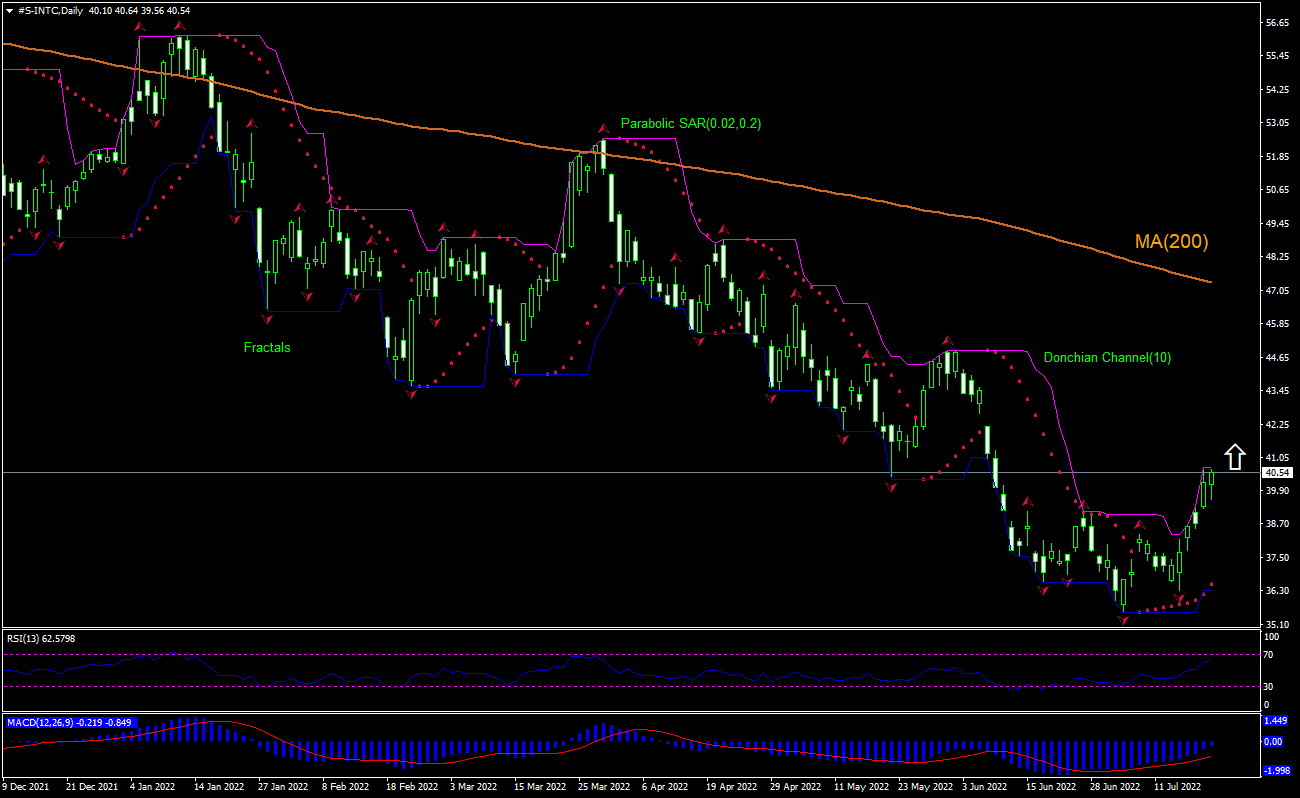

Intel Technical Analysis Summary

Buy Stop։ Above 40.7

Stop Loss: Below 36.29

| Indicator | Signal |

|---|---|

| RSI | Neutral |

| MACD | Buy |

| Donchian Channel | Neutral |

| MA(200) | Sell |

| Fractals | Buy |

| Parabolic SAR | Buy |

Intel Chart Analysis

Intel Technical Analysis

The technical analysis of the Intel stock price chart on daily timeframe shows #S-INTC,Daily is rebounding toward the 200-day moving average MA(200) after hitting four-and-half-year low three weeks ago. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 40.7. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below the fractal low at 36.29. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (36.29) without reaching the order (40.7), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Stocks - Intel

Intel stock edged up after news the Senate may vote on a bill of chip industry subsidies this week. Will the Intel stock price persist advancing?

Intel Corporation is a major US chip manufacturer that designs, manufactures and sells computer products and technologies worldwide. The company capitalization is at $164.5 billion currently, the stock is trading at P/E Ratio (Trailing Twelve Months) of 6.68, Intel earned a revenue (ttm) of $77.7 billion and Return on Assets (ttm) of 7.38% and Return on Equity (ttm) of 26.92%. US Senate may vote on $52 billion in CHIPS Act as soon as this week which is aimed at bolstering the US computer chip industry. The bill includes $52 billion in subsidies and an investment tax credit to boost US manufacturing and has bipartisan support. Intel might get $20 billion from CHIPS Act, and another $5 billion from FABS Act introduced in the US House of Representatives which has the support of the Semiconductor Industry Association. Subsidies and tax credits are bullish for a company stock.