Yeah it gets too silent at times, it’s rather encouraging though, to see all these many peeps silently lurking around… Me, I have to stick around somewhere anywhere to see if I get feedback for my burning queries, I have those too you know? Its either here like this, or outside in the weather, or gazing at live h1 charts and loosing money in real-time – choose your poison.

When you set everything up, you can gaze at still charts for hours, and you’re sure you’re not seeing things because you’re scribbling on paper for posterity. Take the E$: starting at mn1 timeframe, I have labeled waves of primary, intermediate and minor, set the major s+r’s (blue) & scalp(brown), then down to wk1 timeframe set even more scalps; on d1 set some more scalps… by now were sporting a rather crowded population, so I’ve got a method for labeling them (like ‘s+r 1.3600 _#1212804 /220210_wk1close’, description ‘7mn1closes, 12 wicks and Kumo tables’); on h4 I have the last scalps, and other lighter lines which I move around a lot. Those of lower timeframe aren’t seen on higher timeframe. Fire up IKH visible on h4 and d1 only, and label the EW count (with accurate description) for the last minute degree, and maybe minuette, wiggles. That fibb there is the projection of minute[i] of minor A intermediate ©, for minute [v]; now the current [v] is testing 61.8% projection.

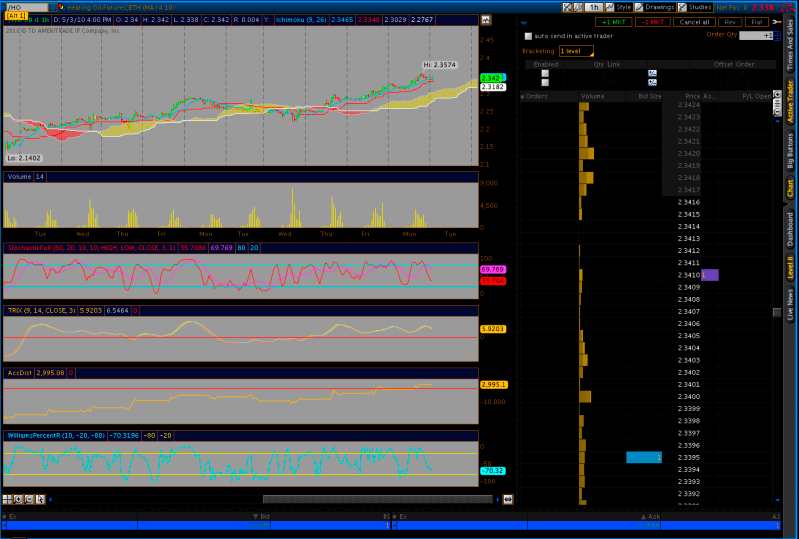

Now see the last chart h4 used for actual trading, notice how reversal price-action happens at or near these lines, and how they relate to the IKH levels of equilibrium, and how a wave end/turning point orchestrates. The main reversal bars (at great or so location) happen, then TS gets tested then broken, going for KS…kumo break…all crossed. They now act as resistances, with mainly KS on h4 or TS on d1 & s+r lines calling the entry and exits, and price-action (shape of candles) showing wave progression. Use stop-orders, so whether the candle is halfway or closed, you’re in when the surf comes to you, and out when it’s gone.

I’m looking to trade All impulse waves, minute degree and above, 70pips on H4, 250p is very fine, if I catch 1000p on GY I may have to close shop for the month to count the spoils. If wave [v] is over and 61.8 proj holds, then I’m looking to exit the remaining position from trading 1.3600 –and a dumb half-position at 1.3300 – at 1.3420. If Ks resistance holds with nice price action, I might add another final half-position looking for 100% proj. To be here, I have messed up like three other trades around ii and iv and this is not a no-brainer-enter-at-cross system. But of course, they were shorts running small profit, and thus I didn’t have to wait for SL=50p or 140p to get hit, just see adverse price action closed and jump out with whatever to regroup at better position tomorrow without overdoing it by staring at moving charts (do the DJIA in the meantime?). But what if 1.3120 is retested without breaking (the ICT observation) and price takes off bullish again for 1.3400, I’d know to look for a second-wave of an impulse up and price action response to that location, and take it.

You know I can answer ten more questions, right? This time with G$?