The Goldman Sachs Group, Inc. (GS) is an American multinational investment bank and financial services company headquartered in New York City. It offers services in investment management, securities, asset management, prime brokerage, and securities underwriting.

Since March 2020 low, GS is moving with a bullish momentum. The structure of this movement in Elliott Theory we call a motive wave or impulse. If you want to learn more about Elliott Wave Theory, please follow this link: Elliott Wave Theory. This impulse needs to build 5 waves before a correction.

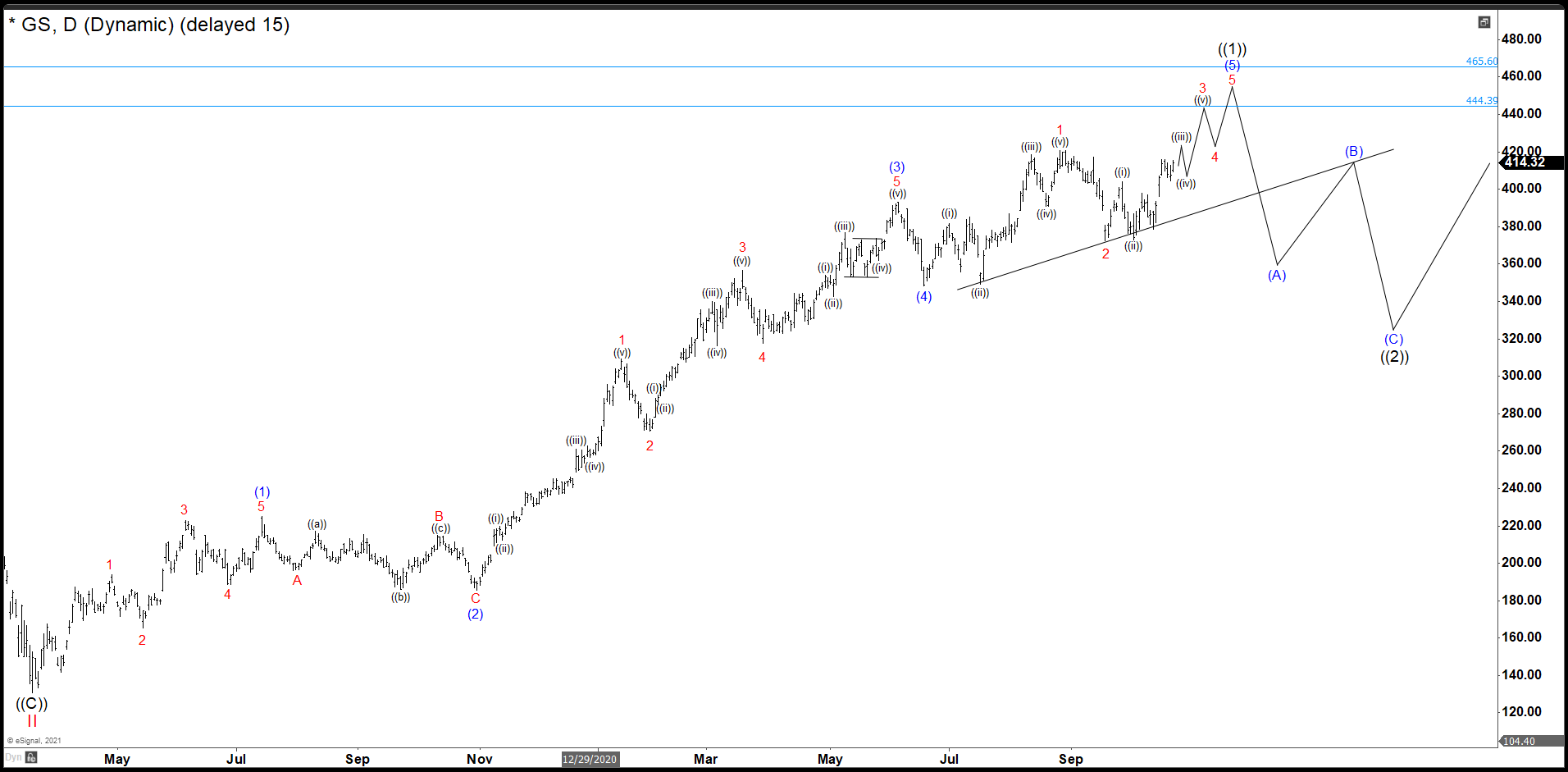

GS DAILY CHART

In the charts above, we can see the first wave of impulse that we called wave (1) ended at 225.24 dollars. Pullback as wave (2) end at 185.52. Then the stock rally creating 5 swings up in lesser degree to form wave (3) completed at 393.26. Wave (4) correction finished at 348.13 and from here we are still developing wave (5) in 5 waves in lesser degree.

Wave 1 of (5) in red ended at 420.73. Wave 2 correction bounce from 372.50. Wave 3 is building now which one should continue higher to 444.00 to complete wave 3. Then you must see a pullback in wave 4 and a last push to complete wave 5 of (5) and the whole motive wave as wave ((1)). We expected that impulse ((1)) finishes in 444.39 – 465.60. area and we should see a correction in the market.

Source: Goldman Sachs (GS) Still Looking Higher After Q3 Results