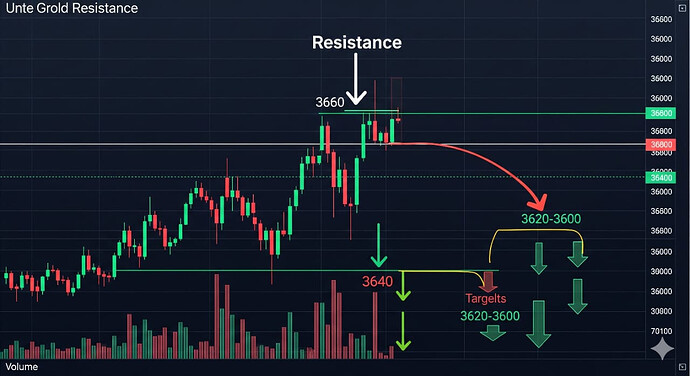

Stay cautious of another potential dip in gold today!

#Gold is testing a crucial resistance at 3660. If prices fail to sustain above this level, a drop below 3640 could open the way toward 3620–3600.

For short-term setups, I continue to favor a selling approach

For short-term setups, I continue to favor a selling approach

.

Currently running in 100 Pips profit

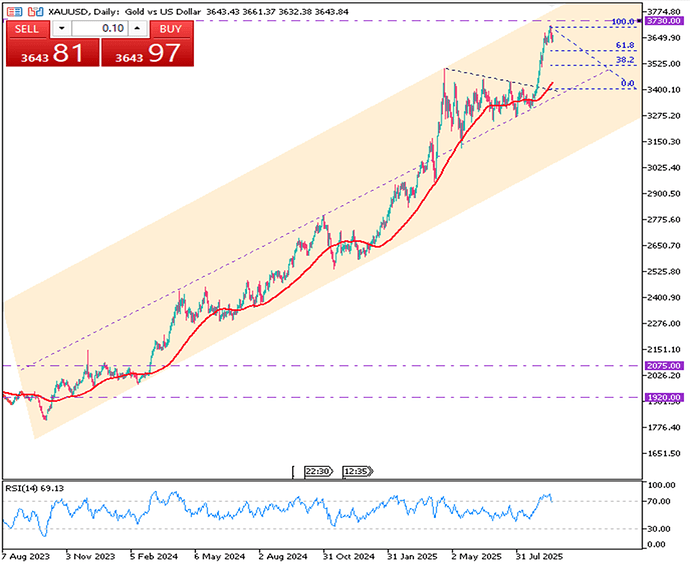

Gold Consolidates After Fed’s 25 bps Cut

Gold hovered near $3,650 per ounce on Friday, recovering after a two-day drop and pausing a four-week rally. The Fed’s first cut since December was seen as a cautious response to labor market weakness, with officials warning inflation could slow easing. Gold is up 39% this year, supported by easing expectations, geopolitical risks, central bank demand, and a surge in Swiss exports to China.

Gold is currently facing resistance around $3,700, with strong support near $3,625.

| R1: 3700 |

S1: 3625 |

| R2: 3730 |

S2: 3590 |

| R3: 3760 |

S3: 3550 |

This is the strangest chart I ever seen, the price scale makes no logical sense

Your candles also don’t match the XAUUSD London spot price feeds I get, what symbol are you looking at?

Are you also shorting this strong of a bull  ???

???

Wow, instead of being a 1st class passenger on a speeding train, you prefer to pick up pennies in front of it?

Truly different strokes for different folks, I guess.

3 Likes

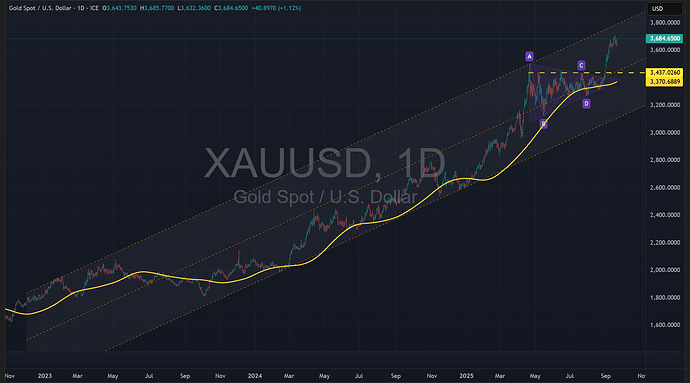

GOLD ended Friday’s session on a stronger note, recovering from a weekly low of $3579 and settling above $3680 per ounce. This marked the fifth straight week of gains as traders welcomed the Federal Reserve’s first rate cut of the year and awaited further guidance on monetary policy.

Currently, GOLD is trading near $3685. A sustained move above the crucial $3700 mark could pave the way toward $3715, $3750, and even $3800. Conversely, a drop below $3625 may trigger extended weakness, pulling prices down toward $3515.

![]() For short-term setups, I continue to favor a selling approach

For short-term setups, I continue to favor a selling approach