We are approaching milestone prices in gold and silver:

Gold (already in record price territory) is approaching $2,000 / Troy ounce, and

Silver is approaching $25 / Troy ounce (not a record).

The gold/silver ratio, which reached absurd levels around 113:1 in the Spring, has now settled back to a less-absurd 80:1. If history is a reliable guide, the gold/silver ratio should be somewhere in the 60:1 to 70:1 range.

The recent spectacular upmove in the price of silver has been powered by (1) strengthening gold prices, and (2) a narrowing G/S ratio, as silver plays catch-up.

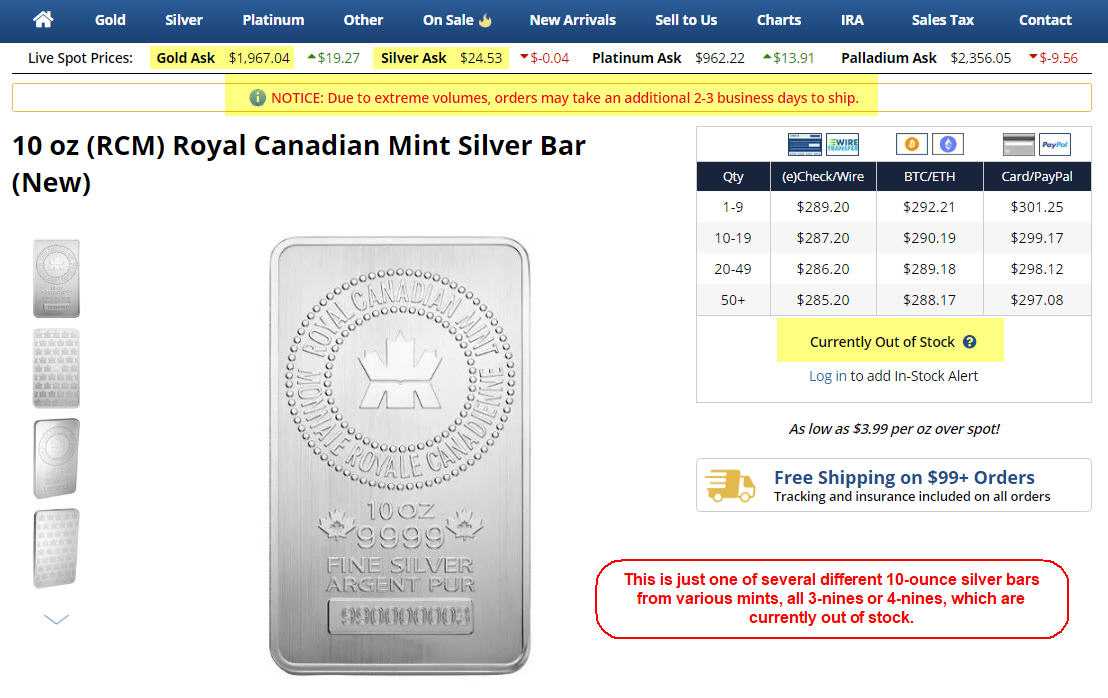

Since earlier this year, physical metals have been in short supply, or simply unavailable on the retail market. Off and on since winter, a large bullion dealer I have traded with in Dallas has listed pages and pages of out-of-stock merchandise (both gold and silver) on their website.

Here’s one example (screen-shot taken today) –

Throughout the Spring, I was stacking silver, and it was a challenge to acquire simple items like 10-ounce silver bars and fractional silver rounds.

Several fundamentals are driving precious metals prices. Helicopter money is at the top of that list.

According to Conventional Economic Theory: As the U.S. government continues to shovel cash out to individuals and businesses, in an attempt to forestall a major depression, all that helicopter money is diluting the USD money supply and setting up the preconditions for galloping inflation (and possibly hyperinflation).

Another theory, Modern Monetary Theory, argues that it’s okay for sovereign nations to create and spend as much helicopter money as needed, in order to mobilize idle resources in the economy. During this Chinese Bat-Virus Pandemic, sustaining idle workers and struggling businesses, long enough to get them up and running as the economy recovers, would appear to qualify as “mobilizing idle resources”.

According to Modern Monetary Theory: The U.S. can drop helicopter money all over the country, and still avoid all the dreadful consequences predicted by Conventional Economic Theory, provided all the excess liquidity created by the helicopter money is systematically withdrawn from the economy, after the crisis has passed. And therein lies the problem. The helicopter money is wildly popular politically. Wringing the excess liquidity out of the system later will be bitterly unpopular.

The precious metals markets are betting that the “bitter wringing” will never happen, and that the decades-long erosion in the value of the USD will continue and will accelerate. Consequently, the current weakness in the USD – and much more severe weakness anticipated in the future – account for a large part of the current strength in gold and silver prices.

Anything else you’re looking at these days?

Anything else you’re looking at these days?