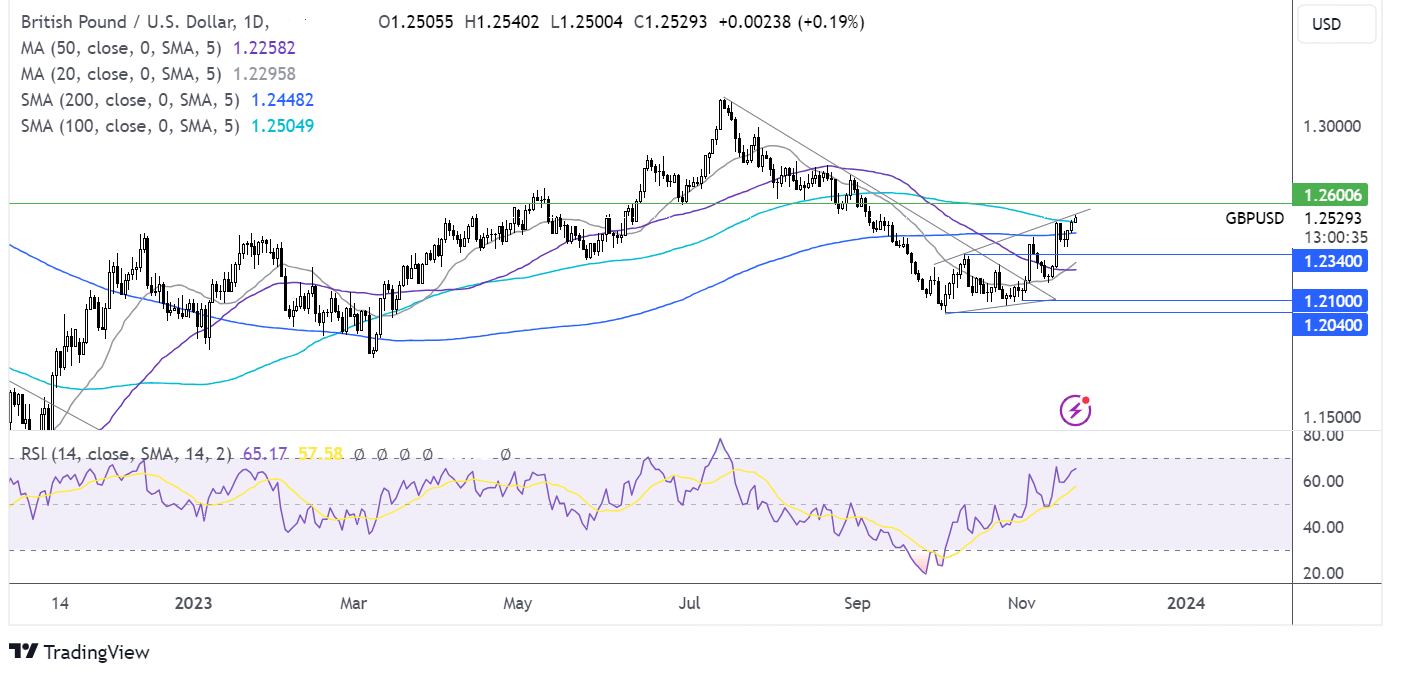

GBP/USD forecast – technical analysis

GBP/USD has risen above the 200SMA in a bullish move and is testing the rising trendline resistance at 1.2520. A rise above here opens the door to further gains towards 1.26.

Support can be seen at the 200 sma at 1.2440. Below here 1.2340 the October high comes into play.

USD/JPY falls ahead of FOMC minutes

- USD falls on bets that the Fed won’t hike further

- FOMC minutes will give more insight into Fed discussions

- USDJPY tests support 147.20 the October low

USD/JPY has fallen to a seven-week low below 147.50 on USD weakness amid expectations that the Federal Reserve is done with interest rate hikes.

Today’s focus is on the minutes from the Federal Reserve’s November meeting for further insight into policymakers’ discussions when deciding whether to raise interest rates again this year.

Traders have priced in expectations that the Fed will keep interest rates unchanged in December and are even starting to price in rate cuts as soon as March, according to the CME 's Fed Watch tool.

These expectations came after a series of weaker-than-expected data last week, including inflation, which cooled to 3.2% YoY in October, and signs of a weakening jobs market.

However, the Fed has stuck to the script that interest rates need to stay high for longer in order to tame inflation.

Treasury yields are trading lower after solid bidding for $16-billion sale of 20 treasury bonds. The yield on the 10-year treasury note is down at 4.393%.

Meanwhile, the stronger yen means that the market no longer fears intervention by Japanese authorities to support the currency.

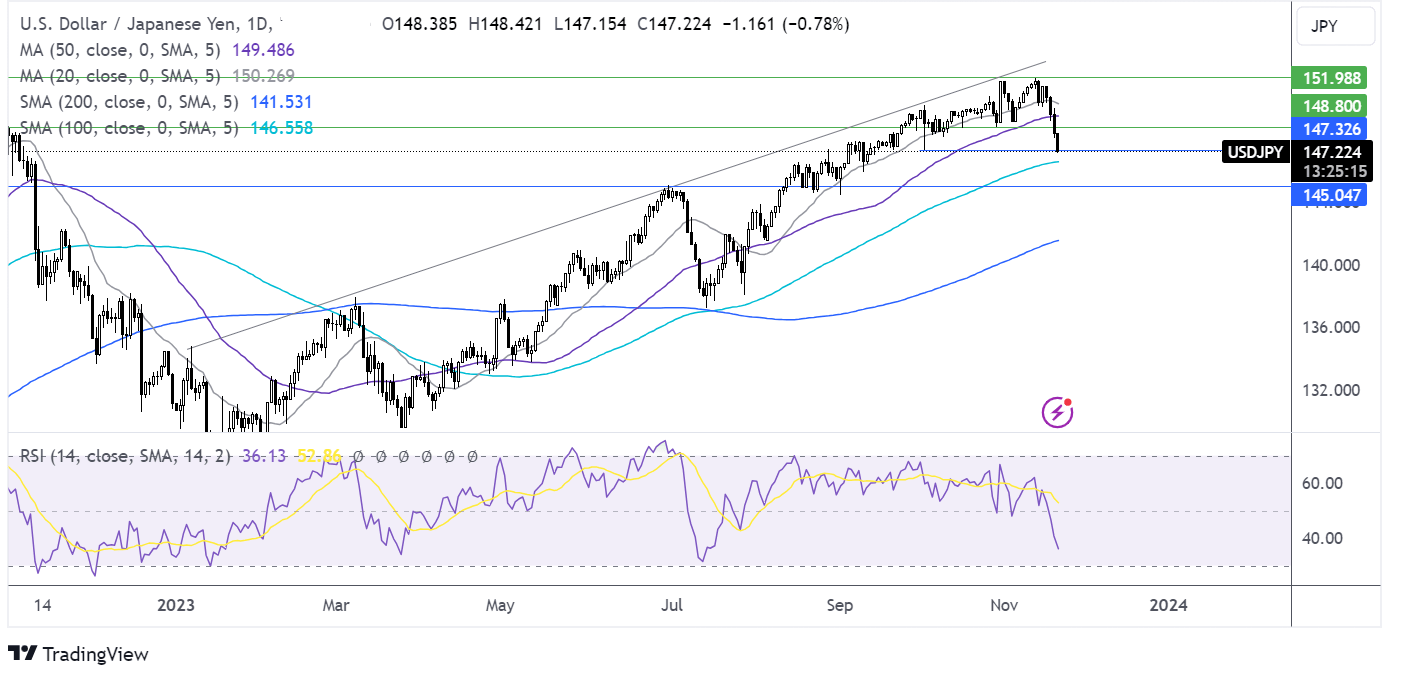

USD/JPY forecast – technical analysis

USD/JPY has fallen sharply in recent sessions, breaking below the 50 SMA and the November low of 149.20 and is testing support at 147.30, the October low. The RSI supports further losses.

Sellers need to break below 147.30 to expose the 100 sma at 146.55, ahead of 145.00 the June high.

Any recovery needs to rise above 149.20 and the 50 sma at 149.50 to negate the near trm downtrend and target the 20 sma at 150.30.

StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information purposes only and it does not take into account your personal circumstances or objectives. This material has been prepared using the thoughts and opinions of the author and these may change. However, City Index does not plan to provide further updates to any material once published and it is not under any obligation to keep this material up to date. This material is short term in nature and may only relate to facts and circumstances existing at a specific time or day. Nothing in this material is (or should be considered to be) financial, investment, legal, tax or other advice and no reliance should be placed on it.

No opinion given in this material constitutes a recommendation by City Index or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although City Index is not specifically prevented from dealing before providing this material, City Index does not seek to take advantage of the material prior to its dissemination. This material is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For further details see our full non-independent research disclaimer and quarterly summary.