Market Summary:

- An increase in labour costs is expected to see US retailers reduce hiring to lower levels not seen since 2008. 410k jobs are expected to be added, compared with 519k in Q4 2022- which itself was -26% lower than the previous year.

- US consumer confidence slipped from its 22-month high, but the bigger news is that inflation expectations continued to diminish. 1-year CPI expectations are now at the 33-month low of 2.7% and the 5-year is at a 32-month low of 3.1%.

- This helped gold prices recover back above its 200-day EMA on Friday, during its most bullish day in 13.

- Yet bond yields continued to advance and weighed on sentiment for Wall Street indices, on the prospects that the Fed will keep interest rates higher for longer

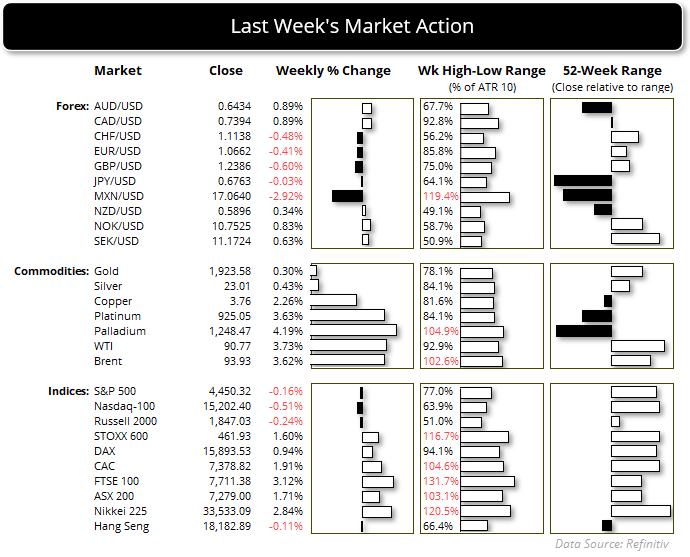

- Tech stocks led the declines on Friday with the Nasdaq 100 falling -1.75% (-0.51% for the week) and the S&P 500 was down by -1.21% (-0.16% for the week). Both indices are on track for a bearish month, in line with their seasonal patterns.

- The US dollar index posted a small inverted hammer on Friday just beneath 105.50 and trades ~0.5% beneath it YTD high, yet still managed to rise for a 9th consecutive week, which is its most bullish sequence since September 2014

- The Nikkei 225 rose to a 10-week high on Friday ahead of the long weekend in Japan. It now trades just -0.74% from a 33-year high.

- Oil prices rose for a third week with WTI crude oil closing the week above $90 for the first time this year, which itself raises concerns that inflation will remain high and force the Fed to maintain higher rates for longer

- Bets that the BOE may hike for their last time this cycle this week continued to weigh on the British pound, sending GBP/USD to a 3.5-month low and closing beneath its 200-day EMA and 200-day average last week

- AUD/USD rose nearly 2% last week, which was its best week in two months and USD/CAD suffered its worst week in 15 as rising oil prices continued to support the Canadian dollar.

Events in focus (AEDT):

- Public holiday in Japan

- No major economic news is scheduled for today

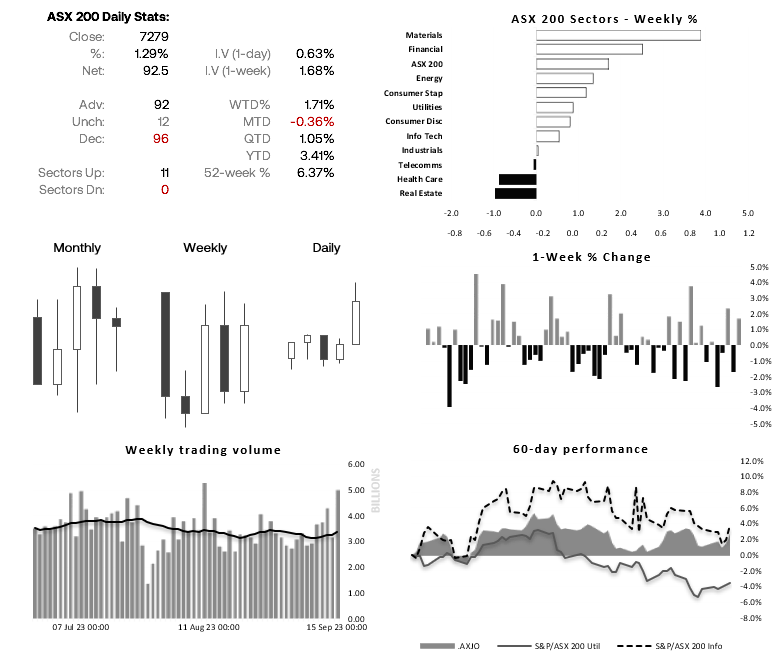

ASX 200 at a glance:

- The ASX 200 rallied for a second consecutive day on Friday and extended its run from the March 2020 trendline

- It was its most bullish day in nine weeks ad most volatile daily range in ten weeks

- However, a weak lead from Wall Street and SPI futures (which were -0.56% by Friday’s close) means the cash index is expected to open lower today

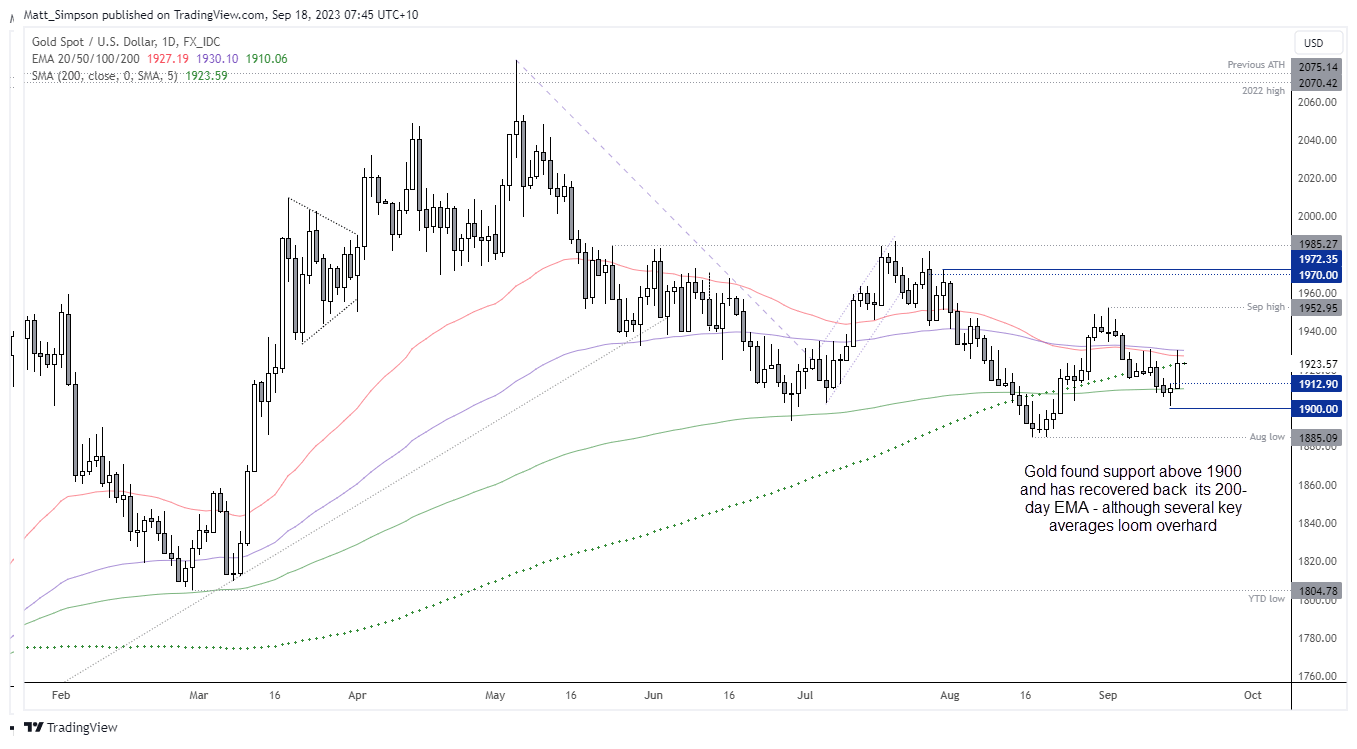

Gold technical analysis (daily chart):

I was looking for evidence of a swing low last week, and it seems Thursday was the day it happened, with a small bullish doji forming just above the 1900 level. A strong rally on Friday suggest the low is in place and prices recovered back above the 200-day EM, although it failed to hold above the 200-day MA (dotted green line), and the high of the day respected the 50 and 100-day EMA’s. Whist I suspect further gains are possible, it may be a case of patiently waiting to see if we can see a pullback to more desirable levels to help increase the potential reward to risk ratio.

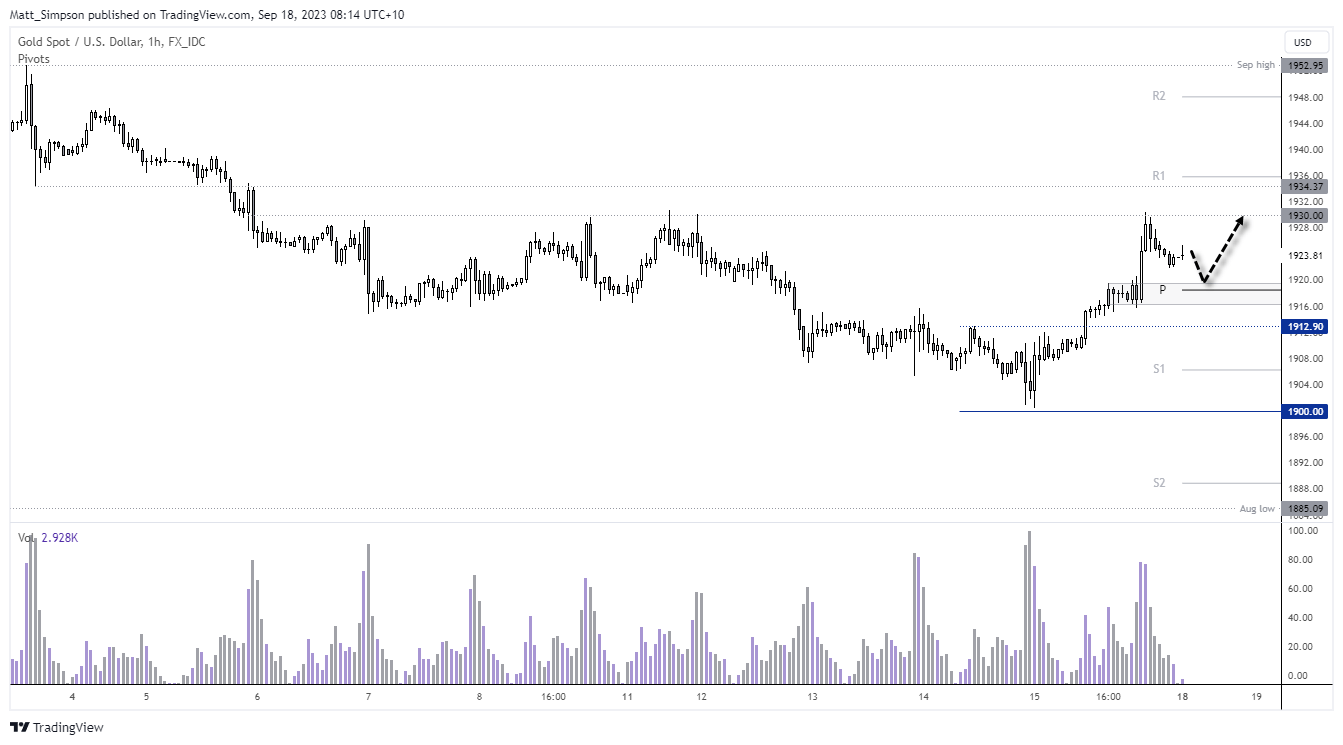

Gold technical analysis (1-hour chart):

Gold’s rally into the 1930 resistance area was accompanied with high volumes to show bulls entering the market. Volumes also diminished whilst prices pulled back from Friday’s high to suggest the move lower is corrective. The weekly pivot point sits within a consolidation zone between 1916 – 1920, so id prices continue to drift lower the 1916 – 1920 zone is an area of interest for a potential swing trade long back towards 1930. Of course, we’d need to see the US dollar and bond yields move lower before we could expect a sustained rally on gold, and as the FOMC meeting looms I suspect markets will trade in choppy ranges – which makes intraday swings more appealing for now.