Self-belief and hard work will always earn you success

The only way to Beat The Market Maker is to trade exactly in the direction of their own trades. In simpler terms, if Market Makers are trading Up, then you should be trading Up. If Market Makers are trading Down, then you should be trading Down. Now, the hard part is figuring out whether they are trading Up or Down.

I think it’s impossible to beat market makers, however I’m sure there are some tips which can help you to change price movement. Market makers just provide the bid and ask quotes you see when you look up the price of an asset, they earn a profit from the spread between buy and sell rates and they don’t want to be exposed to any net position so they hedge any net exposure that develops in order to eliminate portfolio risk, so they are not in the markets to profit from price fluctuations but they are there to make a profit from the bid and ask spread. So, you should try not to succumb to such tricks while trading.

A very interesting topic! a vivid example of how you can get a positive result on the market with your hard work.

I might be jumping in a bit late on the discussions, but, I thought I would just add some inputs

Market Makers are basically he big traders, not categorised as retail traders like you and me. A market maker because of the size of the trading contracts, the grouping of a few of them together basically manipulate the market to make profit, I am yes suggesting, these are institutions who trade in a day and make millions, not a few Dollars.

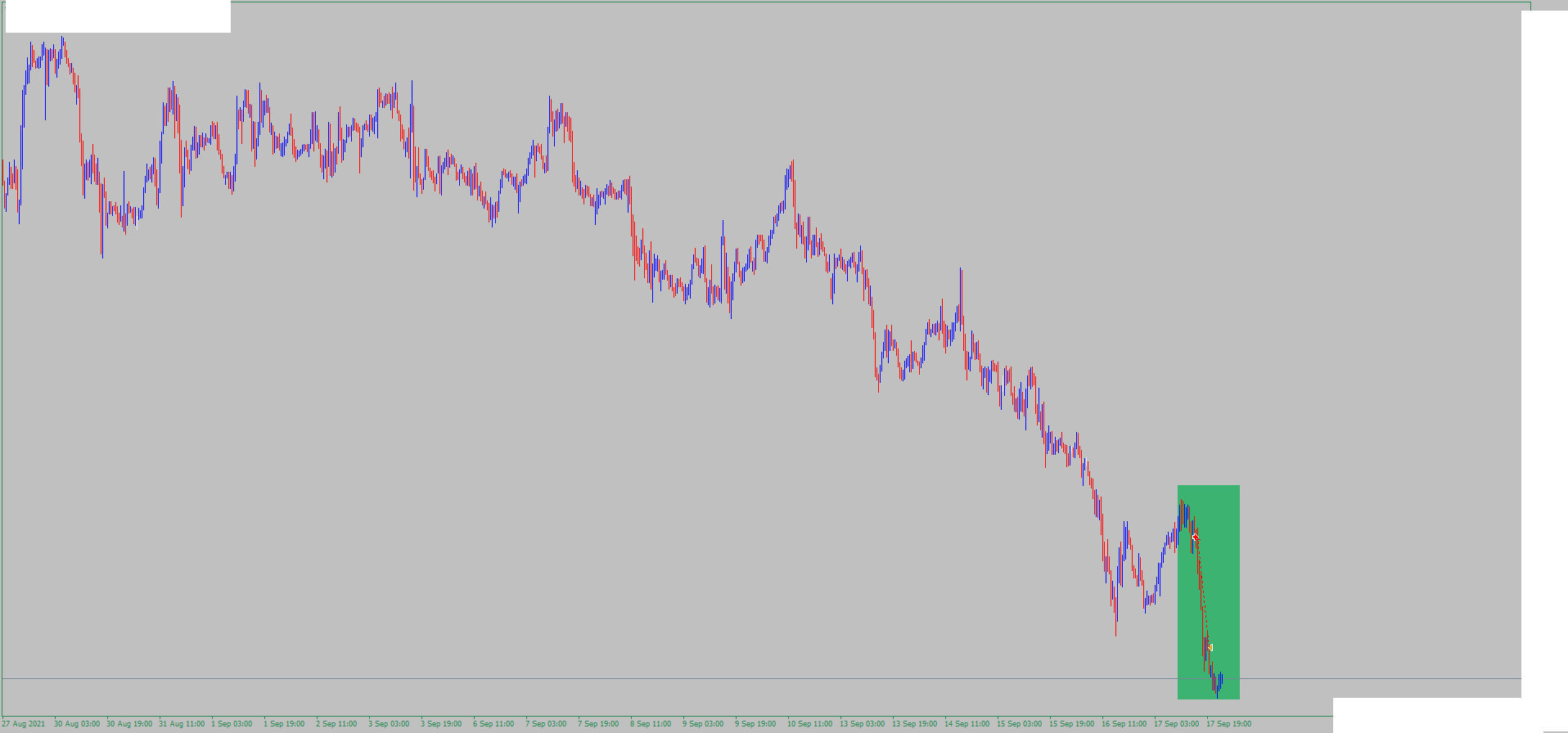

Market makers in summary use manipulation, especially high impact news events to move the markets where they want to go. The whipsaw and stop hunt to create liquidity for their trades in order to move the market and to make a profit. Must differentiate between a broker, a MM and a retail trader.

Market Makers use structure to trade and yes, we need to be in line with that structure to trade and to make money. One need to understand reversal formations, like M and W, reversing candles and then, yes, fundamental news to swing it their way. Where we look at sentiment, they love that, they swing against the retail traders so as to gain liquidity.