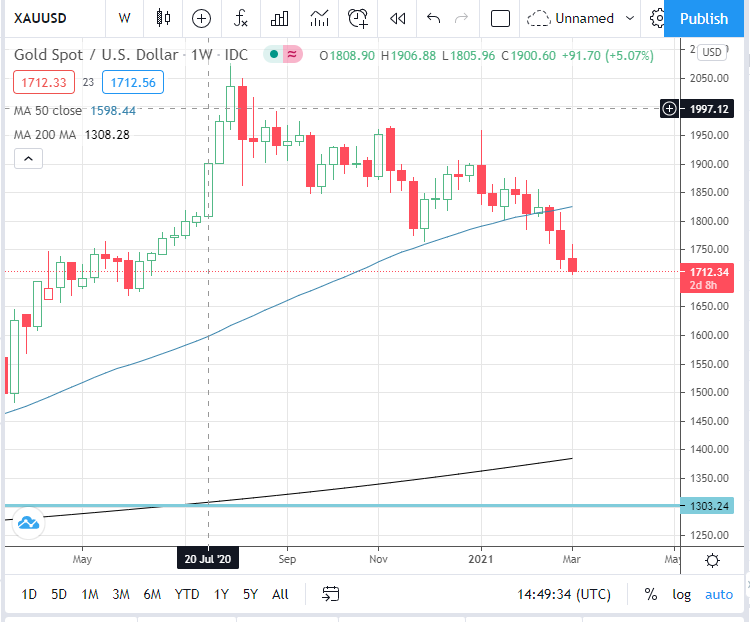

After hitting an all-time high Gold has been in a 6-month correction, that correction could be that handle for the mother of all bullish Cup w/Handles. This pattern has been forming for over a decade. If you own gold, don’t let the correction force you out, if you don’t own, now might be time to buy

2 Likes

Where’s the handle? IMO, you’re seeing what you want to see- not what is actually there.

In my post I said

The handle is in the early stage, the cup is undeniable, so I am not sure what you are looking at to draw that conclusion, and looking at your posting history you seem to be posting to a lot of topics with a very low number of likes. I think that says it all

1 Like

Trying to understand your thought pattern / how you trade. I can pull up any instrument (FX, equity, future, crypto) and apply tech analysis that “could” eventually play out. What I see is a double top and $185-ish handily defended.

One can argue that the chart is showing 20 different patterns in “the early stage”. The conclusion is- What value / benefit does the community attain through analysis of something that hasn’t even come to fruition yet? How much energy/time/emotions are wasted on analysis of instruments to fit a narrative? If the price action has not printed the pattern, then there is no signal and I’d argue you’re wasting your time sitting around waiting for something to happen.

Popcorn anyone. Love it Jake

1 Like

Technical Analysis 101, Recognizing patterns in their early stages allows the Trader to do his research and be ready if the pattern plays out, we clearly have a cup and the beginnings of a handle, this is undeniable. What we don’t know yet is will the pattern play out. The entry point for a trade would be breaking above the the white line at around 187, I have found that taking a small position early keeps you focused on the trade and you are less likely to forget about it.

As far as a double top, you are correct, there is also a double top in play and had you shorted at 187 you would be looking at a nice profit, Your double top just happens to be a shorter term element of my Cup w/Handle,

This Gold play could still take months to playout and I will be watching and up dating

1 Like

First chapter of my Tech Analysis 101 book says “Don’t trade what you don’t see”

This is a unique way to stay engaged- I don’t think it’s a bad idea.

Exactly- no one knows. I’d say that this correction has gained steam as of late, and a break beneath 165 is going to take out some stops. From there, things can be a bit dicey in terms of support.

But hey, this back and forth is what makes a market! Markets move in two directions.

-Jake

1 Like

Even I was thinking about the same, I am waiting for a bit more fluctuation and than to purchase gold.

1 Like

Did you enter this trade?

Gold will run when real yields turn south and head negative; watch the bond market. For the time being the 10y yield is signaling inflation expectation. I prefer silver, personally I’m looking for lows in the gold miners for investment purposes (1 to 3 year holds).

1 Like

In the short term holding Gold is going to be a bit painful as the bears keep pushing price lower, and I agree silver might give us a better return once this price correction is over

Thanks for that update—the coffee mug appears to be breaking.

We have the making of a bullish engulfing candle, could this mark the end to this correction in gold price, or is it just more false hope

Hey Dennis, just for awareness-- that is not a valid engulfing (reversal) pattern. Bar 1 must be completely engulfed (thus the name) by bar 2. There is a wick sticking out and down beyond the low of Bar 2.

If anything (if the candle were to print right now), it’d technically be a valid 2 bar reversal.

Respectfully,

Jake

1 Like

technically you are correct, and I do not see this on its own a strong reversal signal, we need some follow through and something on the Weekly chart, then I will be feeling good about it, until then the market maybe just playing with us,

time will tell

We’ll I had a lot of respect for Dennis3450 before this thread. Guess he’s on the books now like Mario was!

I pity the fool with so little patients, this pattern has been 10+ years in the making and you want to call it quits after less than a month. It might be another year or two before this plays out

Its like making a call that water will run down hill cobber.

You’re call

my call (which the BP gods edited) 50 cent army