USD/JPY is pressing against resistance as Japan’s fiscal year-end adds to quarter-end volatility risks. With interest rate differentials playing a reduced role, the yen’s fate may rest on risk sentiment and price action in equities.

By : David Scutt, Market Analyst

- USD/JPY on cusp of bullish breakout as Japan’s fiscal year-end approaches

- Rate differentials losing influence, with risk sentiment now driving price action

- PCE report is the U.S. data highlight, but surprises are rare

- Japanese CPI now a key focus for the BOJ’s inflation outlook

- Treasury auctions and Fed speeches may impact market dynamics

Summary

USD/JPY is on the cusp of a bullish breakout as the final full week of Japan’s fiscal year begins, pressing against downtrend resistance dating back to the January highs. With its relationship to interest rate differentials weakening over the past fortnight, it may be left up to price action and risk sentiment to determine whether the yen sinks or swims into quarter-end.

Big Event Risk Arrives Late

Known event risk is limited and skewed toward the latter part of the week, meaning the market reaction may not follow traditional fundamentals given the proximity to quarter-end where window dressing can drive unusual price action. This effect is even more pronounced as it coincides with Japan’s fiscal year-end.

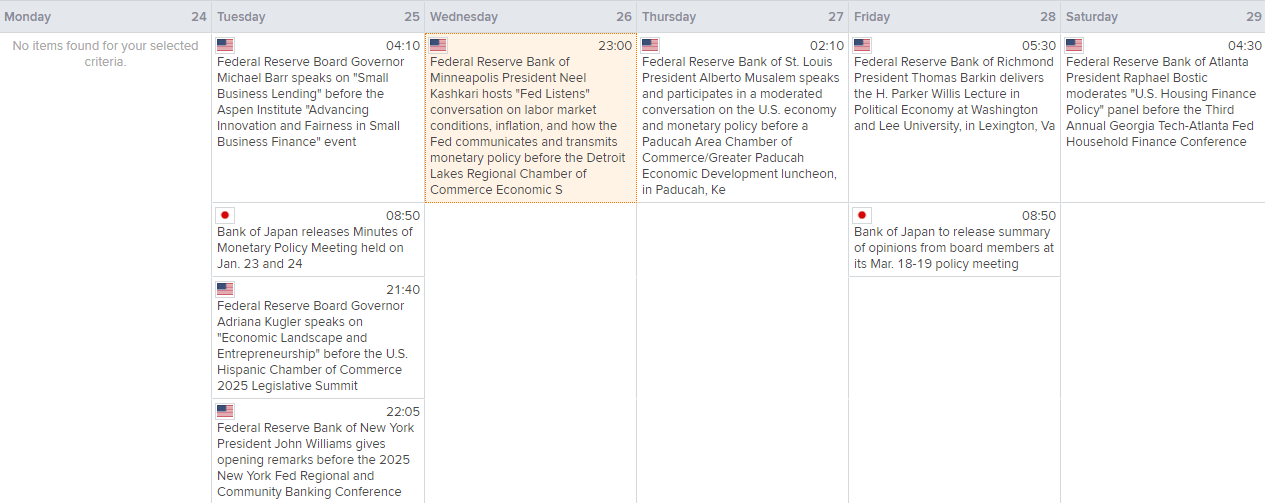

Events to watch have been colour-coded based on their likelihood of sparking volatility, with red marking those most likely to provide trade entry and exit points, and yellow signalling those that could still generate a decent market move.

Source: Refinitiv

In the United States, Friday’s PCE report is the clear highlight. However, despite containing the Fed’s preferred underlying inflation gauge—the core PCE deflator—economists’ mapping techniques using data from other inflation reports have improved to the point that it rarely delivers a major surprise. That means if an unexpected outcome does emerge, it will almost certainly trigger a sizeable market reaction.

In the absence of such an outcome, focus will shift to the separate income and expenditure data within the release. With concerns about a potential U.S. economic slowdown still unresolved, any signs of weakness could easily reignite the fears seen earlier in the month.

Beyond PCE, inflation, labour market, and leading indicators in the flash PMIs, consumer confidence, and jobless claims reports could also drive volatility, particularly if they point to renewed softness.

For Japan, key releases include Wednesday’s services producer price inflation report and Friday’s Tokyo CPI print for March. The latter—published three weeks before the national CPI—is arguably Japan’s most important economic release right now given the BOJ is looking for signs that stronger wage growth is filtering into broader inflation trends. While the BOJ cites core CPI (excluding fresh food) as its preferred inflation measure, markets are more sensitive to core-core CPI, which also excludes energy prices.

Source: Refinitiv

With a light economic calendar in both the U.S. and Japan, Fed speakers may attract more attention, though their impact could be limited given the lack of fresh economic data and uncertainty surrounding potential changes to Trump administration trade policies slated for April 2.

Similarly, the minutes from the BOJ’s January meeting—when rates were raised by 25bps to 0.5%—seem unlikely to offer much new insight when released on Tuesday. There may be more interest in the summary of opinions from the BOJ’s March meeting on Thursday, though even that could struggle for relevance given the uncertain outlook.

Click the website link below to read our Guide to central banks and interest rates in 2025

https://www.forex.com/en-us/market-outlooks-2025/FY-central-banks-outlook/

Source: TradingView

Treasury auctions of two, five, and seven-year notes on Tuesday, Wednesday, and Thursday, respectively, warrant attention, as they have influenced U.S. interest rates in the past depending on the underlying details. This primer explains what you should be watching for.

Yen Weakens and Risk Appetite Rises

Source: TradingView

A major shift USD/JPY traders need to be aware of is the weakening of its previously strong relationship with interest rate differentials between the United States and Japan over the past fortnight. Correlation coefficients in the black box above have disintegrated compared to earlier in the year. Instead, rather than being a play on rate differentials, USD/JPY is now behaving more as a proxy for investor risk sentiment, as seen in the red box by the strengthening of its relationship with Nasdaq 100 futures and S&P 500 volatility index (VIX). As stocks have risen and volatility has subsided over the past week, USD/JPY has rebounded, suggesting the performance of riskier asset classes this week may influence directional risks for the yen.

Click the website link below to read our exclusive Guide to USD/JPY trading in 2025

https://www.forex.com/en-us/market-outlooks-2025/FY-usd-jpy-outlook/

USD/JPY Eyes Bullish Breakout

Source: TradingView

The downside break of the rising wedge didn’t last long last week, with dip-buyers stepping in again as USD/JPY slid below 148.65. The hammer candle printed on Thursday was followed by a strong rally on Friday, forming a three-candle morning star pattern that suggests downtrend resistance dating back to the January highs may come under significant threat early in the week—especially if risk appetite improves.

USD/JPY was rejected again at the downtrend on Friday, but with momentum indicators like RSI (14) and MACD still flashing bullish signals, the setup remains in place for a breakout. A clean break above the downtrend would put 151.00 in focus for bulls, with the 50-day and 200-day moving averages, along with 152.43 and 153.38, other levels of note.

Alternatively, if the downtrend continues to cap rallies, a pullback toward 148.65 or even 147.10 is possible. While the 50-day moving average appears set to cross below the 200-day—forming a death cross—recent history suggests this alone doesn’t guarantee a sustained downside move. It’s a signal worth noting, but not one to act upon without clear bearish price confirmation.

– Written by David Scutt

Follow David on Twitter u/scutty

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.