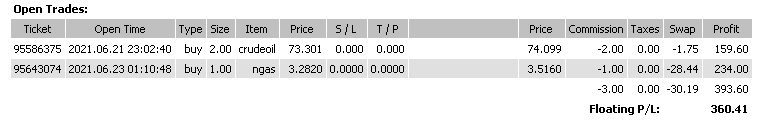

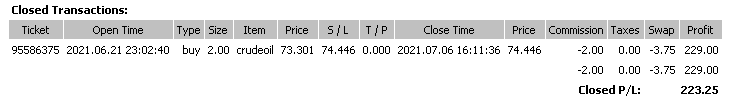

I closed my buy position in US Crude Oil this week for a $223.25 net profit.

My strategic stop loss was triggered at 74.446, as prices tumbled after OPEC+ talks were abandoned.

As it sits, OPEC+ members want to increase oil production, the disagreement is over the increase amount. The UAE, for instance, agrees with increasing production, but says it “wants a level playing field”, which translated means, proportionally higher oil production over other OPEC+ participants.

Meanwhile, the fundamentals “strongly” support higher crude oil prices if oil production is not increased.

OPEC allies are at odds over a proposed deal that would have brought more oil to the market.

Strong positive fundamentals are driving crude oil prices higher. Crude oil inventories remain stubbornly low, and gasoline stocks have taken a tumble. Supply continues its tightening.

But then stories like this.

“Prices were weighed down early in the week by the collapse of output talks between the Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia, together known as OPEC+. “

So why did crude oil prices take a tumble?

Well, the reasoning is that if one member goes rogue, and sets its own production output, others may follow suit. A rush of new supply into the arena putting downward pressure on prices.

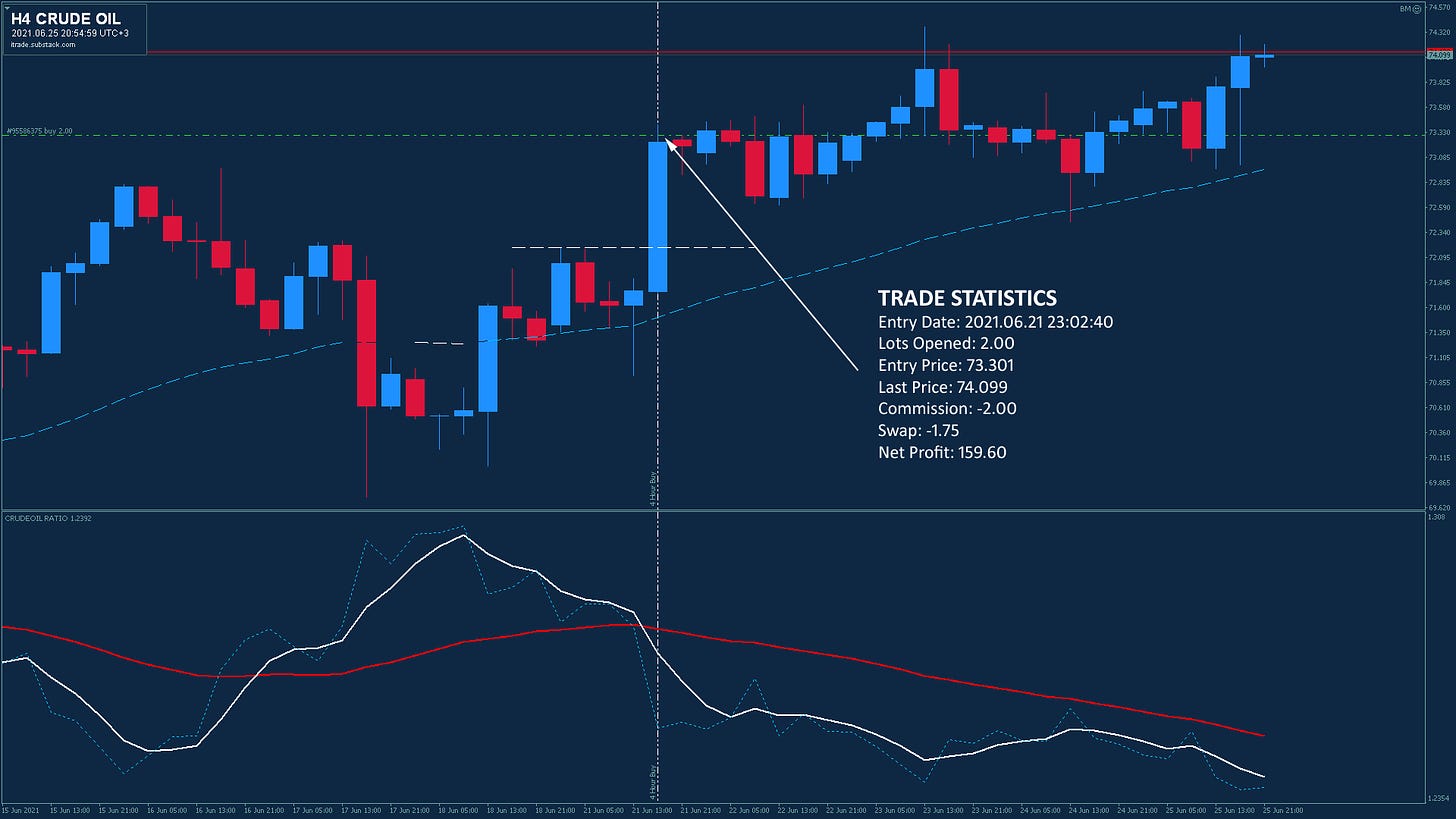

But look at the 4-hour chart. Prices have already recovered quite a bit. The fundamentals remain true, and prices should be rising. That is exactly what prices are doing right now.

All the activity in the 4-hour chart above, is contained within the last 9 price bars in the daily chart below. Barely a blip on the radar

The obvious uptrend is exactly what you would expect to see given that crude oil inventories are still negative, imports are flat, and the U.S. crude oil rig count, despite 10 straight weeks of increases, is unable to satisfy demand.

The OPEC+ meeting has caused some unexpected volatility, but nothing more. While the fundamentals remain in their current status, with demand strongly out-performing supply, prices will continue to rise.

Just have to wait for the next buy opportunity.

While you wait, have a deep and meaningful meeting with the fundamentals below.

API Crude Oil Stocks Report

Stocks of crude oil in the United States fell by 7.983 million barrels in the week ended July 2nd, 2021, following an 8.153 million drop in the previous week and marking the seventh straight weekly decline, data from the American Petroleum Institute showed. It compares with market expectations of a 3.925 million fall. source: American Petroleum Institute (API)

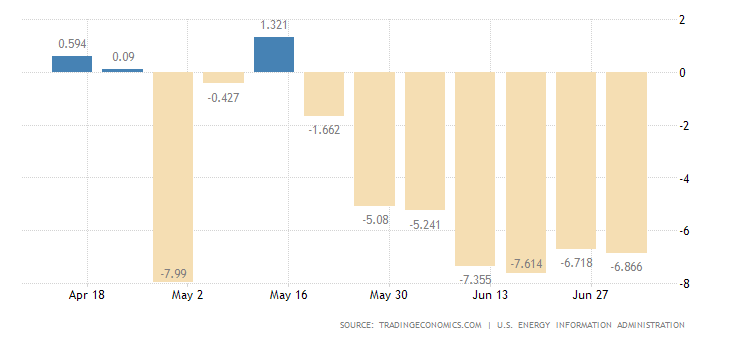

EIA Crude Oil Stocks Report

U.S. crude and gasoline stocks fell and gasoline demand reached its highest since 2019, the U.S. Energy Information Administration said on Thursday, signalling increasing strength in the economy.

But gains in oil prices were capped by worries that members of the OPEC+ group could be tempted to abandon output limits that they have followed during the COVID-19 pandemic, with talks breaking down because of an impasse between major producers Saudi Arabia and the United Arab Emirates.

Crude stockpiles in the US dropped by 6.866 million barrels in the July 2nd week, to the lowest level since February of 2020, data from the EIA Petroleum Status Report showed. It is the 7th consecutive weekly decline, compared with market consensus of a 4.033 million fall. Meantime, gasoline inventories were down by 6.076 million barrels, much more than forecasts of a 2.176 million decrease, and the biggest decline in 4 months. source: U.S. Energy Information Administration

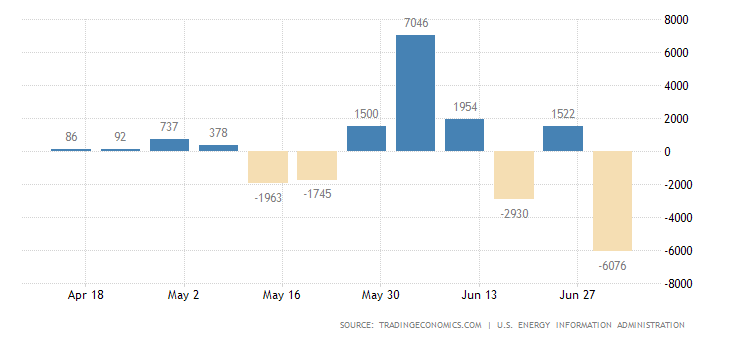

Gasoline Stocks Change

Stocks of gasoline in the United States decreased by 6076 thousand barrels in the week ended July 2 of 2021, the biggest drop in 4 months. source: U.S. Energy Information Administration

Crude Oil Imports

Crude Oil Imports in the United States increased by 558 Thousand Barrels in the week ended July 2nd 2021. source: U.S. Energy Information Administration

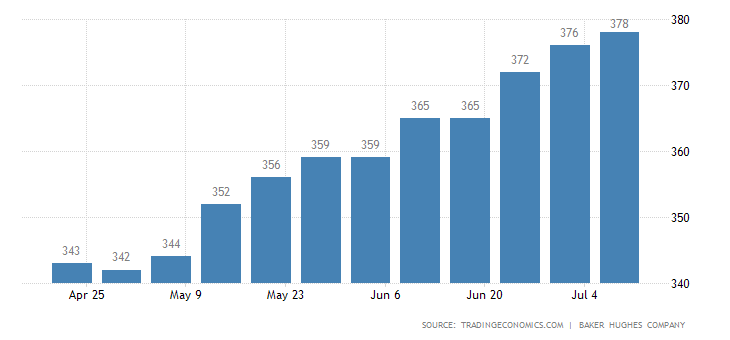

Baker Hughes Oil Rig Count

The rig count has risen for 10 straight weeks in a row, but inventories keep falling.

Crude Oil Rigs in the United States increased to 378 in July 9 from 376 in the previous week. source: Baker Hughes Company