Hello,

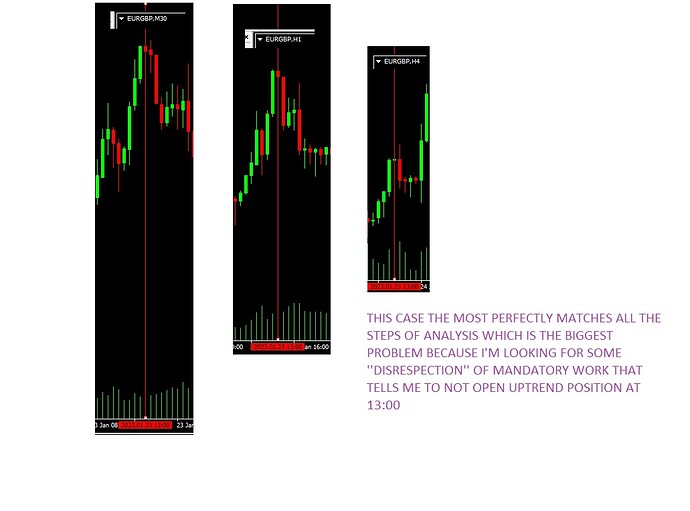

I’m kindly asking if someone could please tell me with advice what else, which additional step, should I integrate in my strategy. Image file is attached - please look at it.

I’m looking for additional part of the strategy where I could get the answer that would tell me something like this: ‘‘Even if current situation is looking good to open downtrend position, do NOT open it yet’’

The purpose is to get some warning that everything might not be so good as it looks like but I’m asking you for some help please, what else should I do to get such informaiton from the task I’m asking for.

So far my normal procedure, when I get an alert on H1, looks similar to this (note: my message has no relation to criteria when alert is shown and when not so I will exclude this otherwise only this criteria, which is automated by my tool, consist of around 8 additional steps - I’m EXCLUDING all those from below steps):

Step1: Direction of a trend must match the alert on H1.

Step2: Direction of a trend must match the alert on M30.

Step3: Making sure there is no ranging market neither on H1, nor on M30 nor on H4.

Step4 (relevant only for H1): IF BUY Position: No larger size of upper shadow of latest closed candle on the price level where bearish retracement(s) has/have recently happened where trend was already forming large size of upper shadows. IF SELL Position: No larger size of lower shadow of latest closed candle on the price level where bullish retracement(s) has/have recently happened where trend was already forming large size of lower shadows.

Step5 (relevant for H1 and M30): IF BUY: As small as possible upper shadow of latest closed candle indicating continuation of (potentially strong) bullish momentum. IF SELL: As small as possible lower shadow of latest closed candle indicating continuation of (potentially strong) bearish momentum.

Step 6 (relevant only for H4): Direction of a trend must match the alert on H4.

Step 7 (relevant only for H4): IF BUY: Latest closed candle must be bullish. IF SELL: Latest closed candle must be bearish.

Step 8 (relevant only for H4): latest closed candle should NOT be indecision (allowed exception which is otherwise required as stated in step 9: accuracy when it comes to lower highs [IF SELL] or accuracy when it comes to higher lows [IF BUY])

Step 9 (relevant only for H4): Previously stated accuracy.

So my work consist of those steps, several even more important steps of background functionality depending on whether or not the alerts will be shown and several YEARS of development work (not by me personally) for creation of unique MT4 EA tools.

However in the purple color text of attached image, nothing works. Whatever I do, nothing works and I really need your help.

Unfortunately the crucial importance of Step5 lost the logic in the background of analysis. There is extremely small lower shadow (in fact, none!!!) on both H1 and M30 as you see on image but retracement still happened.

I have already considered the following 7 approaches that are all pointless to be implemented so I’m NOT asking for them (I already thought about them) but something else, something by far more accurate and better because approaches below could lose very good chances of making profit:

Approach 1:

Usage of economic calendar. Some result of news event could cause trend retracement in unwanted direction. Sometimes those even high impact events don’t really move the trend directions which means complete nonsense and waste of opportunity. Sometimes news events could push the trend towards wanted (matching opened position) direction. So considering economic calendar for exact time as result of event is posted is not a good idea.

Aproach 2:

I don’t want to use lower than M30 time frames or higher than H4. Reason for lower than M30: not enough accuracy (reliability). Reason for higher than H4: too few opportunities.

Approach 3:

Please look at attached image file at purple color case (the main problem). See bearish candle on H1 that opened at 20:00 so the one before the purple circle located at around the center of entire image file. Do you see that 20:00 bearish candle? Look at closure price. You can see a clear Support zone. I will not use such Support/Resistance zones analysis in such way because there are hundreds of them and trend is usually entirely disrespecting them. I need your by far more accurate advice please what to do so I would REFRAIN from opening downtrend position.

Approach 4:

Please look at attached image at purple color case, right-side TOP graphic saying ‘‘H4 situation’’. Do you see the purple circle? I mean the purple circle at the top right side near ‘‘h4 situation’’? There is no need for H4 (reason: alerts are based on H1 as main time frame) that LOWER shadow of latest closed candle (circled one) would be below the lower shadow of previous candle.

Approach 5:

I don’t want to use any MT4 indicators, particularly not default ones. Indicators are showing past and current situation. There is no reliability that near-by future (e.g. next few hours) will be the same.

Approach 6:

Hedging is for very obvious reason out of question. I need something that PREVENTS me from opening bearish momentum because of disaster that follows at 21:00.

Approach 7:

Websites such as Investing dot com and similar ones, searching for currency pair and checking there graphical arrow. Reason: Updates of those graphical arrows are having by far too high delays. When retracements really happen, arrows stays from previous momentum. When momentums are coming to an end, arrows on such website have zero effects. Very poor updates. I’m usually referring to arrows where % is also given. Try to open investing dot com website and do your search for random currency pair and you will see what I’m referring to.

So all those 7 ideas are poor. I thought about them and they won’t solve the problem.

What else can I do please?

Thank you!