I’ve always hated risk, as I understood the word to mean. In high school I was intuitively fascinated by Probability, but did not score very well. At uni I loved probability in coursework, but was weak(lazy) on getting the actual maths behind it right. Everyone feels though that they understand what they mean when they say that something is “risky”. But in truth we are irrational creatures driven mostly by emotions generated in our glands and amygdala, and most of our so called so called risk assessments are nothing more than gut reactions.

I started studying the trading of currencies in the foreign exchange market about 18 months ago, and I read as many books as I could on the topic. Then I found some online courses and did those. I flicked from online guru to online guru. Mostly the ones who were genuinely successful traders in their own right (you can spot it immediately after a while) all had one or two valuable insights to share. They all preached the value of psychological discipline. I knew I was a very disciplined person (hahaha), and I thought I just needed a great system, and my natural discipline would do the rest. I learned to backtest different trading strategies, and I created, tested and discarded many different ideas for trading systems, some hopelessly complex, others naively simple. I demo traded for a few months, and quickly learned that I couldn’t force myself to take it seriously.

Another common theme in the educational materials emerged- Grit. Grit happens to also be the title of one of my favourite books, and the “Grit scale” is used to help filter candidates to the elite Westpoint Academy. But even if my discipline wasn’t perfect, I still knew I had grit, and actually I still do.

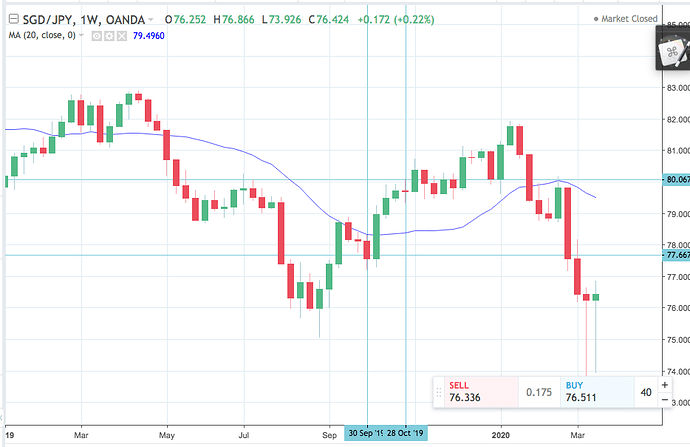

I knew I needed to trade with real money, as everyone said adjusting to the emotional roller coaster of real money was very difficult. I also knew I would probably be a horrible trader to begin with. So in September 2019 I opened my first trading account at the lowest leverage setting available of 10 times, with the princely sum of $100. I knew this was smart. I need to prove the system first, to know 100% through and through that it worked. Only then would I scale up. I wanted near total seperation between the emotional journey of watching money come and go, and learning to trade competently. I would trade for 12 months with nothing more than $100, because I was in it for the long game and I was determined to succeed.

I opened my first ever trade, a sell on ZAR/JPY. I didn’t even know that ZAR was the ticker for the south african rand. I didn’t realise that the spread was expensive and might make the trade not really worth it. I didn’t know that the pair was highly volatile and might whiplash me out of the trade for a loss, and only then go in my chosen direction. I close the trade for a profit of 0.02%.

I opened a buy order on the british pound against the US dollar, and made a profit of half a percent. I felt good. I knew what I was doing. Emboldened I uncovered in my trading platform that you could also trade commodities. Blind freddy could see that Brent Crude Oil was going to depreciate against the US dollar, so I opened a sell on that. One problem, my account was too small to be trading contracts- I was going to have to break my own self imposed strict risk limits of 2% per trade. To make this trade I was going to have to risk 8%. Everything up till then had been bubbling attempts at competence, but this was the first day that my greed took an axe to my discipline. I opened the trade.

Oil went down and I made an 8% gain. My account was rocketing up, and clearly I had this trading thing nailed. I closed a few more trades out for a profit, and that was the last of the good times. I traded pairs that were just travelling sideways, telling myself there were surely going up. It was like looking up at the sky and saying it did look possibly just a little bit red. It was 5, 6 ,7 losses in a row. I knew they were only cents, but it was agonising. I wouldn’t care too much if I dropped 10 cents on the ground, but for some reason when I lost that money in a trade it felt like the market was stealing from me. The screen was always red. I had no confidence in my system, in myself, I was in drawdowns that went for 2 to 3 months (I did have the grit to stick them out), and still then they would hit my stop losses for the final humiliation. By January 2020, I wasn’t completely back to where I started, but I was sitting only a measly gain of 3%, a far cry from the confident early 10% I had incompetently rocketed up to.

Then I set about the business of learning to trade, of not giving up, of making better decisions, of diversifying my risk correctly, of avoiding exotic currency pairs, and of sitting through drawdowns knowing that the decision I had made was correct, I had merely to wait it out. Over the last three months I have crawled and ground my way back inch by inch, and as of writing my account sits in profit of %10.6, with six months to go until my yearly milestone in September when I was reassess and write up my experience in full. Nowadays I see stock indexes plummeting and I know it would be very easy money to hit sell on those using a wide stop and make profit- but my account is too small for those contract sizes, my leverage is too low, and so I remain disciplined and small and just let opportunity pass me by. That’s another thing I’m learning, there are so many opportunities, more than could possibly be take advantage of. So it doesn’t matter when they slide by. 12 months from now I will probably buy a long term position in both the AUD and the ASX index, and ride them up from the depths- or not- it doesn’t matter, so long as I follow my risk limits and position sizing.

I am aiming to get to 20% at the full year. But I will not alter my trading to get there. I will not rush. I will not change my trading style, listen to any expert, indulge in macroeconomic or fundamental analysis, I will just trade my system.

Thanks for reading!

-Mark