My market outlook for the week will have to make do with that sub-standard GY count for the time being, used together with prevailing G$ and $Y outlooks, E$ still leading the way and a big gap for EY market posn?

E$: On h1 and h4, ended minuette (v) of minute [v] minor 1, which is quite a significant turn; thus started minor 2 three-waves with int (A) and © either five-wave impulses components of larger zigzag minor 2, or three wave complexes components of larger sideways/flatish minor 2. Target for minor 2 end predicted for: 61.8% or there about correction of minor 1; wave four range one degree lower of minor 1, that is range of minute [iv] of 1, or; 1.3600 next strongest s+r or one of its shadows. First target for the bullish wave, minute [a] of 2, expected: in range of wave four one degree lower, that is not past range minuette(iv) of [v]-1, or; in range of wave two one degree lower, that is not past range minuette(ii) of [v]-1. Clearly no overlapping for first bullish sub-i, must be impulse part of minuette(a)? Outlook to catch sub-i end, avoid/survive sub-ii, not miss sub-iii coming up next. Therefore pair currently in four of sub-i, or sub-ii; projecting sub-i… IKH looking like bearish bounce off h4 SSb, but still below d1 Ksen, watching for bullish support and signals. Below 1.2300 start watching for bearish continuation.

G$: On d1 just touched channel bottom far from eqbm looking up, on h1 and h4 sub-v of int(v) minute [iii] -5 just ended at 0000gmt 19May10, 21hr rise from there is three wave sub-a, sets pace for overall sideways minuette(a) whose first target may have hit with sub-c at wave four range one degree lower of prev (v) or yet to hit at wave two range of prev (v). Therefore currently pair is in sub-c of (a)’ ending/ended, now sub-a’ of (b) to bring more sideways bearish, then minuette© a must-catch bullish towards first target for [a] at prev (iv) of [iii]-5. Alternatively completed sub off 1.4530 is one degree lower, thus we’re in sub-a of (a) ending/ended, now sub-b of (a) to bring more sideways bearish, then sub-c, will be watching for range between 1.4300 on lower, and 1.47/1.50 on upper side. See h4 TKsx, d1far below eqbm.

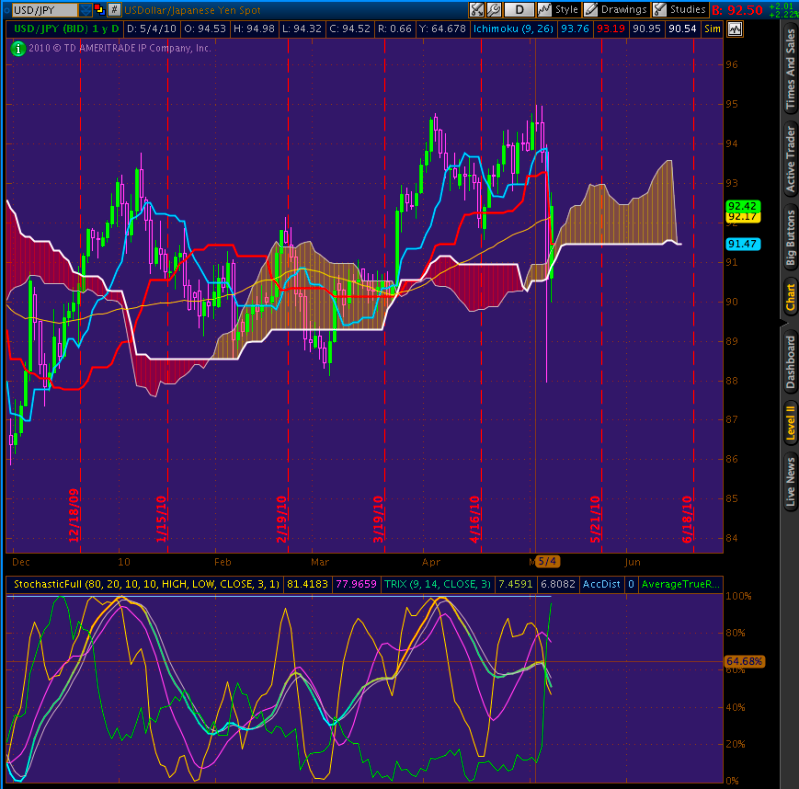

GY: Gauging the leading pairs in my circle, I’m expecting bullish continuation for minuette (iv) minute[iii] minor 5 int(3) pri[5], up until G$ turns bearish and strong reversals on GY suggest (iii) isn’t over? Watching bullish h4 PTsx & PKsx, aiming for d1 eqbm.

For the record, last Thursday & Friday I wasn’t around so could do nothing about getting stopped out on both pounds, E$ managed to take off. Watching for London volume and bullish E$ h1 & h4 bars and I’m back in solid four pairs, kill the two under-performers by Wednesday? Swing with it, watch your hinges, keep your count up. Wish all o’yo great trading.