Gold just posted its highest monthly close on record, and now trades less than $40 from its record high set in May. With seasonality on its side, I suspect another crack at the record high could be in order. Although it does run the risk of a shakeout around the milestone level.

By :Matt Simpson, Market Analyst

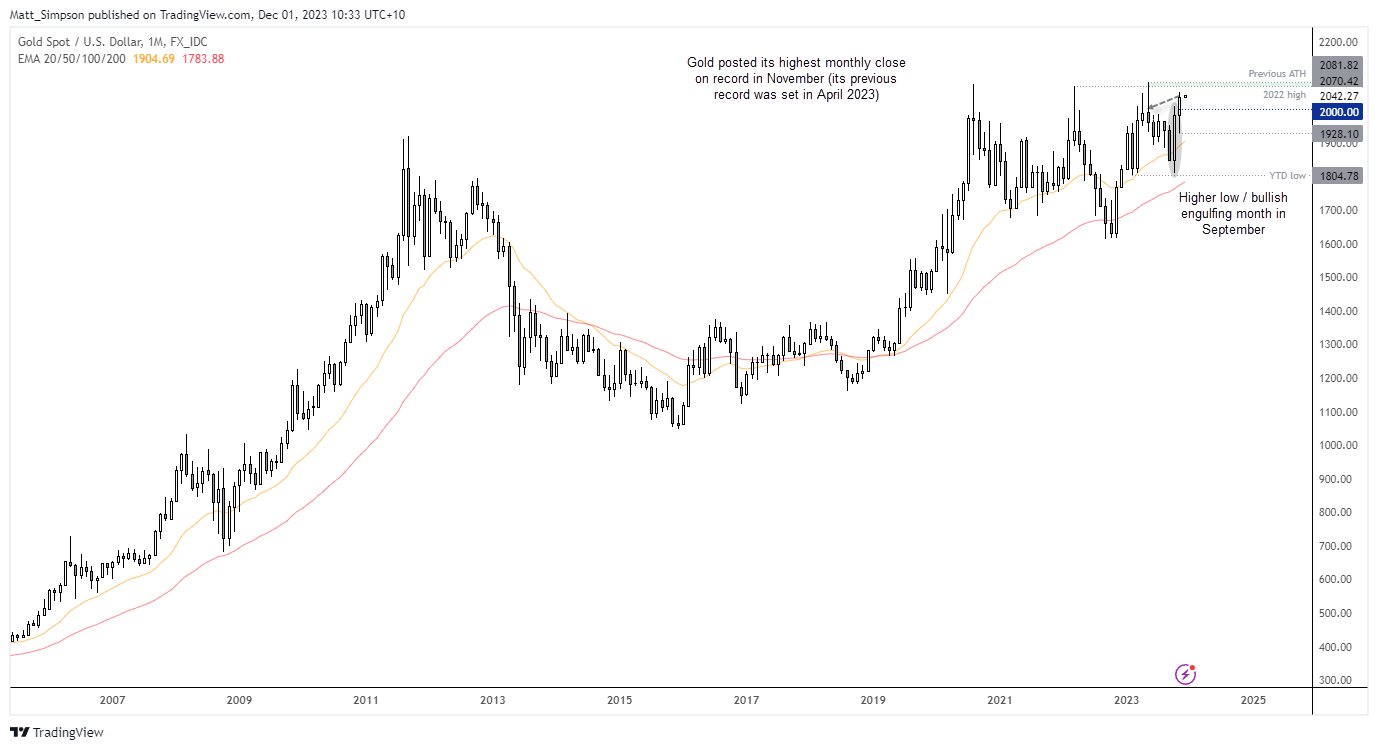

Gold monthly chart:

The monthly chart shows that gold posted its highest close on record, which was last set in April. It now trades less than $40 from its ‘intra-month’ record high, and the trend structure alongside favourable seasonality could see gold bulls try and conquer that milestone level.

A bullish engulfing month formed in September which is also a prominent swing low, which to me suggests we could see an eventual breakout above $2082. However, that is not to say it will simply slice through the record high like a hot knife through butter, and I would be surprised if we don’t see a volatile shakeout around the highs before the trend continues.

Either way, the bias remains cautiously bullish over the near term with the view then seek dips at lower support levels, on the assumption that gold will eventually break to a new record high.

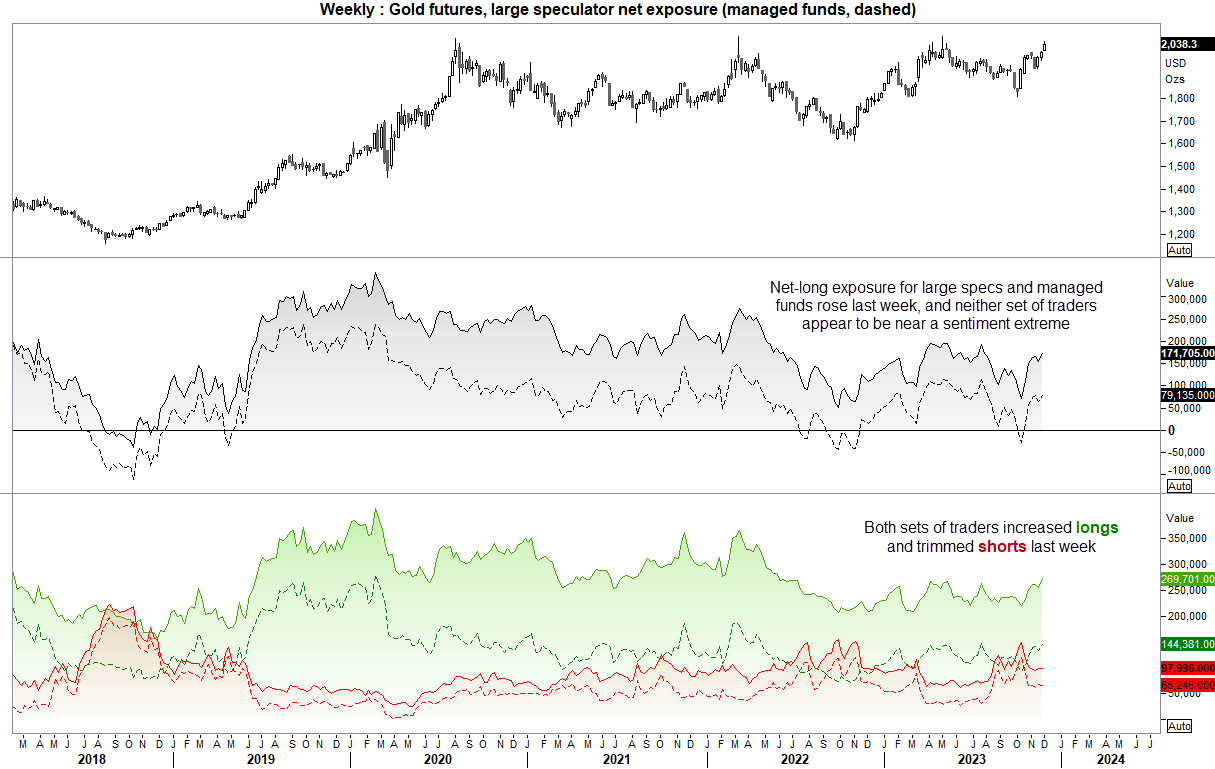

Gold positioning from the weekly COT report:

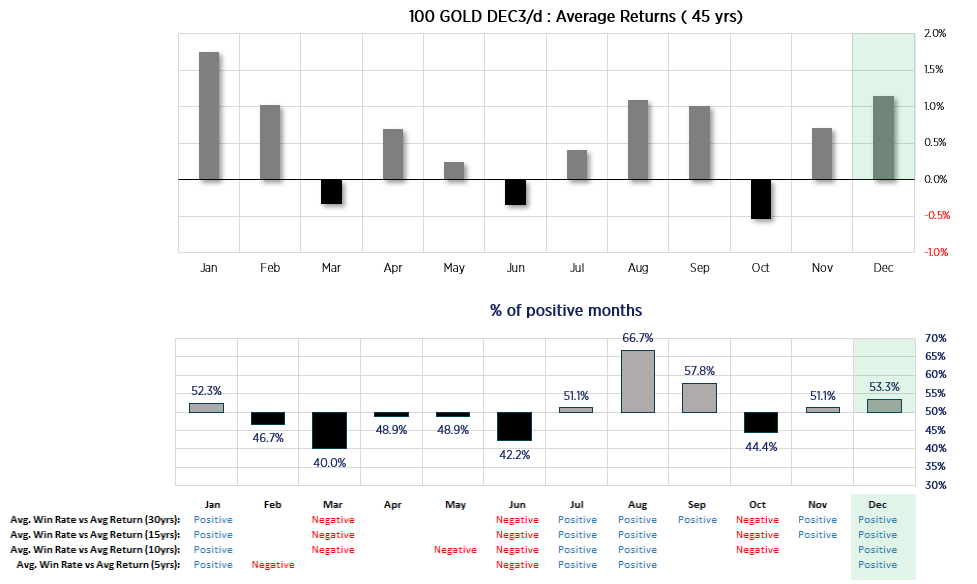

Historically, Gold has generally performed well between November and February. Demand for Jewellery in Asia tends to be a key driver, alongside the seasonal pattern of a weaker US dollar. Of that period, January tends to post the largest returns, with December coming in second place with an average return of 1.15% and a ‘win rate’ of 53.3%.

With traders convinced that the Fed are set to cut rates in 2024, we may be in for another bullish month on gold. However, the fact it is so close to its record high – a level which could spur profit taking and a shakeout – may leave its upside potential limited until the anticipated breakout eventually occurs.

December is generally positive for gold price:

Historically, Gold has generally performed well between November and February. Demand for Jewellery in Asia tends to be a key driver, alongside the seasonal pattern of a weaker US dollar. Of that period, January tends to post the largest returns, with December coming in second place with an average return of 1.15% and a ‘win rate’ of 53.3%.

With traders convinced that the Fed are set to cut rates in 2024, we may be in for another bullish month on gold. However, the fact it is so close to its record high – a level which could spur profit taking and a shakeout – may leave its upside potential limited until the anticipated breakout eventually occurs.

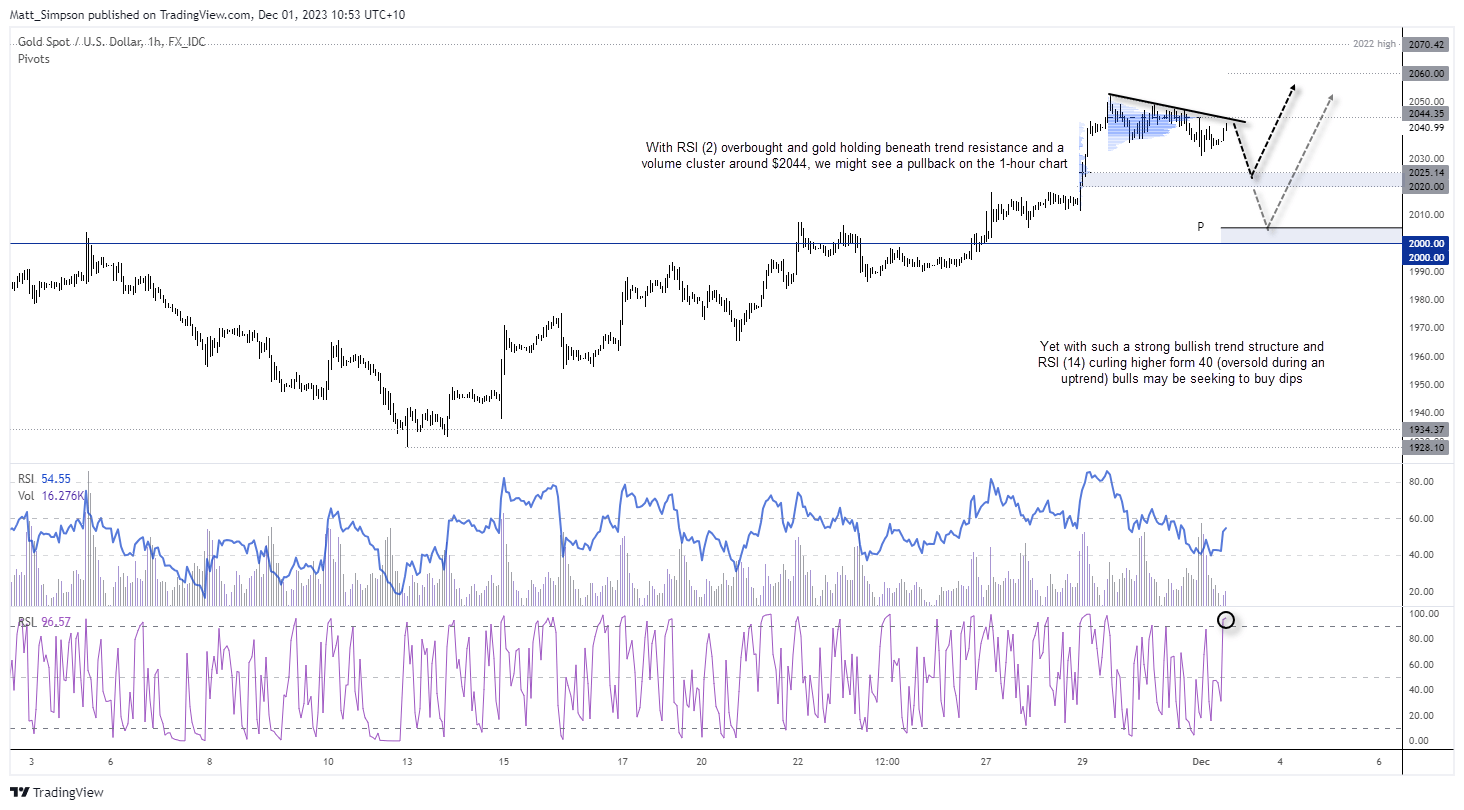

Gold technical analysis (1-hour chart)

A strong bullish trend is more than apparent on gold’s one-hour chart. However, we may need to factor in ‘month end flows’ for the recent leg high, and I’ll admit to being a tad suspicious of the early move higher in today’s Asian session.

And with RSI (2) being overbought whilst prices remain beneath a HVN (high volume node) around $2044 and trend resistance, I suspect a pullback could be due on this timeframe as the hype of gold’s December rally recedes.

However, as we’re seeing rising volumes during rallies and cycle lows, and RSI (14) has curled higher from 40 (which can be oversold during an uptrend), I will be keeping an eye out for a suitable long at a lower level.

Note the HVN around $2025 which may provide potential support / swing low. Bulls can either seek bullish setups around the $2020 - $2025 zone, or countertrend bears could seek to fade the hype and seek mean reversion towards the support zone. A break above $2050 on high volume assumes bullish continuation.

– Written by Matt Simpson

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.