Gold has maintained a strong bullish bias in recent sessions, posting a gain of more than 3.2% in just four sessions. The consistent buying pressure of recent weeks has been crucial as expectations of lower rates persist and market confidence shifts.

By : Julian Pineda, CFA, Market Analyst

Gold has maintained a strong bullish bias in recent sessions, posting a gain of more than 3.2% in just four sessions. The consistent buying pressure of recent weeks has been crucial, and as expectations of lower rates persist and market confidence shifts, the metal may continue to show strength in the sessions ahead.

Click the website link below to Check Out Our FREE “How to Trade Gold” Guide

https://www.forex.com/en-us/whitepapers/

Are Lower Rates Still Favorable?

One of the key drivers behind gold’s recent rally has been last week’s announcement by the Federal Reserve, which signaled a new phase of interest rate cuts. This measure has steadily weakened U.S. Treasury yields, considered gold’s main rival as a safe-haven asset. As capital flows out of Treasuries, demand for gold has gained momentum.

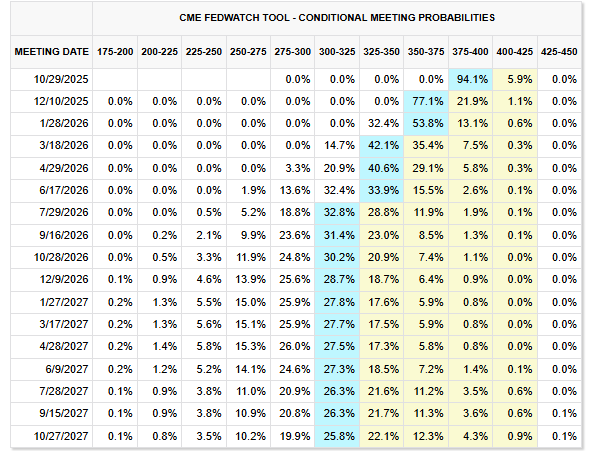

Expectations for more cuts remain intact in the short term. The CME Group shows a 94.1% probability of another 0.25% cut on October 29, and a 77.1% probability of another cut of the same size at the December 10 meeting.

Source: CMEGROUP

Although the Fed has warned that it will continue to monitor inflation closely, this has not been enough to change expectations for two additional cuts this year. If confirmed, 10-year Treasury yields could weaken further, reducing the appeal of dollar-denominated investments and driving capital toward gold.

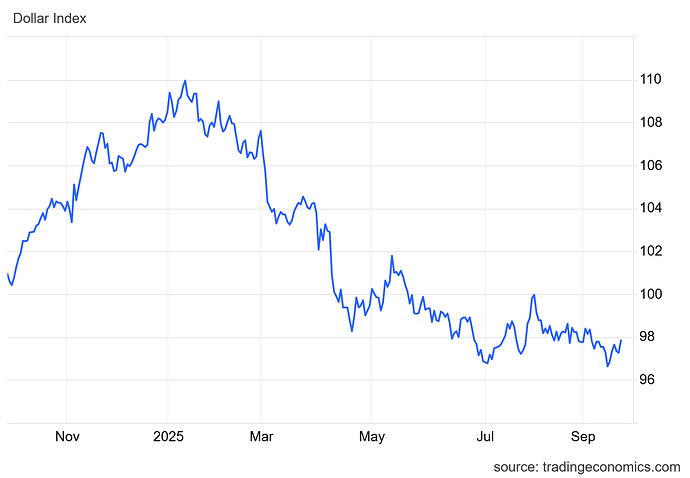

Also, the DXY index, which measures dollar strength, has attempted to recover to the 98-point zone in recent sessions, but the rebound has been insufficient to restore stability to the currency. In this environment, gold, which is priced in dollars, benefits from a weaker greenback and positions itself as an attractive alternative for international capital flows.

Source: TradingEconomics

Thus, the new environment of lower rates continues to reduce the appeal of both the dollar and Treasuries. As long as this dynamic persists, gold could continue to gain prominence as a safe-haven asset and sustain buying pressure in the short term.

What About Market Confidence?

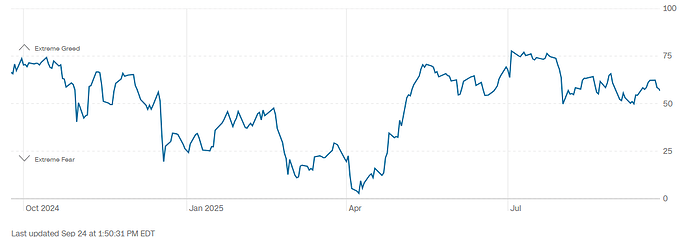

Gold continues to play its role as the safe-haven asset of choice, often benefiting when confidence indices reflect neutrality or weakness. In recent sessions, the Fear and Greed Index tried to recover toward the “greed” zone but has slipped back to around 58 points, moving closer to the neutral range.

Source: CNN

If this trend persists and overall confidence declines, the preference for safe-haven assets such as gold could increase. In that case, buying pressure may once again become a determining factor in the short term, reinforcing XAU/USD’s strength.

Gold Technical Forecast

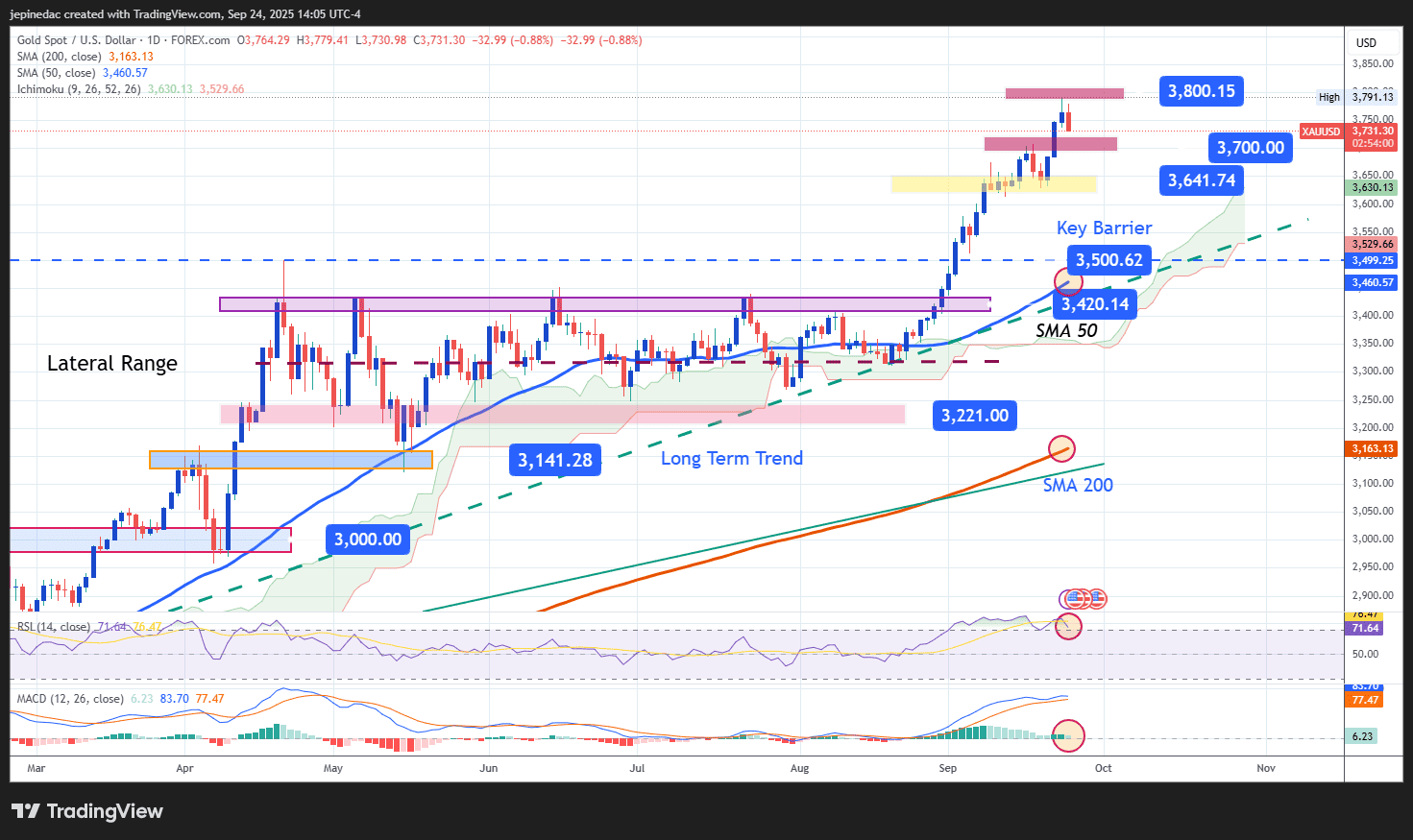

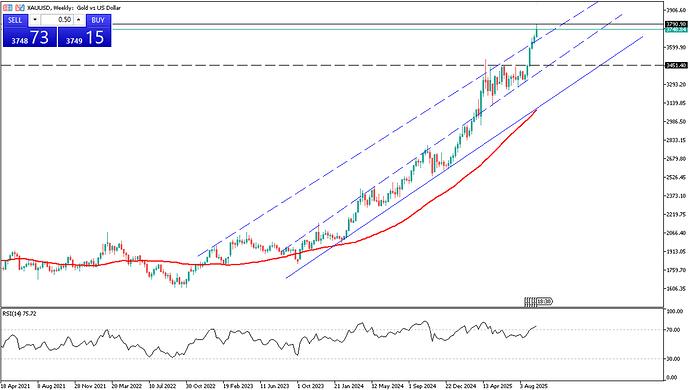

Source: StoneX, Tradingview

-

Bullish momentum remains dominant: Since late August, gold has maintained a strong rally, pushing prices to new all-time highs, nearing the $3,800 per ounce level. No major technical signs of a trend change are visible, making the bullish bias the key reference. If buying pressure continues, the uptrend could remain aggressive.

-

RSI: The RSI remains above 70, in overbought territory, reflecting very strong short-term buying pressure and creating a certain imbalance in the market. This is often interpreted as a sign that the price may need a pause, opening room for short-term corrective pullbacks. However, as long as the RSI does not clearly break downward, bullish strength is expected to remain dominant, albeit with the latent risk of temporary adjustments.

-

MACD: The MACD histogram is moving closer to the zero line, indicating growing neutrality in the strength of short-term moving averages. If this continues, the market could enter a consolidation phase.

Key Levels to Watch:

-

$3,800 – Major Resistance: A key psychological round number and the most important level in the absence of historical references. A sustained breakout would confirm continuation of the uptrend.

-

$3,700 – Nearby Barrier: A recent neutrality zone that could act as an intermediate support during pullbacks.

-

$3,640 – Critical Support: A key correction level from the past month. A break below would put the current uptrend at risk and activate a stronger bearish bias.

Written by Julian Pineda, CFA – Market Analyst

Follow him: @julianpineda25

https://www.forex.com/en-us/news-and-analysis/gold-update-xauusd-holds-near-3800-per-ounce/

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.