Market Summary:

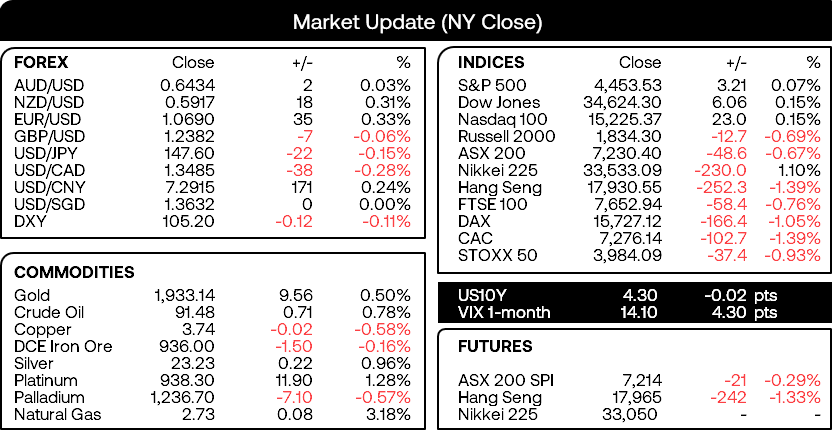

- There was a bit of excitement (and likely fear) in yesterday’s Asian session when the US 2-year bond experienced a mini flash crash, sending the yield up ~40bp during low liquidity trade, although the move was quickly put down to a technical glitch.

- It was a little less exciting for currency markets with all FX majors trading within their average true ranges (ATRs), although the Canadian dollar was given a boost following stronger-than-expected housing data and industrial prices. Canada releases a key inflation report later today which could sway markets into pricing in another Bank of Canada (BOC) hike.

- USD/CAD fell to a 25-day low and achieved 94% of its 10-day ATR, before finding support at its 50-day EMA.

- The British pound continued to decline on speculation the BOE may even pause (if not announce one) at this week’s meeting. GBP/CAD closed beneath its 200-day EMA for the first time in three months

- It was also quiet on Wall Street, with the Nasdaq 100 and S&P 500 both gapping lower on to their 50-day EMAs before closing the gap and posting a minor gains on the day

- And we could find markets continue to chop around on reduced volumes without a clear catalyst, with the Wednesday’s FOMC meeting and Thursday’s BOE meeting in the pipeline

- USD/JPY traded within a tight range beneath its 9-month highs and 148 handle. Perhaps we’ll see volatility increase with Japan’s traders returning to their desks after a 3-day weekend, but with the FOMC meeting looming it feels like a coin flip as to whether prices will pull back or break above 148 ahead of it

Events in focus (AEDT):

- 11:30 – RBA minutes: I’m not expecting anything profound from today’s minutes, as data has backed up the RBA’s decision to hold rates at 4.1% fore the foreseeable futures and it was Governor Lowe’s last meeting at the helm.

- 19:00 – European CPI

- 22:30 – US building permits

- 23:30 – Canada’s CPI: With data coming in hotter than the BOC would like, today’s inflation report has the potential to sway market opinion towards another hike if CPI continues to misbehave around elevated levels. Yes inflation has peaked, but its not slowing as quickly as the BOC would like, and with US CPI and inflation inputs for Canada turning higher, it leaves the potential for an upside surprise in today’s figures.

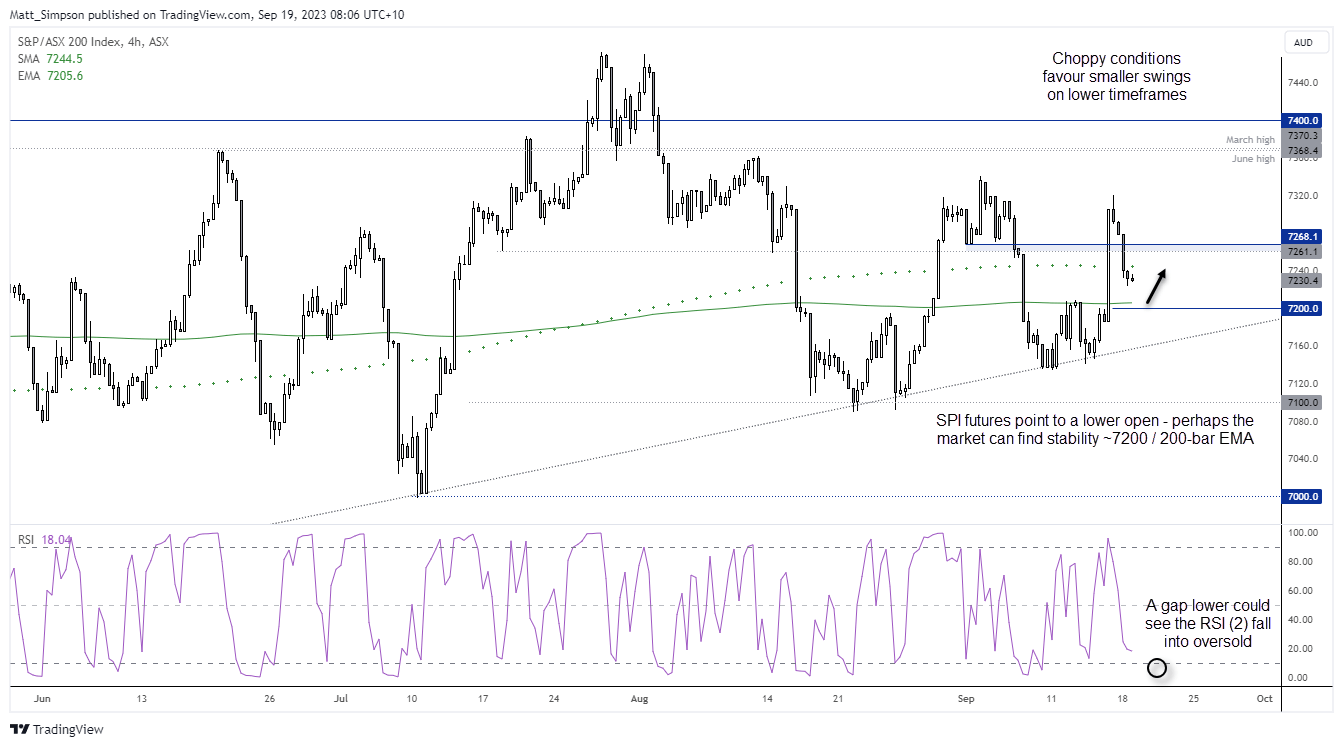

ASX 200 at a glance:

- The ASX 200 retracted around half of Friday’s gains to quickly remind traders of its choppy nature price action seems to exhibit each time it trades above 7300

- For that reason, I would prefer to stick with intraday timeframes to seek opportunities and not expect large sustained price swings to develop on the daily chart

- With SPI futures pointing to a weaker open, perhaps the ASX 200 can find some support around or even above the 7200 handle, near its 200-day EMA

- A gap lower could even see the 4-hour RSI reach overbought to hint at a swing low, in which case we could consider a cheeky swing trade long for a move back up to its 200-day MA (dotted) around 7240

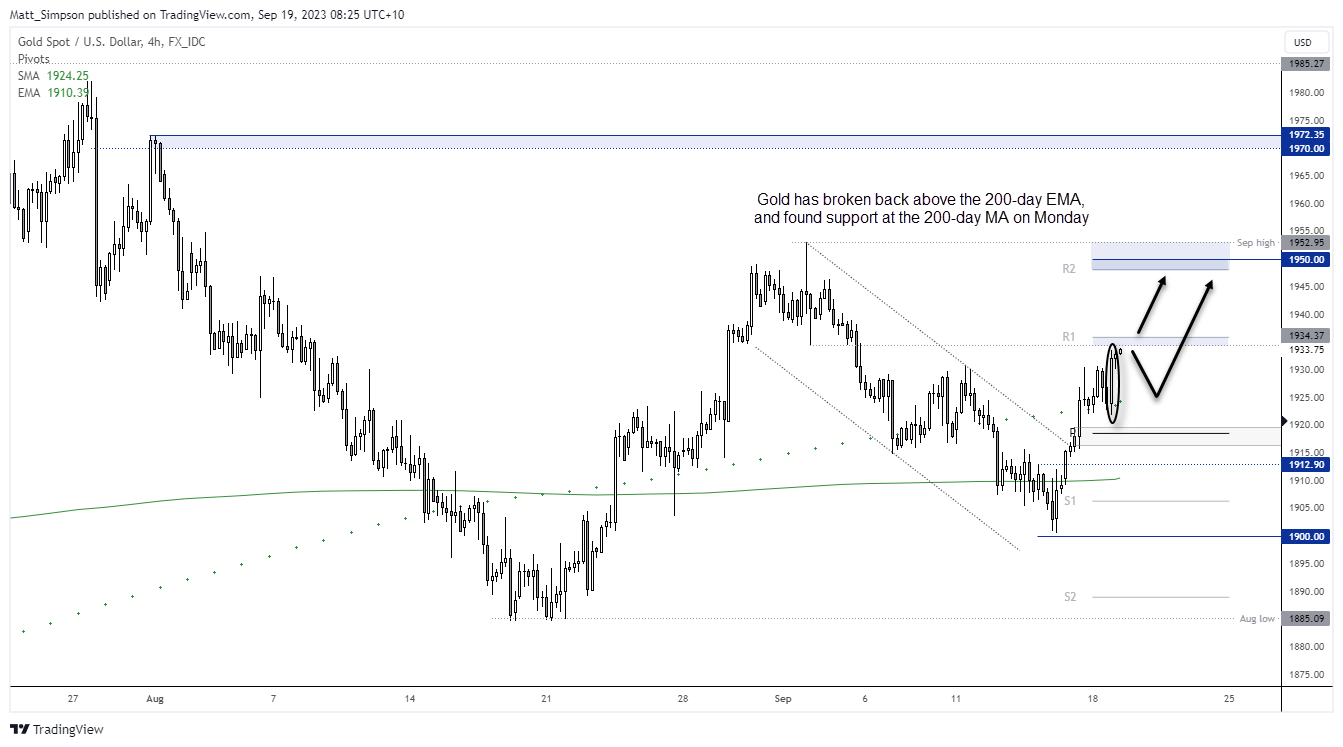

Gold technical analysis (4-hour chart):

Yesterday I was looking for a pullback towards the 1916-1920 area near the weekly pivot, although the pullback was minimal due to a helping hand from the 200-day MA. Given the significance of the level, I am now wondering if we’ll see prices continue to move higher heading into the FOMC meeting. Especially since we have now seen gold break back above the 200-day EMA as well.

A bullish engulfing candle formed on the gold 4-hour chart, so any retracement within it could improve the potential reward to risk ratio for a move above the weekly R1 pivot, towards R2 / 1950.