Buy GBPUSD at current price - 1.26813 TP : 100 PIPS lOSS : 100 PIPS

I’d have better luck flipping a coin and landing 50/50.

That’s basically what you’re posting here.

You’ll need to add more than just signals. They’ve been removing posts with just signals since you’re not really learning anything.

Not a good week for GBP trades. we have a general election tomorrow. Unless you are a gambler, or you trade the news, which I do not.

by now, you should have seen the reality

by now, you should have seen who is right or wrong between you and I

We are both right. I choose not to trade the news, so I am right in staying out of GBP trades today.

You are right because you chose to participate in the market today (whether real participation or paper trade).

When you get to realize this is not a competition between you and me, you will learn something valuable. ![]()

In the first instance, you don’t have good technical trading expertise. That’s strong enough for you to acknowledge that you’re wrong with your assertions. Man ! if you must trade, learn the technicals

Sell GBPUSD at the current market price - 1.29696. or 1.29600

Take Profit : 150 pips / 200pips

Stop loss : 150 pips / 200 pips

These might be good trades for me to take. Maybe for others too. But I must ask what is the reason for these signals now, today. Why not Wednesday? Or next Wednesday?

Because the technicals informed the trades

What’s the purpose of posting them as “trading signals” with no discussion at all of the technicals that informed the trades?

How does it help you to post them here, with no discussion?

Why would it interest forum members, on that basis?

I know already that your focus is on technical analysis to identify trades. But TA covers a lot of territory.

There will be multiple methodologies available to highlight the timing and direction of the entries you have posted. But it’s more interesting to understand what methodology you yourself used on this occasion.

I hope you can trust the signals now.

I believe you can trust the signal now

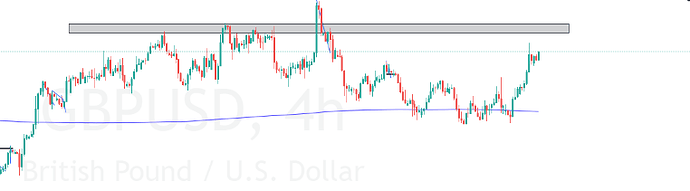

This chart shows an upward trend with an ascending trendline providing support. It also features horizontal resistance and support levels indicating a potential trading range.

Analysis

Trend Continuation:

- The overall trend is upward, supported by the ascending trendline.

- Price is currently above the trendline and approaching the horizontal support level.

- If the price continues to respect the trendline and bounces off the support level, it suggests the possibility of trend continuation.

Reversal Sign:

- The price action near the resistance level shows multiple rejections, indicating strong selling pressure at that level.

- If the price breaks below the ascending trendline and the horizontal support level, it could indicate a potential trend reversal.

Key Levels to Watch

- Support Levels: Near 1.7750 (horizontal support and trendline intersection).

- Resistance Levels: Near 1.7850 (horizontal resistance).

Conclusion

For Trend Continuation: Watch for a bounce off the ascending trendline and horizontal support level, with a potential move back toward the resistance level around 1.7850.

For Reversal: A break below the ascending trendline and horizontal support level around 1.7750 could indicate a potential reversal, suggesting a move lower.

The next few candlesticks and their interaction with these key levels will provide more clues on the likely direction.