S&P 500, the US market is correcting

The US stock market continues to evaluate the recent revision of financial forecasts from leading analytical agencies. The day before, analysts at UBS Group AG raised the target price of Meta Platforms Inc. shares for Q2 2022 from 280 to 300 dollars. In turn, Chevron Corp., according to UBS Group AG estimates, will rise from 150 to 192 dollars. Prior to this, Goldman Sachs Group analysts also raised their forecast for the issuer’s shares.

The US bond market is currently experiencing active growth: the rate of return on 10-year Treasury bonds rises by 2.44% and by 1.89% on conservative 20-year ones. More dynamic growth is traditionally demonstrated by short-term assets: annual bonds grow by 2.55%, and 6-month bonds rise by 4.26%.

The index quotes are traded in a local uptrend, having overcome the resistance line of the lateral channel the day before. Technical indicators are holding a local buy signal: fast EMAs on the Alligator indicator are above the signal line, and the AO oscillator histogram is in the buy zone.

Support levels: 4470.0, 4216 | Resistance levels: 4630, 4800

Solid ECN Securities

Silver prices are falling during the Asian session, correcting after yesterday’s attempt to grow. The instrument is now testing the level 24.2 for a breakdown and waiting for new signals.

The situation on the market is changing slightly since there are no prerequisites for the completion of a special military operation initiated by the Russian authorities on the territory of Ukraine. Moreover, the economic outlook is only worsening as more sanctions are imposed on the Russian economy. In particular, yesterday, the EU announced its intention to expand the list of goods banned from imports from Russia, but analysts report that this package of sanctions has not been agreed upon so far. The project involves a ban on importing coal and some agricultural products, in particular, potash fertilizers. Certain foodstuffs may also be subject to restrictions. According to experts, sanctions could cost the economy about 9B euros a year.

The pressure on the instrument’s position is exerted by the growth in the yield of US Treasury bonds. The minutes of the US Federal Reserve’s Open Market Committee (FOMC) published yesterday reflected the regulator’s readiness to accelerate the tightening of monetary policy, including through the launch of a quantitative tightening program. Similar sentiments can be traced in the speeches official representatives of the regulator, for example, Lael Brainard, who is known for her rather reserved position.

On the daily chart, Bollinger Bands are steadily declining. The price range expands, letting the “bears” renew local lows. The MACD indicator is falling, keeping a relatively strong sell signal (the histogram is below the signal line). Stochastic shows similar dynamics but is approaching the level of 20, which indicates that silver may become oversold in the ultra-short term.

Resistance levels: 24.42, 24.67, 25, 25.35 | Support levels: 24, 23.6, 23.32, 23

Serious pressure on the US stock market was exerted by the minutes of the meeting of the Federal Open Market Committee of the US Federal Reserve (FOMC) published yesterday. According to the document, most of the participants in the meeting would have preferred to raise the rate by 0.50% already in March against the backdrop of high inflation, but as a result, the indicator was corrected by a minimum amount of 25 basis points. Also, the regulator confirmed plans to reduce the balance sheet by 95B dollars per month. According to forecasts, the agency is ready to start a quantitative increase and increase the rate by 50 basis points at once in May.

This week, traders were on the lookout for reports that investment firm Berkshire Hathaway Inc. has purchased an 11.4% stake in the American manufacturer of personal computers and printing equipment HP Inc. The deal amounted to 4.2B dollars.

The index quotes have left the limits of the narrow downward channel and are forming a global Head and shoulders reversal formation. Technical indicators give a poor signal to buy: indicator Alligator’s EMA fluctuations range is still quite wide, and the AO oscillator histogram forms downward bars in the buy zone.

Resistance levels: 15150, 16387 | Support levels: 14225, 13070

Trade with a True ECN Broker

Solid ECN Securities

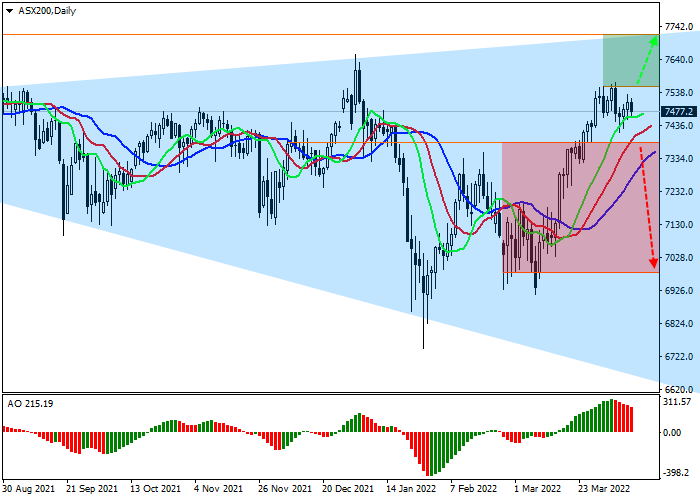

The leading index of the Australian economy, ASX 200, is strengthening, being near 7477.0. The Australian stock market is trading ambiguously due to a poor Friday report on economic stability and growth in the bond market.

Thus, the Reserve Bank of Australia announced the growing uncertainty regarding the development of the national economy, caused primarily by the continuing rise in inflation. Officials said they were closely monitoring the dynamics of household mortgage debt and lending and warned borrowers that they should be prepared for higher interest rates. According to department representatives, the country’s financial system remains stable, and financial institutions are well-capitalized. However, inflation will continue to rise in the future, putting serious pressure on both borrowers and consumers.

The stock market is not allowed to fall by the bond market, which continues to grow actively. Today, the yield of popular 10-year bonds of Australia added 1.96%, while the rate of return on conservative 20-year bonds is 1.78%. Short-term assets show a more restrained trend: 1-year securities rose by 1.68%, and 2-year securities added 0.89%.

The price moves within the global Expanding formation pattern, approaching the resistance line. Technical indicators keep a stable buy signal: fast EMAs of the Alligator indicator are above the signal line, and the AO oscillator histogram is high in the buying zone.

Support levels: 7380, 6980 | Resistance levels: 7550, 7750

Trade with a True ECN Broker

Solid ECN Securities

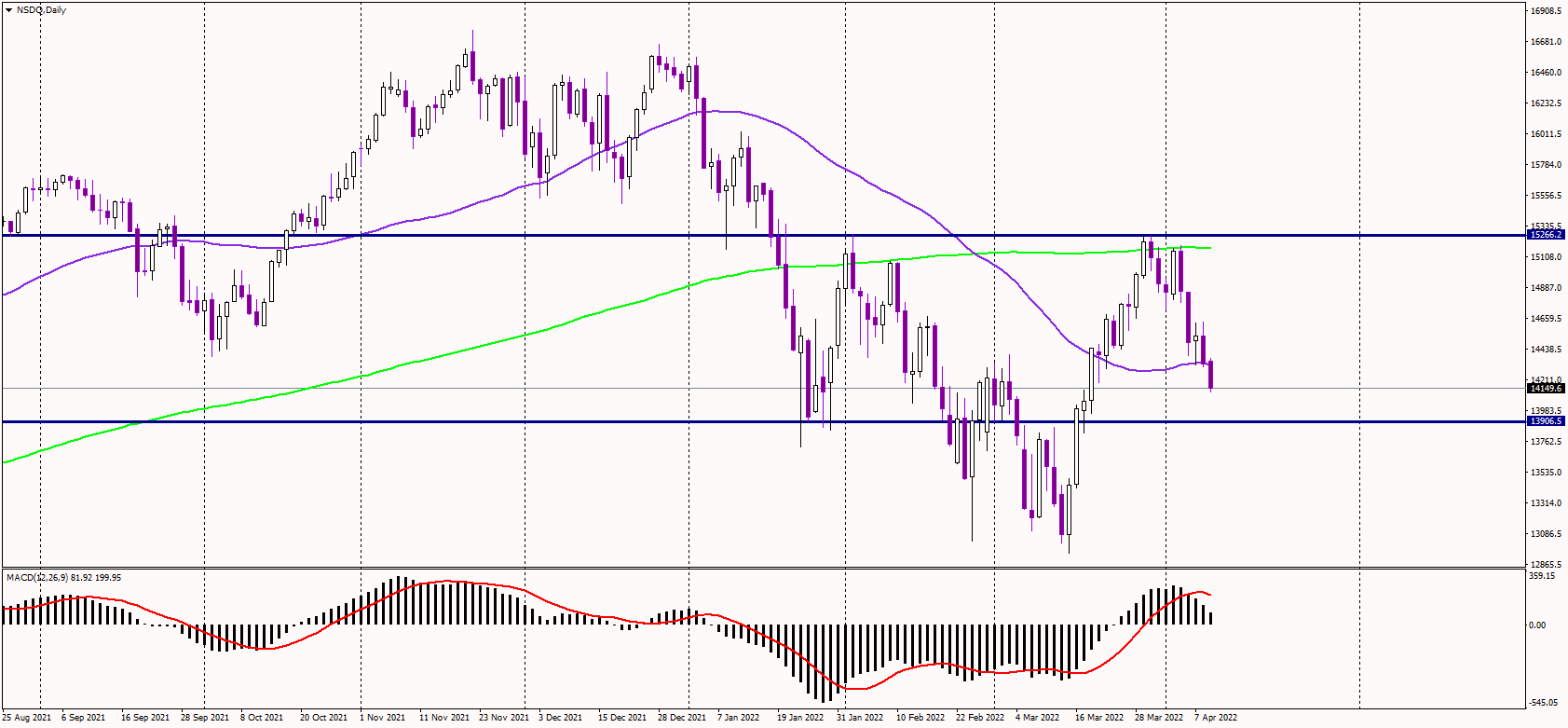

The tech-heavy Nasdaq 100 index declined more than 1% on Monday as US yields continue to rise, undermining high growth and tech sectors.

As measured by the Fibonacci retracement tool, the Nasdaq has erased nearly 50% of the rally from March lows to April highs. However, the critical resistance remains at the 200-day moving average, currently near 15,200 USD. Regarding the Ukraine war, White House national security adviser Jake Sullivan said on Sunday that Ukrainian forces could push back Russian troops successfully so that they were forced to retreat and regroup.

Bears pushed the Nasdaq below the 50-day moving average (the purple line) at 14,330 USD, changing the short-term outlook to bearish. As long as the index trades below the 50-day average, the next target for decline seems to be at 13,900 USD. If the index jumps above 14,330 USD, we might see a bullish reversal, targeting 14,630 USD in the initial reaction.

However, sentiment might stay bearish in the near future as the Fed seems ready to deliver more rate hikes than previously expected, likely crushing the high-debt and high-growth sectors, tech included.

The Dow Jones is correcting down and trading at $34,180.

The corporate reporting season starts this week with the publication of data by companies in the banking and insurance sectors. Despite the fact that the stock market is trading at its highs, strong financial results should not be expected during this period, and if the figures are higher than predicted, this will probably not affect the long-term plans of issuers.

The bond market is also showing historical growth, so a serious influx of money into stocks is not expected. The yield on popular 10-year US Treasuries updated the record of 2019 and amounted to 2.826%, while conservative 20-year bonds overcame the figure of 3.040% the day before. Short-term bonds are the fastest rising, adding 3.85% and 5.67% for 3-month and 6-month notes, respectively.

The index quotes are traded inside the descending channel, having reached the resistance line and reversed from it. Technical indicators are about to change direction and give a sell signal: fast EMAs on the Alligator indicator are approaching the signal line, and the AO oscillator histogram is actively forming downward bars.

Support levels: 33,860, 32,550 | Resistance levels: 34,820, 35,870

Trade with a True ECN Broker

Solid ECN Securities

Alphabet Inc. is an American multinational technology conglomerate holding company headquartered in Mountain View, California. It was created through a restructuring of Google on October 2, 2015, and became the parent company of Google and several former Google subsidiaries

If the assumption is correct, the price will grow to the levels of 3030.2 - 3300. In this scenario, critical stop loss level is 2522.05.

Trade with a True ECN Broker

Solid ECN Securities

Visa Inc, the price may fall.

On the daily chart, the third wave of the higher level (3) developed, and a downward correction forms as the fourth wave (4). Now, the wave A of (4) is developing, within which the third wave of the lower level iii of А has formed, and the wave iv of A has developed.

If the assumption is correct, the price will fall to the levels of 178.37 - 135.65. In this scenario, critical stop loss level is 230.11.

Trade with a True ECN Broker

Solid ECN Securities

The FTSE 100 index shows a local corrective trend, trading at 7574.0.

Corporate news is beginning to come to the fore in stock markets around the world, as the period for publishing the financial results of index component companies kicks off next week. The budget carrier EasyJet Plc. reported that the revenue forecast suggests a loss of around 500 million pounds due to low overall bookings. In turn, the shares of the online retailer ASOS Plc. strengthened marginally after maintaining the company’s strong growth forecast for 2022, despite an expected drop in first-half earnings due to supply issues.

In addition, the continued growth in the UK bond market should be noted, where 10-year treasuries renewed another high, reaching 1.8080%, and the yield on 20-year conservative bonds increased to 2.021%, which significantly exceeds 1.741% at the beginning of the month.

The growth leaders in the index are British Petroleum Plc. (+2.40%), Fresnillo Plc. (+2.30%), JD Sports Fashion Plc. (+2.18%). Among the leaders of the decline are Rolls-Royce Holdings Plc. (-5.48%), Land Securities Group Plc. (-4.53%), Ocado Group Plc. (-4.32%).

Index quotes are trading within the global Expanding Formation pattern. Technical indicators are in a stable buy signal state: the range of EMA fluctuations on the Alligator indicator stays wide and the histogram of the AO oscillator is trading high in the purchase zone.

Support levels: 7500, 7232 | Resistance levels: 7673, 7900

The shares of Tesla Inc., the world’s leading manufacturer of electric cars, continue their global correction, trading at 1022.

On the daily chart, the trading instrument is within the global Expanding formation pattern, which began to implement in October 2021. At the moment, the price has completely formed its sixth wave, having reached the resistance line at 1146, and reversed downwards.

On the 4-hour chart, there are signs of a new downward wave, with the target at the support line of the pattern around 760. The readings of technical indicators also confirm the likely continuation of the decline: fast EMAs on the Alligator indicator are actively approaching the signal line, and the AO oscillator histogram is forming bars with a downward trend in the buying zone.

Trade with a true ECN broker

Solid ECN Securities

General Electric, technical analysis

The global sideways correction in the shares of General Electric Co., an American multi-industry corporation, is strengthening, and the instrument is currently trading just below 91.

On the daily chart of the asset, a wide downwards channel is forming, inside which the price failed to break the resistance line at 96 again and reversed downwards.

On the four-hour chart, quotes are moving towards the support line, being in the middle of the range. Now, the main target is the channel’s support line, located around 82. The readings of technical indicators also confirm the high probability of a possible decline: fast EMAs on the Alligator indicator are below the signal line, and the AO oscillator histogram has moved into the sell zone and is forming downward bars.

Trade with a true ECN broker

Solid ECN Securities

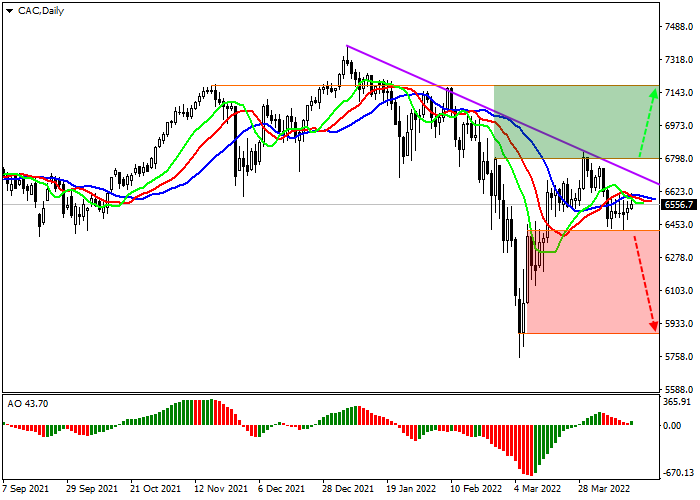

Against the backdrop of the start of the corporate reporting period, corporate news comes to the fore for stock indices. ArcelorMittal SA announced that it intends to acquire a majority stake in the Austrian steel company Voestalpine AG. The preliminary amount of the deal is estimated at 1 billion dollars. The day before, Hermes International SA published its financial results, according to which the quarterly revenue exceeded 3.10 billion euros, and the growth compared to the previous quarter was 33%, thanks to an increase in sales in all segments.

The rally that began in the French bond market in March of this year is continuing now, with popular 10-year bonds yielding 1.334%, up from 0.350% in early March, and conservative 20-year bonds hitting 1.628%, the last time observed at the beginning of 2017.

The quotes of the asset are traded as part of a global downtrend, rising in the direction of the resistance line. Technical indicators are holding a local buy signal: the range of EMA fluctuations on the Alligator indicator is about to start expanding in the direction of growth, and the histogram of the AO oscillator is trading in the purchase zone while forming local ascending bars.

Support levels: 6420, 5880 | Resistance levels: 6800, 7150

Trade with a true ECN broker

Solid ECN Securities

The shares of Netflix Inc., an American entertainment company, correct at $340 per share.

On the daily chart of the asset, the formation of a global downtrend continues, which has passed into the stage of active slowdown. Despite the high potential for a reversal, the price is as close as possible to the annual low around 329.

The four-hour chart shows that the main barriers for further movement are the resistance line of the local downward channel around 388.00 and the initial correction of 23.6% Fibonacci around 415.00. Their breakout allows further growth of the instrument and achieving two targets: the 38.2% Fibonacci base retracement level at 468.00 and the Fibonacci 61.8% retracement level at 554.00.

However, technical indicators are currently in a state of uncertainty: indicator Alligator’s EMA fluctuations range is directed downwards, and the histogram of the AO oscillator is trading close to the transition level.

Trade with a true ECN broker

Solid ECN Securities

The corporate reporting period in Japan started with the publication of financial results of real estate companies. So, the investment company Daiwa House REIT Investment Corp., Ltd. showed quite strong results: revenue was recorded at around 30.26B yen, surpassing 29.57B yen in the previous quarter. In turn, Mitsubishi Estate Logistics REIT Investment Corp. reported revenue of 5.03B yen, which was also higher than the 4.95B yen shown in the previous quarter. LaSalle Logiport REIT showed revenue of 10.59B yen, which was better than the projected 10.55B yen.

In the domestic bond market, the situation began to stabilize after the global downtrend changed last week. Thus, the yield on 10-year Japanese treasuries lost 1.26% relative to Friday’s close, while conservative 20-year bonds rose by 2.19%, and global 30-year bonds — by 3.11%.

On the global chart of the asset, the price remains within a wide descending channel, moving in the direction of the resistance line. Technical indicators are in a state of uncertainty: the histogram of the AO oscillator is close to the transition level, forming descending bars, and the fast EMAs on the alligator indicator are below the signal line.

Support levels: 26175, 24681 | Resistance levels: 27386, 28506

The shares of Snap Inc, the US company that owns the Snapchat messenger, are trading at 32.

On the daily chart of the asset, a global downtrend continues to form, at the lows of which the price is clamped inside the Triangle pattern. There is not much time left before the figure’s implementation, and if the quotes break the February low of 28, the downward scenario will receive the necessary confirmation.

The four-hour chart shows that a full-fledged correction has not yet begun, as the instrument has not consolidated above the initial Fibonacci 23.6% correction level of 41. At the moment, the upward dynamics seem unlikely since technical indicators confirm the increased activity of the “bears”: fast EMAs on the Alligator indicator crossed the signal line downwards, and the AO oscillator histogram consolidated below the transition level, continuing to form downward bars.

Trade with a true ECN broker

Solid ECN Securities

The stock markets of the EU countries continue to trade in a local downtrend against the background of the reduction by the World Bank of the world economic growth forecast for 2022 to 3.2%. The main reasons for the correction of the indicator are losses caused by the development of the military conflict in Ukraine, quarantine restrictions due to the spread of the coronavirus pandemic, as well as a significant increase in inflation. These factors can lead to an increase in the level of poverty in the world due to sudden spikes in prices for energy, fertilizers and food, and the policy of adjusting interest rates is likely to exacerbate the inequality of residents of different territories. The previous forecast for global GDP growth was 4.1%, but due to the situation in Ukraine, it was also lowered. Meanwhile, the estimated global economy in 2021 grew by 5.5%, showing the highest post-recession pace in 80 years.

At the moment, the situation in the German domestic bond market is coming to the fore again, where growth continues. Thus, 10-year debt stocks reached a yield of 0.9240%, despite the fact that at the beginning of the month it was only 0.5170%. In turn, the yield of conservative 20-year bonds exceeded the 1% mark for the first time since 2018, and is now at 1.014%, having risen from 0.556% at the beginning of the month.

On the global chart of the asset, the price is trading as part of a correction to the previous decline. Technical indicators are reversing again, and are ready to issue a signal to start purchases: the range of EMA fluctuations on the alligator indicator is actively narrowing, and the histogram of the AO oscillator has moved into the buying zone, forming the first ascending bar.

Support levels: 13883, 12600 | Resistance levels: 14550, 15420

On the daily chart, the first wave of the higher level (1) of C formed, and a correction developed as the second wave (2) of C. Now, the wave C of (2) has formed and the development of the wave (3) has started, within which the first wave of the lower level 1 of (3) is forming.

If the assumption is correct, the price will grow to the levels of 242.7 - 260. In this scenario, critical stop loss level is 173.09.

The Dow Jones is correcting upwards and is trading at 35330.

The first week of corporate reporting showed that investors are redirecting their capital from the communications sector to the real one after companies in this segment began to publish disappointing financial results one after another. The day before, Netflix Inc. lost more than 35% of value after the company announced a possible decrease in the number of active subscribers by 2 million earlier this year.

In turn, the reports of Tesla Inc. and Procter & Gamble Co. supported the market. Electric car manufacturer Tesla Inc. reported revenue of 18.76 billion dollars, up from 17.72 billion dollars a quarter earlier, and EPS hit 3.22 dollars for the first time in history. Industrial group Procter & Gamble Co. also posted quarterly revenue growth of 19.38 billion dollars versus a forecast of 18.72 billion dollars, with earnings per share of 1.33 dollars, higher than the expected 1.3 dollars.

The index quotes made an attempt to overcome the resistance line and leave the long downward channel. Technical indicators issued a new buy signal: fast EMAs of the Alligator indicator began to actively expand the range of fluctuations in the direction of growth, and the histogram of the AO oscillator is forming new rising bars.

Support levels: 34150, 32560 | Resistance levels: 35680, 36930

On the daily chart, the fifth wave of the higher level (5) develops, within which the wave 3 of (5) formed, and the fourth wave 4 of (5) develops. Now, the wave a of 4 has formed, the wave b of 4 has ended, and the development of wave c of 4 has started, within which the wave of the lower level (ii) of c is ending.

If the assumption is correct, the price will fall to the levels of 144.62 - 131.35. In this scenario, critical stop loss level is 194.7.

The shares of eBay Inc., an American online retailer, are correcting upwards of around 55.

On the daily chart of the asset, a narrow downward channel has developed. Currently, the price is approaching the range resistance line passed earlier to retest it. Despite exiting the channel, the rate is still below the initial 23.6% Fibonacci retracement at 57.00, which is a prerequisite for starting an upward correction.

On the four-hour chart of the asset, the first signs of future growth begin to appear, and if it consolidates above the initial correction of 23.6% around $57, two trend development scenarios are relevant. The first and most likely one is reaching the 38.2% Fibonacci base correction level at $62 The second scenario assumes a fully formed correction, reaching the 61.8% full correction level at 69.