- Gold delivered strong gains in October (its third best month this year)

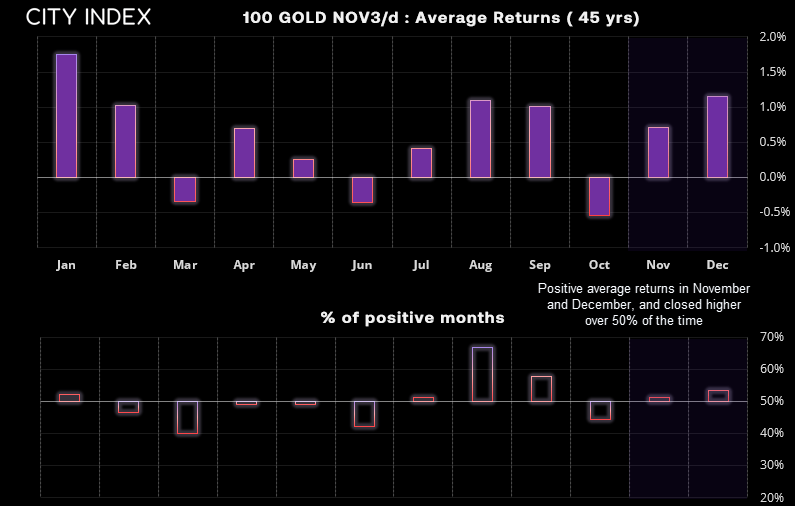

- Seasonality is on gold’s side for November and December, and is now within striking distance of its record high

- But a record high may not be a slam dunk, given the $2075 area has triggered three multi-month retracements since 2020

- Momentum is turning lower for gold on the daily chart, and shows the potential for a move to at least the $2050 area

Gold enjoyed its best month in seven in October, with its 7.3% rise forming a clear bullish engulfing candle and was its third best month of the year. Whether it can extend its rally and make a run for a new record high remains to be seen, but we have seen gold failed around the $2075 highs three times since 2020. What would be so different this time?

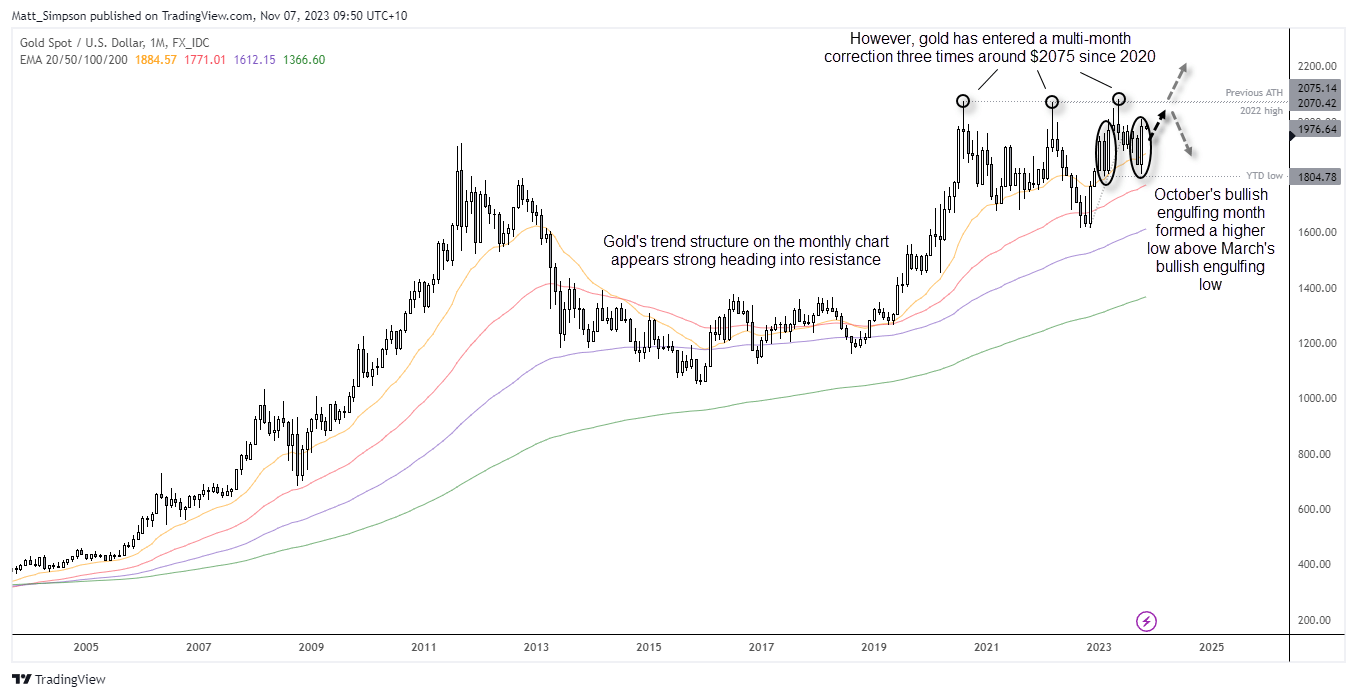

Gold technical analysis (monthly chart):

Well, we could argue that the structure on the monthly chart appears to be more bullish. October’s bullish engulfing low held above the bullish engulfing candle formed in March (a higher low) and momentum is now accelerating into resistance. Seasonality is also on its side, with November and December posting average positive gains over the past 45 years, slightly more than 50% of the time.

Yet the significance of these highs cannot be understated, given each rally to the $2075 area resulted with a multi-month retracement. But for gold to stand any chance of breaking sustainably above the previous high, we’d need to see the US dollar and yields move sharply lower. And that may require a refreshingly dovish Fed to be driven by another round of weaker US employment figures. It certainly is not impossible, but unless US data comes in weaker on aggregate then it seems plausible the Fed may want to push back against dovish market pricing, if inflation remains elevated.

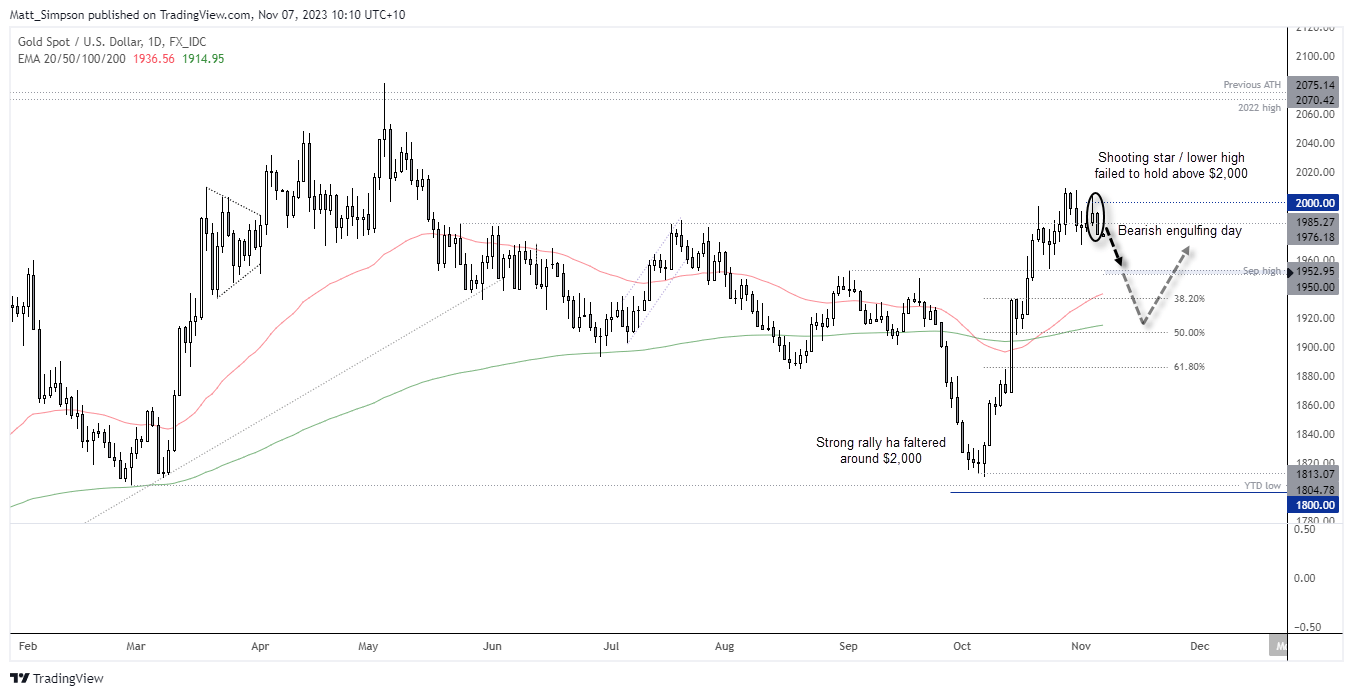

Gold technical analysis (daily chart)

Whilst we wait to see if gold can make a break for a new record high, I suspect gold is due a retracement lower on the daily chart. Gold prices surged nearly 11% over 15 days, and whilst it achieved a daily and weekly close above $2000, prices have since eased and momentum is trying to turn lower. A shooting star candle formed on Friday after failing to hold above $2000, which itself was a lower high and followed by yesterday’s bearish engulfing day.

A move towards the September high / 1950 handle seems plausible from a technical perspective, at which point I’d want to reassess its potential to form a swing low. But even a pullback to $1950 is quite shallow relative to its preceding move, meaning the 50 and 200-day EMAs come into focus (near the 38.2% and 50% retracement levels) should prices break beneath $1950.

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.