Fed–ECB Divergence & Shutdown Risks Mix Markets (09.30.2025)

The euro slipped below $1.1720 in late September, pressured by diverging monetary outlooks as the Fed is expected to deliver more rate cuts while the ECB holds steady.

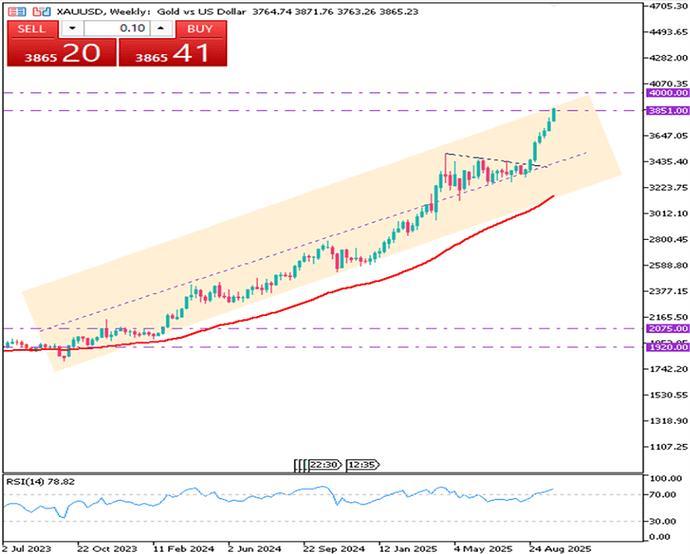

Record Gold Rally as Shutdown Worries

Gold surged to a record $3,870 per ounce on Tuesday, its strongest monthly gain in 14 years, as investors sought safety amid worries of the U.S. government shutdown risks and expectations of further Fed cuts. Talks between President Trump and congressional leaders on Monday failed to secure short-term funding, raising the likelihood of a shutdown when current funding expires at midnight Tuesday.

From a technical perspective, support is around 3800 and resistance is at 3875.

| R1: 3875 | S1: 3800 |

|---|---|

| R2: 3910 | S2: 3760 |

| R3: 4000 | S3: 3700 |

Oil Slips, Tech Stocks Advance

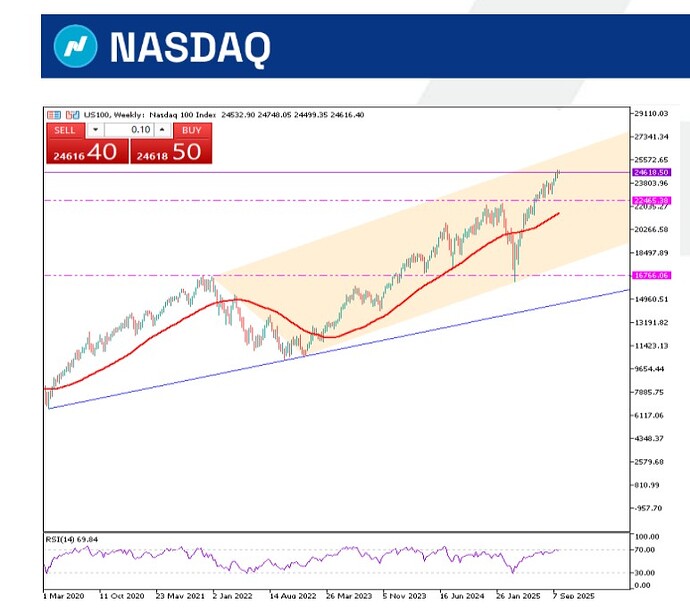

Equities showed slight improvement, with the U.S. 100 Tech Index up 108 points at 24,611, sustaining its upward trend despite recent volatility

Global markets delivered a mixed performance on Tuesday as participants weighed central bank signals and fresh economic data.

The Nasdaq ended the session at 24,611, up 108 points (0.44%). The index has risen nearly 6% over the past month and more than 24% over the past year. Trading Economics’ models and analyst outlooks place it around 24,477 by quarter-end and 24,396 over the next twelve months.

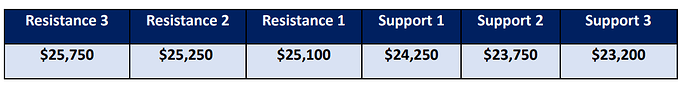

The index is challenging resistance at 25,100, with support established near 24,250.