HDFC Bank Limited is an Indian banking and financial services company headquartered in Mumbai. It is India’s largest private sector bank by assets and world’s 10th largest bank by market capitalization as of April 2021, the third largest company by market capitalization of $122.50 billion on the Indian stock exchanges. It is also the fifteenth largest employer in India with nearly 120,000 employees.

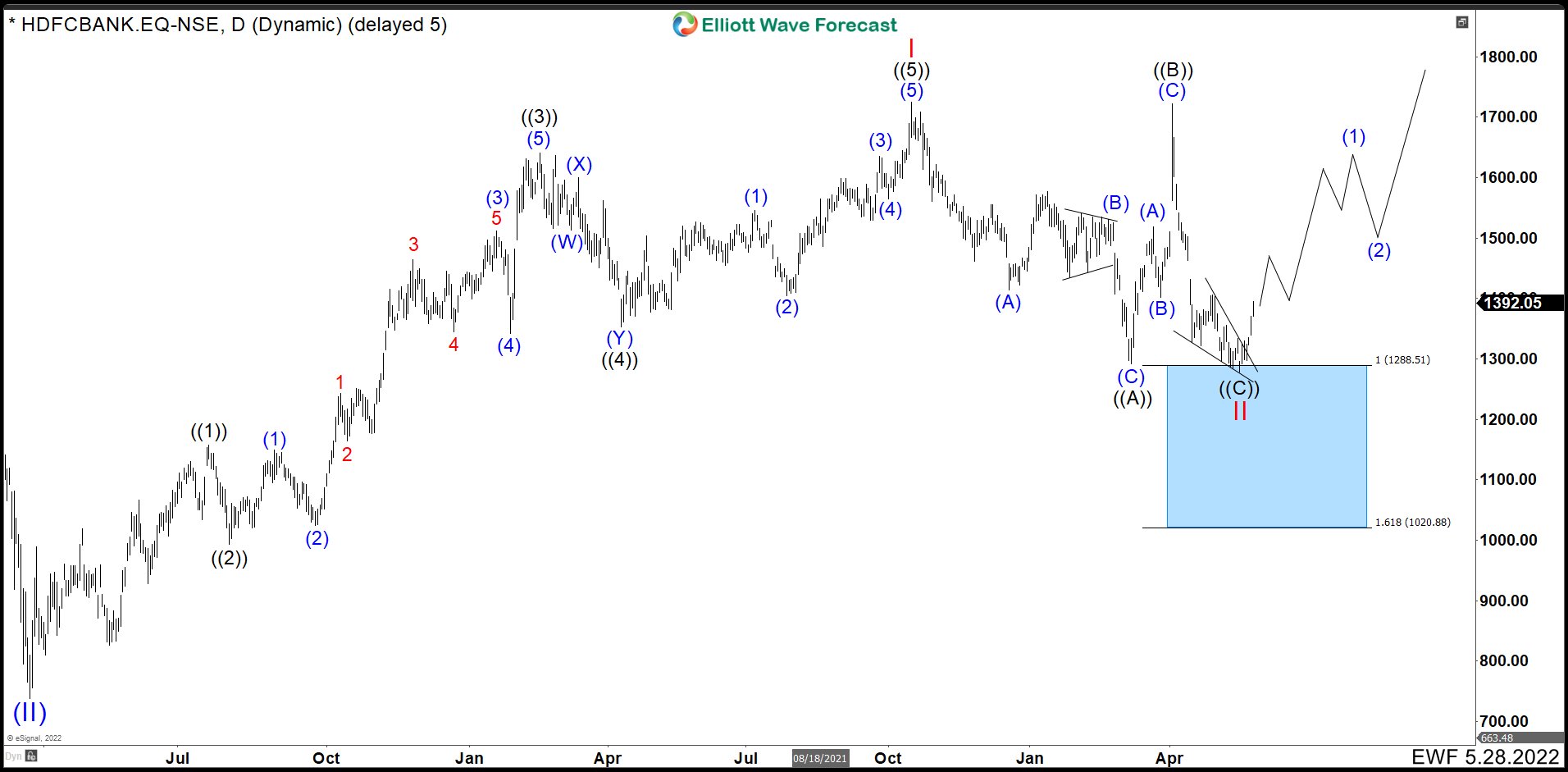

HDFC BANK Daily Chart May 28th 2022

Since March 2020, HDFC BANK maintained a sustained growth in the value of its shares. For us it was to build an impulsive structure that ended in December of last year. An impulse is a 5-wave structure. We can see on the chart that wave ((1)) ended at 1159.41. The pullback towards 993.36 was wave ((2)). From there, it continue to rally in an extended wave ((3)) ending at 1651.54. Then wave ((4)) appeared in the form of a double correction ending at 1353.13. The last push up we had an impulse, as expected, to complete wave ((5)) at 1726.02 and complete wave I.

Since March 2020, HDFC BANK maintained a sustained growth in the value of its shares. For us it was to build an impulsive structure that ended in December of last year. An impulse is a 5-wave structure. We can see on the chart that wave ((1)) ended at 1159.41. The pullback towards 993.36 was wave ((2)). From there, it continue to rally in an extended wave ((3)) ending at 1651.54. Then wave ((4)) appeared in the form of a double correction ending at 1353.13. The last push up we had an impulse, as expected, to complete wave ((5)) at 1726.02 and complete wave I.

From December, stocks have moved lower and it seems that we have already completed the downward cycle with a flat structure according to Elliott Wave Theory. The market hit the blue box at 1288.51 and we have already seen a bullish reaction from this level. (If you want to learn more about Elliott Wave Theory, follow these links: Elliott Wave Education and Elliott Wave Theory).

The drop from the peak 1276.02 was in 3 swings. Wave (A) ended at 1412.85, corrective wave (B) made a triangle and ended at 1530.84. It then continued lower to complete wave (C) and wave ((A)) at 1291.96. The market had a strong rebound that tested the highs ending wave ((B)) at 1721.65 and turned quickly making an ending diagonal structure completing wave ((C)) and wave II at 1280.31.

We have already seen a bullish reaction from the blue box and this should continue through the year as HDFC shares should break above 1726.02 as long as we stay above 1280.31 from here.

Source: HDFC BANK Shares Broke Higher From An Ending Diagonal