Grain Index Technical Analysis Summary

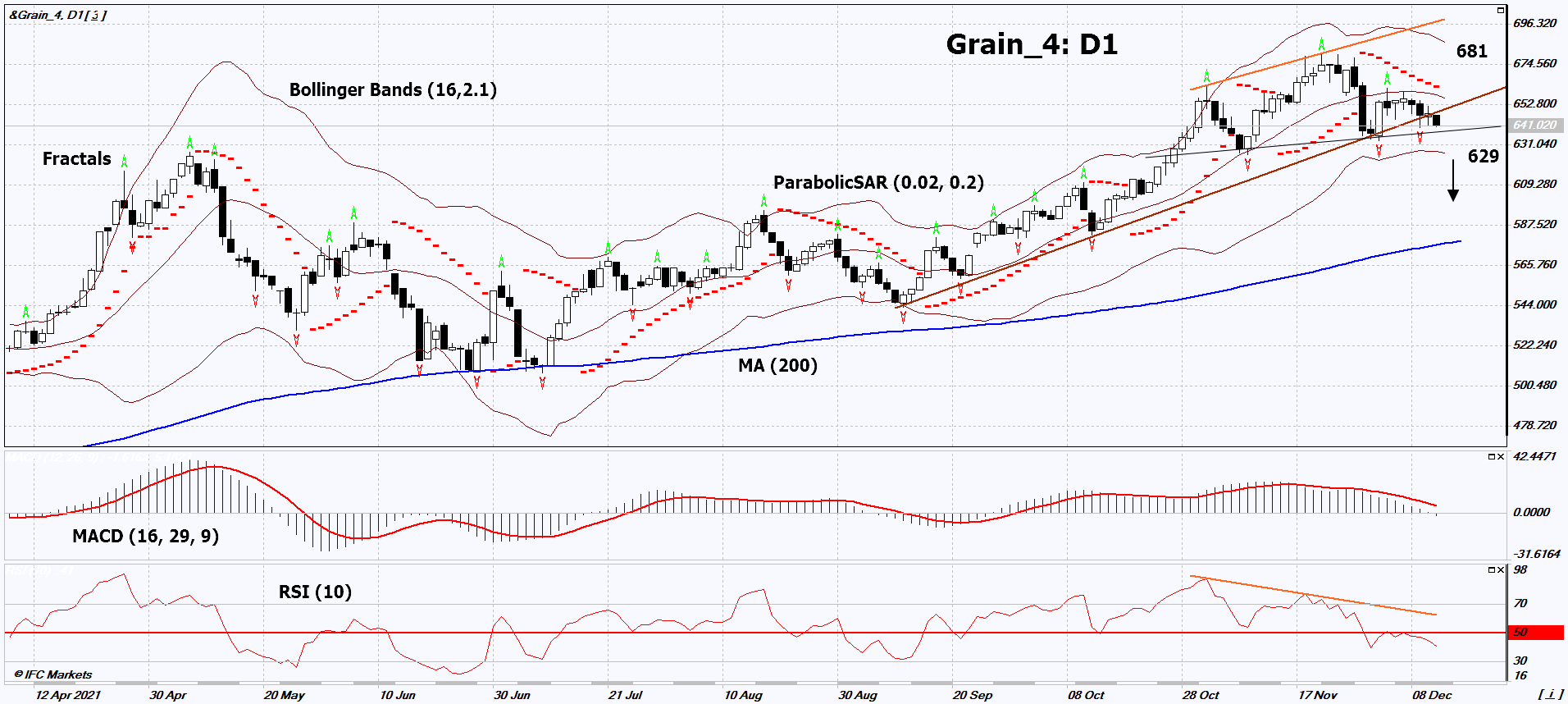

Sell Stop։ Below 681

Stop Loss։ Above 629

| Indicator | Signal |

|---|---|

| RSI | Sell |

| MACD | Sell |

| MA(200) | Neutral |

| Parabolic SAR | Sell |

| Fractals | Neutral |

| Bollinger Bands | Neutral |

Grain Index Chart Analysis

Grain Index Technical Analysis

If you already have an account, please login to join the webinar. On the daily timeframe, Grain_4: D1 broke down the uptrend support line. A “Head and Shoulders” pattern is forming on the chart. A number of technical analysis indicators have formed signals for a decline. We do not exclude a bearish movement if Grain_4 falls below the last two lower fractals: 629. This level can be used as an entry point. The initial risk limitation is possible above the last two upper fractals, the maximum since September 2012 and the Parabolic signal: 681. After opening a pending order, move the stop following the Bollinger and Parabolic signals to the next fractal minimum. Thus, we change the potential profit/loss ratio in our favor. The most cautious traders, after making a deal, can go to the four-hour chart and set a stop-loss, moving it in the direction of movement. If the price overcomes the stop level (681) without activating the order (629), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis of PCI - Grain Index

In this review, we propose to consider the “& Grain_4” Personal Composite Instrument (PCI). It reflects the price dynamics of a portfolio of 4 popular grain commodities. Will the Grain_4 quotes continue to decline?

The continuing strengthening of the US dollar may become a significant factor in a possible decline in world grain prices. Investors do not rule out any additional statements about plans to tighten monetary policy at the next Fed meeting on December 15. In addition, the U.S. The Department of Agriculture raised its forecast for the global wheat and corn harvest for the 2021/2022 growing season to 278.2 million tones and 305.5 million tones.